VVS Finance Value Loss Calculator

Investment Loss Calculator

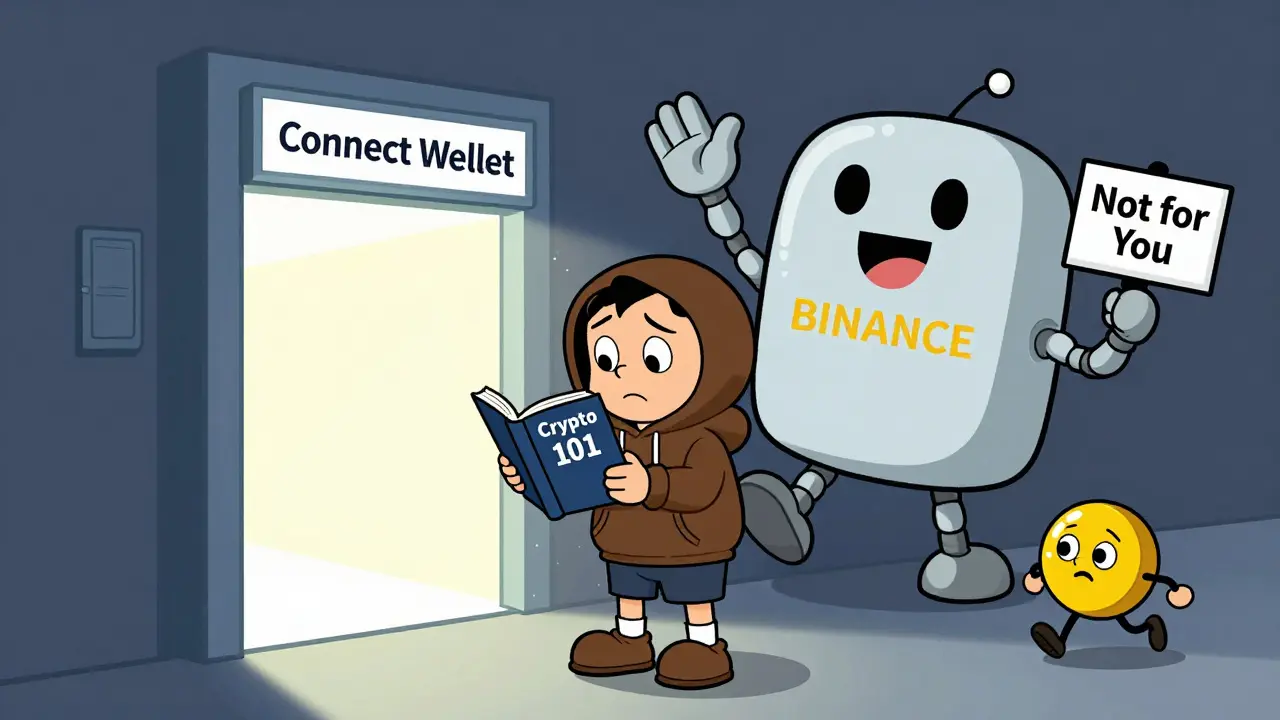

When you hear "crypto exchange," you probably think of Binance, Coinbase, or Kraken. But what about VVS Finance? It’s not on your radar for a reason-and that’s exactly what you need to know before you even think about putting money into it.

What Is VVS Finance?

VVS Finance is a decentralized exchange (DEX) built on the Cronos blockchain, which is owned by Crypto.com. It launched on November 22, 2021, with a bold promise: earn rewards just by providing liquidity or staking its native token, VVS. Unlike centralized exchanges, you don’t deposit funds with a company-you connect your wallet and trade directly on the blockchain.

It’s not a full-service exchange. There’s no fiat on-ramp, no customer support hotline, no mobile app. You need a Web3 wallet like MetaMask, configured for the Cronos network, and you need to already own crypto like CRO, USDC, or ETH to swap or stake. If you’re new to DeFi, this isn’t the place to start.

How VVS Finance Makes Money (And How You Might Too)

The platform runs on an automated market maker (AMM) model. That means trades happen through liquidity pools, not order books. If you add your tokens to a pool-say, VVS and CRO-you become a liquidity provider. In return, you earn 66.7% of all swap fees generated by that pool. The rest goes to the ecosystem.

Then there’s Glitter Mine, their staking program. You lock up VVS tokens and earn more VVS over time. It sounds simple, but here’s the catch: the token’s value has crashed more than 96% since its peak. So even if you’re earning 10% APY, you’re earning it in a coin worth pennies.

Back in February 2022, VVS Finance was the top project on Cronos. The whole ecosystem had over $2 billion locked in. The token hit $0.0001549. Today, it trades around $0.000006. That’s not a correction-it’s a collapse.

Token Price History: A Story of Hype and Crash

VVS Finance didn’t fail slowly. It exploded and imploded in weeks.

- Launch price (Nov 22, 2021): just over $0.0001

- All-time high (Nov 24, 2021): $0.0001549

- February 10, 2022 peak: $0.000043 (after Cronos TVL hit $2B)

- May 2022: dropped below $0.00001

- June 18, 2022: hit $0.0000049

- October 2022: $0.000005936

- December 2025 estimate: between $0.0000027 and $0.0000091-depending on who you ask

That’s a 96% drop from its peak. Even the most optimistic forecasts say it might reach $0.0000091 by 2025. That’s still less than 6% of its all-time high. If you bought at launch, you’d need a 1,400% gain just to break even.

Is VVS Finance Regulated?

No. Not even close.

According to FxVerify’s 2023 review, VVS Finance is not regulated by any government or financial authority. There’s no KYC, no AML checks, no investor protection. If the smart contract gets hacked, if the team vanishes, if the Cronos network goes down-you lose everything. And there’s no recourse.

This isn’t unusual for DeFi. But most DeFi projects at least have a public team, a whitepaper, and community transparency. VVS Finance? The developers are anonymous. The "litepaper" is thin. No roadmap updates since late 2021. No new token listings. No partnerships announced in over two years.

Traffic and Market Presence: A Ghost Town

Here’s the cold hard number: VVS Finance gets about 18,000 monthly visits. Most of those-99%-are organic. That means people are searching for it, not being drawn in by ads or influencers.

Compare that to Binance, which gets over 200 million visits a month. Or even smaller DEXs like Uniswap or PancakeSwap, which get millions. VVS Finance ranks #330 out of 608 crypto exchanges by traffic. That’s not niche. That’s irrelevant.

People aren’t using it because it doesn’t offer anything unique. The rewards are low. The token is worthless. The platform is invisible. And there’s zero reason to believe that will change.

Price Predictions: Why Nobody Agrees

Some analysts say VVS could hit $0.00002067 by 2025. Others say it’ll drop to $0.00000267. That’s a 700% difference. Why the chaos?

Because there’s no fundamental reason to believe VVS Finance has a future. No product updates. No team credibility. No liquidity growth. No adoption beyond a small group of speculators.

Even if you believe the best-case scenario-$0.0000091-you’re still looking at a coin worth less than one-hundredth of a cent. You’d need to hold millions of tokens to make $100. And you’d have to pay transaction fees in CRO to move them. At current rates, a single swap might cost you 10-20% of your token value.

Who Should Avoid VVS Finance?

If you’re asking this question, you’re probably already in the wrong group. But here’s who definitely shouldn’t touch it:

- Beginners - You don’t understand DeFi yet. Don’t gamble on an anonymous project with no track record.

- Risk-averse investors - This isn’t speculative. This is gambling with no odds.

- Anyone in a regulated jurisdiction - If you live in the U.S., EU, or UK, you could be breaking rules just by interacting with it.

- People looking for real returns - The APY looks good on paper. But when your asset loses 96% of its value, yield doesn’t matter.

Who Might Still Use It?

Only two types of people still use VVS Finance today:

- DeFi speculators chasing dead coins - They believe in a miracle bounce. They’ve already lost money and are hoping to break even.

- Cronos ecosystem loyalists - They hold CRO and want to farm VVS because they believe in Crypto.com’s blockchain. Even then, they’re likely using it as a side project, not a core holding.

There’s no community momentum. No developer activity. No news. No updates. Nothing.

Final Verdict: Don’t Bother

VVS Finance isn’t a crypto exchange you should consider. It’s a relic.

It had a moment in early 2022, fueled by hype around Cronos and the broader DeFi boom. But that moment passed. The token crashed. The team went silent. The users left.

Even if you think you’re "getting in early," you’re not. You’re walking into a graveyard.

There are hundreds of better DeFi options on Ethereum, Solana, or even Cronos itself. Projects with real teams, updated code, active communities, and actual utility. VVS Finance has none of that.

Don’t chase the ghost of a $0.0001549 price. That ship sailed. And it’s not coming back.

What to Do Instead

If you want exposure to Cronos, use Crypto.com’s own DeFi Wallet or trade on Cronos-based DEXs with real volume-like VVS’s competitors. If you want yield farming, look at established platforms like Aave, Compound, or Curve. If you want staking, use Binance, Kraken, or even Coinbase.

There’s no shortage of alternatives that are safer, more transparent, and actually growing.

Don’t waste your time on a project that’s already dead.

Is VVS Finance a scam?

No, it’s not a scam in the traditional sense-there’s no evidence the team stole funds. But it’s a failed project. The token lost 96% of its value, the developers vanished, and there’s been no meaningful update since 2022. It’s more accurate to call it abandoned than fraudulent.

Can I still stake VVS tokens in 2025?

Technically, yes. The Glitter Mine contract is still live. But with the token trading at $0.000006, your earnings are practically worthless. You’d need to stake millions of tokens to make $100. And the transaction fees to move them could eat up 15-20% of your reward. It’s not worth the gas.

Is VVS Finance on any major exchanges?

No. VVS is only available on decentralized exchanges like VVS Finance itself and a few small DEXs on Cronos. It’s not listed on Binance, Coinbase, Kraken, or any other major centralized exchange. That limits liquidity and makes it nearly impossible to cash out without massive slippage.

What wallet do I need to use VVS Finance?

You need a Web3 wallet like MetaMask or Trust Wallet, but it must be configured for the Cronos blockchain. You can’t use it with a standard Ethereum wallet-you’ll need to add the Cronos network manually. If you’re not familiar with adding custom RPCs, don’t attempt it.

Are there any alternatives to VVS Finance on Cronos?

Yes. While VVS was once the top project on Cronos, other DeFi platforms like CronosSwap and Crypto.com’s own DeFi Wallet offer similar services with better liquidity and more active development. If you’re interested in Cronos, those are safer bets.

Why did VVS Finance crash so hard?

It was built on hype, not fundamentals. The 2021-2022 crypto boom inflated its price artificially. When the market turned, there was no real use case, no team to guide it, and no community to support it. Without those, even the best incentive models collapse. It’s a textbook example of a meme token disguised as a DeFi platform.

Lawal Ayomide

December 1, 2025 AT 21:02justin allen

December 3, 2025 AT 03:09ashi chopra

December 3, 2025 AT 13:51Darlene Johnson

December 4, 2025 AT 01:10Ivanna Faith

December 4, 2025 AT 03:13Akash Kumar Yadav

December 5, 2025 AT 05:20samuel goodge

December 6, 2025 AT 23:37alex bolduin

December 8, 2025 AT 23:21Vidyut Arcot

December 10, 2025 AT 19:25Jay Weldy

December 11, 2025 AT 06:53Melinda Kiss

December 11, 2025 AT 07:07Christy Whitaker

December 12, 2025 AT 17:10Nancy Sunshine

December 13, 2025 AT 02:13Alan Brandon Rivera León

December 13, 2025 AT 03:18Mohamed Haybe

December 13, 2025 AT 04:47Andrew Brady

December 14, 2025 AT 07:16Sharmishtha Sohoni

December 16, 2025 AT 01:23Althea Gwen

December 17, 2025 AT 06:25Durgesh Mehta

December 17, 2025 AT 17:08justin allen

December 19, 2025 AT 00:43