Smart Contracts: What They Are and How They Power Decentralized Finance

When you hear smart contracts, self-executing code on a blockchain that runs exactly as programmed without human interference. Also known as blockchain protocols, they’re the engine behind nearly every decentralized app — from trading tokens to locking up your crypto for rewards. Unlike old-school contracts that need lawyers and notaries, smart contracts run on networks like Ethereum and automatically trigger actions when conditions are met — like sending tokens when payment is received, or unlocking funds after a deadline.

They’re not magic. They’re code. And like any code, if it’s poorly written, it breaks. That’s why so many projects fail — not because the idea was bad, but because the smart contract had a漏洞 (bug), no audit, or was deployed by a team that didn’t understand what they were building. You see this in posts about dead tokens like MARGA or abandoned metaverse coins like CVTX. Their smart contracts either didn’t do anything, or were never meant to. Meanwhile, platforms like VoltSwap and AlphBanX use smart contracts to handle staking, lending, and trading without a central authority. That’s the promise: no middlemen, no delays, no excuses.

Smart contracts also enable things like NFT royalties and automated airdrops — but only if they’re built right. The AdEx Network airdrop worked because the contract was transparent and verifiable. The LEOS and BABYDB scams? Those didn’t even have real contracts — just fake websites pretending to be one. And when privacy coins like Monero get delisted, it’s often because regulators can’t inspect their smart contracts to track where money goes. That’s the tension: smart contracts give you freedom, but they also leave no room for error or excuses.

If you’re using DeFi, trading tokens, or even just holding NFTs, you’re interacting with smart contracts every day. You don’t need to write them. But you do need to know what to look for — audits, open-source code, community reviews. The posts below show you real cases: what worked, what blew up, and why the difference matters. Whether it’s wrapped tokens like wETH, zero-knowledge proofs like zk-STARKs, or lending protocols like ABX, they all run on the same foundation. Understand that foundation, and you stop guessing. You start knowing.

Chainlink solves the oracle problem by securely connecting smart contracts to real-world data. Learn how its decentralized network powers DeFi, tokenization, and more with reliable, tamper-proof information.

View More

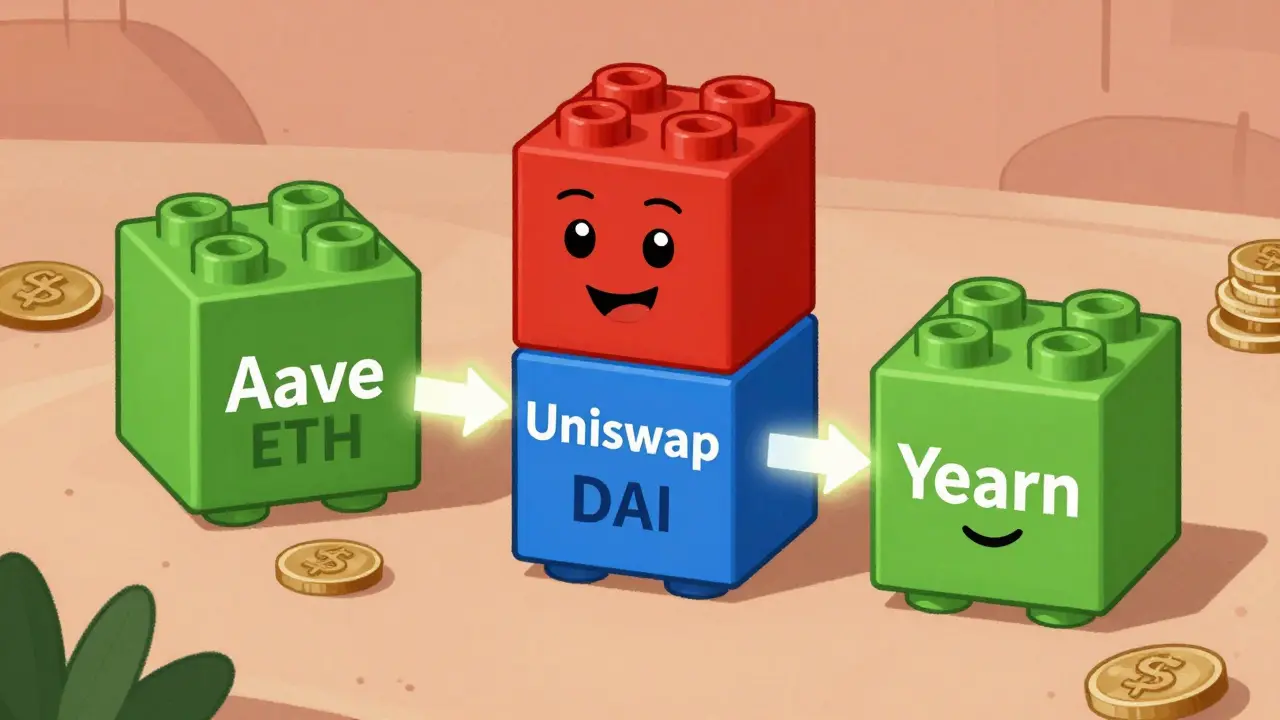

DeFi composability lets financial protocols work together like Lego blocks, enabling faster, cheaper, and more powerful financial tools than traditional banking. Learn how it works, its benefits, and the risks you need to know.

View More

Æternity (AE) is a blockchain with off-chain smart contracts, zero-fee transactions via state channels, and native oracles. It’s technically advanced but struggles with adoption. Learn how it works, who uses it, and whether it’s worth your time.

View More

Clinical trial data on blockchain creates an immutable, transparent record of every data interaction, preventing fraud, ensuring patient control, and improving trust in medical research. Learn how it works and why it matters.

View More