Decentralized Exchange: What It Is, How It Works, and What to Avoid

When you trade crypto on a decentralized exchange, a platform that lets users trade directly with each other without a central company holding their money. Also known as DEX, it removes banks, brokers, and middlemen from the process—giving you full control over your funds. That sounds great, right? But not every platform calling itself a DEX actually is one. Some are fake, unregulated, and designed to steal your crypto. The real ones run on smart contracts, let you connect your own wallet, and don’t ask for your ID. The fake ones? They look like real DEXs but lock your funds behind login pages, fake trading volumes, and ghost teams.

That’s why knowing the difference matters. A true decentralized exchange, a platform that lets users trade directly with each other without a central company holding their money. Also known as DEX, it removes banks, brokers, and middlemen from the process—giving you full control over your funds. runs on blockchain code you can verify. It doesn’t need KYC, the process of verifying your identity before using a financial service. Also known as identity verification, it’s often required by centralized platforms to follow anti-fraud rules. to start trading. But look closer at platforms like LocalTrade or Decoin—they claim to be DEXs, but they’re just websites asking for your wallet password or private keys. Real DEXs like Uniswap or PancakeSwap don’t ask for that. They use wallet connectors like MetaMask. If a site asks you to sign in with an email or upload a photo of your ID, it’s not a DEX—it’s a trap.

And it’s not just about safety. Many fake DEXs are tied to dead tokens with zero supply, like Margaritis (MARGA), or abandoned projects like Carrieverse (CVTX). These tokens show up on price trackers but can’t be bought, sold, or used. They’re just numbers on a screen—designed to trick people into thinking something’s valuable when it’s not. Meanwhile, real DEXs support live tokens with actual utility, like Flux (FLUX) for decentralized cloud computing or AlphBanX (ABX) for lending on Alephium. The difference? One lets you earn or use crypto. The other just takes your money.

What you’ll find below isn’t a list of the best DEXs. It’s a list of what to avoid—and why. We’ve dug into platforms that pretend to be decentralized but are built on lies. We’ve tracked down tokens that vanished overnight. We’ve checked the truth behind airdrops, IDOs, and "free crypto" offers that turn out to be scams. You’ll see how KYC rules are changing crypto access, how privacy coins are being kicked off exchanges, and why wrapping crypto can be useful—or dangerous. This isn’t theory. These are real cases. Real losses. Real lessons.

OneSwap is a fast, low-cost decentralized exchange on Binance Smart Chain, ideal for trading BSC-native tokens. It offers simple swaps, staking, and a clean interface - but comes with high scam risk and low liquidity on major pairs.

View More

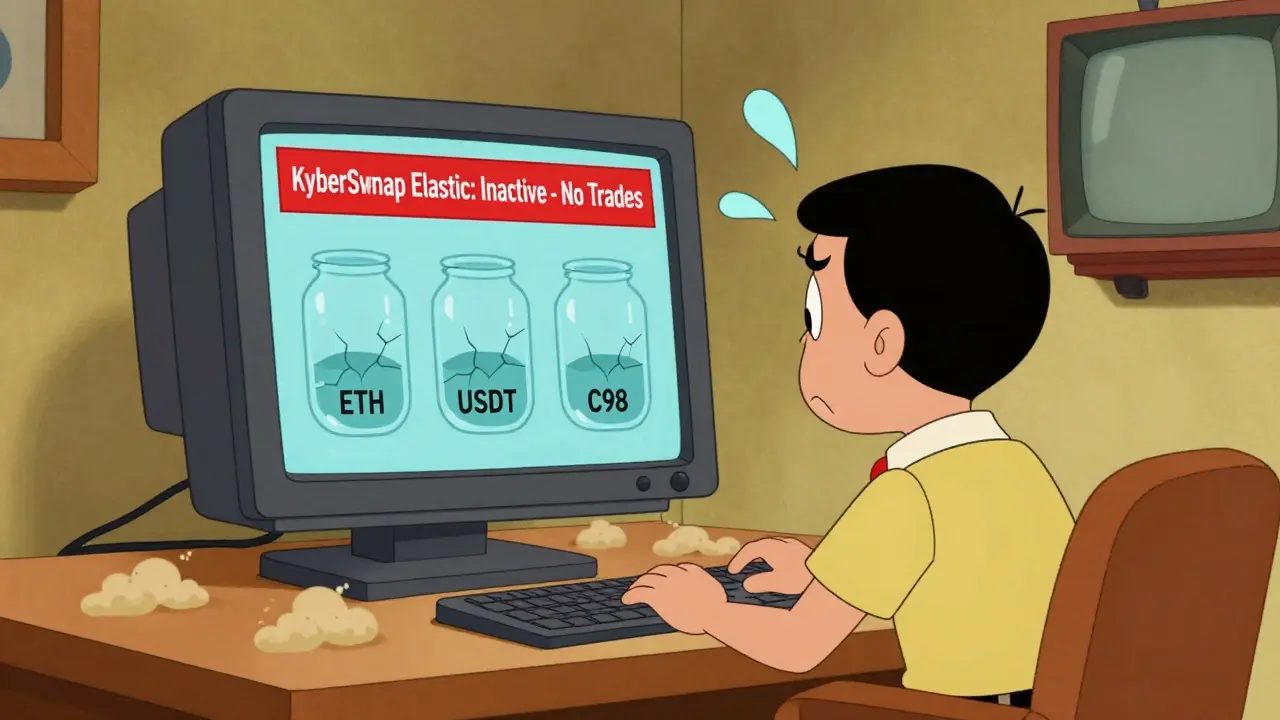

KyberSwap Elastic on Ethereum was designed for advanced traders with automated fee compounding - but as of 2025, it's inactive with $0 volume. Users are advised to withdraw funds immediately due to a critical security flaw. Avoid this protocol.

View More

KyberSwap Classic (BSC) offers tight slippage on USDT/WBNB but supports only two tokens with minimal volume. Is it worth using in 2025? Here's the real breakdown.

View More

VVS Finance is a dead DeFi project on Cronos with a collapsed token price, no updates since 2022, and zero regulatory oversight. Don't waste time or money on this abandoned exchange.

View More

VoltSwap is a front-running resistant DEX on the Meter blockchain with low fees and single-sided VOLT staking. Though volume is tiny, its unique tech makes it worth exploring for privacy-focused traders tired of bot manipulation.

View More

Solidly V2 on Ethereum is a niche AMM with only $49.70 in daily volume and five trading pairs. Its innovative $SOLID tokenomics never attracted users, making it impractical for trading or staking.

View More

IceCreamSwap (Core) is a tiny decentralized exchange built for the Core Chain blockchain. With only $290 in daily volume and zero user reviews, it's not for most traders - but it may be the only option if you're holding WCORE.

View More

Alien Base is the top decentralized exchange on Base chain, offering low fees, limit orders, and a token generator. Perfect for memecoin traders and developers looking for speed and simplicity in DeFi.

View More

DYORSwap (Plasma) offers 0% trading fees but lacks liquidity, security, and transparency. This review exposes its risks as a niche DEX for obscure meme coins with minimal adoption and high scam potential.

View More

RubyDex promises CEX-like trading with decentralized control, offering perpetual futures on crypto, stocks, and NFTs. But with $0.0M TVL and no verified volume, it's an unproven experiment-not a reliable exchange.

View More