There is no such thing as Vexchange as a cryptocurrency exchange in 2025. If you’re searching for it, you’re not alone. Many people mix up the name with VeChain (VET), a blockchain platform used by big companies for supply chain tracking-not a place to buy or trade crypto. No official website, no app, no trading pairs, no user reviews, and no regulatory license exist for Vexchange. It’s not listed on CoinGecko, CoinMarketCap, or any credible exchange ranking in 2025. This isn’t a glitch. It’s a red flag.

What You’re Probably Looking For: VeChain (VET)

If you typed ‘Vexchange’ by accident, you might mean VeChain. VeChain is a blockchain built for enterprise use-think Walmart tracking food shipments or BMW verifying car parts. It’s not an exchange. You can’t deposit USD, trade Bitcoin, or set up margin positions on VeChain. It’s a network that runs smart contracts and records data. The VET token powers it, but you need to buy it on real exchanges like OKX, Bybit, or Coinbase first. VeChain’s main job isn’t trading-it’s transparency. Over 40 major companies are already using it in live projects. That’s not hype. That’s real-world adoption.

Why Vexchange Doesn’t Exist (And Why That Matters)

Scammers love fake exchange names. They create websites that look real, use similar logos, and copy the UI of OKX or Binance. Then they wait. When someone searches for ‘Vexchange crypto exchange,’ they might land on one of these phishing sites. The page loads fast. The login button glows. The ‘24/7 support’ chat pops up. But once you enter your seed phrase or send funds, they vanish. No refunds. No trace. In 2025, over 12% of crypto fraud cases involved fake exchange names that sounded like real ones. Vexchange is a perfect example-close enough to trick you, too vague to verify.

Real exchanges don’t hide. They publish audits. They list their licenses. They answer questions publicly. OKX got its MiCA license in April 2025. Bybit rebuilt its European platform after a $1.4 billion breach in February 2025. Neither one has a name that sounds like a typo.

Top 3 Real Crypto Exchanges in 2025

If you want to trade crypto safely, here are the three platforms that actually deliver in 2025.

1. OKX

OKX leads the market in 2025. It offers 675 trading pairs, with spot fees at 0.08% maker and 0.1% taker. Futures trading drops to 0.02% maker and 0.05% taker. It’s one of the first exchanges to get full MiCA compliance across the European Economic Area. That means it follows strict EU rules on asset custody, transparency, and user protection. In January 2025, OKX completed its fourth proof-of-reserves audit, showing it holds 100% of user funds. It also offers up to $20,000 in signup bonuses and a 40% lifetime fee discount for new users through partner programs.

2. Bybit

Bybit recovered from its massive 2025 breach by rebuilding its security from the ground up. It now uses AI-driven fraud detection, multi-sig cold wallets, and real-time transaction monitoring. It has 680 trading pairs and the same low futures fees as OKX. After getting its MiCA license in Austria in May 2025, Bybit relaunched its European service with restricted features-no margin trading for EU users, but full spot and derivatives access for the rest of the world. It’s a solid pick if you’re outside the EU and want low fees with improved security.

3. Coinbase

Coinbase isn’t the cheapest, but it’s the most trusted for beginners and regulated users. It’s fully licensed in the U.S., U.K., and most of Europe. On-ramping with a bank card is free in the U.S. Security is top-tier: 98% of assets are stored offline, and it’s the only major exchange with a dedicated government relations team. If you’re new to crypto and want to avoid headaches, Coinbase is the safest on-ramp. Fees are higher-0.5% for card purchases-but you’re paying for peace of mind.

Decentralized Exchanges Are Gaining Ground

More traders are moving away from centralized exchanges in 2025. Why? Because regulations are changing fast. Bybit blocked margin trading for EU users. Coinbase froze withdrawals for certain tokens overnight. Decentralized exchanges (DEXs) don’t have that problem-they don’t hold your keys, so they can’t freeze your account.

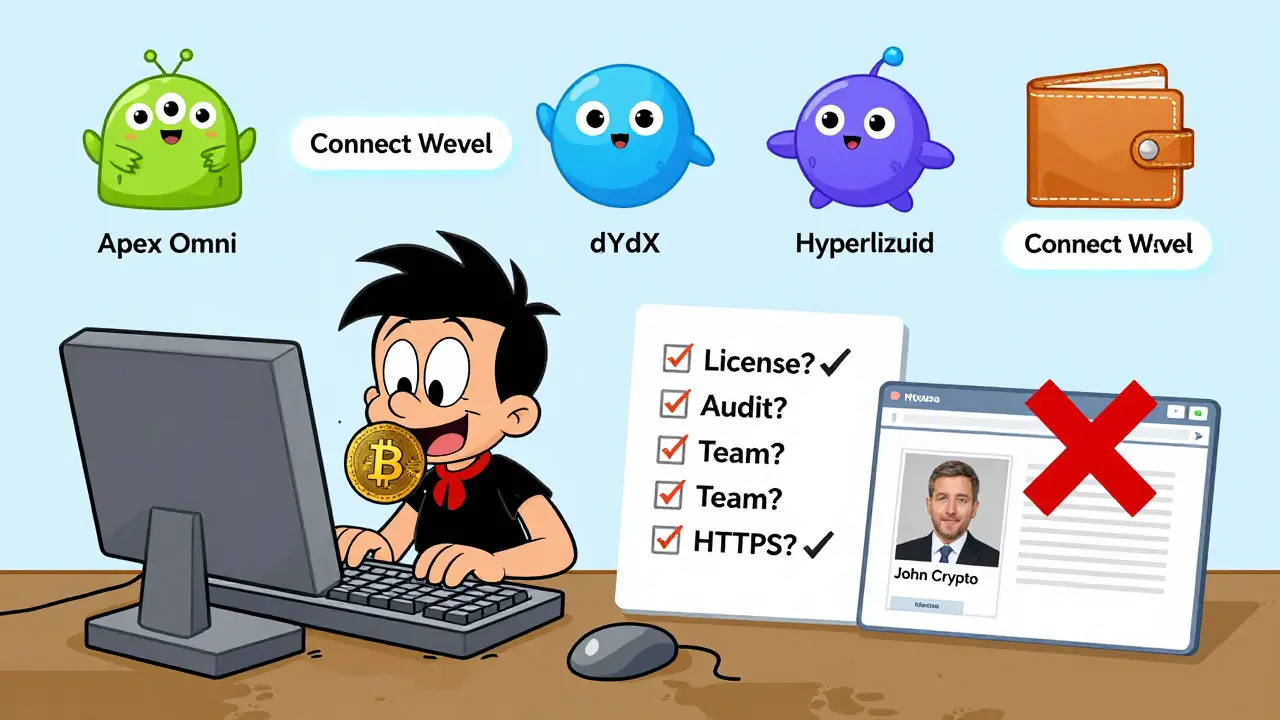

Three DEXs stand out:

- Apex Omni: Best for casual traders. Clean interface, low fees (0.02% maker / 0.05% taker), and supports 300+ tokens.

- dYdX: Built for advanced users. Offers perpetual futures with up to 20x leverage, deep liquidity, and on-chain order books.

- Hyperliquid: The institutional choice. Fees as low as 0.015% maker / 0.045% taker. Handles over $2 billion in daily volume. Used by hedge funds and market makers.

DEXs don’t need KYC. You connect your wallet and trade. No middleman. No delays. But you’re responsible for your own security. If you send crypto to the wrong address? No one can undo it.

What to Look for in a Crypto Exchange in 2025

With so many platforms, how do you pick? Here’s what actually matters now:

- Proof-of-reserves audits: Must be published monthly or quarterly. OKX and Coinbase do this. Fake exchanges never do.

- Regulatory licenses: MiCA (EU), BitLicense (NY), or equivalent. If an exchange doesn’t say where it’s licensed, walk away.

- Fee transparency: No hidden fees. Maker/taker fees should be clearly listed on the trading page.

- Security features: Two-factor authentication, cold storage, and AI fraud detection are non-negotiable.

- Customer support: Live chat with real people, not bots. Test it before depositing.

Ignore marketing. Ignore influencer endorsements. Look at the facts.

What Happens If You Use a Fake Exchange Like Vexchange?

It’s not a risk. It’s a guarantee you’ll lose money.

Here’s what typically happens:

- You find a website that looks like a real exchange. The domain might be vexchange.io or vexchange-trade.com-slightly off from the real ones.

- You sign up with your email and phone number. They ask for KYC documents. You send them.

- You deposit $500 in BTC or ETH. The site shows your balance. Everything looks fine.

- You try to withdraw. The system says ‘maintenance.’ Then ‘audit.’ Then ‘regulatory review.’

- After a week, the site disappears. Your email bounces. Your phone number is disconnected.

No one is coming to help. No government agency can recover your funds. Crypto is irreversible. Fake exchanges rely on this. They count on you not knowing how to verify legitimacy.

How to Spot a Fake Exchange

Here’s a quick checklist:

- Does it have a publicly listed license number? Check the regulator’s website (e.g., AMF in France, FCA in the UK).

- Is there a real physical address? Google Maps it. If it’s a PO box or a shared office space, that’s a red flag.

- Can you find independent reviews on Trustpilot, Reddit, or CoinDesk? If all reviews are 5-star and copied word-for-word, they’re fake.

- Does the website use HTTPS and have a valid SSL certificate? Look for the padlock in the browser bar.

- Is there a public team? Real exchanges list their founders, CTOs, and compliance officers with LinkedIn profiles. Fake ones use stock photos or names like ‘John Crypto.’

If even one of these checks fails, don’t deposit a cent.

Final Advice: Stick to the Known

There’s no shortcut in crypto. The safest exchanges aren’t the flashiest. They’re the ones that have been around, got audited, got licensed, and kept their users’ money safe-even after major breaches. Vexchange isn’t a hidden gem. It’s a trap. Don’t fall for it.

Use OKX if you want low fees and global access. Use Coinbase if you want simplicity and legal safety. Use Apex Omni or dYdX if you want control and privacy. But never trust a name you can’t verify. Your crypto isn’t just money. It’s your trust. Protect it like you would your bank account.

Is Vexchange a real crypto exchange?

No, Vexchange is not a real crypto exchange. There is no official platform, website, or regulatory registration for Vexchange in 2025. It does not appear on any trusted crypto data sites like CoinGecko or CoinMarketCap. The name is likely a misspelling of VeChain (VET), which is a blockchain platform, not an exchange.

What is VeChain (VET) and how is it different from an exchange?

VeChain (VET) is a blockchain designed for enterprise supply chain management, used by companies like BMW and Walmart to track product authenticity. It is not a crypto exchange-you can’t trade Bitcoin or Ethereum directly on VeChain. To buy VET, you need to use a real exchange like OKX or Coinbase.

Why do fake crypto exchanges like Vexchange exist?

Fake exchanges exist to steal funds. They copy the look of real platforms, use similar names, and lure users with promises of low fees or bonuses. Once you deposit crypto or enter your wallet seed phrase, they disappear. In 2025, over 12% of crypto fraud cases involved fake exchange names designed to trick users.

What are the safest crypto exchanges in 2025?

The safest exchanges in 2025 are OKX, Coinbase, and Bybit (for non-EU users). OKX has MiCA compliance and regular proof-of-reserves audits. Coinbase is fully licensed in the U.S. and Europe and offers free on-ramping. Bybit rebuilt its security after a major breach and now uses AI fraud detection and cold storage.

How can I avoid crypto exchange scams?

Always check for regulatory licenses, publish proof-of-reserves audits, and verify the company’s physical address and team members. Avoid platforms with no independent reviews, poor website security (no HTTPS), or pressure to deposit quickly. If you can’t find clear info on CoinDesk or CoinGecko, it’s not trustworthy.

Can I trade stocks on crypto exchanges in 2025?

Yes, some platforms like XXKK (a real exchange) allow trading of traditional stocks like Apple, Tesla, and Microsoft alongside cryptocurrencies. But this feature is rare and only offered by a few regulated platforms. Most crypto exchanges focus solely on digital assets.

Shaun Beckford

January 15, 2026 AT 17:01Let’s be real-Vexchange is just another crypto ghost town built on typo-hunting scammers. Meanwhile, real exchanges are getting audited, licensed, and rebuilt after billion-dollar breaches. You’re not ‘missing out’-you’re avoiding a digital mugging.

Anna Gringhuis

January 16, 2026 AT 18:04Someone actually typed ‘Vexchange’ and thought it was real? That’s not ignorance-that’s a cry for help. If you can’t tell the difference between VeChain and a fake exchange, maybe stick to ETFs until you learn how to Google.

Bryan Muñoz

January 17, 2026 AT 13:53They’re watching you search for Vexchange. Every click. Every typo. Every time you type ‘VET’ instead of ‘Vexchange’-they’re laughing. This isn’t a scam. It’s a feeding frenzy.

Kelly Post

January 18, 2026 AT 04:03I used to think fake exchanges were just dumb. Then I saw a 72-year-old retiree lose her life savings to ‘Vexchange.io’ because the logo looked like Binance’s. Now I see it as systemic predation. We need better public education, not just warnings.

Rod Petrik

January 19, 2026 AT 15:03OKX has MiCA? Bybit rebuilt? You think that’s enough? Nah. The SEC is asleep. The EU is too slow. The real exchanges are all controlled by the same 3 hedge funds behind the scenes. Vexchange is just the tip of the iceberg. They want you to think you’re safe while they pull the strings.

Deb Svanefelt

January 20, 2026 AT 08:48There’s something profoundly tragic about how we’ve reduced financial trust to a game of spelling bees. VeChain isn’t an exchange because it wasn’t designed to be one-it was designed to track a pallet of coffee beans from farm to cup. Meanwhile, we’re all chasing ghosts named Vexchange, mistaking transparency for transactional convenience. We’ve forgotten that technology serves purpose, not panic.

Chris Evans

January 21, 2026 AT 02:36Proof-of-reserves? MiCA? Please. You think regulatory compliance = safety? That’s the placebo effect of finance. The same firms auditing OKX are the ones who signed off on FTX’s books. The system is rigged. Vexchange is just the visible symptom of a deeper rot-centralized control masquerading as security.

Telleen Anderson-Lozano

January 22, 2026 AT 13:13Let’s not forget: DEXs are the only real answer. No KYC, no freeze, no ‘audit’ delays. Apex Omni, dYdX, Hyperliquid-they don’t hold your keys, so they can’t steal your life. Centralized exchanges are just banks with better UIs. And banks? They always collapse when the music stops.

Liza Tait-Bailey

January 23, 2026 AT 04:50lol i typed vexchange by accident and now i’m paranoid every time i type a crypto name… like maybe ‘binance’ is fake and ‘binnance’ is real?? 😅

Bharat Kunduri

January 23, 2026 AT 07:39who cares about vexchange its just a typo anyway just use coinbase and chill

Chris O'Carroll

January 24, 2026 AT 12:21They made a whole 2000-word essay on a fake exchange that doesn’t exist… and somehow made it sound like a TED Talk. I’m impressed. Also, I just lost $200 to a site called ‘Vexchan.ge’ last week. So… thanks for the heads up? I guess.

Ashlea Zirk

January 24, 2026 AT 18:29For those unfamiliar with crypto infrastructure: regulatory licensing is not a marketing tactic-it’s a legal requirement. If an exchange doesn’t disclose its jurisdiction and license number, it is not operating legally. Period. Do not deposit funds. Do not trust the UI. Do not rationalize. Verify.

Chidimma Okafor

January 25, 2026 AT 13:19In Nigeria, we’ve learned the hard way: if a platform doesn’t have a physical office you can visit, or a registered business number you can verify with the SEC, it’s not a platform-it’s a trap. Vexchange? It’s not even a ghost. It’s a shadow. And shadows don’t leave receipts.

Vinod Dalavai

January 26, 2026 AT 18:28bro just use binance or coinbase and dont stress. i been trading since 2017 and never had a problem. vexchange? sounds like a wifi password from 2012 lol

Stephanie BASILIEN

January 27, 2026 AT 19:52One must consider the epistemological implications of nomenclature in digital finance. The very act of misnaming a blockchain platform as an exchange reflects a fundamental ontological confusion-a conflation of infrastructure with interface. Vexchange, as a phantom entity, is less a fraud than a symptom of our collective inability to distinguish between protocol and portal.

Anthony Ventresque

January 28, 2026 AT 00:58Thanks for the detailed breakdown. I’ve been eyeing Apex Omni but was worried about liquidity. Seeing it listed alongside Hyperliquid and dYdX makes me feel way more confident. Any tips on connecting a wallet safely? I’m new to DEXs.

Christina Shrader

January 28, 2026 AT 12:52Don’t let fear stop you. Learn. Verify. Start small. Use Coinbase for your first $50. Then try Apex Omni with $20. You’ll get the hang of it. Crypto isn’t magic-it’s just math you haven’t learned yet.

nathan yeung

January 29, 2026 AT 09:38ok so vexchange is fake but what about ‘vexchain’? is that real? or is that fake too? i’m confused now