Crypto Exchange Comparison Tool for Iranian Users

Find Your Best Exchange

Based on your priorities, we'll compare the top exchanges for Iranian users in 2025. Note: All exchanges require crypto deposits only (no bank transfers).

Your Priorities

Key Considerations

Results

Why This Exchange

Important Notes

Iranian citizens face real barriers when trying to use traditional banks for international transactions. Sanctions have cut off access to SWIFT, blocked dollar accounts, and made it nearly impossible to send or receive money from abroad. In this vacuum, cryptocurrency has become more than a speculative asset-it’s a lifeline. Over 11 million Iranians now use digital currencies to pay for goods, save value, and move money across borders. But not all crypto exchanges let them in. Some block Iranian IPs outright. Others freeze funds without warning. And a few, like Nobitex, have been hacked for over $90 million. So which exchanges still work in 2025? Here’s what actually works, based on real user reports and recent enforcement actions.

Domestic Exchange: Nobitex-The Giant That Fell

Nobitex is Iran’s biggest crypto exchange. It handles more than 87% of all local crypto trades. It’s where most Iranians buy Bitcoin, sell Ethereum, and swap Tether. But in June 2025, hackers stole $90 million from its wallets. The breach exposed how fragile its security was. Then, in July, Tether froze 42 Iranian-linked addresses-many of them tied to Nobitex. The exchange was already under sanctions, but after the hack, it became a target. Users lost money. Some never got it back. Now, Nobitex is still operational, but trust is gone. Many Iranians have moved on.

International Exchanges That Still Work

While domestic platforms struggle, several global exchanges still let Iranians sign up and trade. These aren’t officially endorsed by Iran-they don’t advertise there. But users find them anyway. Here are the top five that still work as of November 2025, based on deposit limits, coin selection, fees, and user feedback.

| Exchange | Minimum Deposit | Coins Supported | Spot Maker Fee | Key Strengths |

|---|---|---|---|---|

| MEXC | $30 | 196 | 0.2% | Low fees, fast withdrawals, strong mobile app |

| Bitsgap | $0 | 673 | Varies | No deposit minimum, trading bots, connects to other exchanges |

| XT.com | $10 | 1,010 | 0.2% | Most coins available, good for altcoins, stable interface |

| LATOKEN | $1 | 475 | 0.49% | Low entry, decent liquidity, supports staking |

| CoinEx | $1 | 475 | 0.49% | Simple UI, good for beginners, offers futures and staking |

These platforms don’t ask for your passport number during signup. But if you use a VPN to bypass geo-blocks, they might flag your account later. Some users report being locked out after a few months. Others stay active for over a year. It’s unpredictable. What’s consistent? They all accept crypto deposits. No bank transfers. No credit cards. You need to buy Bitcoin or USDT from a peer, then send it over.

KuCoin and BingX: The Alternative Picks

Not everyone trusts the top five. KuCoin gets high marks from Iranian traders who want more than just spot trading. It offers savings accounts that pay interest in crypto, copy trading where you mirror experienced users, and even crypto loans. Its interface is clean, and it supports Persian language in its help center-rare for international platforms. BingX is similar but leans more toward futures and margin trading. It’s not beginner-friendly, but if you know what you’re doing, it’s one of the few places with deep liquidity for Iranian-traded altcoins.

Both KuCoin and BingX have lower ratings on some review sites, but that’s because they don’t have Persian customer service. If you get locked out, you’re on your own. Still, thousands of Iranians use them daily. One user in Tehran told me: “I don’t trust Nobitex anymore. KuCoin doesn’t answer my emails, but my money is safe. That’s better.”

What Changed in 2025? USDT Is Out, DAI Is In

Before July 2025, almost every Iranian trader held USDT. It was the default stablecoin-easy to buy, easy to send. Then Tether froze over $200 million in Iranian-linked wallets. The message was clear: don’t use us. Overnight, the market shifted. Users started swapping USDT for DAI, a decentralized stablecoin built on the Polygon network. Why? Because DAI isn’t controlled by a company. You can’t freeze it unless you lose your private keys.

Now, most Iranian traders use DAI as their base currency. They buy it via decentralized exchanges like SushiSwap or QuickSwap, then move it to MEXC or XT.com. The process takes 10 minutes. It’s cheaper than using centralized services. And it’s harder for sanctions to hit. The Iranian government even encouraged this shift through crypto influencers. It’s not just a technical change-it’s a survival tactic.

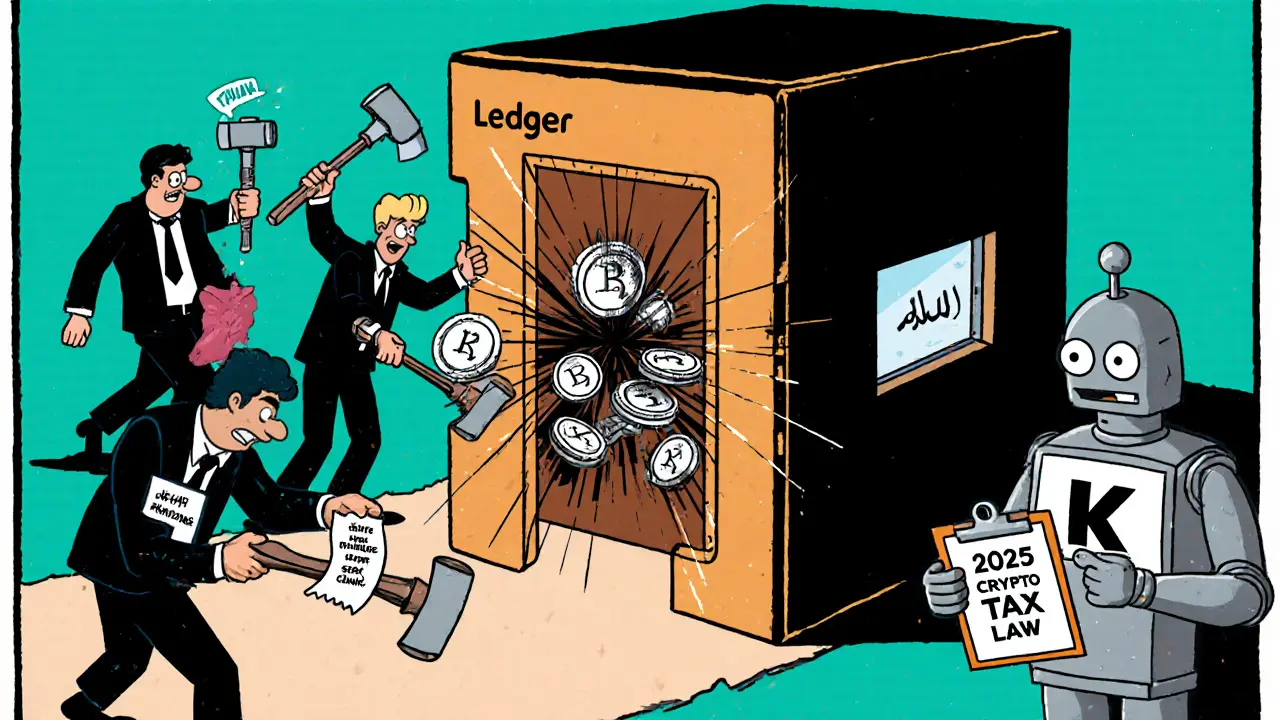

Iran’s New Crypto Tax Law

In August 2025, Iran passed its first law taxing crypto profits. It’s called the Law on Taxation of Speculation and Profiteering. It treats Bitcoin, Ethereum, and other digital assets the same as gold, real estate, and forex. If you make a profit, you owe tax. The government hasn’t started auditing yet, but it’s coming. They’re building a blockchain monitoring system with help from Russian and Chinese firms.

This law doesn’t ban crypto. It tries to control it. The message: we don’t stop you from using crypto, but we want our cut. Many traders are now keeping records of every trade. Some are even filing voluntary tax reports to avoid future penalties. It’s a strange twist-sanctions forced Iranians into crypto, and now the state wants to tax it.

Security Risks and How to Avoid Them

Using crypto in Iran isn’t safe. Not because the exchanges are evil-but because the environment is unstable. Here’s what you need to do:

- Never keep large amounts on an exchange. Withdraw to a hardware wallet like Ledger or Trezor after trading.

- Use a VPN. Some exchanges block Iranian IPs. A reliable one (like NordVPN or ExpressVPN) helps you sign up and log in.

- Avoid USDT. Use DAI or BUSD instead. USDT is too risky.

- Don’t share your seed phrase. Ever. Even with “support staff.” Legit exchanges will never ask for it.

- Use two-factor authentication. Google Authenticator, not SMS.

One Iranian trader lost $15,000 after giving his password to someone claiming to be from “MEXC Support.” That person was a scammer. There is no Persian-language customer service on these platforms. If someone messages you first, it’s fake.

What’s Next for Iranian Crypto Users?

The future is decentralized. More Iranians are moving away from centralized exchanges entirely. They’re using wallets like MetaMask, swapping tokens on Uniswap or SushiSwap, and earning interest through Aave or Compound. The learning curve is steeper, but the control is total. No one can freeze your wallet. No government can shut it down. No exchange can disappear overnight.

For now, the best strategy is simple: use international exchanges like MEXC or XT.com to trade, keep your main funds in DAI on a hardware wallet, and avoid USDT. If you’re new, start with KuCoin-it’s the friendliest. If you’re experienced, try Bitsgap for automation. And always, always back up your keys.

The sanctions won’t end soon. Banks won’t reopen. But crypto? It’s still working. Not because it’s perfect. But because it’s the only thing left that isn’t broken.

Can I use Coinbase or Binance if I’m from Iran?

No. Both Coinbase and Binance block Iranian users outright. They enforce sanctions strictly. If you try to sign up with an Iranian IP or ID, your account will be rejected or frozen. Don’t waste time trying.

Do I need a passport to sign up on these exchanges?

Some require basic KYC-like a photo ID or selfie. Others don’t ask for anything at signup. But if you deposit large amounts, they may request documents later. If you’re asked for an Iranian passport, it’s safer to decline and use a different exchange.

How do I deposit money if I can’t use a bank card?

You can’t. Iranian users buy crypto from local P2P sellers using Iranian rials. Then they send that crypto (usually Bitcoin or USDT) to the international exchange. Use platforms like LocalBitcoins or Paxful to find sellers, then transfer to MEXC or XT.com.

Is it legal to use crypto in Iran?

It’s not officially banned, but it’s not fully legal either. The government allows mining and personal use, but prohibits trading through domestic banks. The 2025 tax law treats crypto as a taxable asset, meaning the state acknowledges its existence-and wants a share. Use it, but keep records.

Why is DAI better than USDT for Iranians?

USDT is issued by Tether, a company that follows U.S. sanctions. If they freeze your address, your money is gone. DAI is decentralized-it’s controlled by smart contracts on Ethereum and Polygon, not a single company. You can’t freeze DAI unless you lose your wallet keys. After the July 2025 freezes, DAI became the preferred stablecoin in Iran.

What should I do if my account gets frozen?

You’ll likely get no response. Most exchanges don’t have Persian support, and sanctions limit their ability to help. Your best move is to stop using that exchange and move your funds to another platform. Always keep backups of your private keys and seed phrases. If you have them, you can recover your crypto even if the exchange locks you out.

Ruby Gilmartin

November 10, 2025 AT 23:42This article is dangerously naive. You list exchanges like they’re safe havens, but every single one of them is just a waiting room for asset seizure. MEXC? XT.com? They’re all under US jurisdiction. Tether froze $200M in July-what makes you think the next freeze won’t be $500M? And DAI isn’t magic-it’s still on Ethereum, which is still monitored by Chainalysis. This isn’t freedom. It’s a slower, more complicated prison.

Douglas Tofoli

November 12, 2025 AT 13:44omg this is sooo helpful!! 🙌 i just used bitsgap last week and got my first usdt in like 2 mins from a local guy in tehran!! 💪 but yeah… i’m scared to keep more than $500 on there lol. dais for life!! 🌱

William Moylan

November 13, 2025 AT 18:30They’re all CIA fronts. You think MEXC doesn’t have a backdoor? You think DAI isn’t secretly pegged to the dollar via hidden oracle feeds? The Russians are feeding the Iranian government blockchain surveillance tools right now. They’re building a crypto surveillance state. And you’re all just cheerleading your own digital chains. Wake up. This isn’t liberation-it’s data harvesting with extra steps.

Michael Faggard

November 15, 2025 AT 14:18Let’s clarify the operational architecture here. The shift from USDT to DAI represents a migration from centralized, custodial risk to permissionless, algorithmic stability. By leveraging decentralized exchanges like SushiSwap, users bypass KYC-locked liquidity pools and reduce attack surface. The key is maintaining non-custodial control via hardware wallets-Ledger Nano X or Trezor Model T. Avoid any platform requiring email verification. Use Tor + VPN + multi-sig for maximum resilience. This isn’t speculation. It’s financial sovereignty engineering.

Elizabeth Stavitzke

November 17, 2025 AT 08:23Oh look, another ‘crypto is freedom’ fairy tale for the masses. Iranians are using crypto because they’re desperate-not because it’s noble. And you’re acting like these exchanges are doing them a favor. They’re not. They’re just the new colonial middlemen. You think MEXC cares about your ‘lifeline’? They care about your trading volume. And your ‘DAI’? It’s just a more expensive way to get hacked. The real hero here? The Iranian government-for finally taxing this mess. At least they’re not pretending it’s magic.

Ainsley Ross

November 18, 2025 AT 02:00As someone who has worked with humanitarian crypto initiatives in conflict zones, I want to express deep respect for the ingenuity and resilience of Iranian users. This article accurately reflects the painful reality: when institutions fail, people innovate. The shift to DAI is not just technical-it’s ethical. It represents a quiet revolution in self-determination. To those reading this: please, if you can, support decentralized infrastructure. Don’t just trade-help build wallets, translate guides, or fund open-source devs. This isn’t just about money. It’s about dignity.

Brian Gillespie

November 20, 2025 AT 00:40DAI is the way. No more USDT. Hardware wallet. Always.

Wayne Dave Arceo

November 21, 2025 AT 23:37You misstate the legal status. Iran’s 2025 Taxation Law does not merely ‘acknowledge’ crypto-it classifies it as a ‘commodity subject to capital gains under Article 12 of the Commercial Code.’ Any use without reporting is tax evasion. Furthermore, the claim that ‘no passport is needed’ is false. All major exchanges now require at least one form of ID for deposits over $5,000. The notion that Iranians are ‘free’ is a dangerous myth perpetuated by crypto influencers with affiliate links.

Joanne Lee

November 23, 2025 AT 11:40I’m curious about the reliability of Bitsgap’s bot integrations when used with Iranian P2P sources. Have any users documented success with arbitrage between local rial-based BTC sellers and XT.com’s liquidity? Also, does the platform’s API remain stable under high latency conditions common in Iran’s internet infrastructure? I’d appreciate any empirical data or user logs.

Laura Hall

November 23, 2025 AT 11:57hey everyone-just wanted to say i’ve been using kucoin for 8 months now and it’s been fine. i use a vpn, keep everything in daif, and never share my seed. i’m not a pro, but i’ve learned a lot. if you’re new, don’t panic. start small. use the app. watch a few youtube videos in farsi. the community is out there. and yeah, no one’s gonna help you if you get locked out… but if you’re careful, you’ll be okay. we’re all just figuring it out together 💛

Arthur Crone

November 24, 2025 AT 17:32Nobitex got hacked so what? That’s why you don’t use domestic exchanges. The real problem? You’re all still using centralized platforms. You think DAI saves you? It’s just another token. The only real solution is running your own node. Buy a Raspberry Pi. Sync Bitcoin Core. Learn to sign transactions offline. Everything else is gambling with your life savings. You’re not pioneers. You’re cattle with wallets.

Phil Bradley

November 24, 2025 AT 21:44I just want to say… I cried reading this. Not because I’m emotional (okay maybe I am) but because I know a girl in Shiraz who lost $12k when Nobitex collapsed. She’s 19. She was saving to study abroad. Now she tutors kids online and buys DAI every Friday. She says it’s the only thing that makes her feel like she still has a future. So yeah. This isn’t just about tech. It’s about people. And we owe them better than hype.

Stephanie Platis

November 25, 2025 AT 11:19It is imperative to note that the use of a VPN to circumvent geo-restrictions constitutes a violation of the Terms of Service of every exchange listed herein. Furthermore, the promotion of DAI as a ‘sanction-proof’ asset is factually incorrect: the MakerDAO governance system is subject to U.S. regulatory pressure, and any entity interacting with its contracts may be deemed complicit in sanctions evasion. This article is not merely irresponsible-it is legally perilous.

Michelle Elizabeth

November 26, 2025 AT 10:57DAI? Pfft. It’s just crypto glitter. The real power move? Buying gold via Telegram P2P, melting it into bars, smuggling it to Turkey, then selling it for EUR. Less ‘tech,’ more sweat. Less ‘decentralized,’ more smuggler’s grit. The exchanges? Just fancy ATMs for people who think they’re hackers. I’m not anti-crypto. I’m anti-illusion.

Joy Whitenburg

November 26, 2025 AT 11:57so i’ve been using coinex for like 6 months now and it’s been chill?? i use a free vpn (protonvpn) and just send small amounts at a time. i don’t even know what a hardware wallet is lol. but i do backup my seed phrase on paper and hide it in my bookshelf. if you’re scared, just start with $20. it’s not perfect… but it’s something. you’re not alone 💕

Kylie Stavinoha

November 28, 2025 AT 03:52There is a profound philosophical shift occurring here. The Iranian user, denied access to the global financial architecture, has turned not to rebellion, but to redefinition. Crypto is not a tool-it is a new epistemology of value. DAI, unbound from corporate oversight, embodies the Kantian ideal of autonomy: value derived not from authority, but from consensus and code. This is not evasion. It is the quiet emergence of a post-sanction moral economy. We are witnessing not just finance, but the birth of a new social contract-one written in Ethereum’s gas fees.