There’s a lot of confusion online about something called "BTCs" or "BTCS"-people are calling it a new crypto coin, claiming it’s the next big thing after Bitcoin. But here’s the truth: Bitcoin Ordinals are not a coin. There is no such thing as BTCs or BTCS as a separate cryptocurrency. That’s a misunderstanding. What people are actually talking about is Bitcoin Ordinals-a protocol built directly on top of Bitcoin that lets you turn individual satoshis (the smallest unit of Bitcoin) into unique digital collectibles, like NFTs. If you’ve heard someone say they bought "BTCS" or "BTCs," they’re either misinformed or selling you something that doesn’t exist.

Bitcoin Ordinals Aren’t a Coin-They’re a Protocol

Bitcoin Ordinals were created by software engineer Casey Rodarmor and launched on January 21, 2023. The first inscription-an image of a Bitcoin logo-was added to the blockchain on February 8, 2023. This wasn’t a new token. It wasn’t a new blockchain. It was a clever way to use Bitcoin’s existing rules to store data inside transactions.

Every Bitcoin is made up of 100 million satoshis. Ordinals assigns a unique number to each satoshi, tracking them like serial numbers. When you inscribe something-a piece of art, a text file, even a meme-you’re embedding that data into one of those satoshis. That satoshi becomes unique. It’s no longer just a unit of value; it’s a digital artifact. Think of it like writing your name on a dollar bill and then trading that exact bill. The bill is still a dollar, but now it has history.

This is different from Ethereum NFTs, where you buy a token that points to a file stored somewhere else-like on IPFS or a server. If that server goes down, your NFT becomes a broken link. With Bitcoin Ordinals, the image, text, or code is stored directly on the Bitcoin blockchain. It’s permanent. It’s uncensorable. But it’s also expensive and bulky.

Why People Confuse Ordinals With a New Coin

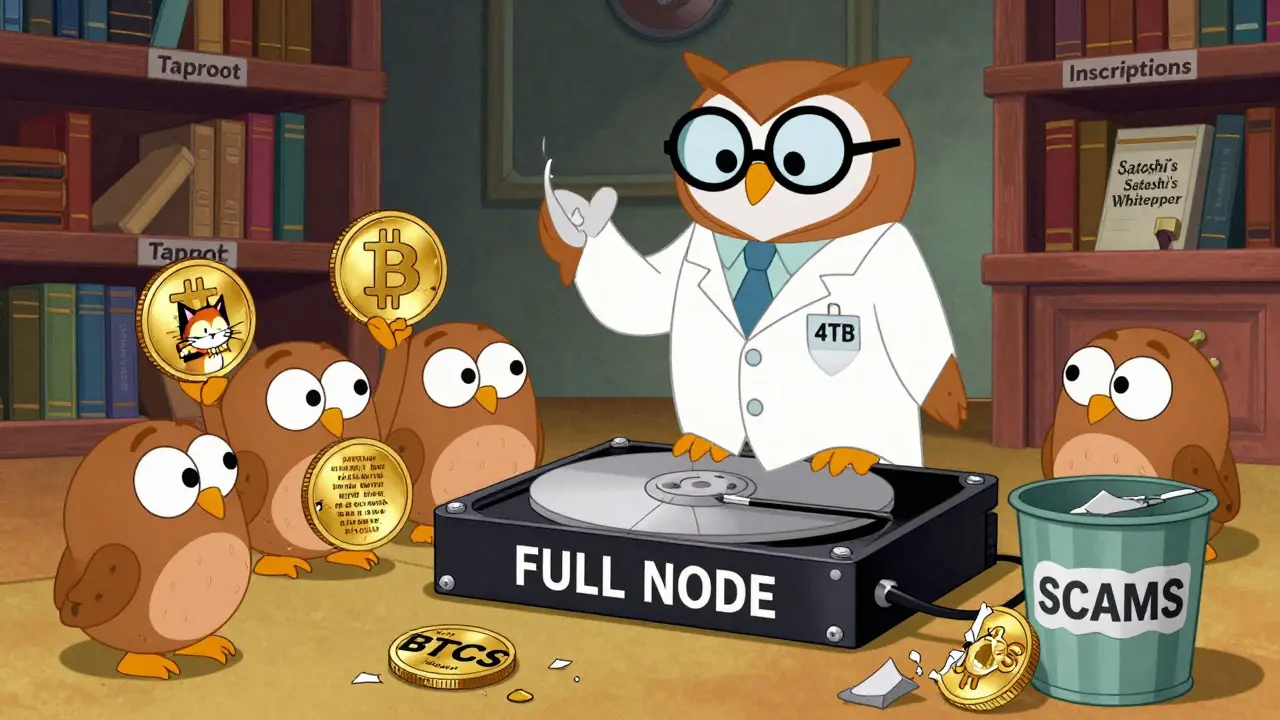

The confusion comes from names. People see "ORDI," "BRC-20," or "BTCs" and assume these are new cryptocurrencies. ORDI is a fungible token built on top of Ordinals-it’s not Bitcoin itself. BRC-20 is a token standard that lets people create coins on Bitcoin using Ordinals. Neither is Bitcoin. Neither is BTCS. There is no official cryptocurrency called BTCS or BTCs. Any website, exchange, or wallet claiming to trade "BTCS" is either mistaken or scamming you.

Some exchanges have even listed fake "BTCS" tokens. In 2024, a token called "BTCS" appeared on a few decentralized exchanges, trading under the ticker BTCS. It had no connection to Bitcoin Ordinals, no team, no whitepaper. Within months, it crashed to near zero. This kind of noise is common in crypto. When a new trend emerges, bad actors rush to cash in by inventing fake assets with similar names.

If you want to interact with Bitcoin Ordinals, you need Bitcoin. You don’t buy "BTCs." You buy BTC, then use it to pay for inscriptions.

How Bitcoin Ordinals Work (Without the Jargon)

Here’s how it actually works, step by step:

- You have Bitcoin (BTC). You need at least 0.001 BTC to cover fees.

- You use software like Ord (a command-line tool) or a wallet like Gamma.app to create an inscription.

- You upload a file-say, a JPEG of a cartoon dog or a poem.

- The software embeds that file into a Bitcoin transaction, attaching it to one specific satoshi.

- You pay a fee to miners to include that transaction in a block. Fees vary wildly-from $15 during quiet times to over $250 during spikes.

- Once confirmed, that satoshi now carries your data. It’s forever part of Bitcoin’s history.

That’s it. No new coin. No new blockchain. Just Bitcoin doing something it was always technically capable of doing-storing data. The Taproot upgrade in late 2021 made this possible by increasing how much data could fit in a single transaction.

The Cost and the Catch

Bitcoin Ordinals are not cheap to create or store. As of January 2026, the Bitcoin blockchain is over 805GB. About 145GB of that-nearly 18%-is taken up by Ordinal inscriptions. That’s over 10 million unique inscriptions, mostly images and text.

This has real consequences:

- Node operators need more storage. A full Bitcoin node used to need 400GB. Now, it needs at least 4TB. Many home users can’t afford that.

- Transaction fees spike. During peak times in early 2024, sending a regular Bitcoin payment cost $150. Now, it’s back down to $1-$5, but spikes still happen.

- Miners are happy. Ordinals now make up 25-35% of Bitcoin’s total transaction fees. That’s a big deal because Bitcoin’s block reward halves every four years. By 2028, miners will get almost no new BTC-just fees. Ordinals might keep them paid.

But critics say this goes against Bitcoin’s original purpose. Satoshi Nakamoto wrote in the 2008 whitepaper that Bitcoin should be "a peer-to-peer electronic cash system." Storing memes and JPEGs isn’t cash. It’s clutter. Blockstream CEO Adam Back called Ordinals a threat to Bitcoin’s core function. Others, like Bitcoin Core developer Luke Dashjr, argue that Bitcoin was always meant to be a universal ledger-not just for payments, but for any kind of data.

Market Reality: Who’s Buying and Why?

People are spending real money on these digital artifacts. The most expensive Ordinal ever sold was a piece called "Bitcoin Bull," which went for 690 BTC-about $41 million at its peak in November 2025. That’s more than most homes.

But most sales are much smaller. The average Ordinal sells for under 0.1 BTC ($6,000). Many are free or traded for pennies. There’s a whole subculture of collectors hunting for rare inscriptions-like those from the first block, or those with unusual patterns in the satoshi numbers.

On Reddit’s r/ordinals, users share their wins and losses. One user bought a rare inscription in 2023 for 0.5 BTC ($30,000) and sold it for 15 BTC ($900,000) in 2025. Another spent $200 on 10 inscriptions and lost it all when the market cooled.

Unlike Ethereum NFTs, which saw $18.7 billion in trading volume in 2025, Bitcoin Ordinals did $1.2 billion. That’s small by comparison, but growing. The market is volatile. The BRC-20 token ORDI peaked at a $1.2 billion market cap in May 2024 and dropped to $180 million by December 2025. That’s a 85% crash in seven months.

Can You Really Use Ordinals? Here’s What You Need

If you want to try this yourself, here’s what you’re signing up for:

- Hardware: A full Bitcoin node with 4TB+ of storage. Most people can’t do this at home.

- Software: Ord, a command-line tool that’s not beginner-friendly. Or, use Gamma.app-a wallet that hides the complexity, but sacrifices decentralization.

- Time: Setting up your first inscription can take 8-12 hours if you’re new.

- Cost: $15-$250 per inscription, depending on network traffic.

- Risk: You might spend thousands and end up with something no one wants.

Wallets like Electrum added Ordinal support in August 2024 after 14 months of development. That’s a sign the community is slowly accepting it. But it’s still not mainstream.

What’s Next for Bitcoin Ordinals?

There’s talk of "Inscription 2.0," a proposed upgrade by Rodarmor that could shrink inscription sizes by 60-70%. If that works, it could make the whole thing more sustainable. Bitcoin Core developers are also discussing changes to better handle data storage.

But the big question remains: Is Bitcoin a payment system or a digital museum? Right now, it’s trying to be both. And that’s causing tension.

Some believe Ordinals will become Bitcoin’s cultural layer-the place where art, identity, and history live on the network. Others believe they’re a dangerous distraction that will fade as users realize Bitcoin isn’t meant to store cat pictures.

One thing’s certain: Bitcoin Ordinals are here to stay for now. They’ve changed how Bitcoin works, how miners earn, and how people think about ownership on the blockchain. But they’re not a coin. They’re a feature. And if you’re looking to buy "BTCS," you’re looking in the wrong place.

What About BRC-20 and ORDI?

You’ll hear a lot about BRC-20 and ORDI. BRC-20 is a token standard built on top of Ordinals that lets people create fungible tokens-like coins-on Bitcoin. ORDI is the most famous one. But again, these are not Bitcoin. They’re tokens that ride on Bitcoin’s infrastructure. You can’t send ORDI to a regular Bitcoin address. You need a wallet that understands BRC-20. And like any speculative token, they can crash fast.

Don’t confuse the platform with the applications built on it. Bitcoin is the foundation. Ordinals are the architecture. BRC-20 and ORDI are the apps.

Is BTCS a real cryptocurrency?

No, BTCS is not a real cryptocurrency. There is no official coin called BTCS or BTCs. The term is often used by scams or confused users who mistake Bitcoin Ordinals for a new token. Bitcoin Ordinals are a protocol that lets you inscribe data on Bitcoin’s blockchain-they are not a coin.

Can I buy Bitcoin Ordinals like a stock or coin?

You can’t buy Ordinals as a standalone asset. You buy Bitcoin (BTC), then use it to pay for inscriptions. Some marketplaces like Magic Eden let you buy and sell inscribed satoshis, but you still need BTC to pay for them. There’s no "BTCS" token to trade on exchanges.

Do I need a special wallet for Bitcoin Ordinals?

Yes, but not in the way you think. Standard Bitcoin wallets like Ledger or Trezor don’t support Ordinals. You need a wallet that can track inscribed satoshis, like Electrum (version 4.4.5 or later) or Gamma.app. Mobile wallets like Gamma make it easier, but they don’t run a full node, so you’re trusting someone else’s infrastructure.

Why are Bitcoin Ordinals so expensive to create?

Because each inscription takes up a lot of space in a Bitcoin block-up to 4MB. Bitcoin blocks are limited in size, and miners prioritize transactions with higher fees. When demand for inscriptions spikes, fees go up. During peak times in 2024, it cost over $200 to inscribe one item. Now, it’s usually $15-$250 depending on network activity.

Are Bitcoin Ordinals good for Bitcoin’s future?

It’s debated. Supporters say Ordinals help miners earn fees after Bitcoin’s block reward disappears in 2140. Critics say they bloat the blockchain and hurt Bitcoin’s ability to function as fast, cheap cash. Right now, they’re adding 18% to Bitcoin’s chain size and causing congestion. Their long-term impact depends on whether the community can find a way to make them more efficient.

Final Takeaway

Bitcoin Ordinals are real. They’re innovative. They’re controversial. But they are not a coin. There is no BTCS. There is no BTCs. If someone tries to sell you one, walk away. If you want to explore Ordinals, learn how Bitcoin works first. Buy BTC. Use a real wallet. Understand the costs. And remember-you’re not investing in a new currency. You’re participating in a cultural experiment on top of the most secure blockchain in the world.

Gurpreet Singh

January 28, 2026 AT 17:13Been watching this unfold from India and honestly? It’s wild how people turn tech into hype. Ordinals aren’t a coin, they’re just Bitcoin doing something clever. No BTCS exists. If someone’s selling it, they’re either clueless or scamming you. Stick to BTC and learn how it actually works.