2025 March Crypto Archive: DeX Trends, Airdrops, and Token Launches

When you look at Decentralized Exchange, a peer-to-peer platform for trading crypto without a central authority. Also known as DeX, it's where most serious traders now move their assets—no KYC, no middlemen, just smart contracts doing the work. In March 2025, DeX trading volume jumped again, not because of hype, but because new protocols finally fixed the lag and high fees that turned people away last year. Layer 2 solutions like Arbitrum and Base became the default choice for swaps, and users started seeing real-time price matching that felt as fast as centralized platforms.

That same month, airdrop, a free distribution of tokens to wallet holders as a reward for early support or participation. Also known as token giveaway, it became less about random drops and more about targeted engagement. Projects like Nebula Network and FluxChain didn’t just blast tokens to every wallet—they rewarded users who actually used their DeX, provided liquidity, or staked for over 30 days. You couldn’t just sit on a wallet and cash in anymore. The ones who won were the ones who were active. And it wasn’t just small projects doing this. Even older, well-known chains rolled out their first meaningful airdrops in years, signaling a shift back to community-driven growth.

token launch, the moment a new crypto project releases its native token to the public. Also known as IDO, it’s where fortunes are made—and lost—in hours. March saw over 40 new tokens go live, but only a handful survived the first week. The winners? Those that launched with locked liquidity, clear use cases, and real utility beyond speculation. One project, ChainPulse, launched a token tied to real-time on-chain analytics. It didn’t have a flashy website or a celebrity influencer. But it solved a real problem: traders needed to know who was dumping before it happened. Within 72 hours, it was trading on three major DeXs. Meanwhile, dozens of others with vague whitepapers and meme names vanished without a trace.

What You’ll Find in This Archive

This collection from March 2025 isn’t just a list of posts. It’s a snapshot of what actually worked when the noise died down. You’ll find guides on how to spot real airdrops before they blow up, breakdowns of the DeXs that delivered the lowest slippage, and honest reviews of token launches that didn’t turn out to be scams. No fluff. No recycled news. Just what traders and builders were doing when the market moved.

Most crypto users think they're anonymous, but their IP address can reveal their location and link transactions to their identity. Learn how tracking works, what actually protects privacy, and why most tools fail.

View More

Setting up a crypto exchange in Malta requires a MiCA license from the MFSA, offering EU-wide access but demanding high compliance, capital, and operational standards. Only serious, well-funded operators succeed.

View More

USDT is banned in the EU under MiCA regulation as of July 1, 2025. Learn why Tether failed compliance, how exchanges reacted, and which stablecoins are now legal alternatives for European users.

View More

Egypt bans all cryptocurrency trading under Law No. 194/2020, enforced by the Central Bank of Egypt. While crypto is illegal, blockchain tech is being used for customs, land records, and a future digital pound.

View More

Tezos (XTZ) is a self-upgrading blockchain with on-chain governance and formal verification for secure smart contracts. Learn how it works, why it's different from Ethereum, and where it's being used today.

View More

BTCC is one of the oldest and most secure crypto exchanges, with 14 years of zero breaches, 500x leverage, and full regulatory compliance in the U.S. and Canada. Learn why it stands out in 2025.

View More

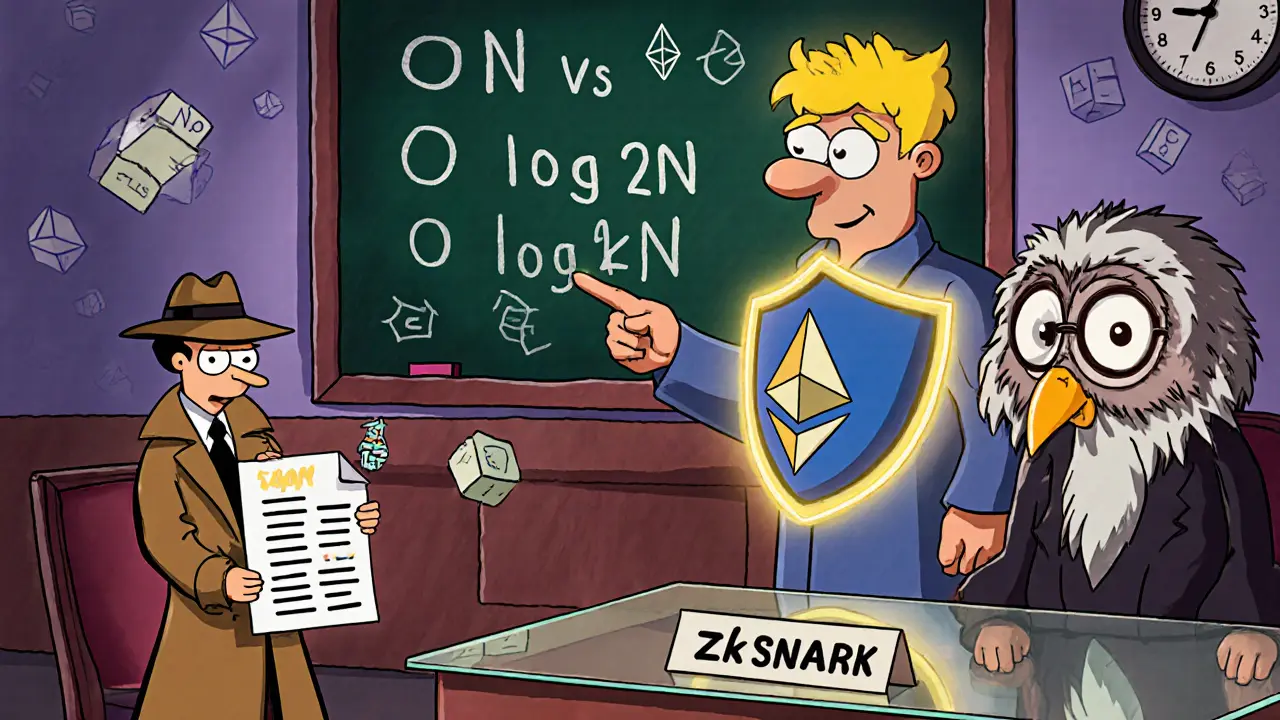

Compare zk-SNARKs and zk-STARKs to understand which zero-knowledge proof system fits your blockchain project-considering cost, scalability, quantum resistance, and developer effort.

View More

OmniCat (OMNI) is a meme coin claiming to be the first omnichain crypto, but it has near-zero trading volume, fake price data, and no real utility. Learn why it's extremely risky and how it compares to established tokens.

View More

DYORSwap (Plasma) offers 0% trading fees but lacks liquidity, security, and transparency. This review exposes its risks as a niche DEX for obscure meme coins with minimal adoption and high scam potential.

View More

Iranian citizens rely on crypto to bypass sanctions. In 2025, exchanges like MEXC, XT.com, and KuCoin still work, while Nobitex collapsed after a $90M hack. DAI has replaced USDT as the safe stablecoin. Here’s what still works and how to stay secure.

View More