The Blockchain DeX Center

When you’re trading on a decentralized exchange, a crypto platform that lets you trade directly without a middleman. Also known as a DEX, it’s where real crypto freedom happens—but only if you know which ones to trust. Many DEXs look legit but hide fake volume, rug pulls, or front-running bots. Meanwhile, crypto airdrops, free token distributions meant to grow a community are everywhere, but 9 out of 10 are scams pretending to be from real projects. And behind it all, blockchain regulation, government rules forcing exchanges to verify users and report activity is reshaping everything—from KYC checks in 2025 to the delisting of privacy coins.

Some projects, like zero-knowledge proofs, a privacy tech that lets you prove something’s true without revealing the data, are pushing crypto forward. Others, like tokens with zero supply or teams that vanished, are just digital ghosts. This isn’t hype. It’s a collection of hard truths: which DEXs actually work, which airdrops you can claim safely, and which coins are dead on arrival.

Below, you’ll find real reviews, broken-down regulations, and scam warnings—all written for people who want to trade smart, not get fooled.

The GENIUS Act is the first federal law regulating U.S. stablecoins, requiring 1:1 reserves, banning risky investments, and limiting issuance to regulated banks. Here’s what it means for users, businesses, and the future of digital money.

View More

Bitcoin Ordinals are not a coin called BTCS or BTCs-they're a protocol that lets you inscribe data on Bitcoin. Learn how they work, why people confuse them with new tokens, and whether they're here to stay.

View More

Learn how to claim your free WAG tokens from the WagyuSwap IDO airdrop, what happened to the project, and why it's no longer worth chasing. Current price, eligibility, and alternatives.

View More

Bitcoin was designed as digital cash, but today it acts more like digital gold. Learn why it's unsuitable for everyday payments, how it's really being used, and what's replacing it in the real world of finance.

View More

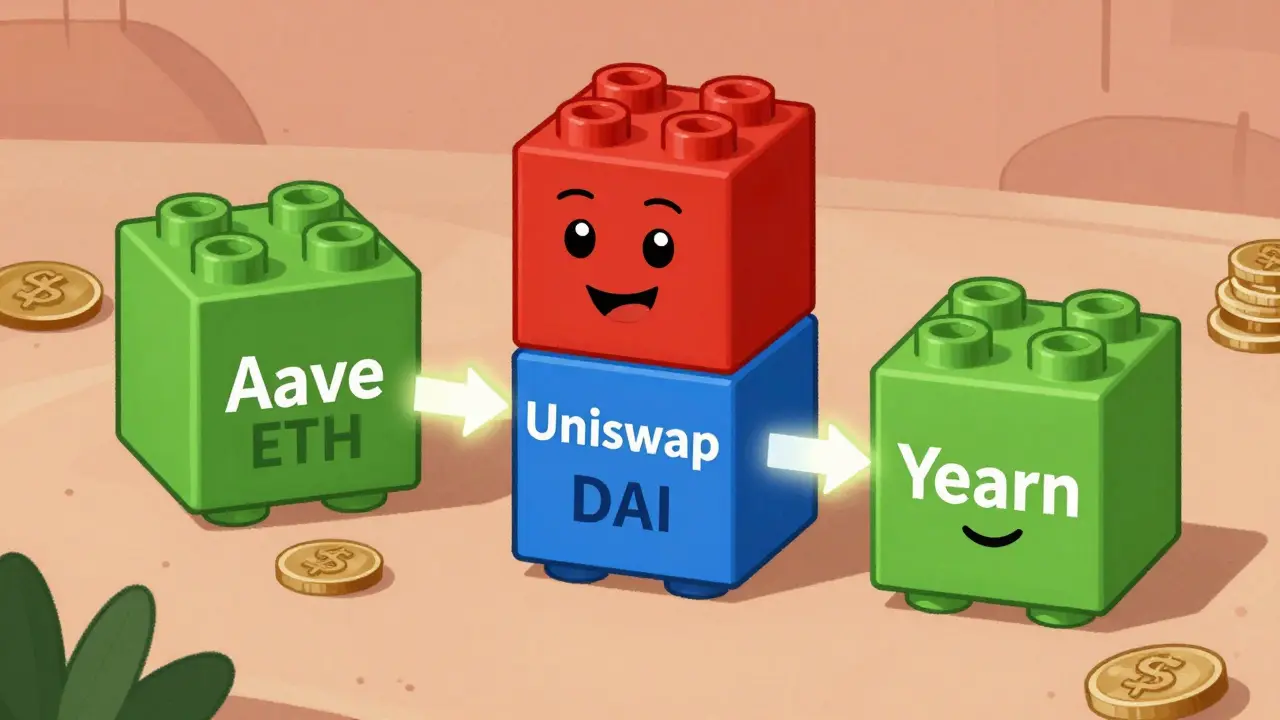

DeFi composability lets financial protocols work together like Lego blocks, enabling faster, cheaper, and more powerful financial tools than traditional banking. Learn how it works, its benefits, and the risks you need to know.

View More

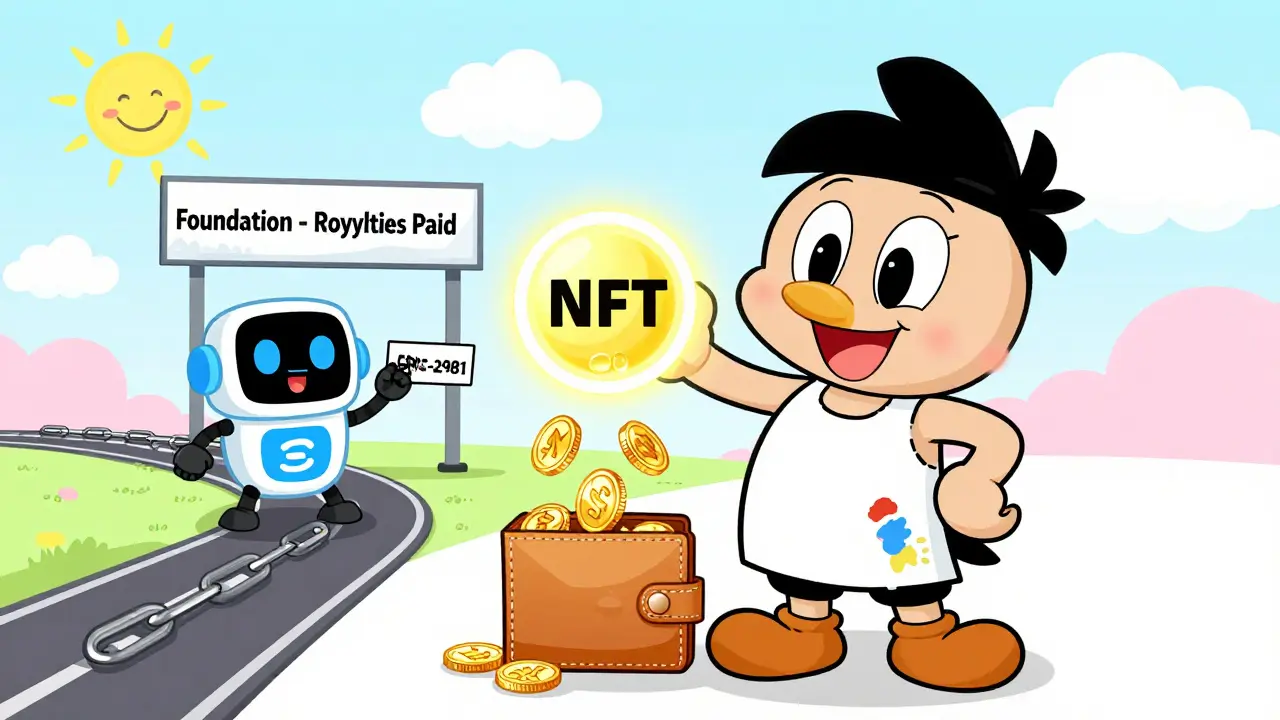

NFT royalties let creators earn from secondary sales, but not all marketplaces pay them. Learn how ERC-2981 works, why platforms like Blur ignore royalties, and what creators and buyers need to know in 2026.

View More

Pochita (POCHITA) is a Solana-based memecoin with no utility, team, or future. Once hyped as a Bonk sibling, it's now a low-liquidity token losing 99% of its value. Don't invest - it's a gamble with near-zero odds.

View More

Marmaj (MARMAJ) is a crypto token with zero coins in circulation but a listed price - a clear sign it's not a real cryptocurrency. No supply, no community, no blockchain. Don't invest.

View More

Blockchain social media gives users control over data and direct monetization-unlike traditional platforms that profit from ads and surveillance. Discover how Lens Protocol, Farcaster, and Mastodon compare to Facebook and Instagram.

View More

HaloDAO (RNBW) never had a real airdrop with CoinMarketCap. Learn what actually happened, why RNBW is worth $0, and how to avoid fake airdrops in 2026.

View More

AEUR is a Euro-backed stablecoin issued by Anchored Coins AG, designed to maintain a 1:1 peg with the Euro. Built for MiCA compliance, it offers regulated, secure on-chain payments across Ethereum and BNB Smart Chain.

View More

Vexchange is not a real crypto exchange in 2025-likely a scam or misspelling of VeChain. Learn which trusted platforms like OKX, Coinbase, and dYdX to use instead, and how to avoid crypto scams.

View More