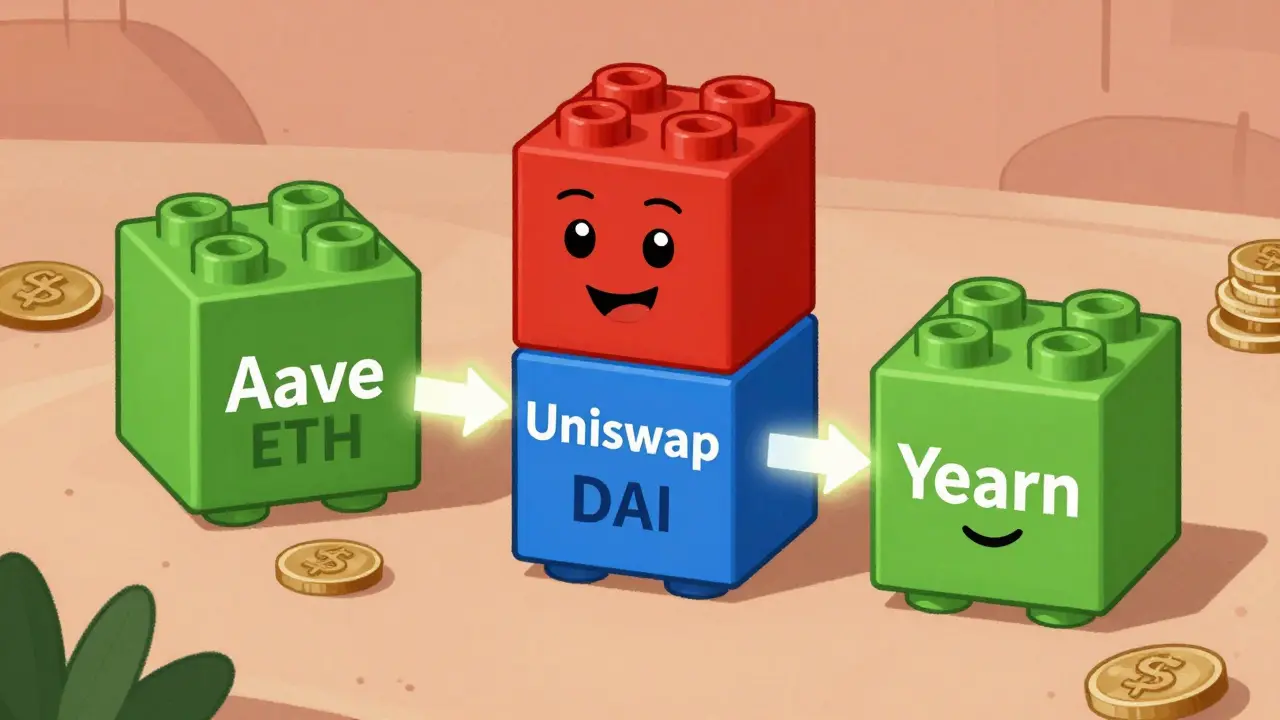

Imagine building a financial system out of Lego blocks. You grab one piece for lending, snap on another for trading, add a third for earning interest, and suddenly you’ve built a custom money machine that no bank could replicate. That’s DeFi composability-and it’s not science fiction. It’s happening right now on blockchains like Ethereum, where protocols talk to each other without permission, without middlemen, and without slowing down.

What Exactly Is DeFi Composability?

DeFi composability means that different decentralized finance protocols can connect and work together like apps on your phone. A lending protocol like Aave can talk to a decentralized exchange like Uniswap, which can then feed data to a yield aggregator like Yearn Finance-all in one transaction. No paperwork. No approvals. No delays. This isn’t just convenience. It’s a structural shift. In traditional finance, if you want to borrow against your stocks, you need to go to a broker, then a bank, then maybe a hedge fund. Each step has fees, waiting times, and gatekeepers. In DeFi, you write one smart contract that does it all at once. That’s composability: building blocks that snap together by design. The foundation? Smart contracts. These are self-executing code snippets stored on the blockchain. They follow rules like “if user deposits 1 ETH, then issue 0.95 DAI.” Because they’re public and automated, anyone can read them, test them, or build on top of them. That’s why protocols like Compound, Curve, and MakerDAO can be used as tools by other developers-no permission needed.Why Composability Makes DeFi Faster and Cheaper

In traditional finance, moving money between systems means multiple intermediaries. Each one takes a cut, adds time, and creates points of failure. In DeFi, composability cuts that out. Take flash loans. A user can borrow $1 million without collateral, as long as they pay it back within the same transaction. How? They use a lending protocol to get the funds, swap them on a DEX to make a profit, then return the loan-all in one block. No bank account. No credit check. Just code. That’s only possible because these protocols are designed to talk to each other. Gas fees, the cost of executing transactions on Ethereum, are lower when you combine actions. Instead of doing five separate transactions (deposit, swap, stake, claim, withdraw), you do one. That saves money and time. A 2025 analysis showed that users who leveraged composability reduced their average DeFi transaction costs by 42% compared to those using single protocols in isolation.Unleashing Innovation: From Simple Loans to Complex Strategies

Before composability, DeFi was mostly about lending and swapping. Now, it’s about building financial products that didn’t exist before. Think of yield farming on steroids. You deposit ETH into a liquidity pool on Uniswap. That pool earns trading fees. You then take those earned tokens and stake them in Aave to earn interest. Then you use that interest as collateral to borrow more assets, which you reinvest. All of this happens automatically through smart contracts chained together. You didn’t need to code it yourself-you used existing tools. Developers don’t have to build everything from scratch. They can use existing, battle-tested protocols as building blocks. That’s why new DeFi apps launch in weeks, not years. In 2024, over 60% of new DeFi projects were built on top of at least three other protocols. That’s the power of composability: innovation at warp speed.

Transparency and Control: You’re the Boss

In traditional finance, you trust banks, brokers, and regulators. You don’t see how your money moves. In DeFi, everything is visible. You can look up any smart contract on Etherscan and read its code. You can see exactly how your funds are being used. That means you can build your own rules. Want to only lend to protocols with a 95%+ audit score? You can code that in. Want to auto-switch your yield strategy when interest rates drop? You can set that up. You’re not stuck with whatever the bank offers-you design your own financial system. This level of control is unprecedented. And it’s only possible because protocols are composable. If they were locked down like proprietary banking software, you couldn’t mix and match. You’d be stuck with one provider’s limited options.The Hidden Risks: When One Block Falls, Others Follow

Composability isn’t risk-free. In fact, it’s where the biggest dangers hide. A bug in one protocol can ripple through the whole system. In 2022, a vulnerability in a popular oracle service caused a chain reaction: a lending protocol mispriced assets, triggering liquidations, which flooded a DEX with sell orders, which crashed token prices, which triggered more liquidations. Millions were lost-all because one small code flaw affected five connected protocols. That’s systemic risk. It’s like a house of cards. One weak card, and the whole structure collapses. The more protocols you connect, the more you rely on their security. You can’t just trust one. You have to trust all of them. That’s why audits matter. Protocols like MakerDAO and Aave have been audited dozens of times by firms like CertiK and OpenZeppelin. Newer protocols? Often not. Before you connect your funds to a new DeFi app, check its audit history. Look for public code reviews. See if it’s been live for over six months without a major exploit.

How to Use Composability Safely

You don’t need to be a coder to benefit from composability-but you do need to be smart about it.- Start small. Try one compositional strategy before stacking three or four protocols.

- Use well-known platforms. Aave, Compound, Uniswap, and Curve have years of real-world testing.

- Check the audit reports. Look for recent ones from reputable firms.

- Don’t put all your funds in one strategy. Spread exposure across different protocols.

- Use tools like DeFi Saver or Zapper. They let you visualize your exposure and manage multiple protocols in one dashboard.

The Future: More Complexity, More Responsibility

DeFi composability is still early. Right now, most users interact with one or two connected protocols. In five years, we’ll see automated financial agents-like AI-powered portfolio managers-that constantly rebalance across 10+ DeFi apps, adjusting for rates, risks, and market conditions. But that future depends on one thing: security. As systems get more interconnected, the cost of failure grows. That’s why auditors, developers, and users all need to take responsibility. Developers must write cleaner code. Users must do their homework. Auditors must keep up with complexity. The goal isn’t to stop innovation. It’s to make it safer. Composability gives us tools to build better finance. But only if we use them wisely.What’s Next for DeFi?

The next big leap? Cross-chain composability. Right now, most DeFi happens on Ethereum. But protocols on Solana, Polygon, and Arbitrum are growing fast. Soon, you’ll be able to borrow on Ethereum, swap on Solana, and earn yield on Avalanche-all in one automated flow. That’s the real promise: a global, permissionless financial network where money flows freely, efficiently, and transparently. No borders. No banks. Just code. It’s not perfect. But it’s the closest we’ve ever come to open, fair, and user-owned finance.What does DeFi composability mean in simple terms?

DeFi composability means different blockchain financial apps can connect and work together automatically, like Lego blocks snapping together. You can borrow, trade, and earn interest all in one step without needing permission from anyone.

Can I lose money because of DeFi composability?

Yes. If one protocol you’re using has a bug or gets hacked, it can affect other protocols connected to it. For example, a price oracle error in one lending app can trigger mass liquidations across multiple platforms. Always check audits and limit exposure to new or untested protocols.

Do I need to code to use composability?

No. You don’t need to write code. Tools like Zapper, DeFi Saver, and Yearn Finance let you combine protocols with just a few clicks. But you do need to understand the risks involved in connecting multiple apps.

What are the best DeFi protocols for beginners using composability?

Start with Aave for lending, Uniswap for swapping, and Curve for stablecoin trading. These are well-audited, widely used, and often integrated into user-friendly dashboards. Avoid new, low-liquidity protocols until you understand how they connect to others.

How is DeFi composability different from traditional finance?

Traditional finance uses closed systems-banks don’t let you plug your account into a hedge fund’s software. DeFi is open. Anyone can build on top of any protocol. That means faster innovation, lower fees, and full control-but also more responsibility and risk.

Is DeFi composability only for Ethereum?

Not anymore. While Ethereum is the most common, protocols on Polygon, Arbitrum, Solana, and Base are starting to connect across chains. Cross-chain composability is the next big frontier, though it’s still early and carries higher risks.

How do I check if a DeFi protocol is safe to use with others?

Look for audits from trusted firms like CertiK, OpenZeppelin, or Trail of Bits. Check the protocol’s GitHub for public code. See how long it’s been live and if there have been any exploits. Avoid protocols with no public code or no audit reports.

Can I automate my DeFi strategies using composability?

Yes. Tools like Gelato and Zapper let you set up automated actions-like rebalancing your portfolio or switching yield farms when rates change. These are called “bots” or “automated strategies,” and they rely entirely on composability to function across multiple protocols.