Tezos Staking Rewards Calculator

Calculate Your Rewards

Enter your XTZ amount and current price to see potential staking rewards at 5.2% annual yield

Why Staking Matters

Tezos uses Liquid Proof-of-Stake (LPoS) where XTZ holders earn rewards by delegating to bakers. With a 5.2% annual yield, you can earn passive income without risking your assets.

Your Rewards

Enter your XTZ amount and price to see rewards

Tezos (XTZ) isn’t just another cryptocurrency. It’s a blockchain built to change how upgrades happen-without splitting the network in half. While Bitcoin and Ethereum have gone through painful hard forks over disagreements, Tezos was designed to avoid that entirely. Its secret? On-chain governance. Token holders vote directly on changes, and if enough agree, the network updates itself automatically. No drama. No forks. Just progress.

How Tezos Works: Self-Amending Blockchain

Tezos calls itself a "self-amending cryptographic ledger." That’s a fancy way of saying it can update its own code without needing a hard fork. Most blockchains require developers, miners, and users to agree on upgrades. If they don’t, the chain splits-like Bitcoin and Bitcoin Cash did in 2017. Tezos skips that mess. Every upgrade proposal is submitted, debated, and voted on by XTZ holders. If it passes, the network rolls out the change seamlessly.

This isn’t just theory. Since its 2018 launch, Tezos has executed over 10 protocol upgrades this way. Each one improved speed, lowered fees, or added new features-all without users having to switch wallets or worry about chain splits.

The system runs on three layers: network, transactions, and consensus. Think of them like the engine, transmission, and wheels of a car. If one part needs an upgrade, you can swap it out without rebuilding the whole vehicle. That’s what makes Tezos so flexible.

How Tezos Secures Its Network: Liquid Proof-of-Stake

Tezos doesn’t use mining like Bitcoin. Instead, it uses something called Liquid Proof-of-Stake (LPoS). In LPoS, people who hold XTZ can become "bakers"-validators who create new blocks and earn rewards. You don’t need expensive hardware. You just need XTZ.

If you have at least 8,000 XTZ (about $10,400 as of November 2025), you can bake yourself. If you have less, you can delegate your XTZ to a baker and still earn rewards-usually around 5.2% annually. This system is energy-efficient, secure, and gives everyday users a real stake in the network.

Here’s the kicker: new XTZ tokens are created with every successful upgrade. These new coins go to bakers and delegators as rewards. That means the network pays for its own upgrades-no outside funding needed. It’s a self-sustaining cycle: better code → more participation → more rewards → more security.

Why Tezos Stands Out: Formal Verification

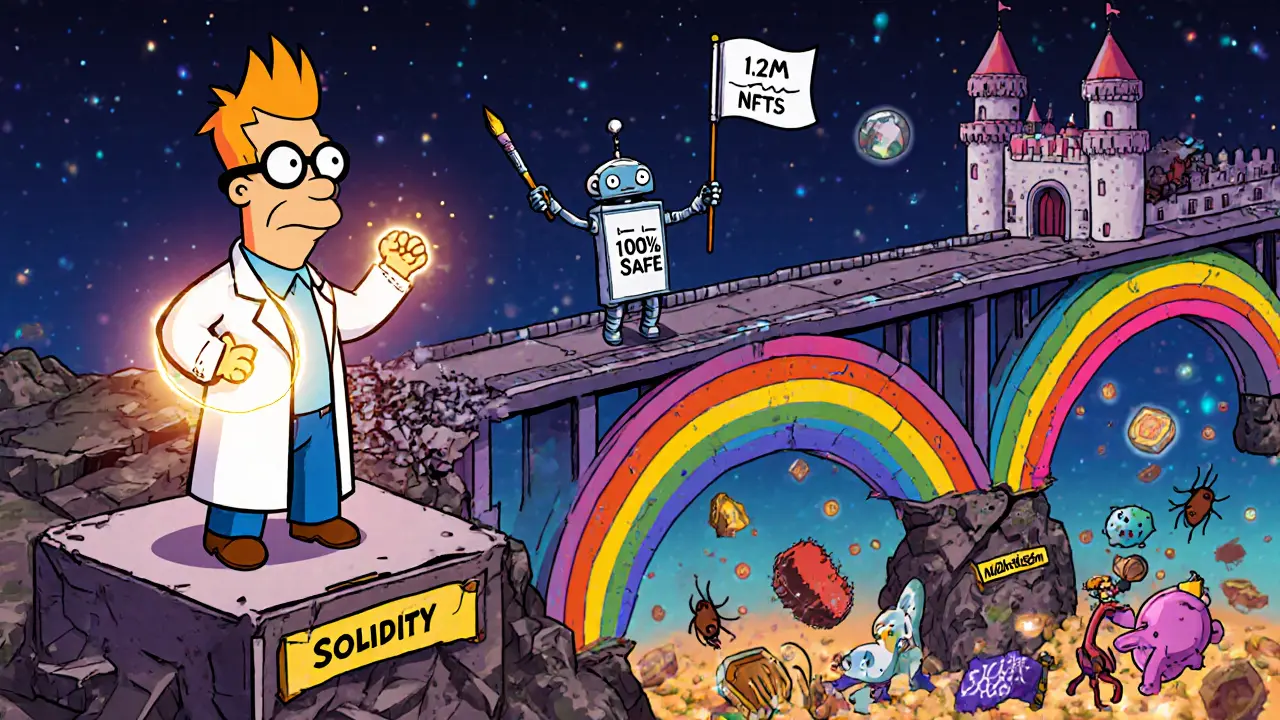

Tezos is one of the few blockchains that supports formal verification for smart contracts. That means developers can mathematically prove their code works exactly as intended-no bugs, no exploits. Imagine building a bridge and using physics equations to prove it won’t collapse before you even lay a single beam. That’s formal verification.

Tezos uses a language called Michelson for smart contracts. It’s low-level and designed for precision. While it’s harder to learn than Ethereum’s Solidity, it’s far safer. According to the Tezos Foundation’s 2023 report, smart contracts using formal verification had 92% fewer critical vulnerabilities than similar Ethereum contracts.

This makes Tezos ideal for high-stakes applications: digital bonds, medical records, financial derivatives. The European Investment Bank used Tezos to issue a $121 million digital bond in 2021. That’s not a gamble-it’s a financial instrument backed by a government institution.

Tezos vs. Ethereum, Cardano, and Others

People often compare Tezos to Ethereum or Cardano. Here’s how it stacks up:

| Feature | Tezos (XTZ) | Ethereum | Cardano |

|---|---|---|---|

| Consensus Mechanism | Liquid Proof-of-Stake | Proof-of-Stake | Proof-of-Stake |

| Upgrade Process | On-chain governance (voting by token holders) | Off-chain (community consensus, social coordination) | On-chain (but slower, less participation) |

| Transactions Per Second (TPS) | 40-50 | 15-30 | 250+ |

| Smart Contract Language | Michelson (formal verification) | Solidity | Haskell-based (Plutus) |

| DeFi TVL (Nov 2025) | $218 million | $41.2 billion | $192 million |

| NFT Volume (since 2021) | $347 million | $18 billion | $12 million |

Tezos doesn’t lead in speed or DeFi size. But it leads in governance and security. Where Ethereum struggles with chaotic upgrades and Cardano moves slowly, Tezos delivers steady, predictable progress. It’s not the flashiest-but it’s the most reliable.

Tezos’ Weaknesses: Who It’s Not For

Tezos isn’t perfect. Its biggest issue? Participation. Only about 7.8% of all XTZ is actively involved in voting. That means a small group of large wallets-roughly the top 100-control over 62% of the supply. That’s a problem for decentralization.

Another issue: the ecosystem is small. There are only 17 active DeFi protocols on Tezos, compared to Ethereum’s 342. Most users don’t interact with governance at all. On Reddit, one user summed it up: "I love baking rewards, but the proposals are too technical-I vote based on baker recommendations."

Also, Michelson is hard. Developers say it’s more difficult than Solidity. That’s why tools like SmartPy and Ligo were created-they let you write code in Python or Haskell, then compile it to Michelson. But for beginners, the learning curve is steep.

Where Tezos Is Winning: NFTs and Institutional Use

Despite its slow DeFi growth, Tezos dominates in one area: NFTs. Platforms like Hic et Nunc and Objkt.com have processed over 1.2 million NFT transactions worth $347 million since 2021. That makes it the third-largest NFT blockchain after Ethereum and Solana.

Why? Low fees. Fast confirmations. And a clean, artist-friendly model. Many NFT creators avoid Ethereum because of gas fees. Tezos lets them mint and sell without breaking the bank.

Big companies noticed. Ubisoft used Tezos for NFTs in its game Ghost Recon Breakpoint. The European Investment Bank issued a digital bond on it. These aren’t marketing stunts-they’re real-world use cases where security and permanence matter.

What’s Next for Tezos? The Roadmap

Tezos isn’t standing still. The "Eiger" upgrade in late 2023 cut gas fees by 37% and sped up smart contracts by 22%. The next big update, "Florence," will focus on cross-chain bridges-letting Tezos talk to Ethereum, Solana, and others.

The long-term plan includes "Zinc," which will add zero-knowledge proofs for privacy, and "Babylon," which will introduce sharding to scale to 1,000 TPS. If they pull this off, Tezos could go from a niche player to a serious contender.

Right now, Tezos has a $1.87 billion market cap and sits at #38 among cryptocurrencies. It’s not a giant. But it’s stable. It’s secure. And it’s building something others keep trying-and failing-to replicate.

How to Get Started with Tezos

Want to try Tezos? Here’s how:

- Get a wallet: Use Kukai (web-based) or Galleon (desktop). Both are easy and support Ledger hardware wallets for extra security.

- Buy XTZ: Buy on Coinbase, Binance, or Kraken. Transfer it to your wallet.

- Delegate or bake: If you have less than 8,000 XTZ, delegate to a baker. If you have more, you can bake yourself.

- Explore: Try NFTs on Objkt.com or check out DeFi apps like Quipuswap.

Don’t expect to become a blockchain developer overnight. Tezos rewards patience. But if you care about long-term stability, security, and real governance, it’s one of the few blockchains that delivers.

Is Tezos a good investment?

Tezos isn’t a get-rich-quick coin. It’s a long-term infrastructure play. If you believe in secure, self-upgrading blockchains and want exposure to institutional-grade applications like digital bonds and NFTs, then yes. But don’t expect it to outpace Ethereum or Solana in price swings. Its value comes from utility, not speculation.

Can I earn rewards with Tezos?

Yes. By delegating your XTZ to a baker or baking yourself, you earn rewards-typically around 5.2% per year. Rewards are paid out every few days and are automatically reinvested. It’s one of the most reliable passive income streams in crypto, with no risk of slashing like in some other PoS chains.

Why isn’t Tezos more popular?

Tezos had a rocky start. Its 2017 ICO raised $232 million, but legal battles delayed the network launch until 2018. By then, Ethereum and others had already gained momentum. Also, its technical depth and low governance participation make it less appealing to casual users. It’s not marketed like a meme coin-it’s built for engineers and institutions.

Is Tezos safe?

Yes, especially for smart contracts. Its formal verification system makes it one of the safest blockchains for high-value applications. Wallets like Ledger and Kukai are also well-reviewed for security. The network has never been hacked. But like all crypto, your private keys are your responsibility. If you lose them, your XTZ is gone.

How does Tezos compare to Bitcoin?

Bitcoin is digital gold-store of value, limited supply, no smart contracts. Tezos is a programmable blockchain-designed for apps, NFTs, and automated contracts. Bitcoin can’t upgrade without a hard fork. Tezos upgrades itself. They serve completely different purposes.

Rachel Everson

November 11, 2025 AT 01:54Love how Tezos just quietly builds stuff without the drama. I delegated my XTZ last year and haven't had to think about it since. Rewards hit every few days like clockwork, and my wallet never bugged me with upgrade alerts. Finally, a crypto that respects your time.

tom west

November 12, 2025 AT 16:20Let’s be real-Tezos is a ghost town disguised as innovation. 7.8% voting participation? That’s not governance, that’s a cult of 100 whales holding the whole network hostage. And don’t even get me started on Michelson. You need a PhD in formal logic just to write a simple contract. This isn’t progress-it’s over-engineered stagnation.

Adrian Bailey

November 12, 2025 AT 18:56idk man i’ve been baking for 2 years now and it’s been chill af. i dont care if the proposals are technical-i just pick bakers i trust. plus the fees are like 1 cent to send an nft. i minted my buddy’s art on objkt and he made $800 without crying over gas. ethereum? nah. tezos just works. also the community is way nicer than the edgy degens on eth. 🤙

James Ragin

November 12, 2025 AT 20:46They say ‘self-amending’ like it’s magic. But who’s really voting? Big institutions. Central banks. Maybe even the Fed quietly controls the baker nodes. Did you know the European Investment Bank’s bond was issued in 2021? Coincidence? Or a test run for sovereign digital currency control? Tezos isn’t decentralized-it’s stealth centralization with a pretty UI.

Joy Whitenburg

November 13, 2025 AT 17:09OMG YES!! I JUST MINTED MY FIRST NFT ON OBJKT AND IT COST ME $0.03!!! I WAS CRYING FROM JOY!! I THOUGHT I'D NEVER BE ABLE TO AFFORD CRYPTO ART BECAUSE OF ETHEREUM'S CRAZY FEES!! TEZOS IS A GIFT FROM THE GODS!! 🙏✨

ty ty

November 15, 2025 AT 00:42So you’re telling me a blockchain that can’t even hit 100 TPS is ‘better’ than Cardano? Bro. Cardano’s got 250+. Tezos is the guy at the party who says ‘I don’t need to dance, I’m just here for the vibe.’ The vibe is… slow. And expensive to learn.

FRANCIS JOHNSON

November 16, 2025 AT 11:22Tezos is the philosophical counterpoint to crypto’s chaos. While others chase hype, Tezos asks: ‘What if we built a system that evolves without breaking?’ It’s not about speed or market cap-it’s about resilience. Like a tree that grows rings over decades instead of a bamboo shoot that snaps in a storm. Formal verification isn’t a feature-it’s a moral stance against sloppiness. The fact that institutions trust it for bonds? That’s not marketing. That’s validation from systems that can’t afford to fail.

Johanna Lesmayoux lamare

November 17, 2025 AT 09:51Just started delegating. Rewards are nice. Still don’t understand the proposals, but I trust my baker. Simple.

Debraj Dutta

November 19, 2025 AT 03:45Tezos is underrated. In India, most people don’t even know it exists. But I’ve seen developers switch from Ethereum because of the cost and instability. Michelson is hard, yes-but once you get past it, the safety is unmatched. I built a supply chain contract on it last month. Zero bugs. No audits needed. That’s rare.

Atheeth Akash

November 20, 2025 AT 12:56Tezos is chill. I bake. I earn. I don’t read the proposals. I trust my baker. NFTs are fun. Fees are low. That’s enough for me. 🌱

Michael Brooks

November 22, 2025 AT 11:51People act like Tezos is ‘boring’ but that’s the point. Boring means stable. Boring means your digital bond won’t get hacked because someone typo’d a contract. Ethereum’s TVL looks big, but how many of those protocols are just vaporware with 100 users? Tezos has fewer apps-but the ones that exist? They’re actually used by banks, museums, and artists. Quality over quantity. Always.

Rebecca Saffle

November 22, 2025 AT 12:10Tezos? That’s the one where the rich guys vote and everyone else gets crumbs. America’s blockchain? No thanks. We don’t need another elite club pretending to be decentralized. If you can’t bake without $10k, it’s not for the people. It’s for the 1% with a blockchain fetish.

Ruby Gilmartin

November 24, 2025 AT 05:07Let’s not romanticize this. Tezos’s ‘self-amending’ model is a failure of participation. The top 100 wallets control 62% of voting power. That’s not democracy. That’s plutocracy with a blockchain sticker. And Michelson? It’s a relic. No wonder adoption is slow. Developers don’t want to learn a language designed by mathematicians for a system nobody uses.

Phil Bradley

November 25, 2025 AT 21:07Tezos is the quiet hero of crypto. While everyone’s screaming about the next 100x, Tezos is quietly fixing its own engine. It’s not flashy. It doesn’t have a dog coin mascot. But when the next crash hits, and every other chain is forked, frozen, or flooded with rug pulls-Tezos will still be there. Upgrading. Stable. Unbroken. That’s not just tech. That’s legacy.

David Billesbach

November 26, 2025 AT 14:37Oh, so Tezos is ‘secure’ because it uses formal verification? Cool. So what? Who’s auditing the validators? Who’s auditing the baker selection process? And why is the entire ecosystem dependent on a handful of French devs who ghosted the community after the ICO? This isn’t innovation-it’s a carefully curated illusion of decentralization. You think you’re voting? You’re just clicking ‘yes’ on what the whales tell you to.

Andy Purvis

November 28, 2025 AT 07:47Appreciate the breakdown. I’ve been on the fence about Tezos but the NFT part sold me. Low fees, real artists, no gas wars. I’m gonna try delegating next week. No pressure, just curious.

BRYAN CHAGUA

November 28, 2025 AT 17:31Thank you for this comprehensive overview. The contrast between Tezos’s governance model and Ethereum’s social coordination is particularly insightful. The institutional adoption-particularly the European Investment Bank’s digital bond-is a strong signal of long-term viability. While market cap and DeFi TVL are often overemphasized, the real test is resilience, security, and sustainable evolution. Tezos, despite its modest size, demonstrates all three. A thoughtful, technically grounded project.