Crypto & Blockchain: Real Insights on Exchanges, Tokens, and Regulations

When you hear Crypto, digital assets built on decentralized networks that let you send, store, and trade value without banks. Also known as cryptocurrency, it’s changed how money moves—but not all of it works the way it’s sold to you. Behind the hype, there’s a messy reality: tokens with zero supply, exchanges with no team, and airdrops that don’t exist. This isn’t science fiction. It’s what’s happening right now.

Blockchain, the public ledger system that records every crypto transaction transparently and permanently. Also known as distributed ledger technology, it’s the backbone of everything from decentralized exchanges to NFT royalties. But not every project using the word "blockchain" is building something real. Some are just rebranding scams with buzzwords. That’s why you need to know the difference between a decentralized exchange, a peer-to-peer trading platform that doesn’t hold your funds or require KYC. Also known as DEX, it like VoltSwap, which uses clever tech to fight bots, and a fake platform like LocalTrade, which fakes volume and vanishes when you try to withdraw. The same goes for crypto regulation, government rules that control how crypto is traded, taxed, and reported. Also known as crypto compliance, it is tightening fast. Countries like Vietnam and Turkey now demand millions in capital just to operate. The U.S. finally classified assets clearly in 2025. And if you’re holding crypto in Switzerland, you pay wealth tax—not capital gains. Ignoring this isn’t rebellion. It’s risking your money.

And then there’s the airdrop jungle. crypto airdrop, free tokens given out to users, often to bootstrapping a new project. Also known as token distribution, it sounds like free money. But most are traps. HappyFans vanished. LEOS never existed. BABYDB is a ghost. Even Metahero’s "2025 airdrop" is just a rumor. Real airdrops come from active platforms, not Telegram bots. They ask for nothing but your wallet address—and even then, you should double-check.

What you’ll find here isn’t theory. It’s the truth behind the noise. We dug into dead coins like MARGA, exposed fake exchanges like Decoin, and broke down how zk-STARKs actually work. We showed you how wrapping BTC into wETH lets you use Bitcoin in DeFi—and why it can backfire. We told you why privacy coins are getting kicked off exchanges and how NFT royalties actually pay artists month after month. This isn’t a list of headlines. It’s a field guide to what’s real, what’s risky, and what’s just gone.

Utility tokens power real blockchain services like decentralized storage, advertising rewards, and DeFi access. Unlike speculative coins, they exist to do something-pay for storage, earn ad revenue, or vote on governance. Discover how they work, where they’re used, and why most fail.

View More

Learn how to qualify for and claim DES tokens from the DeSpace Protocol Space Drop airdrop. Find out what actions earn rewards, how much you can get, and how to avoid scams.

View More

The Philippines SEC blacklisted 15 major crypto exchanges in 2025, requiring all platforms to register locally with strict capital and office rules. Only two exchanges remain legal. Here's what it means for users and the market.

View More

Excalibur Crypto Exchange has no verifiable presence. No audits, no regulation, no user reviews. If you're being pushed to use it, you're being targeted by a scam. Learn the signs of fake exchanges and protect your crypto.

View More

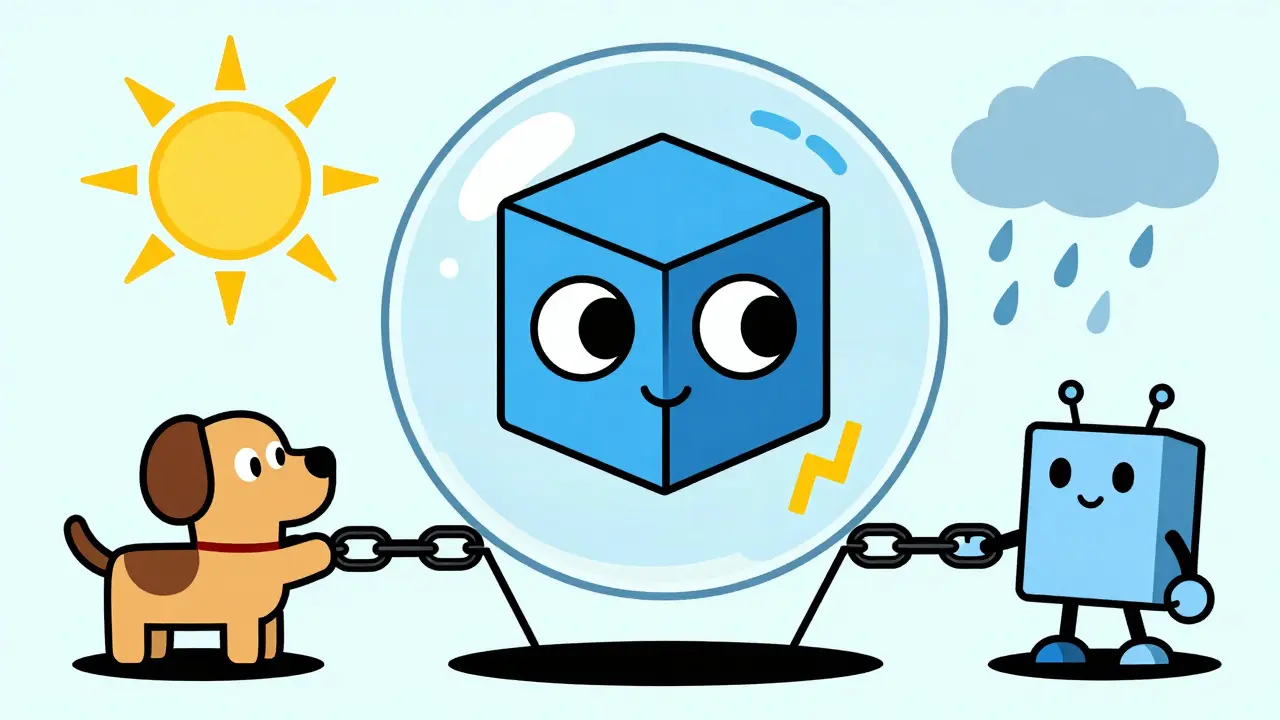

Chainlink is the leading decentralized oracle network that connects smart contracts to real-world data like prices, weather, and APIs. It enables secure, automated agreements in DeFi, insurance, and enterprise apps by using multiple independent data sources and node operators.

View More

Learn how to join TopGoal's CoinMarketCap airdrop event. Get details on eligibility, steps, and NFT rewards. Your guide to claiming free football-themed NFTs.

View More

Zug's Crypto Valley offers clear regulations, tax benefits, and a thriving blockchain ecosystem. Learn about Switzerland's policies for crypto companies, including DLT Act, tax incentives, and how it compares to global hubs.

View More

Chainlink solves the oracle problem by securely connecting smart contracts to real-world data. Learn how its decentralized network powers DeFi, tokenization, and more with reliable, tamper-proof information.

View More

GDOGE was promoted as a meme token with passive BNB rewards, but its 100-quadrillion supply and zero trading volume made rewards impossible. Learn why the airdrop failed and why CoinMarketCap's listing doesn't mean legitimacy.

View More

AgeOfGods (AOG) ran a BUSD airdrop in 2021 to launch its NFT RPG game. The token crashed 99.8% from its peak. Learn how the airdrop worked, why the game failed, and whether AOG is still worth anything today.

View More

The UK's HM Treasury has implemented strict crypto regulations in 2025, requiring FCA authorization for exchanges, stablecoin issuers, and custody providers. Here's what businesses and users need to know in 2026.

View More

Smart contract security has evolved from basic audits to a mandatory, layered defense system. In 2026, formal verification, MPC key management, and real-time monitoring are essential to protect trillions in DeFi. Here’s what works-and what’s still dangerous.

View More