Solidly Slippage Calculator

How This Works

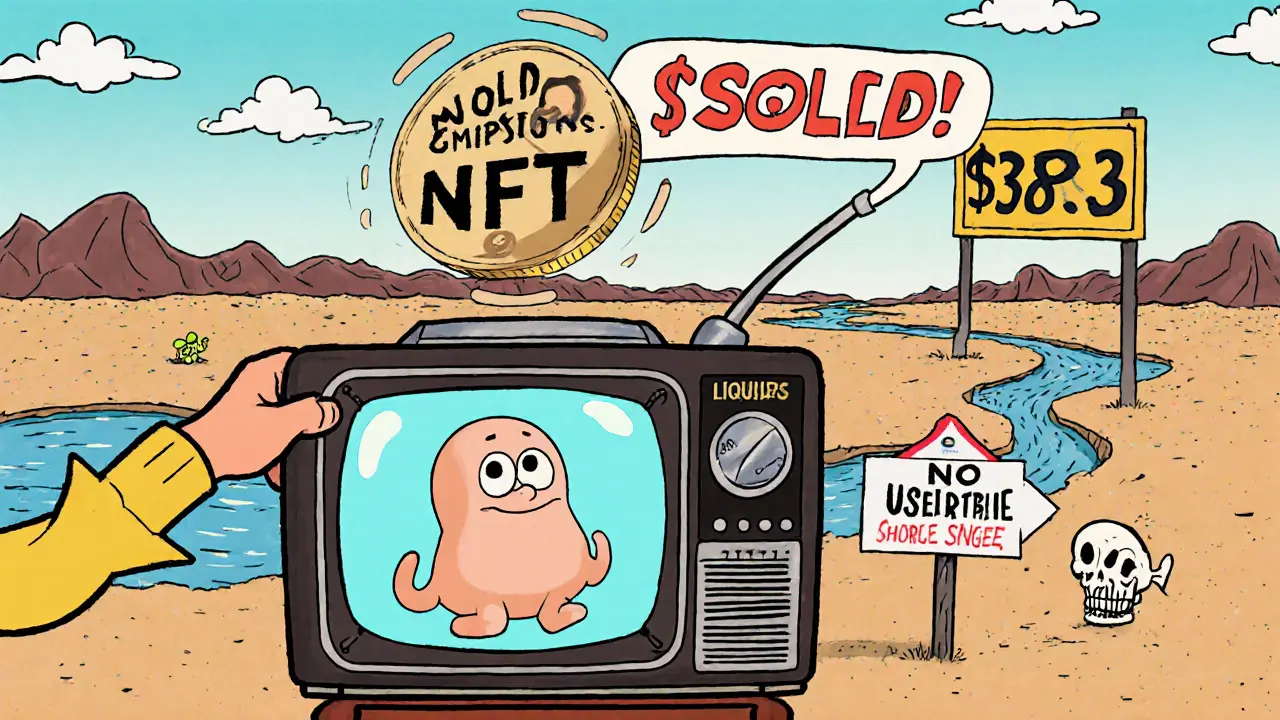

Based on the article's data: Solidly's most active pair (LUSD/WETH) has only $38.53 in 24-hour volume. This calculator demonstrates how slippage increases dramatically as your trade size approaches the available liquidity.

When you hear the name Solidly, you might think of a powerful decentralized exchange like Uniswap or Curve - but the reality is far more modest. Solidly V2 on Ethereum launched in 2022 with big ideas, but today, it operates with just $49.70 in 24-hour trading volume. That’s not a typo. It’s less than the cost of a cup of coffee. And with only five trading pairs available, this isn’t a platform for serious traders. It’s a lab experiment in tokenomics that never found its users.

What Solidly Actually Is

Solidly V2 is a decentralized exchange built on Ethereum, using an Automated Market Maker (AMM) model. It was created by Andre Cronje, the same developer behind Yearn.finance. But unlike his earlier projects, Solidly never took off. It doesn’t support margin trading. No advanced order types. No mobile app. Just a simple swap interface with five token pairs.

The only coins you can trade are: LUSD, WETH, USDT, DAI, and the native $SOLID token. That’s it. The most active pair - LUSD/WETH - moves just $38.53 in a full day. That’s less than 1% of what a single popular pair on Uniswap moves in five minutes. If you tried to swap $1,000 worth of LUSD for WETH, you’d face massive slippage - maybe 10%, 20%, or worse. That’s not trading. That’s gambling.

The $SOLID Token: A Clever Idea That Didn’t Stick

Solidly’s real innovation isn’t its trading interface. It’s how it handles fees and rewards through its $SOLID token. Unlike Curve, where liquidity providers earn a share of all protocol fees regardless of where they stake, Solidly forces you to pick one pool. Only the pool you vote for sends you fees. That’s a radical shift. It’s meant to concentrate liquidity where it’s most needed - but it backfired.

Here’s how it works: You stake $SOLID tokens. They turn into NFTs - non-fungible tokens - that act as proof of your stake. You can trade those NFTs on secondary markets. You can even use them as collateral. That’s smart. It unlocks capital efficiency. But here’s the catch: if no one stakes $SOLID, the protocol pumps out maximum new tokens. If everyone stakes, emissions drop to zero. That’s supposed to create scarcity. But in practice, it created confusion.

Most users didn’t understand the voting mechanic. Why pick one pool when you could earn from all of them? Why lock your tokens into an NFT when other platforms let you stake with a click? The complexity scared off casual users. And without users, liquidity dried up. And without liquidity, no one trades. It’s a death spiral.

No Users, No Reviews, No Trust

Solidly has 9,199 Twitter followers. That’s less than a small crypto influencer. It gets 4,163 monthly pageviews. For comparison, Uniswap gets over 10 million. On FxVerify, Solidly has a 0 out of 5-star rating - because there are zero reviews. Not one. Not a single user left feedback on Trustpilot, Reddit, or DeFi forums. That’s not a glitch. That’s silence.

Why? Because there’s nothing to review. You can’t trade meaningful amounts. You can’t earn meaningful rewards. You can’t even find decent documentation. The website gives you a basic interface. That’s it. No tutorials. No guides. No support. If you’re new to DeFi, you’ll be lost. If you’re experienced, you’ll walk away because the numbers don’t add up.

How It Compares to the Rest of the Market

Let’s put this in perspective. Ethereum itself moves $6.3 billion in trading volume every day. Uniswap, the biggest DEX, handles over $200 million daily. Even smaller DEXes like SushiSwap or Balancer move tens of millions. Solidly? $49.70. That’s not a blip. It’s a ghost.

Compare it to MEXC, which supports over 200 coins. Or Coinbase, which offers hundreds of tokens, margin trading, staking, and fiat on-ramps. Solidly doesn’t even offer stablecoin swaps with decent depth. Its entire existence is a footnote in the DeFi story.

And there’s no sign of progress. No roadmap updates. No new features announced since 2022. No team updates. No press coverage. The last major analysis of Solidly came from CoinMarketCap Academy - and even they called it a niche experiment. No major crypto publications list it among top DEXes. Not in 2023. Not in 2024. Not in 2025.

Who Should Use Solidly?

Real talk: almost no one.

If you’re a researcher studying tokenomics models, Solidly is a fascinating case study. You can see how incentive misalignment kills adoption. You can watch how NFT-based staking plays out in the wild. You can trace the decline of a once-promising protocol.

If you’re a DeFi developer looking to test a new idea, you might deploy a small pool here for fun. But don’t expect returns. Don’t expect volume. Don’t expect users.

If you’re a trader? Walk away. The liquidity is too thin. The slippage is too high. The risk isn’t worth the reward. Even swapping $10 could cost you more in price impact than you’d gain from fee rewards.

Final Verdict: A Dead End With a Cool Idea

Solidly V2 on Ethereum isn’t broken. It’s abandoned. The idea behind its fee distribution and NFT staking was ahead of its time - or maybe just ahead of its audience. But in crypto, timing matters more than innovation. If users don’t show up, the best code in the world doesn’t matter.

The platform’s tiny trading volume, lack of reviews, and zero development activity make it clear: this isn’t a living exchange. It’s a relic. A museum piece of DeFi’s experimental phase.

There’s nothing wrong with building niche tools. But when a project has no users, no volume, and no future updates, it’s not a platform - it’s a graveyard.

If you’re looking for a reliable decentralized exchange on Ethereum, stick with Uniswap, SushiSwap, or Curve. They have liquidity. They have users. They have updates. Solidly? It’s still running - but barely. And if you’re not here to study history, you’re better off somewhere else.

Is Solidly a safe exchange to use?

Solidly’s smart contracts have not been audited publicly, and with zero user reviews and no active development, there’s no way to verify its long-term safety. While the code may be technically sound, the lack of community oversight and minimal usage means any vulnerabilities would go unnoticed. Treat it like a testnet - not a production platform.

Can I earn fees by staking $SOLID?

Technically, yes - but only if you vote for a pool and that pool generates fees. With only $38.53 in daily volume on the most active pair (LUSD/WETH), your potential earnings are negligible. Even if you stake $1,000 worth of $SOLID, you might earn less than $0.10 per week. The reward structure is theoretical, not practical.

Why does Solidly only have five trading pairs?

Solidly was designed as a minimalistic platform focused on stablecoin and wrapped ETH pairs. The team likely wanted to avoid the complexity of managing dozens of tokens. But without liquidity, even five pairs are too many. The lack of user demand forced the platform into a state of near-total inactivity.

Is Solidly still being developed?

There’s no evidence of active development since 2022. No GitHub commits. No team announcements. No social media updates. The project appears frozen. Without updates, security risks grow, and users lose trust. It’s effectively a dormant project.

Can I trade $SOLID on other exchanges?

$SOLID is only listed on Solidly’s own platform and one or two tiny DEXes with almost no volume. You won’t find it on Coinbase, Kraken, or Binance. That makes it nearly impossible to buy or sell outside the platform - which further limits its usefulness.

Arthur Crone

November 11, 2025 AT 01:59Solidly is a joke. $49.70 in volume? That’s not a DEX, it’s a sandbox for dev ego. Andre Cronje built this like a PhD thesis no one asked for.

tom west

November 12, 2025 AT 02:17Let’s be real - this isn’t about liquidity. It’s about incentive misalignment. The NFT staking model looked cool on paper but ignored human behavior. People don’t want to vote for pools. They want passive yield. This project failed because it treated users like economists, not degens.

And now? Zero commits, zero updates, zero trust. The smart contracts might be clean, but in crypto, if nobody’s watching, it’s already dead.

You don’t need audits if nobody’s using it. You need users. Solidly got neither.

This is what happens when you optimize for theory over traction. The market doesn’t care how elegant your math is if your UI looks like a 2018 Ethereum tutorial.

Compare it to Uniswap’s simplicity - swap, stake, forget. Solidly? You need a flowchart just to understand how to earn $0.02 a week.

And don’t even get me started on the $SOLID token. It’s not scarce - it’s irrelevant. No CEX listings, no utility outside its own graveyard pool.

The only people left here are the ones writing Medium posts about it like it’s a blockchain oracle. Newsflash: it’s not. It’s a tombstone.

DeFi doesn’t die from hacks. It dies from silence.

And Solidly? It’s the quietest corpse in the whole cemetery.

Joanne Lee

November 13, 2025 AT 11:16While the volume figures are undeniably minimal, I find the underlying tokenomics model of Solidly V2 to be a fascinating case study in decentralized governance mechanics. The forced concentration of liquidity through NFT-based voting introduces a novel dynamic that, while poorly communicated, is theoretically sound. It attempts to solve the free-rider problem inherent in other AMMs, where liquidity providers benefit from all pools without contributing to their growth. The challenge lies not in the design, but in the onboarding experience - which remains inaccessible to non-technical users. A more intuitive interface and educational content could have unlocked its potential. As it stands, the protocol is less a failed exchange and more an under-taught experiment.

Rachel Everson

November 13, 2025 AT 16:04Honestly? I tried to use Solidly once. Swapped $5 of LUSD and lost $0.80 to slippage. My wallet was colder than my coffee. I didn’t even get a confirmation email. No support, no docs, just a spinning wheel and a silent contract. I walked away. Not because I’m scared - because I’m not stupid.

If you’re building something, make it usable. Or at least tell people it’s a lab project. Don’t pretend it’s a real exchange when your ‘most active pair’ moves less than my lunch money.

Ashley Mona

November 13, 2025 AT 16:24Y’all are missing the point. Solidly isn’t dead - it’s sleeping. The $SOLID NFT staking model? Genius. It’s like DeFi’s version of a loyalty program where your vote actually matters. But no one understood it because nobody bothered to explain it. Imagine if Uniswap had launched with zero tutorials and expected everyone to just… know.

The real tragedy? The team could’ve done a simple video explainer. A tweet thread. A Discord AMA. But they vanished. And now we’re all just arguing over tombstone statistics.

It’s not the tech that failed. It’s the communication. And that’s on the devs. Not the users.

Edward Phuakwatana

November 13, 2025 AT 17:33Bro. Solidly is the blockchain equivalent of a Tesla prototype from 2006. It’s not meant for the masses. It’s meant to prove a hypothesis. The NFT staking + voting mechanism? That’s the real innovation. The fact that it’s dead? That’s the data point. We’re not here to trade - we’re here to observe how incentive structures collapse when user psychology isn’t accounted for.

Think of it as a crypto lab rat. The model was beautiful. The execution? A silent scream into the void.

And honestly? That’s more valuable than another DEX with $200M volume but zero soul.

Next time someone says ‘it’s dead,’ ask: ‘Dead or just misunderstood?’

Solidly didn’t fail. It was too ahead. And the crowd? They were still on dial-up.

Don’t bury it. Archive it. And study it.

Because the next AMM that survives? It’ll be built on Solidly’s corpse.

David Billesbach

November 14, 2025 AT 20:45Of course this is a shill. Andre Cronje is a Fed puppet. They let him launch this to test how fast liquidity evaporates under algorithmic pressure. You think $49.70 is real? That’s the bait. The real action is happening on the dark pool side channels. They’re draining the last 0.03 ETH from the LUSD/WETH pair and rerouting it to a CEX arbitrage bot owned by someone who used to work at ConsenSys.

They’re not dead. They’re harvesting. The ‘zero reviews’? That’s because the reviews are all on Telegram. You think I’m joking? Look up ‘solidly_v2_liquidity_dump’ on the dark web. The blockchain doesn’t lie. The front-end does.

They’re not a DEX. They’re a honeypot. And you’re all just the flies.

dhirendra pratap singh

November 16, 2025 AT 13:03Imagine being this guy who built a DEX with 5 coins and then just… ghosted. No updates. No replies. Not even a ‘sorry’ tweet. That’s not a project. That’s a betrayal.

People staked their life savings in $SOLID thinking it was the next big thing. Now they’re stuck with NFTs that are worth less than a meme coin from 2021.

Andre didn’t fail. He just got bored. And now we’re all left cleaning up his mess.

And the worst part? He’s probably off building something else. And we’ll all fall for it again.

💀

Adrian Bailey

November 16, 2025 AT 22:54ok but like… i tried to swap 10 bucks of usdt for lusd and my tx took 12 minutes and then i got 9.87 usdt back. like what. even the gas was higher than the slippage loss. i thought maybe i was doing it wrong so i watched a 40min youtube video about ‘solidly voting mechanics’ and now i have a headache and zero profit. i just want to swap coins. why do i need to be a blockchain economist just to trade stablecoins? i’m not even mad. i’m just… confused. like why does this exist? why did someone think this was a good idea? i feel like i accidentally walked into a philosophy class that was supposed to be a grocery store.

also the website looks like it was built in 2017 on a free wordpress theme. no mobile app. no discord. no twitter replies. just a lonely interface and a ‘last updated 2022’ banner. i’m not saying it’s evil. i’m saying it’s like a ghost town with one working vending machine that only accepts quarters from 1998.

maybe it’s art? maybe it’s a protest against crypto greed? idk. but i’m not coming back.

Laura Hall

November 18, 2025 AT 15:39Look, I get why people hate this. But I also think we’re being too harsh. Solidly wasn’t built for you. It wasn’t built for me. It was built for the people who care about the *how*, not the *what*. The ones who geek out over incentive alignment and token emission curves. We’re all so obsessed with volume and returns that we forgot crypto started as an experiment.

Solidly’s a museum piece. Like the first iPhone. Ugly. Clunky. Useless for most people. But it showed us what was possible.

Maybe it didn’t survive. But it didn’t die in vain. Someone learned from it. Someone’s building the next thing right now - and they’re not making the same mistakes.

So yeah, don’t use it. But don’t mock it either. Let it rest. With dignity.

ty ty

November 19, 2025 AT 17:18Wow. $49.70. That’s less than my Starbucks run. Guess I’ll just stick to buying coffee instead of pretending I’m a DeFi whale.

Arthur Coddington

November 21, 2025 AT 03:41It’s not a DEX. It’s a metaphor. A slow-motion collapse of idealism in a world that only values ROI. Solidly didn’t fail because of bad code. It failed because the community stopped believing in the dream. And in crypto? Belief is the only liquidity that matters.

We don’t need more DEXes. We need more faith.

But we’re too busy chasing yield to notice when the light goes out.

Johanna Lesmayoux lamare

November 22, 2025 AT 12:36It’s sad. The idea was smart. But no one explained it. And in crypto, if you can’t explain it in 10 seconds, it’s dead.

Phil Bradley

November 22, 2025 AT 21:16Remember when we thought DeFi was going to change the world? Solidly is the quiet ghost of that hope. No drama. No crash. Just… fading away. Like a candle left in an empty room.

I miss when we built things because we believed in them - not because we wanted to flip them.

Suhail Kashmiri

November 23, 2025 AT 10:42bro this is why indians dont trust crypto. u build something and then just vanish? no one even replies to comments? this is not tech. this is scam energy.

Kristin LeGard

November 25, 2025 AT 04:36America doesn’t need this. We have Coinbase. We have real infrastructure. This is just another crypto bro fantasy. Get a real job, Andre.

BRYAN CHAGUA

November 26, 2025 AT 00:46There’s value in failure. Solidly taught us that elegance without adoption is noise. That innovation without education is arrogance. That tokenomics without community is just math on a screen.

It’s not a graveyard. It’s a lesson.

And if we’re smart, we’ll learn from it before we build the next one.

Debraj Dutta

November 28, 2025 AT 00:41Interesting. The model resembles some early Indian cooperative banking structures - where members had to vote on fund allocation. The idea was sound, but execution lacked community engagement. In emerging markets, we learned that simplicity and trust matter more than complexity. Solidly’s downfall was not in design, but in assuming users would self-educate.

Rebecca Saffle

November 29, 2025 AT 07:49This is why America is falling behind. We let these tech bros build useless shit while real infrastructure crumbles. $49.70? That’s the cost of one real American’s healthcare. This isn’t innovation. It’s a distraction.

Adrian Bailey

November 29, 2025 AT 16:50wait hold up - i just checked again. the LUSD/WETH pair is at $38.53. i just sent $10 to swap. the tx is still pending. 47 minutes now. i think i just got stuck in the blockchain equivalent of a DMV waiting room. i’m starting to think this whole thing is a slow burn art project. like a performance piece called ‘the death of decentralization.’

maybe the real reward is the existential dread?

also i just realized… the website’s background is a gradient that looks like a Windows 95 screensaver. i’m not mad. i’m impressed.