DYORSwap Risk Assessment Tool

DYORSwap Risk Assessment

This tool estimates your potential risk based on DYORSwap's documented issues: fake volume, thin liquidity, and lack of security audits.

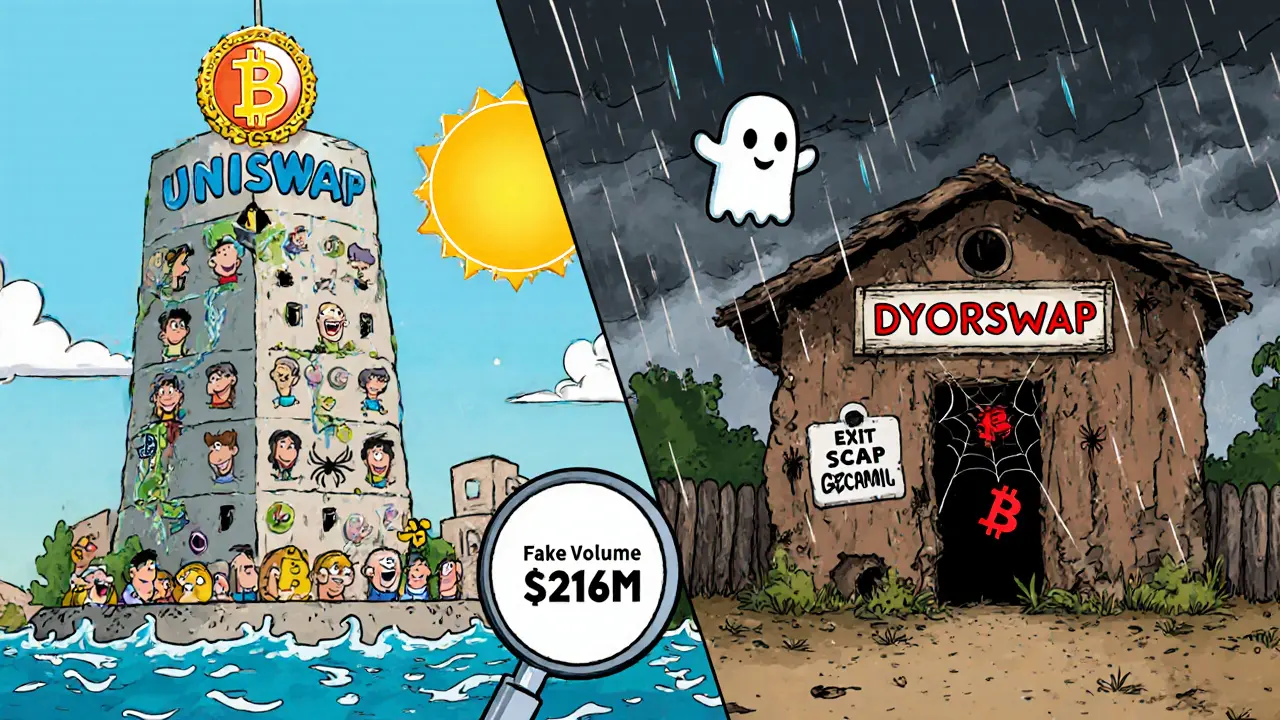

If you're looking for a crypto exchange with 0% trading fees, DYORSwap (Plasma) might catch your eye. But here’s the catch: it’s not the next Uniswap. It’s not even close. DYORSwap (Plasma) is a niche, barely-used decentralized exchange built on a little-known blockchain called Plasma. It’s designed for trading obscure meme coins like trillions and GOD ♱, not Bitcoin or Ethereum. And while the zero-fee model sounds amazing, the risks far outweigh the perks.

What Is DYORSwap (Plasma)?

DYORSwap (Plasma) is a decentralized exchange (DEX) that operates solely on the Plasma blockchain. Unlike big names like Uniswap or PancakeSwap, it doesn’t aggregate liquidity from multiple sources. It’s a single pool, with only eight trading pairs listed as of late 2024. Its entire purpose seems to be serving tokens that barely exist elsewhere - tokens with names like U Plasma USD₡/XP and T trillions/ARAUCO. These aren’t projects with whitepapers or teams. They’re coins launched days ago, often with no clear use case beyond speculation.

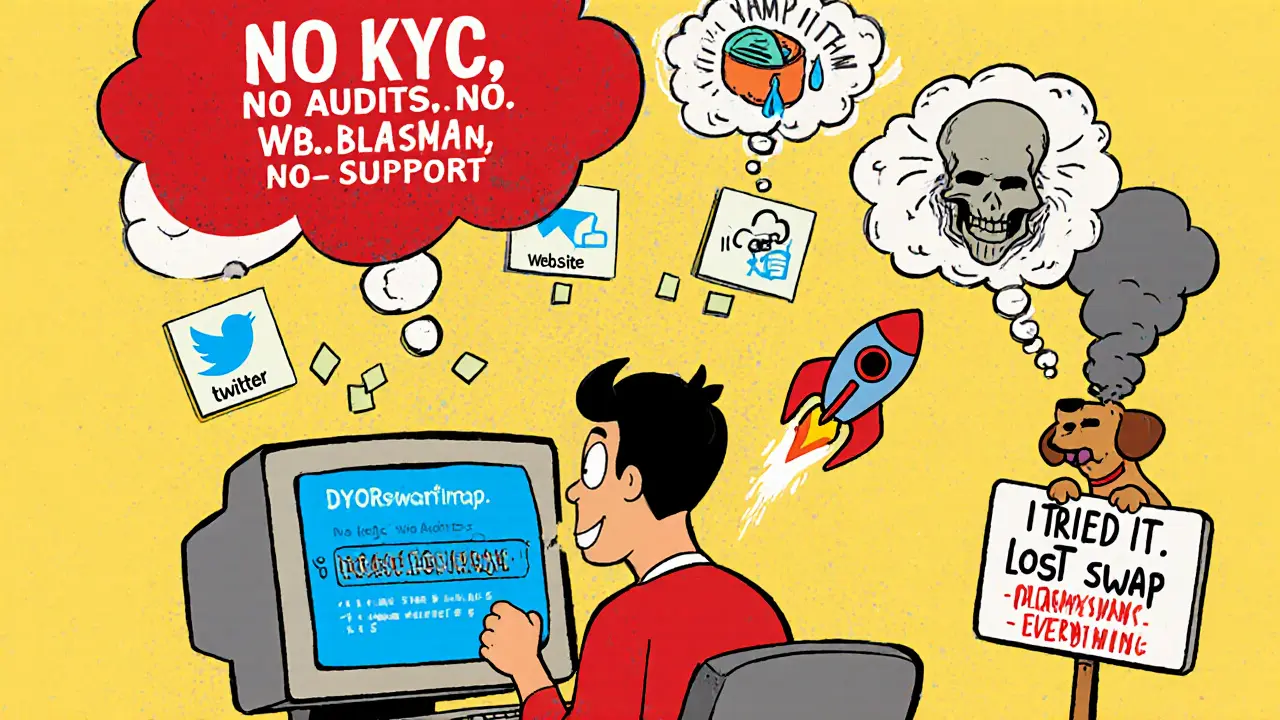

The platform’s website is dyorswap.finance. That’s it. No blog. No roadmap. No team page. No GitHub. No API docs. Nothing. If you’re used to checking a project’s GitHub for code updates or reading a whitepaper for technical details, you’re out of luck here. DYORSwap (Plasma) doesn’t provide any of that. And that’s not just inconvenient - it’s a major red flag.

The Zero-Fee Trap

Most DEXs charge 0.3% per trade. That’s standard. Uniswap, SushiSwap, PancakeSwap - they all take that cut. DYORSwap (Plasma) charges nothing. No maker fee. No taker fee. Sounds like a dream, right?

But here’s the reality: zero fees don’t mean free money. They mean no revenue. And if a platform has no revenue, it has no incentive to maintain security, update software, or even stay online. There’s no team being paid. No infrastructure being funded. No customer support budget. The only thing keeping this exchange alive is the hope that someone will keep trading its weird tokens.

Compare that to Uniswap, which handles over $1.2 billion in daily volume across all chains. DYORSwap’s highest-volume pair - U Plasma USD₡/XP - reports $216 million in 24-hour volume. That sounds big until you realize it’s likely inflated. Blockchain researcher Alex Saunders pointed out that DYORSwap’s volume-to-liquidity ratios are suspicious. One token had $943,000 in liquidity but showed $216 million in volume. That’s not possible unless someone’s washing trades - creating fake volume to trick new users into thinking the market is active.

Liquidity? What Liquidity?

Liquidity is the lifeblood of any exchange. If you can’t swap your tokens quickly without slippage, the exchange is useless. DYORSwap’s liquidity is thin, inconsistent, and sometimes nonexistent.

Liquidity Finder shows “Coins 0. Pairs. Liquidity” - meaning their system can’t even detect any trading pairs. Meanwhile, CoinMarketCap lists eight pairs with high volumes. This contradiction isn’t a glitch - it’s a sign that the data is being manipulated or misreported. When two major data providers can’t agree on whether the exchange even exists, you have a problem.

And here’s the kicker: the Plasma blockchain itself has negligible total value locked (TVL). DefiLlama, the go-to source for DeFi metrics, doesn’t even list DYORSwap as a major contributor. That means almost no real money is backing these trades. If you deposit $1,000 into this exchange, you’re not putting it into a deep, stable pool. You’re putting it into a puddle that could evaporate overnight.

Security and Transparency Issues

There’s no regulation. No KYC. No audits. No public security reports. FxVerify explicitly states DYORSwap (Plasma) is not regulated by any government authority. That’s not unusual for DEXs - but when combined with other red flags, it becomes dangerous.

On DexScreener, DYORSwap is labeled “unknown DEX.” That’s not a technical error. That’s a warning from the crypto community. When analytics tools can’t identify your platform, it means you’re not integrated with the standard infrastructure. No one’s monitoring your smart contracts. No one’s checking for honeypots - malicious contracts that lock your funds when you try to sell.

YouTube analysis shows users have to manually copy contract addresses from Twitter, the project’s website, and a blockchain scanner called PlasmaScan. That’s not user-friendly - it’s a setup for scams. Legitimate projects don’t make you hunt for their contract address across three different sites. They list it clearly on their official page, verified by multiple sources. DYORSwap doesn’t do that. And that’s exactly how exit scams work.

Who Is This For?

DYORSwap (Plasma) isn’t for investors. It’s not for traders looking for long-term growth. It’s not even for DeFi enthusiasts who want to earn yield or stake tokens.

This exchange is for one group: people chasing meme coins with no fundamentals, hoping to catch a quick pump. If you’re buying a token called trillions because it has a funny name and a Twitter account with 3,000 followers, then DYORSwap might be your only option. But even then, you’re gambling. The token’s market cap peaked at $23 million - tiny compared to even the smallest real crypto projects. And as one YouTube reviewer noted, that trading pair was created just two days before they recorded the video.

There’s no long-term play here. No community. No roadmap. No updates. The platform hasn’t changed in months. No new tokens have been added. No features launched. No announcements. It’s frozen in time - which, in crypto, means it’s dying.

What You Won’t Find

You won’t find a mobile app. You won’t find a desktop client. You won’t find customer support. No email. No Telegram. No Discord. No help center. No FAQ. No live chat. Nothing.

And you won’t find any reviews. No Trustpilot. No Reddit threads. No CoinGecko ratings. No Bitcointalk posts. Zero. That’s not because it’s new - it’s because almost no one uses it. If 500 people tried it and got scammed, you’d see at least a few complaints. You’d see someone say, “I lost my ETH because the swap failed.” But there’s nothing. Because the traffic is so low, even scammers aren’t bothering to target it.

How It Works (If You Dare)

If you still want to try it, here’s the process:

- Go to dyorswap.finance.

- Connect a wallet that supports the Plasma blockchain (good luck finding one).

- Find the token you want to buy - say, trillions.

- Manually copy its contract address from Twitter, the project’s website, and PlasmaScan.

- Paste it into DYORSwap.

- Enter how much XPL you want to spend.

- Click swap.

- Hope the contract isn’t a honeypot.

That’s it. No limit orders. No stop-losses. No price alerts. No analytics. Just a simple swap with no safety net.

Bottom Line: Avoid Unless You’re Willing to Lose It All

DYORSwap (Plasma) is not a crypto exchange you should use. It’s a high-risk experiment with no real backing, no transparency, and no future. The 0% fee is a bait. The high volume numbers are likely fake. The liquidity is thin. The security is nonexistent. And the platform shows no signs of growth - only stagnation.

If you’re looking for low fees, try Uniswap on Arbitrum or PancakeSwap on BSC. Both have 0.05-0.2% fees, deep liquidity, active communities, and verified contracts. You’ll get better prices, faster trades, and real protection.

DYORSwap (Plasma) isn’t the future of DeFi. It’s a relic of the meme coin frenzy - a ghost town with a flashy sign that says “Free Trading.” Walk away. Your funds will thank you.

Is DYORSwap (Plasma) safe to use?

No, DYORSwap (Plasma) is not safe. It has no regulatory oversight, no security audits, and no public documentation. Its trading pairs show signs of manipulated volume, and users must manually verify contract addresses - a major red flag for honeypot scams. There’s no customer support, no community, and no recovery options if funds are lost.

Does DYORSwap (Plasma) have a mobile app?

No, DYORSwap (Plasma) does not have a mobile app or desktop client. It’s a web-only platform, and only works with wallets that support the Plasma blockchain - which are extremely rare. Most mainstream wallets like MetaMask or Trust Wallet don’t support Plasma, making access difficult.

Why is DYORSwap labeled as "unknown DEX" on DexScreener?

DexScreener labels DYORSwap as "unknown DEX" because it’s not integrated into standard blockchain analytics systems. It doesn’t have verified contract addresses, no API access, and no public data feeds. This means its trades can’t be tracked reliably, and its liquidity can’t be verified - a common trait of low-quality or scam projects.

Can I earn yield or stake tokens on DYORSwap?

No, DYORSwap (Plasma) offers no staking, yield farming, or liquidity mining features. It’s a basic swap interface with no advanced DeFi tools. Even basic functions like limit orders or price alerts are missing. It’s designed only for one thing: swapping obscure meme coins.

How does DYORSwap compare to Uniswap or PancakeSwap?

DYORSwap is not comparable to Uniswap or PancakeSwap. Those platforms have billions in daily volume, thousands of tokens, verified contracts, active communities, and robust security. DYORSwap has less than $220 million in daily volume across eight obscure tokens, no community, no documentation, and no transparency. The 0% fee is meaningless without liquidity, security, or reliability.

Is DYORSwap (Plasma) a scam?

It’s not confirmed as a scam, but it has all the warning signs: fake volume, no team, no documentation, no support, and tokens requiring manual contract verification. Industry analysts warn that exchanges like this are often exit scams - designed to attract early traders, inflate prices, then disappear. Treat it as high-risk speculation, not an investment.

If you're trading meme coins, you’re already taking risks. DYORSwap (Plasma) doesn’t reduce those risks - it multiplies them. Stick to platforms with proven track records. Your portfolio will be safer for it.

William Moylan

November 12, 2025 AT 09:200% fees? LOL. This is clearly a honeypot backed by the Fed to drain degens' wallets. Plasma chain? Never heard of it - probably a shadow operation run by the same people who sold us Bitcoin as a pyramid scheme. They’re laundering crypto through meme coins so the NSA can’t trace it. I’ve seen this before - the contract address changes every 72 hours. Don’t touch it. Your ETH will vanish like your last relationship.

Michael Faggard

November 13, 2025 AT 16:33Let’s be real - DYORSwap is a perfect example of a non-custodial, permissionless liquidity primitive in a zero-trust environment. The lack of KYC and audit is actually a feature, not a bug. It’s DeFi at its purest: capital efficiency meets atomic swaps without middlemen. The volume-to-liquidity ratio? Classic MEV arbitrage play. If you’re not using Plasma, you’re not living in the future. This isn’t a scam - it’s a paradigm shift the mainstream can’t handle yet.

Elizabeth Stavitzke

November 15, 2025 AT 10:15Oh wow, a crypto exchange that doesn’t even have a team? How… quaint. I suppose in America we still believe in ‘free markets’ even when they’re run by anonymous people who name their tokens after numbers. Meanwhile, in real countries, exchanges have compliance officers and legal counsel. But hey - if you want to gamble your life savings on a token called ‘GOD ♱’, go ahead. I’ll be over here, investing in something that doesn’t look like a drunken Twitter thread.

Ainsley Ross

November 16, 2025 AT 19:54I understand the appeal of zero-fee trading - who doesn’t love saving on costs? But safety isn’t optional in crypto. DYORSwap’s complete lack of transparency, community, or infrastructure is deeply concerning. If you’re going to engage with DeFi, please at least verify contracts on Etherscan or use a wallet with built-in scam detection. Your peace of mind is worth more than a few gas fees. I’ve seen too many people lose everything chasing ‘free’ - please, don’t be one of them.

Brian Gillespie

November 18, 2025 AT 13:46Don’t use this. It’s a trap.

Wayne Dave Arceo

November 19, 2025 AT 13:09There is no such thing as a ‘zero-fee’ exchange. Fees are always paid - either by the user, the liquidity providers, or the system itself. DYORSwap has no revenue model, no team, no audit, no documentation, no support, no GitHub, no blog, no API - and you’re telling me this is legitimate? This isn’t innovation. This is negligence dressed up as decentralization. If you can’t even spell ‘Plasma’ correctly in their domain name, you shouldn’t be trading on it. The grammar alone is a red flag.

Joanne Lee

November 19, 2025 AT 13:43I’m curious - if DYORSwap’s highest-volume pair shows $216M in volume with only $943K in liquidity, what mechanism is being used to inflate those numbers? Is it wash trading? Bot-driven arbitrage? Or is it simply misreported data due to poor integration with blockchain explorers? I’d love to see a breakdown of the transaction patterns - especially if the Plasma chain doesn’t support standard indexing protocols. Could this be a case of data poisoning?

Laura Hall

November 20, 2025 AT 18:05Look, I get it - meme coins are wild, and DYORSwap feels like a garage project that got lucky. But if you’re going to try it, please at least double-check the contract on PlasmaScan and never put in more than you’re willing to lose. I’ve seen friends lose their rent money on stuff like this. It’s not worth it. You don’t need to be a genius to know when something smells like burnt toast. Just walk away. There’s plenty of real DeFi out there. We don’t need to glorify chaos.

Arthur Crone

November 21, 2025 AT 20:32Wash trading. No team. No code. No future. Just a shiny button that says ‘swap’ and a graveyard of wallets. You’re not a trader - you’re a donation to the void.

Suhail Kashmiri

November 23, 2025 AT 11:27Bro, this is why India banned crypto exchanges - people like you think ‘zero fee’ means ‘free money’. You’re not smart, you’re just greedy. This isn’t finance, it’s a carnival ride with no safety rails. I’ve seen this in my uncle’s WhatsApp group - same thing, different token. Don’t be the next guy crying on Reddit when your wallet is empty. Just stop.