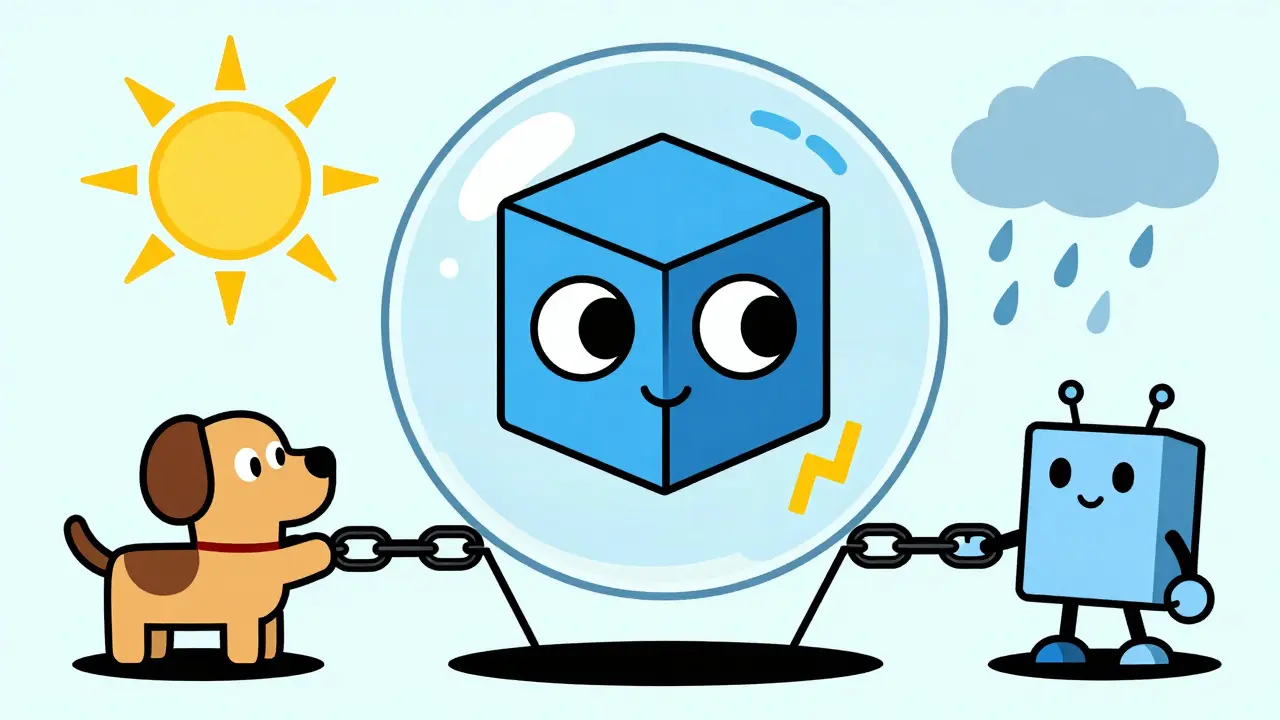

Smart contracts on blockchains like Ethereum can't access real-world data on their own. They're stuck in a closed system. That's where the Chainlink oracle comes in. Without it, most DeFi apps wouldn't function. Tens of billions of dollars in smart contracts rely on Chainlink for secure, accurate data from outside the blockchain.

Chainlink is a decentralized oracle network (DON) that serves as a secure middleware layer connecting blockchain-based smart contracts to external data sources, APIs, and off-chain systems, solving the fundamental 'oracle problem' that has historically limited smart contracts' ability to access reliable real-world information. Founded by Sergey Nazarov and Steve Ellis, Chainlink launched its mainnet in May 2019 and has since become the industry-standard oracle solution, with Chainlink 2.0 representing its current evolution.How Chainlink Solves the Oracle Problem

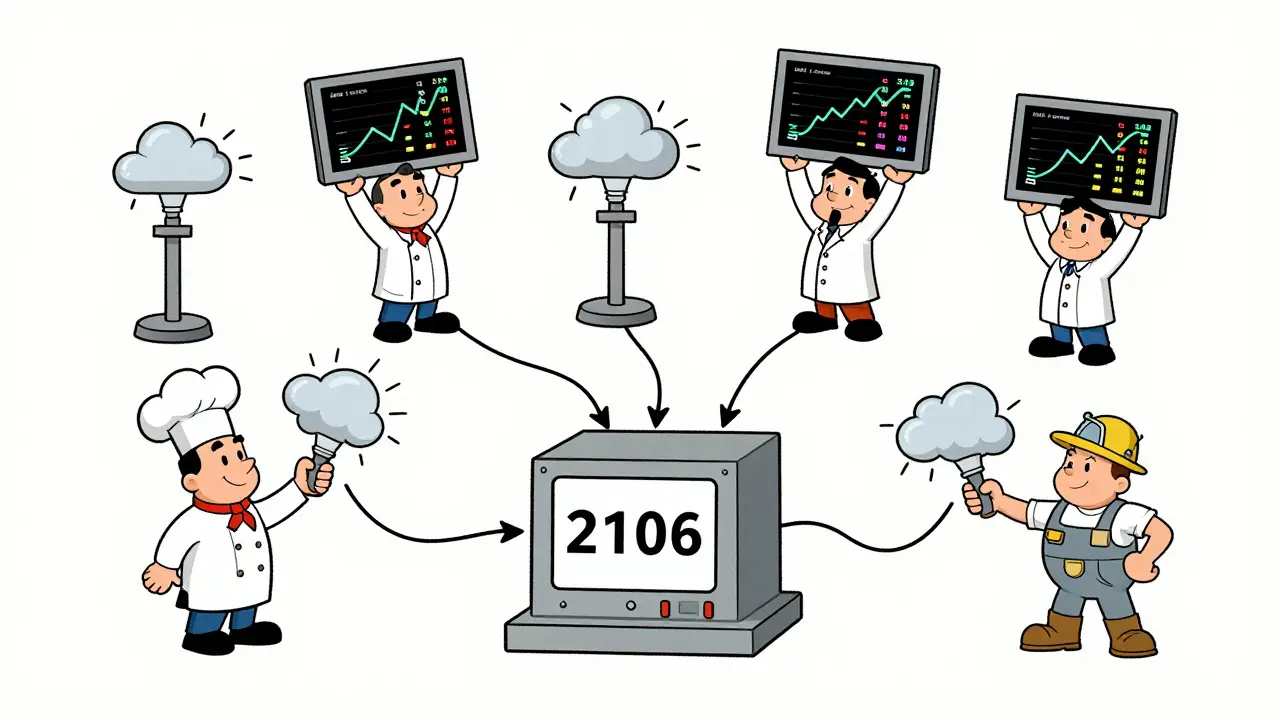

The oracle problem is simple: blockchains can't natively interact with external data. Smart contracts execute based on pre-set conditions, but if those conditions depend on real-world events-like stock prices or weather data-they need an oracle to fetch and verify that information. Centralized oracles, like a single API provider, create a single point of failure. If that provider goes down or gets hacked, the whole smart contract fails. Chainlink solves this by using a decentralized network of independent node operators. Instead of one source, it aggregates data from hundreds of sources across multiple nodes. This means no single entity controls the data flow.

How Chainlink Works

Chainlink operates through three layers of decentralization. First, the data sources: Chainlink pulls information from multiple providers (like CoinGecko, Tiingo, or even direct API calls). Second, the node operators: independent parties run nodes that fetch and validate data. Third, the oracle network itself: multiple node sets work together to process requests. For example, when a DeFi app needs ETH/USD price data, Chainlink asks several nodes to fetch prices from different exchanges. The nodes then send data to an aggregator contract, which calculates a median value. This median is used in the smart contract. If one node provides bad data, the others can override it. This multi-layer approach eliminates single points of failure.

Key Components

The LINK token is crucial here. It's an ERC-677 token that powers the network. Node operators earn LINK for providing accurate data. If they submit incorrect data, they lose LINK. This creates a financial incentive for honesty. The system also uses Oracle contracts, which manage requests from consumer smart contracts. When a smart contract needs data, it sends a request to the Oracle contract. The Oracle contract then assigns the job to node operators. Each node has a job specification (job spec) that defines what data to fetch and how to process it. For instance, a job spec might say "fetch ETH price from Coinbase and Binance, then return the average."

Chainlink 2.0 Upgrades

Chainlink 2.0 introduced significant upgrades. It added Cross-Chain Interoperability Protocol (CCIP), which allows smart contracts to communicate across different blockchains securely. This is a big deal for projects that operate on multiple chains. Chainlink Functions, launched in August 2023, lets smart contracts directly call external APIs without needing custom node setups. Before, developers had to write separate contracts for each API. Now, they can do it in one step. Staking v0.2 improved how node operators are rewarded, making the system more sustainable during market downturns.

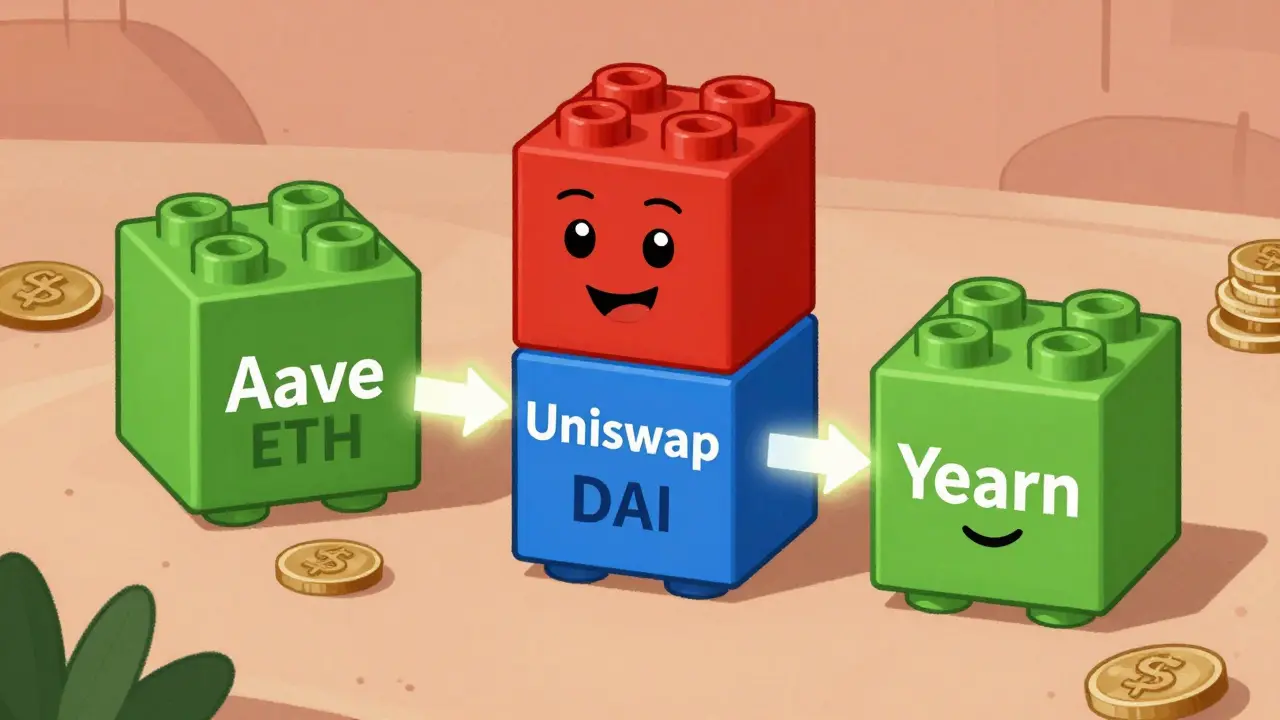

Real-World Use Cases

DeFi protocols like Aave and Compound use Chainlink Price Feeds for accurate collateral values. If prices are wrong, users could lose money. Chainlink ensures these prices are reliable, securing over $30 billion in DeFi assets. For tokenization, Chainlink's Proof of Reserve (PoR) system verifies that tokenized assets like stablecoins are fully backed. This is critical for regulatory compliance. Gaming platforms use Chainlink VRF for provably fair randomness. Imagine a lottery where the winning number must be random and verifiable-VRF provides that. Enterprises like Siemens use Chainlink to connect IoT devices to blockchain systems, ensuring real-time data from factories is securely recorded.

Challenges and Considerations

New developers often struggle with Chainlink's complexity. Setting up a custom job specification requires Solidity knowledge and understanding of node operations. One developer reported taking three weeks to integrate a simple price feed on Reddit in December 2022. Gas fees can also be a problem. Frequent oracle requests increase transaction costs, so optimizing when and how often data is fetched is key. Additionally, node operators need sufficient LINK tokens to accept jobs. If they run out of LINK, they can't fulfill requests. Chainlink's developer forums have over 15,000 active members helping new users navigate these issues.

What is the role of LINK tokens in Chainlink?

LINK tokens are the native currency of the Chainlink network. They pay node operators for providing data to smart contracts. Nodes earn LINK for accurate work and lose LINK for bad data. This creates a financial incentive for honesty. Without LINK tokens, there would be no way to reward or penalize node operators, making the network insecure.

How secure is Chainlink's oracle network?

Chainlink uses multi-layered decentralization-data sources, nodes, and network level-to prevent single points of failure. Data is aggregated and verified cryptographically, making tampering extremely difficult. For example, Chainlink Price Feeds secure over $30 billion in DeFi assets, with data accuracy verified through cryptographic proofs. This ensures tamper-proof inputs and outputs for complex smart contracts.

What's the difference between Chainlink 1.0 and 2.0?

Chainlink 2.0 introduces key upgrades like Cross-Chain Interoperability Protocol (CCIP) for secure cross-chain communication, Chainlink Functions for direct API calls from smart contracts, and improved staking economics. These changes make the network more scalable, easier to use, and better suited for enterprise adoption. Chainlink 2.0 also adds cryptographic guarantees that reduce the need for trust in the system.

Can Chainlink be used outside of DeFi?

Absolutely. Chainlink is used in tokenization platforms for Proof of Reserve verification, gaming for provably fair randomness (VRF), enterprise IoT (like Siemens), and even supply chain management. Any smart contract needing reliable real-world data can use Chainlink. For example, a pharmaceutical company might use Chainlink to verify temperature data for shipping vaccines.

How do I start using Chainlink as a developer?

Start with Chainlink's official documentation, which has over 200 code examples and 50+ video tutorials. You'll need to deploy a consumer contract, fund it with LINK tokens, and set up a job specification for the data you need. The process is straightforward for experienced Solidity developers. Chainlink's developer community on Reddit and GitHub also offers active support for beginners.