Cream Finance isn’t just another crypto coin-it’s a decentralized lending protocol built to let people earn interest, borrow assets, and move money across multiple blockchains without a bank. Launched in August 2020, it started as a surprise experiment on Ethereum and quickly expanded to Binance Smart Chain, Fantom, and Polygon. Unlike big names like Aave or Compound, Cream Finance doesn’t focus only on Bitcoin or Ethereum. Instead, it targets the overlooked, low-liquidity tokens that other platforms ignore. That’s its edge.

How Cream Finance Works

Cream Finance lets you deposit crypto like USDC, ETH, or even obscure tokens like YFI or CRV into a lending pool. In return, you earn interest-paid out in real time, every block. If you need cash, you can lock up your deposited assets as collateral and borrow other coins. It’s like a crypto bank, but there’s no human in charge. Everything runs on smart contracts.

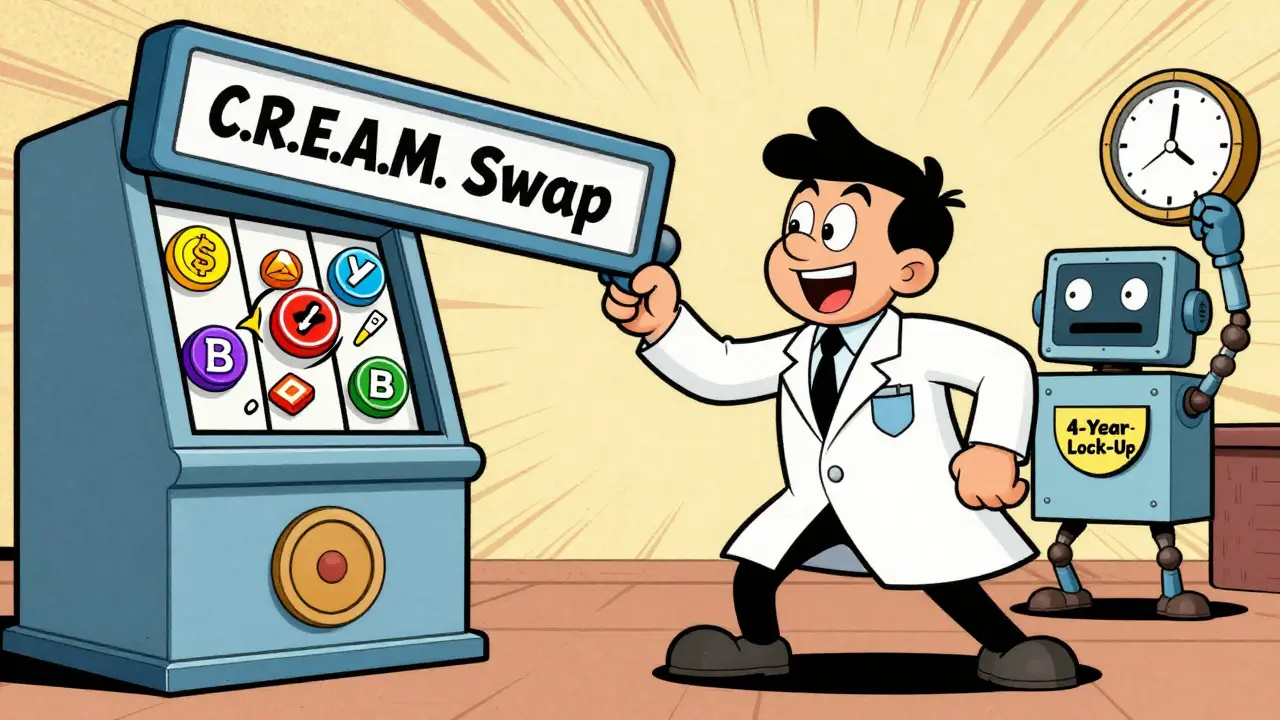

The protocol is built on the same foundation as Compound, but with key upgrades. It supports more blockchains, handles more types of assets, and includes tools like C.R.E.A.M. Swap-a decentralized exchange built into the platform. You can trade tokens directly on Cream without leaving the app. There’s also creamY, a feature that automatically shifts your deposits to the highest-yielding pools across DeFi, similar to how yearn.finance works.

The CREAM Token: More Than Just a Coin

The CREAM token isn’t just a currency. It’s the backbone of governance and rewards. Holders can vote on changes to the protocol-like adjusting interest rates, adding new assets, or changing fee structures. The more CREAM you stake, the more voting power you have.

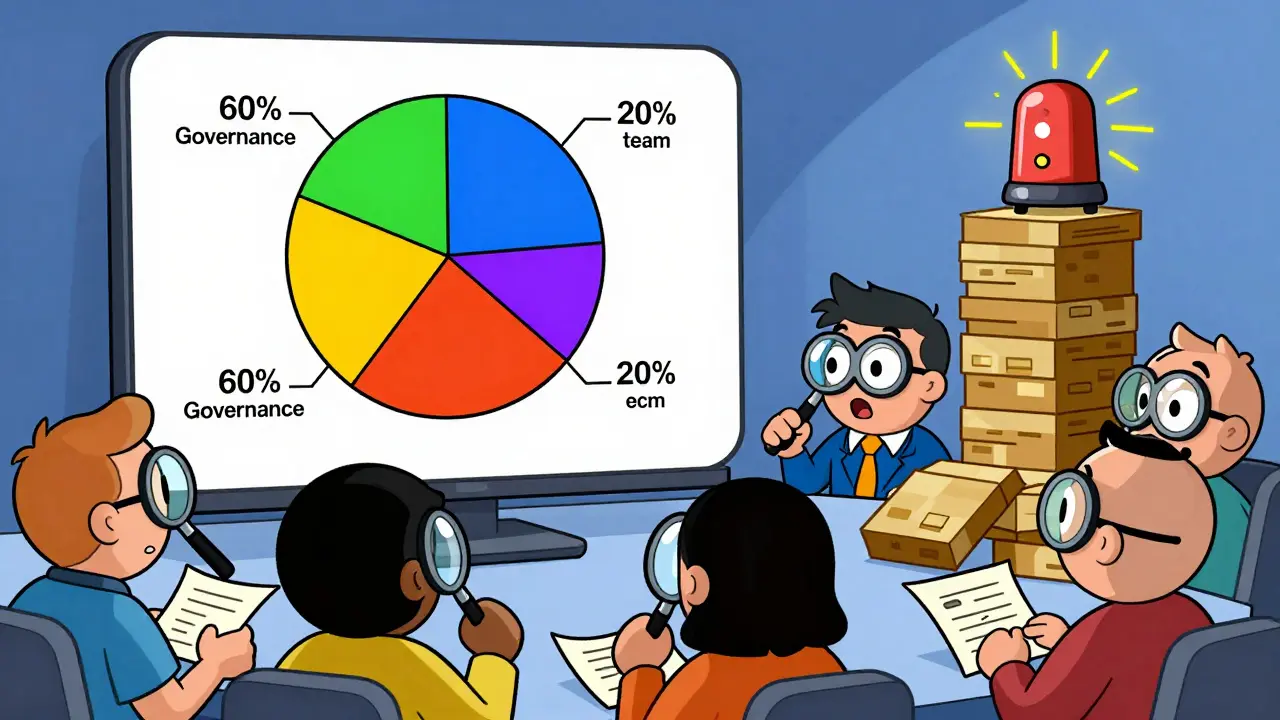

Here’s how the supply is split:

- 60% for protocol governance (distributed to users over time)

- 20% to the core development team

- 10% to Compound Finance (its original parent project)

- 10% to early investors

That 20% to the team raised eyebrows. Some users worry it gives too much control to insiders. But the team has locked most of their tokens for years, reducing immediate selling pressure.

Multi-Chain Advantage

Most DeFi platforms stick to Ethereum. That means high gas fees and slow transactions. Cream Finance works on four chains: Ethereum, BSC, Fantom, and Polygon. You can deposit ETH on Ethereum, then instantly switch to BSC to get lower fees and faster swaps. The platform handles the bridge for you.

This multi-chain setup is rare. It lets users avoid congestion, save on fees, and access assets that aren’t available on one network. For example, if you own a token only listed on Polygon, you can still lend it and earn yield without moving it to Ethereum.

Why It’s Different From Aave or Compound

Aave and Compound are giants. They dominate TVL (Total Value Locked) and have deep liquidity. But they mostly support top-tier assets: ETH, USDC, WBTC, DAI. Cream Finance fills the gaps.

Think of it like this: Aave is the supermarket. Cream Finance is the specialty shop that stocks rare spices you can’t find anywhere else. It lends out tokens like BAL, LEND, yCRV, and renBTC-assets that other protocols won’t touch because they’re too small or risky.

This focus on longtail assets means Cream Finance can offer higher yields. But it also means higher risk. If a token’s price drops fast, your loan could get liquidated. That’s why users need to monitor their collateral ratios closely.

Staking CREAM: High Rewards, Long Wait

If you want to earn the best rewards from Cream Finance, you have to stake CREAM tokens. But here’s the catch: the best rewards come with a 4-year lock-up. You lock your CREAM, and you get nothing until the end of the period. No weekly payouts. No early access.

Some users call this a dealbreaker. Others see it as a way to align incentives-forcing long-term commitment to the protocol’s success. If you’re patient and believe in Cream’s future, this can pay off. If you need cash flow, it’s not for you.

There’s also a shorter staking option-6 months-but the rewards are much lower. You’re trading speed for yield.

Who Uses Cream Finance?

It’s not for beginners. If you’ve never used MetaMask, never swapped tokens on Uniswap, or don’t know what a liquidity pool is, Cream Finance will overwhelm you. It assumes you already understand DeFi basics.

Its users are typically:

- Experienced DeFi traders looking to maximize yield on niche assets

- Investors who hold low-volume tokens and want to earn interest on them

- Developers building other protocols that need lending infrastructure

Reddit and Discord users often praise the platform’s flexibility but complain about the interface. It’s functional, not flashy. No guided onboarding. No tooltips. You’re expected to read the docs.

Market Status and Price Outlook

As of late 2025, CREAM’s market cap sits around $2.4 million. That puts it at #1682 among all cryptocurrencies. The circulating supply is roughly 1.86 million tokens. The price hovers around $1.28-far below its all-time high of over $1,000 in 2021.

Some analysts predict CREAM could hit $290 by 2030. That’s based on assumptions about DeFi adoption and Cream’s role in multi-chain lending. But these are guesses. No one can predict crypto prices with certainty.

What’s clear: Cream Finance isn’t growing fast. It’s not a top 100 coin. But it’s not dead either. It survives because it serves a niche that others ignore.

Pros and Cons at a Glance

| Pros | Cons |

|---|---|

| Works across 4 blockchains (Ethereum, BSC, Fantom, Polygon) | 4-year lock-up for best staking rewards |

| Lends obscure, low-liquidity tokens others ignore | Interface is clunky, no hand-holding for new users |

| Integrated AMM (C.R.E.A.M. Swap) for trading | High risk on volatile collateral assets |

| Part of the yearn.finance ecosystem for yield optimization | Token distribution favors team and early investors |

| Non-custodial-you keep control of your assets | Low market cap means less liquidity and higher slippage |

Is Cream Finance Worth It?

Yes-if you’re holding under-the-radar tokens and want to earn yield on them. Yes-if you’re comfortable with long-term staking and don’t need instant cash flow. Yes-if you’re already deep in DeFi and want to squeeze more out of your portfolio.

No-if you’re new to crypto. No-if you want a simple, fast, low-risk way to earn interest. No-if you’re scared of smart contract risks or hate managing multiple chains.

Cream Finance isn’t trying to be the biggest. It’s trying to be the most useful for a small, technical crowd. And for that group, it still delivers.

How to Get Started

If you’re ready to try it:

- Get a wallet like MetaMask or Trust Wallet.

- Buy some ETH, BNB, or MATIC to pay for gas fees.

- Go to app.cream.finance.

- Connect your wallet and pick your chain (Ethereum, BSC, etc.).

- Deposit a supported asset (USDC, ETH, CRV, etc.).

- Choose to earn interest or borrow against it.

- If you want to vote on governance, stake CREAM tokens.

Always read the fine print. Check collateral ratios. Watch for liquidation thresholds. And never invest more than you can afford to lose.

What is CREAM coin used for?

CREAM is the native token of Cream Finance. It’s used for voting on protocol changes, earning staking rewards, and paying fees on C.R.E.A.M. Swap. It’s not a currency for everyday spending-it’s a governance and utility tool within the DeFi ecosystem.

Can I buy CREAM on Coinbase or Binance?

Yes, CREAM is listed on major exchanges like Binance, KuCoin, and OKX. You can trade it for BTC, ETH, or USDT. But it’s not available on Coinbase. Always check the trading pair before buying-some listings have low liquidity.

Is Cream Finance safe?

It’s as safe as any DeFi protocol-if you understand the risks. The smart contracts have been audited, but no code is 100% bulletproof. The biggest risk isn’t hacking-it’s losing money because your collateral dropped in value and got liquidated. Always keep your loan-to-value ratio below 80%.

Why does Cream Finance have a 4-year staking period?

The 4-year lock-up is designed to ensure long-term commitment from users. By making rewards delayed, the protocol discourages short-term speculation and encourages people to stick around and help grow the ecosystem. It’s a trade-off: lower immediate returns for higher long-term gains.

How does Cream Finance make money?

Cream Finance doesn’t make money like a company. Instead, it takes small fees from borrowers and traders. On C.R.E.A.M. Swap, 0.05% of every trade goes to the protocol treasury. These funds are controlled by CREAM token holders through voting. The treasury can be used for development, security audits, or incentives.

What happens if I don’t stake CREAM?

You can still lend, borrow, and trade on Cream Finance without staking. But you won’t get governance rights or the highest yield rewards. Staking is optional, but if you want influence or maximum returns, you need to lock up your CREAM tokens.

Alexandra Wright

December 28, 2025 AT 12:45Let me guess-you’re the type who thinks DeFi is just ‘buy low, sell high’ with extra steps. Cream isn’t for you if you need a babysitter. It’s a tool for people who already know what a liquidity pool is. If you’re still asking ‘how do I connect MetaMask?’ then go play with Coinbase. This isn’t a kindergarten.

And yes, the 4-year lockup is brutal. But so is watching your 10x coin get liquidated because you deposited a token with 0.02% volume and thought ‘it’ll go up’. Patience isn’t optional here. It’s the only thing keeping you from losing everything.

Jackson Storm

December 29, 2025 AT 09:06ok so i was kinda skeptical at first but after i started using cream on bsc i was like… wow this is actually kinda smooth? like i had this random token i got from airdrop-like 0.001% of my portfolio-and i was just letting it sit. then i threw it into cream and now it’s earning me 18% apy?? no one else even lists it. i feel like a wizard.

interface is still trash tho. like why is the button for ‘stake’ hidden under 3 menus?? but hey, if you’re smart enough to find it, you’ll be rewarded. kinda like life.

Raja Oleholeh

December 29, 2025 AT 10:14USA always think they invented everything. Cream is good. But India has better DeFi protocols. More secure. More efficient. No 4-year lockup. No drama. Just results. 🇮🇳

Vernon Hughes

December 29, 2025 AT 14:11Most DeFi platforms are like Walmart. Cream is the family-owned shop that knows your name and remembers you bought yCRV last Tuesday. They don’t have a loyalty program. They don’t need one. You just come back because they’re the only ones who carry what you need.

And yeah the interface looks like it was built in 2017. But the code? Clean. Audited. Functional. Sometimes the ugliest tools make the best results.

Phil McGinnis

December 31, 2025 AT 12:15The notion that a 20% allocation to the core team constitutes ‘insider control’ is a fundamental misunderstanding of decentralized governance. The token distribution is not a measure of equity-it is a mechanism of incentive alignment. The lock-up period is not a restriction; it is a philosophical assertion that value creation requires temporal commitment.

Furthermore, the assertion that Cream Finance is ‘not growing fast’ is irrelevant. Growth is not the metric of utility. Utility is the metric of survival. And Cream survives because it serves the neglected. The overlooked. The unbankable. That is not a flaw. That is a virtue.

Andy Reynolds

January 2, 2026 AT 07:35Imagine if every DeFi project was a pizza place. Aave and Compound? Domino’s. Big, reliable, everyone knows the menu.

Cream Finance? That weird little shop downtown that only makes pepperoni with pineapple and jalapeños on sourdough crust. No one else does it. You have to know to look for it. But if you like that combo? It’s the only place that gets it right.

And yeah, the interface looks like it was designed by someone who hates UI. But the food? Legendary. Just don’t order if you’re expecting a napkin.

Alex Strachan

January 2, 2026 AT 19:05So you’re telling me I can earn 20% APR on a token that no one’s ever heard of… but I have to lock my CREAM for 4 years? 😂

Bro, I can’t even commit to a 6-month gym membership. But if I could time travel? I’d come back and slap my past self for not staking. 1.28 to 290? That’s not a prediction. That’s a fairy tale. But hey, I’ll still throw 5% of my portfolio in. For the meme.

Also, C.R.E.A.M. Swap? The name alone is worth the gas fees.

Antonio Snoddy

January 4, 2026 AT 14:59What is value, really? Is it the price on the chart? The number of wallets holding the token? Or is it the quiet persistence of a protocol that refuses to chase hype, that chooses to serve the invisible, the illiquid, the forgotten assets that the giants deem too risky to touch?

Cream Finance is not a product. It is a statement. A refusal to conform. A quiet rebellion against the tyranny of liquidity.

We live in a world that rewards noise. Cream rewards patience. And perhaps, in the end, that is the only kind of wealth that lasts.

Do I own CREAM? Yes. Do I care if it hits $5? No. Do I care if it survives when the next bear market wipes out 90% of DeFi? Yes. That’s the only metric that matters.

Amy Garrett

January 4, 2026 AT 18:24OMG I JUST MADE 300% ON YFI IN CREAM AND I DIDNT EVEN KNOW WHAT I WAS DOING 😭😭😭 I JUST CLICKED STAKE AND IT WORKED?? I THOUGHT I WAS GONNA LOSE EVERYTHING BUT NOW I GOT LIKE 500 DOLLARS IN FREE MONEY?? I LOVE CREAM

Haritha Kusal

January 5, 2026 AT 23:05so i tried cream last month and i was scared because i dont know much but my friend helped me and now i earn interest on my CRV and its like 15% a year? its not much but its free money and i dont have to do anything. its like a piggy bank but for crypto. i feel smart now 😊

Mike Reynolds

January 6, 2026 AT 06:49I’ve used Aave, Compound, Curve… and honestly? Cream’s the only one that made me feel like I was actually doing something useful with my weird tokens. I had 0.2 BAL sitting there doing nothing. Now it’s earning. No drama. No fluff. Just code working. That’s all I ask for.

Also, the interface is trash but I’ve learned to live with it. Like a grumpy old dog. It doesn’t wag its tail, but it’s still loyal.

dayna prest

January 7, 2026 AT 05:50Calling Cream a ‘niche’ is an understatement. It’s the crypto equivalent of a 1987 Honda Civic with a turbocharger and a broken AC. No one else wants it. No one else understands it. But if you know how to fix it? It’ll outlast every Tesla on the road.

And yes, the 4-year lockup is a joke. But so is the idea that you can get rich in crypto without waiting. If you want fast cash, go gamble on memecoins. Cream is for people who want to win the long game. Even if the game has no leaderboard.

Ian Koerich Maciel

January 7, 2026 AT 15:59While the protocol’s architecture demonstrates commendable innovation, particularly in its multi-chain interoperability framework, one must remain cognizant of the non-trivial counterparty risk inherent in undercollateralized lending positions on low-liquidity assets. Furthermore, the governance token distribution model, while transparent, presents potential centralization vectors, particularly given the concentration of voting power among early participants.

That said, the integration of yield optimization via creamY represents a significant advancement in automated DeFi strategy execution, and should be considered a benchmark for future protocol design.

Johnny Delirious

January 8, 2026 AT 14:40Let me be clear: Cream Finance is not a cryptocurrency. It is a philosophy. A commitment to decentralization beyond the superficial. A refusal to compromise on accessibility for the marginalized assets of the blockchain ecosystem.

Those who dismiss it as ‘low market cap’ are not investors. They are speculators. And speculators will be left behind when the next wave of DeFi innovation arrives-because it won’t be built on ETH and USDC. It will be built on yCRV, renBTC, and BAL. And Cream will be the only one who still remembers how to use them.

Bianca Martins

January 9, 2026 AT 01:21Used Cream on Polygon last week. Deposited some USDC, got 12% APY, traded some tokens on C.R.E.A.M. Swap with 0.05% fee, and didn’t get rekt. Honestly? That’s a win.

Yeah the UI looks like it was made by a dev who hasn’t slept since 2021. But it works. And that’s more than I can say for half the ‘DeFi 2.0’ projects out there.

Also, the 4-year lockup? I’m not doing it. But I’m not mad about it. It’s just not for me. And that’s okay.

alvin mislang

January 10, 2026 AT 13:35Why are you all defending this? It’s just another rug-pull waiting to happen. The team has 20% of the supply. That’s not decentralization. That’s a cartel. And the 4-year lockup? That’s not commitment-it’s a trap. Lock your tokens, then they change the rules. Classic.

Don’t be fooled. This isn’t innovation. It’s manipulation dressed up in code.

Monty Burn

January 12, 2026 AT 07:28What is risk? Is it the volatility of an asset? Or is it the fear of losing control? Cream Finance does not promise safety. It offers autonomy. And in a world where banks control your money, and exchanges hold your keys, autonomy is the only true security.

Perhaps the 4-year lockup is not a punishment. Perhaps it is a test. A test of whether you believe in the future more than you fear the present.

And if you fail that test? You never belonged here anyway.

Jack and Christine Smith

January 12, 2026 AT 21:47my husband and i tried cream last weekend and we were both like ‘this is too complicated’ but then we figured it out and now we’re earning on our old CRV and we feel like crypto wizards 😍

also the name C.R.E.A.M. is the best thing ever. we keep saying ‘get that cream’ like it’s a meme. it’s our thing now.

Prateek Chitransh

January 13, 2026 AT 14:46People here act like Cream is some secret weapon. It’s not. It’s just a good protocol that doesn’t scream for attention. Aave and Compound are the loud kids in class. Cream is the one who actually knows the answer but doesn’t raise their hand.

And yes, the 4-year lockup is harsh. But if you’re holding CREAM just to flip it? You’re missing the point. This isn’t a coin. It’s a membership card to a club no one else wants to join. And that’s why it works.