When the UK government first started talking about regulating cryptocurrency, many thought it would be years before anything concrete happened. But by early 2026, the rules are no longer rumors-they’re law. The HM Treasury crypto policy and regulations have officially reshaped how crypto businesses operate in the UK. If you’re running a crypto exchange, issuing stablecoins, or holding digital assets for clients, you need to understand what changed-and what’s coming next.

What’s Actually Regulated Now?

The core of the new rules, passed in late 2025, expands the Financial Services and Markets Act 2000 to include five specific crypto activities that now require FCA authorization:- Operating a cryptoasset trading exchange

- Issuing qualifying stablecoins

- Dealing in qualifying cryptoassets

- Providing custody services for cryptoassets

- Arranging transactions in qualifying cryptoassets

Stablecoins Are the Big Focus

Not all cryptoassets are treated the same. The new rules put heavy emphasis on qualifying stablecoins-digital tokens pegged to fiat currencies like the pound or dollar. Why? Because they’re designed to be used for payments, not just speculation. And payments mean real economic risk if things go wrong. Here’s the key detail: Only UK-based issuers of stablecoins need FCA authorization. A stablecoin issued in the US or Singapore can still be traded in the UK, but the issuer doesn’t need to be licensed. That’s intentional. The UK is trying to protect its own residents without driving innovation offshore. But if you’re based in London and issuing a GBP-backed stablecoin? You’re under the microscope.Decentralized Finance (DeFi) Is Mostly Excluded

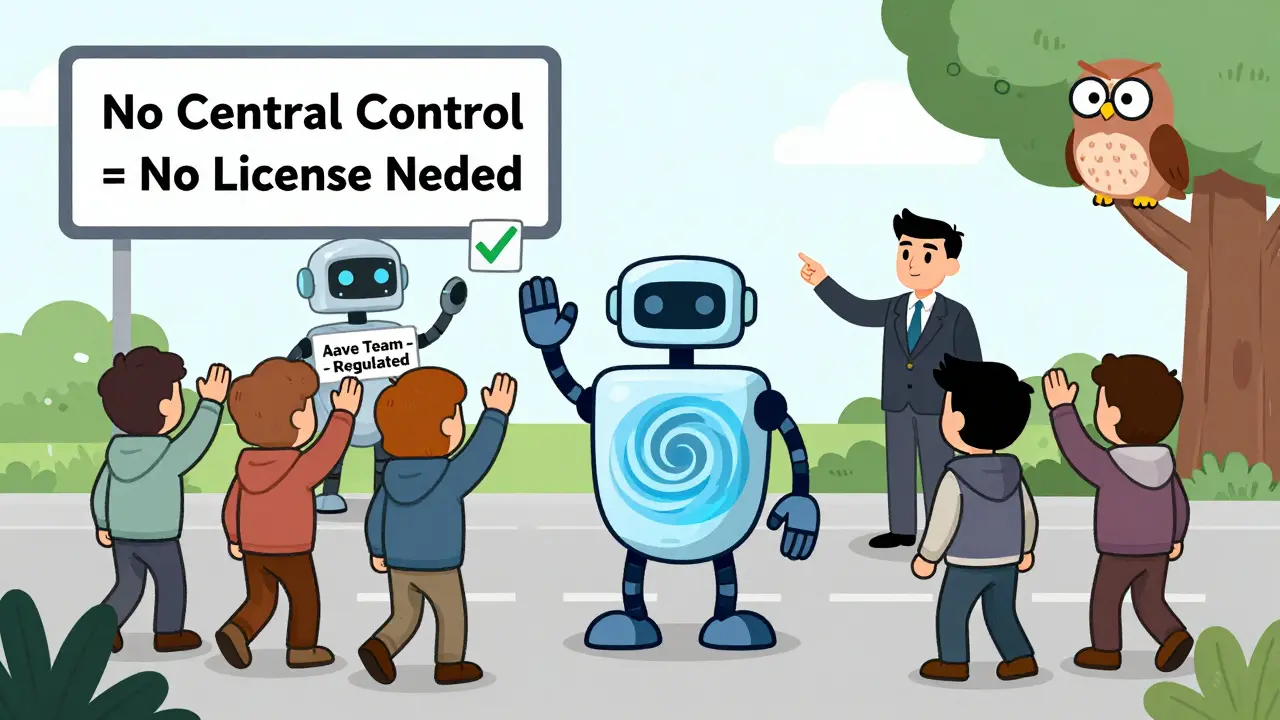

One of the most surprising parts of the policy is what’s not regulated. Truly decentralized protocols-like Uniswap or Aave, where no single entity controls the code-are exempt. The FCA won’t go after a smart contract that runs on its own. Instead, they’re looking for the human or corporate entity behind the system. If there’s a team managing updates, collecting fees, or controlling keys, that’s who they’ll hold accountable. This isn’t a loophole. It’s a realistic acknowledgment that you can’t regulate code the same way you regulate a bank. The UK is betting that targeting the people running DeFi platforms-rather than the platforms themselves-will be more effective and less damaging to innovation.Same Rules as Banks-But for Crypto

The government didn’t invent a new system. They plugged crypto into the existing financial rules. That means crypto firms now face the same standards as traditional banks:- Strict anti-money laundering checks on every customer

- Proof of financial resilience-enough capital to cover losses

- Clear disclosures about risks and fees

- Segregated client assets (your customers’ crypto can’t be mixed with your company’s funds)

- Robust cybersecurity and operational controls

Who Has to Apply-and When?

The clock is ticking. Firms already operating in the UK had until December 31, 2025, to submit their authorization applications. If you missed that deadline, you’re technically operating illegally. The FCA isn’t shutting down every small exchange overnight, but they’re prioritizing enforcement on larger platforms and those handling retail customers. New entrants have no grace period. If you’re launching a crypto exchange in Manchester in 2026, you must be authorized before you go live. The FCA’s application process is modeled after traditional financial services, which means:- At least 6-9 months of preparation

- Legal documentation covering governance, risk, and compliance

- Background checks on all key personnel

- Proof of IT infrastructure that can handle audits and reporting

Anti-Money Laundering Just Got Tighter

In September 2025, HM Treasury released draft amendments to the Money Laundering Regulations, specifically targeting crypto firms. These changes require:- Real-time customer due diligence (not just at signup-ongoing monitoring)

- Reporting of suspicious activity within 24 hours

- Clear rules on pooled client accounts (no more commingling funds)

- Trust registration for crypto asset holders who are trusts or estates

What’s Coming Next?

The 2025 rules are just the beginning. HM Treasury has confirmed two major pieces are still coming:- Market abuse rules: Insider trading, price manipulation, and spoofing in crypto markets will be illegal. The FCA will have direct authority to investigate and punish these actions.

- Admissions and disclosures: Crypto tokens listed on exchanges will need to meet transparency standards-like how stocks have prospectuses. Investors will get clear info on risks, team backgrounds, and tokenomics.

How This Compares to the EU and US

The UK’s approach is closer to the EU’s MiCA regulation than anything in the US. Both require licensing for key activities and treat stablecoins as financial instruments. But the UK is more targeted. The EU regulates all stablecoins, regardless of where they’re issued. The UK only cares about UK issuers. The US? Still a mess. Some states have their own rules. The SEC sues companies retroactively. No clear federal framework yet. That’s why many crypto firms are choosing London over New York or San Francisco. The UK offers clarity-even if it’s strict.Real-World Impact: Who’s Already Moving?

In early 2026, major crypto firms are already adapting:- Revolut applied for FCA authorization to offer crypto custody and trading-now live under the new rules.

- Circle (issuer of USDC) opened a UK entity to issue GBP-backed stablecoins under the new regime.

- Local UK exchanges like CoinCorner and Bitstamp UK have fully restructured their compliance teams.

- DeFi protocols like Aave and Compound have added UK-specific disclaimers but aren’t applying for licenses-they’re relying on the decentralization exemption.

What This Means for You

If you’re a UK resident trading crypto on a non-licensed platform? You’re not breaking the law-but you’re taking a risk. Your funds aren’t protected. If the platform fails, you won’t get compensation. If you’re a business owner? Your options are simple:- Get authorized by the FCA

- Partner with a licensed firm

- Stop serving UK customers

Final Thoughts

The HM Treasury crypto policy isn’t about killing innovation. It’s about bringing order to chaos. For too long, crypto in the UK operated in a legal vacuum. Now, there’s a clear path-if you’re willing to follow it. The rules are tough. The deadlines are tight. The costs are high. But for businesses that adapt, this is an opportunity. The UK is positioning itself as the most transparent, well-regulated crypto hub in the world. And that’s worth competing for.Do I need FCA authorization if I’m a UK resident trading crypto for myself?

No. The regulations apply to businesses offering services, not individual traders. If you’re buying, selling, or holding crypto as a private person, you don’t need FCA approval. But be aware: unlicensed platforms you trade on may not be safe or protected.

What happens if I operate a crypto exchange without FCA authorization?

You’re breaking the law. The FCA can issue fines, shut down your website, freeze your bank accounts, and pursue criminal charges against directors. In 2025, the FCA blocked over 120 unlicensed crypto platforms from targeting UK customers. They’re actively monitoring and enforcing.

Are Bitcoin and Ethereum regulated under these rules?

Bitcoin and Ethereum aren’t classified as “qualifying cryptoassets” under the new rules because they’re not issued by a central entity. But if you run an exchange trading them, you still need FCA authorization because operating a trading platform is a regulated activity. The asset type doesn’t matter-the activity does.

Can I use a non-UK stablecoin in the UK?

Yes. You can buy, hold, or trade USDC, USDT, or other foreign-issued stablecoins in the UK. But the issuer doesn’t need to be licensed. The UK only regulates stablecoins issued by UK-based companies. Your protection comes from the platform you use-not the stablecoin issuer.

Is DeFi completely unregulated in the UK?

Only if it’s truly decentralized. If a team controls the smart contracts, updates the code, or collects fees, they’re considered a regulated entity. The FCA looks for the “controlling party.” If there’s no single entity in charge, then the protocol itself isn’t regulated-but the people promoting it might be.

How long does FCA authorization take?

On average, it takes 6 to 9 months. The FCA reviews applications thoroughly-checking financial health, compliance systems, team backgrounds, and IT security. Applications submitted in late 2025 are still being processed in early 2026. Start early if you plan to apply.

Will the UK allow crypto mining under these rules?

Mining isn’t a regulated activity under the current framework. You can mine Bitcoin or Ethereum without FCA approval. But if you’re running a mining pool that accepts payments in crypto or offers staking services, those activities may fall under regulation. It depends on what services you offer, not what you mine.