Smart contracts aren't just code anymore-they're digital vaults holding trillions.

In 2025, over $2.8 billion vanished because of smart contract exploits. Not because of weak passwords or stolen keys, but because of flaws in the code itself-flaws that automated tools missed, auditors overlooked, and developers assumed were harmless. Today, the stakes are even higher. With $2.1 trillion locked in DeFi protocols, a single vulnerability can trigger cascading failures across multiple platforms. The future of smart contract security isn't about doing audits better. It's about building security into every line of code from day one.

Formal verification is no longer optional-it's mandatory for high-value contracts

Remember when a smart contract audit meant hiring a firm to scan your code after it was deployed? That’s outdated. By 2026, if your protocol handles more than $100 million in value, you’re required to use formal verification. Tools like VeraLang, ProverX, and Certora Prover don’t just check for bugs-they mathematically prove your contract behaves exactly as intended under every possible condition. A 2026 ChainSecurity study found these tools catch 98.7% of logical flaws that traditional scanning misses. One team building a lending protocol reported a 92% drop in critical vulnerabilities after switching to VeraLang. But there’s a catch: it adds three weeks to development time. For many startups, that’s a hard sell. Yet, every project that skipped formal verification and lost money in 2025 had the same story: "We thought we were safe."

The bridge problem: 64% of all hacks happen at the gateway

Most people think of smart contracts as isolated pieces of code. They’re not. Today’s DeFi is a web of interconnected protocols, and the weakest link is almost always the bridge-the system that moves assets between blockchains. In 2025, 64% of all DeFi hacks targeted bridges. Custodial bridges, where a single entity controls the funds, suffered 4.3 times more attacks than decentralized ones. The average loss? $47 million per incident. Decentralized bridges, like those using Chainlink’s CCIP security layer, cut those losses by over half. The lesson? Don’t trust intermediaries. Build bridges that require multiple independent parties to approve every transfer. And never assume a bridge is secure just because it’s built on a "safe" chain like Ethereum. The exploit doesn’t come from the chain-it comes from how the bridge interprets data across chains.

Security isn’t a checkpoint-it’s a continuous process

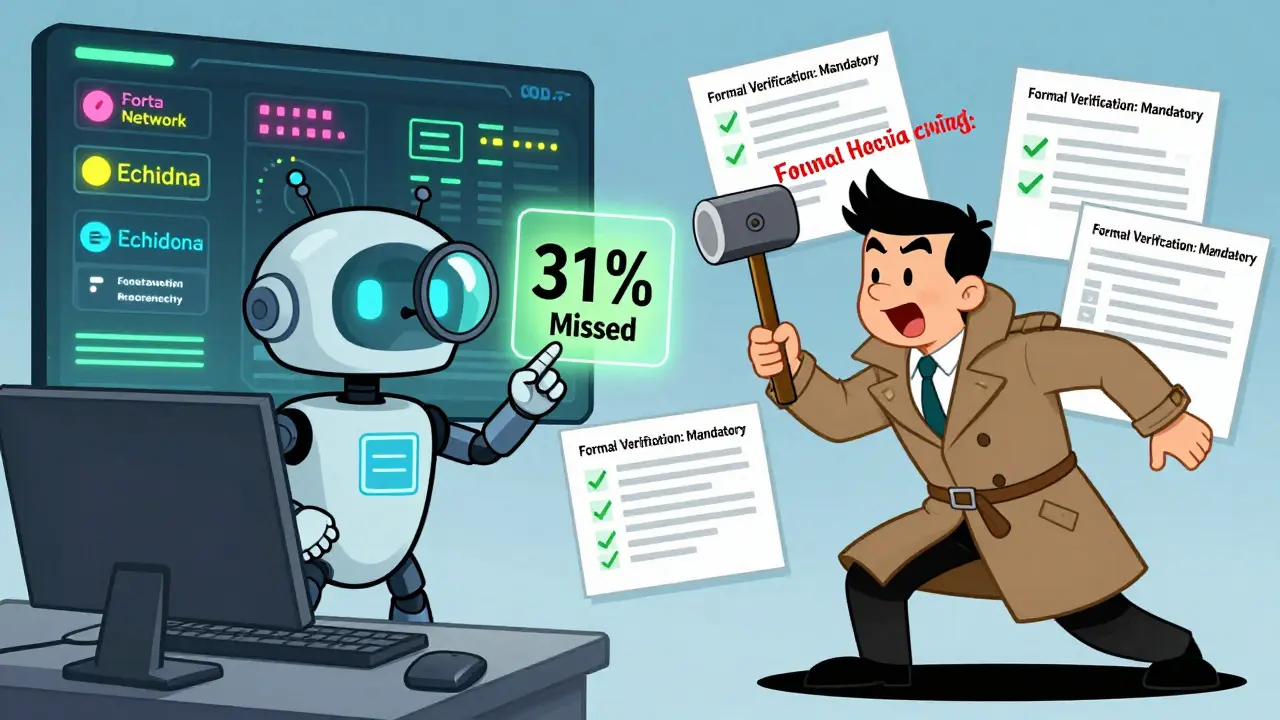

Pre-deployment audits are dead. They’re like checking your car’s brakes once a year and hoping for the best. Modern security means scanning code at every commit, monitoring transactions in real-time, and updating defenses as new threats emerge. Tools like Forta Network detect threats in under 0.8 seconds. Slither and Echidna are now built into CI/CD pipelines, catching 87% of vulnerabilities before the code even reaches testnet. OpenZeppelin’s 2026 benchmark showed teams using continuous scanning had 78% fewer critical bugs than those relying on one-time audits. This isn’t about being paranoid. It’s about matching the speed of attackers. Hackers use AI to generate new exploit patterns daily. If your security stops at deployment, you’re already behind.

AI helps-but it’s not a magic shield

AI-powered security tools are everywhere now. They scan code faster than any human, flag anomalies, and even suggest fixes. But here’s the problem: they miss 31% of novel attacks, according to Cornell Tech’s 2026 research. Why? Because AI learns from past exploits. If a hacker invents a new way to trigger reentrancy across chains, the AI won’t recognize it until it’s seen it before. Trail of Bits found AI tools generate 12-15% false positives in complex DeFi protocols, wasting developer time. The best teams use AI as a first filter, then hand off flagged issues to human auditors with deep protocol knowledge. Don’t let automation make you lazy. The most dangerous vulnerability is the one you think AI already caught.

Key management is the silent killer

Most hacks don’t target the contract-they target the keys. If your treasury uses a simple multisig wallet with three keys held by three people, you’re vulnerable. One person gets phished. One key gets lost. One person gets coerced. That’s it. The solution? Multi-Party Computation (MPC). MPC splits a private key into encrypted fragments distributed across multiple nodes. No single entity holds the full key. Safeheron’s 2025 report showed MPC reduces single-point-of-failure risks by 92% compared to traditional multisig. The Blockchain Standards Alliance now requires MPC for all protocol treasuries over $50 million. It’s not expensive. It’s not complicated. It’s just not optional anymore.

The regulatory storm is here

Regulators aren’t waiting. The EU’s Blockchain Security Directive now mandates formal verification for all public sector smart contracts over €1 million. The SEC’s December 2025 guidance requires DeFi protocols operating in the U.S. to meet specific security benchmarks or face enforcement action. This isn’t about control-it’s about accountability. If your protocol is used by institutions, pension funds, or retail investors, you’re now legally responsible for security. The days of "it’s decentralized, so we’re not liable" are over. Companies that ignored this are already facing lawsuits. Those that adapted are now being asked to audit their competitors.

Who’s winning in 2026?

The top five audit firms-OpenZeppelin, Trail of Bits, CertiK, Quantstamp, and BlockSec-handled 58% of all major protocol audits in 2025, up from 39% in 2023. Why? Because they don’t just offer audits. They offer security infrastructure: integrated scanning tools, real-time monitoring dashboards, and formal verification templates. Enterprises are taking notice. 61% of Fortune 500 companies now have smart contract security protocols in place, per Deloitte’s 2026 survey. They’re not using crypto for speculation. They’re using it for supply chain tracking, digital identity, and automated payments. And they won’t touch a contract without proof of security.

What you need to do right now

- If you’re building a contract handling over $50 million: Start formal verification today. Don’t wait until launch.

- If you’re using bridges: Switch to decentralized ones with MPC-backed key management. Avoid custodial bridges entirely.

- If you’re auditing: Learn Slither, Echidna, and at least one formal verification tool. The market now demands three-tool proficiency.

- If you’re a user: Don’t just look at APY. Check if the protocol publishes its security reports. Look for mentions of formal verification and MPC.

The bottom line: Security is survival

McKinsey’s 2026 outlook found protocols with comprehensive security frameworks had 5.3 times higher survival rates over five years. That’s not a nice-to-have. That’s the difference between staying in business and disappearing overnight. The future of smart contract security isn’t about better tools. It’s about better thinking. It’s about treating every line of code like it’s holding someone’s life savings. Because it is.

What is the biggest threat to smart contract security in 2026?

The biggest threat is cross-chain exploits, especially through bridges. In 2025, 64% of all DeFi hacks targeted bridges, with attackers exploiting unexpected interactions between different blockchains. These attacks bypass traditional security tools because they rely on protocol logic, not code bugs. The solution is decentralized bridge designs with MPC key management and real-time threat intelligence sharing.

Is formal verification worth the extra time and cost?

Yes-if your contract handles over $50 million. Formal verification reduces post-deployment vulnerabilities by 89%, according to ConsenSys Diligence. While it adds 3-4 weeks to development, it prevents losses in the hundreds of millions. Projects that skipped it in 2025 lost an average of $110 million each. The cost of skipping it now far exceeds the cost of doing it right.

Can AI replace human auditors?

No. AI tools miss 31% of novel attack vectors that human auditors catch, according to Cornell Tech’s 2026 study. They also generate false positives in complex DeFi setups. The best approach combines AI for speed and scale with human auditors for deep logic analysis. Treat AI as a first-pass filter, not a final answer.

What should I look for in a smart contract security audit report?

Look for three things: proof of formal verification (tool name and scope), details on MPC-based key management, and evidence of continuous runtime monitoring. Avoid reports that only list "no critical issues found" without explaining how they tested. The best reports include attack scenarios, tool outputs, and remediation steps.

Are smart contract security standards the same across all blockchains?

No. EVM chains like Ethereum and Polygon follow similar standards, but non-EVM chains like Solana and Cardano have different architectures and tooling. The Blockchain Standards Alliance’s Framework 3.1 applies broadly, but implementation varies. Always verify which tools and methods were used for your specific chain. A security audit on Ethereum doesn’t guarantee safety on Solana.

How do I get started with smart contract security?

Start by learning Slither for static analysis and Echidna for fuzz testing. Then move to formal verification with VeraLang or Certora Prover. Join developer communities like Ethereum Stack Exchange and r/ethdev to see real-world issues. Don’t skip training-8-12 weeks of focused study is typical for proficiency. Use GitHub repositories of well-audited protocols as learning examples.

Will quantum computing break smart contract security?

Not yet. Quantum-resistant cryptography is being tested and will become standard for high-value contracts by 2028, according to Forrester. But current quantum threats are theoretical-no functional quantum computer exists that can break ECC or RSA used in blockchain keys. The bigger risk right now is poor coding practices. Focus on fixing those first.

What’s the most common mistake developers make?

Assuming their contract is isolated. Most developers test their contract in a vacuum. But in reality, it interacts with other contracts, oracles, and bridges. A flaw in a price feed or a cross-chain message can trigger a cascade failure. Always model your contract’s entire ecosystem, not just its own code.

christal Rodriguez

January 30, 2026 AT 16:21Gavin Francis

January 31, 2026 AT 06:09Dahlia Nurcahya

February 2, 2026 AT 01:08Steven Dilla

February 3, 2026 AT 11:46