KyberSwap Elastic Liquidity Checker

The KyberSwap Elastic protocol on Ethereum has been declared inactive due to a critical security vulnerability. If you have funds in this protocol, you should withdraw immediately.

Position Status

KyberSwap Elastic is currently inactive with $0 volume

Your liquidity position shows no trading activity. This protocol is no longer functional and is at high risk of permanent loss.

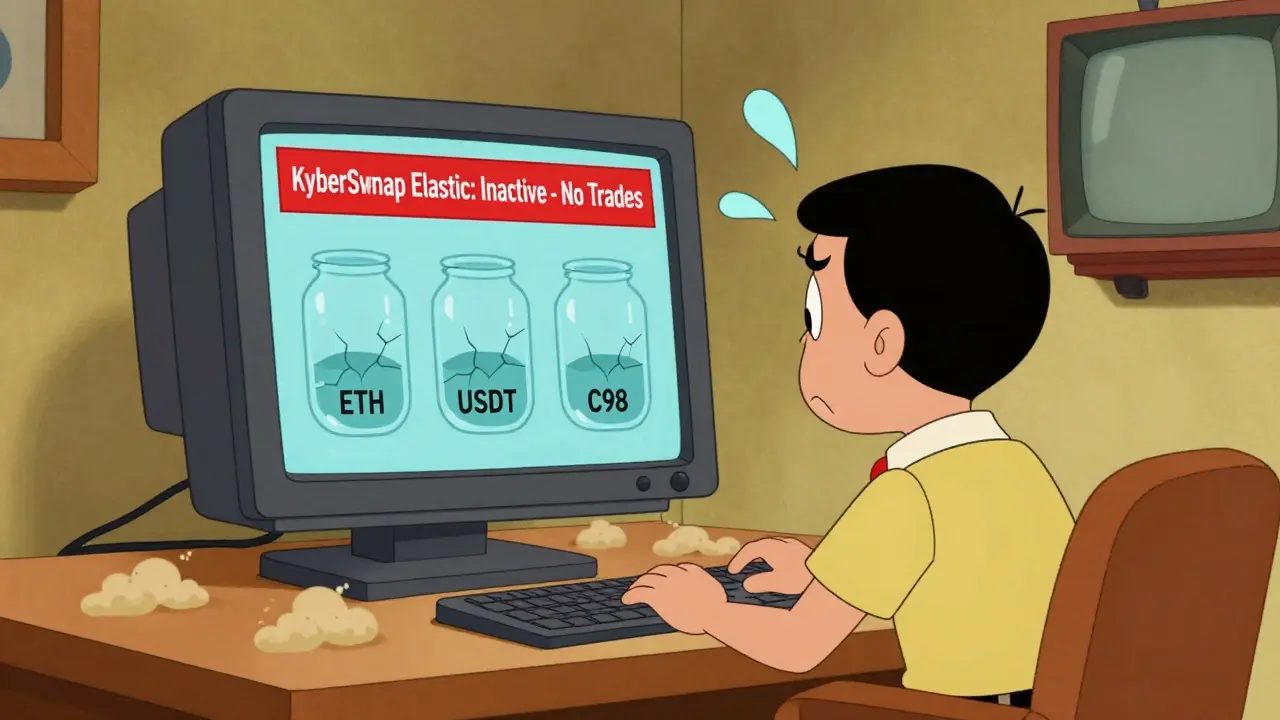

When you hear "KyberSwap Elastic," you might think of a powerful, cutting-edge crypto exchange built for smart traders. And for a while, it was. But as of December 2025, the story has changed - dramatically. KyberSwap Elastic on Ethereum isn’t just struggling. It’s inactive. No trades. No volume. Just a warning on the site telling users to withdraw their funds immediately. This isn’t a slow day. This is a shutdown in progress.

What KyberSwap Elastic Was Supposed to Be

KyberSwap Elastic launched in 2022 as the advanced version of KyberSwap’s original automated market maker (AMM). Unlike older DEXs that spread your liquidity across every possible price, Elastic let you lock your funds into specific price ranges. Think of it like setting a price guardrail - you only provide liquidity when the market is near your chosen range. That meant less wasted capital and higher returns for experienced traders. It wasn’t just about concentration, though. The real kicker? KyberSwap Elastic automatically reinvested your trading fees back into your position. No manual claiming. No gas fees for compounding. It did it all on its own. That feature alone made it stand out from Uniswap v3, which required users to manually claim and reinvest rewards. For passive liquidity providers, this was a game-changer. The protocol ran on Ethereum, used no KYC, and kept full control of your assets - classic DeFi. You weren’t handing over your keys to a company. You were interacting directly with smart contracts. That’s the promise of decentralized finance: trustless, permissionless, and user-owned.What Happened to KyberSwap Elastic?

Something went very wrong. In late 2024, security researchers flagged unusual behavior in the Elastic protocol’s fee distribution system. By January 2025, the KyberSwap team confirmed a critical vulnerability. The exploit didn’t steal funds directly - instead, it allowed attackers to manipulate fee calculations, potentially draining liquidity pools over time. The team issued an emergency advisory: “Withdraw all funds immediately.” Since then, nothing has moved. As of today, KyberSwap Elastic on Ethereum shows:- 24-hour trading volume: $0.00

- Active trading pairs: 1 (C98/USDT)

- Last trade: 6 days ago

- Status: “Inactive - No trades in the last 3 hours”

- Price anomaly warning: “Trading price or volume is an outlier”

How It Compares to the Competition

Before the crash, KyberSwap Elastic had one clear edge: automated compounding. But now, that advantage means nothing. Uniswap v3 still works. It’s active. It has billions in volume. You still need to manually reinvest your fees, but at least your money isn’t trapped. SushiSwap’s concentrated liquidity pool is also live. Curve Finance? Still processing thousands of trades daily. Even newer players like Balancer v2 have kept momentum. KyberSwap Elastic? Dead in the water. The broader KyberSwap ecosystem - the aggregator that finds the best rates across 8 blockchains - is still going strong. It handled $3.7 billion in volume in March 2025. But that’s the aggregator, not Elastic. The aggregator doesn’t hold your funds. It just finds routes. Elastic was the part where you actually deposited your assets. And that part is broken.

Who Was This For? (And Who Should Avoid It)

KyberSwap Elastic was never for beginners. You needed to understand:- How price ranges affect impermanent loss

- When to adjust your liquidity bounds

- How gas fees eat into small returns

- Why automated compounding matters in volatile markets

The Bigger Picture: Is KyberSwap Still Trustworthy?

This isn’t the first time a DeFi protocol had a security issue. But it’s rare for a team to go silent for months after a major warning. KyberSwap’s website still gets over 200,000 monthly visits. Its aggregator works. Its mobile app still connects to other chains. The team has added integrations with Ronin, Arbitrum, and Optimism. They’re clearly still building - just not on Ethereum Elastic. That’s the red flag. If they were fixing Elastic, they’d be talking about it. They’d post audit reports. They’d give updates. Instead, they’ve buried it under the rest of the ecosystem. The lesson? Even well-funded, well-known projects can fail silently. You can’t assume a team’s reputation protects your money. You have to watch the chain.

What You Should Do Right Now

If you still have funds in KyberSwap Elastic on Ethereum:- Log in immediately - don’t wait.

- Withdraw every last dollar, every token.

- Don’t trust the interface. If the withdrawal button is grayed out, try connecting a different wallet (MetaMask, Coinbase Wallet, etc.).

- Once withdrawn, don’t redeposit. This isn’t a temporary outage. This is abandonment.

- Try Uniswap v3 - it’s the most battle-tested

- Use SushiSwap’s concentrated liquidity pools for lower fees

- Check Balancer v2 if you want multi-token pools

Sarah Luttrell

December 11, 2025 AT 05:41Oh sweet mother of DeFi, they actually let this thing live long enough to die on its own? 🤦♀️

Automated compounding? More like automated suicide. If you didn’t know how to manage price ranges, you shouldn’t have been near this thing - and if you did, you should’ve pulled out the second you saw the ‘inactive’ banner.

At least the team had the decency to not pretend they were fixing it. Just… ghosted. Like a bad Tinder date with a $200M TVL.

Meanwhile, Uniswap v3 is out here making bank while Kyber’s ghost pool sits there like a tombstone with a ‘RIP Your Capital’ plaque.

Also, C98/USDT still showing a price? Bro, that’s not a price - that’s a memory. A digital ghost haunting the Ethereum blockchain.

Someone please write a book called ‘How to Lose $10M in 6 Months: A KyberSwap Elastic Tragedy.’ I’ll buy the audiobook narrated by a crying robot.

PRECIOUS EGWABOR

December 11, 2025 AT 20:32Wow. Just… wow.

It’s wild how fast these ‘innovative’ DeFi projects can go from ‘next big thing’ to ‘dead in the water.’

They had the tech, they had the branding, they even had the auto-compound feature - but no one bothered to test the emergency shutdown protocol properly.

It’s not just about code. It’s about accountability. And Kyber’s silence speaks louder than any audit report ever could.

People still don’t get it: if your team stops talking after a warning, your protocol is already dead. The code might still run, but the trust? Gone.

And now we’re left with this eerie, frozen liquidity pool like a museum exhibit of bad decisions.

Next time, maybe don’t build a Ferrari with a broken brake pedal and call it ‘user-friendly.’

Kathleen Sudborough

December 13, 2025 AT 19:08I just want to say - if you’re reading this and you still have funds in KyberSwap Elastic, please, please withdraw them.

Even if the interface looks broken, even if the button is grayed out, try MetaMask, try Coinbase Wallet, try connecting from a different browser.

I’ve seen too many people assume ‘inactive’ means ‘temporary’ - but in DeFi, silence is the loudest red flag.

It’s okay to admit you got caught up in the hype. What matters now is protecting what’s left.

You didn’t fail. The protocol failed you.

And if you’re thinking of moving to Uniswap v3 or SushiSwap next - you’re making the right choice.

Stay safe, stay informed, and don’t let one bad experience make you quit DeFi entirely.

We need more thoughtful participants, not more ghosted wallets.

Heath OBrien

December 15, 2025 AT 16:23LOL they thought they could outsmart everyone

now their pool is a ghost town

typical crypto drama

withdraw or lose it

no tears

no refunds

just move on

Taylor Farano

December 17, 2025 AT 05:01Let me get this straight - a team built a product that auto-compounds fees… and then forgot to compound their own sense of responsibility?

That’s not a bug. That’s a personality disorder wrapped in a smart contract.

And now they’re quietly building on Arbitrum like nothing happened?

Classic. The same people who told you ‘trustless’ means ‘no one can steal your money’ are now hiding in the shadows like they didn’t just turn a $50M liquidity pool into a digital graveyard.

At least they had the decency to not rename it ‘KyberSwap Elastic 2.0 - Now With More Trust!’

What a joke.

Toni Marucco

December 18, 2025 AT 13:04The collapse of KyberSwap Elastic represents a profound epistemological rupture in the DeFi paradigm - one wherein technological innovation, divorced from ethical stewardship and communicative transparency, inevitably devolves into systemic abandonment.

One may admire the elegance of concentrated liquidity provision, the elegance of automated fee reinvestment - but these are hollow achievements if the moral architecture of the protocol - the implicit covenant between developer and depositor - is breached.

The team’s silence is not merely negligence; it is a metaphysical withdrawal from the social contract of decentralized finance.

Uniswap v3 persists not because it is superior in feature, but because it honors the primacy of user agency through persistent operational integrity.

KyberSwap Elastic, by contrast, has become a monument to hubris - a blockchain-based ossuary where liquidity goes to die, not because of market forces, but because of human failure.

We must not romanticize innovation without demanding accountability.

For in DeFi, as in all things, the architecture of trust is more critical than the architecture of code.

Kathryn Flanagan

December 19, 2025 AT 02:53Hey everyone, I just wanted to say - if you’re new to DeFi and you’re scared after reading this, that’s totally normal.

I remember when I first put money into a liquidity pool and thought, ‘Wait, is this safe?’

It’s okay to feel that way.

But here’s the thing - this isn’t your fault.

KyberSwap had a responsibility to keep their users safe, and they dropped the ball.

But that doesn’t mean all DeFi is dangerous.

Uniswap v3? Solid. SushiSwap? Still running. Balancer? Active.

And guess what? You can still earn great returns if you stick with projects that are transparent and keep talking to their community.

Just take your time. Read the docs. Don’t rush.

And if something feels off - trust your gut.

You’ve got this. We’ve all been there. You’re not alone.

amar zeid

December 20, 2025 AT 10:30Interesting analysis. But I wonder - was the vulnerability exploitable only by insiders, or could an external attacker have drained the pool gradually?

Also, has anyone checked the contract’s transaction history on Etherscan to see if there were any large, unusual transfers before the silence?

And what about the governance token holders? Did they vote on the shutdown? Or was this a unilateral decision?

I’m curious if the team even disclosed the vulnerability to the community before pulling the plug.

It’s one thing to have a bug - it’s another to vanish without a trace.

Maybe this is a lesson in decentralization: if no one owns it, no one is responsible for it.

Alex Warren

December 21, 2025 AT 16:57Volume: $0.00. Last trade: 6 days ago. Status: Inactive. Price anomaly warning. All of this is objectively verifiable on-chain.

No speculation. No opinion. Just data.

And yet, people still ask if it’s ‘coming back.’

It’s not. The blockchain doesn’t lie.

What’s more concerning is that Kyber’s aggregator still works - which means their engineering team is active, just selectively so.

That’s not a coincidence. It’s a strategy.

They’re keeping the brand alive while quietly burying the product that failed.

And users paid for that with their capital.

Trust is not a feature. It’s a requirement.

Claire Zapanta

December 22, 2025 AT 02:04Anyone else think this was a honeypot?

They built a ‘smart’ system with auto-compounding - perfect for attracting big liquidity.

Then let a ‘vulnerability’ quietly drain it over weeks.

Then they vanish - and now the whole thing’s ‘inactive.’

But the aggregator still works? Coincidence?

And the C98/USDT pair? Still showing a price? That’s not a bug - that’s a trap.

They wanted the liquidity. They got it. Now they’re gone.

Who’s to say this wasn’t planned?

They didn’t get hacked.

They hacked us.

And now they’re laughing all the way to Arbitrum.

Lloyd Cooke

December 23, 2025 AT 00:05There is a quiet, almost poetic tragedy in the death of KyberSwap Elastic.

It was not destroyed by a bear market, nor by regulatory crackdown, nor by a hostile takeover.

It was murdered by silence.

By the absence of a voice. By the refusal to say, ‘We made a mistake.’

It is the silence that makes this death feel like a betrayal - not because the code failed, but because the humanity did.

We built DeFi to escape the lies of banks.

But here we are, betrayed by the very architects who swore to be different.

And now, we are left with a frozen pool - not a monument to innovation, but to the fragility of human integrity.

Perhaps the real lesson is not in the contract - but in the conscience.

Kurt Chambers

December 24, 2025 AT 11:08they said trustless but we trusted anyway

lol

now my eth is stuck in a ghost pool

and the devs are sipping margaritas on arbitrum

decentralized my ass

crypto is just a casino with extra steps

and i was dumb enough to play

send help or just take my money

im done

Jessica Eacker

December 25, 2025 AT 14:35Hey, if you’re still holding funds in KyberSwap Elastic - you’re not alone.

I was there too. Thought I was being smart with my ranges.

Then the silence hit.

But here’s what I learned: pulling out was the bravest thing I did.

It wasn’t easy. I had to try three wallets. One didn’t connect. One timed out.

But I kept trying.

And now? I’m on Uniswap v3 - manual compounding, but at least I can see my money move.

It’s not glamorous.

But it’s real.

You can do this too.

One step at a time.

You’ve got this.

Jessica Petry

December 27, 2025 AT 08:49Let me be the first to say it - KyberSwap Elastic wasn’t killed by hackers.

It was killed by people who thought they were too smart to need transparency.

‘Oh, we have automated compounding!’

‘Oh, we’re on Ethereum!’

‘Oh, no KYC!’

But no one asked: ‘Who’s watching the house?’

And now? The house is empty.

And the people who trusted them? Left holding the keys to a ghost mansion.

It’s not a failure of technology.

It’s a failure of character.

And I’m tired of pretending otherwise.

Scot Sorenson

December 27, 2025 AT 12:22They didn’t get hacked.

They got outsmarted.

By their own ego.

They thought auto-compounding made them geniuses.

Turns out it just made them lazy.

And now the whole thing’s dead.

Meanwhile, Uniswap’s still crushing it - because they don’t pretend to be magic.

They just do the work.

And you? You’re still stuck wondering if your money’s safe.

It’s not.

So go withdraw.

Now.

Before they delete the whole thing and claim it was ‘a test.’

Sarah Luttrell

December 29, 2025 AT 02:57Someone just said they’re on Uniswap v3 now.

Good. But don’t just copy-paste your old ranges.

That’s how you get re-hacked - by repeating the same mistakes.

Adjust your bounds. Check the volatility. Use a liquidity calculator.

Don’t be lazy.

And for god’s sake, don’t trust ‘automated’ anything again unless you’ve audited the code yourself.

Or at least read the audit.

Not the marketing blog.

The real one.

With the footnotes.

And the disclaimer that says ‘we’re not liable if your money vanishes.’

That’s the one.