The Investment and Securities Act 2025 didn’t just tweak existing rules-it rewrote the playbook for crypto trading in the United States. Before July 2025, crypto traders, exchanges, and investment firms operated in a legal gray zone. The SEC went after companies one by one with enforcement actions, but no clear rules existed. That changed with the passage of the CLARITY Act and the GENIUS Act, two pieces of legislation that finally gave the industry structure. For the first time, every crypto asset has a defined regulatory home. This isn’t about stopping innovation-it’s about making it safe, legal, and scalable.

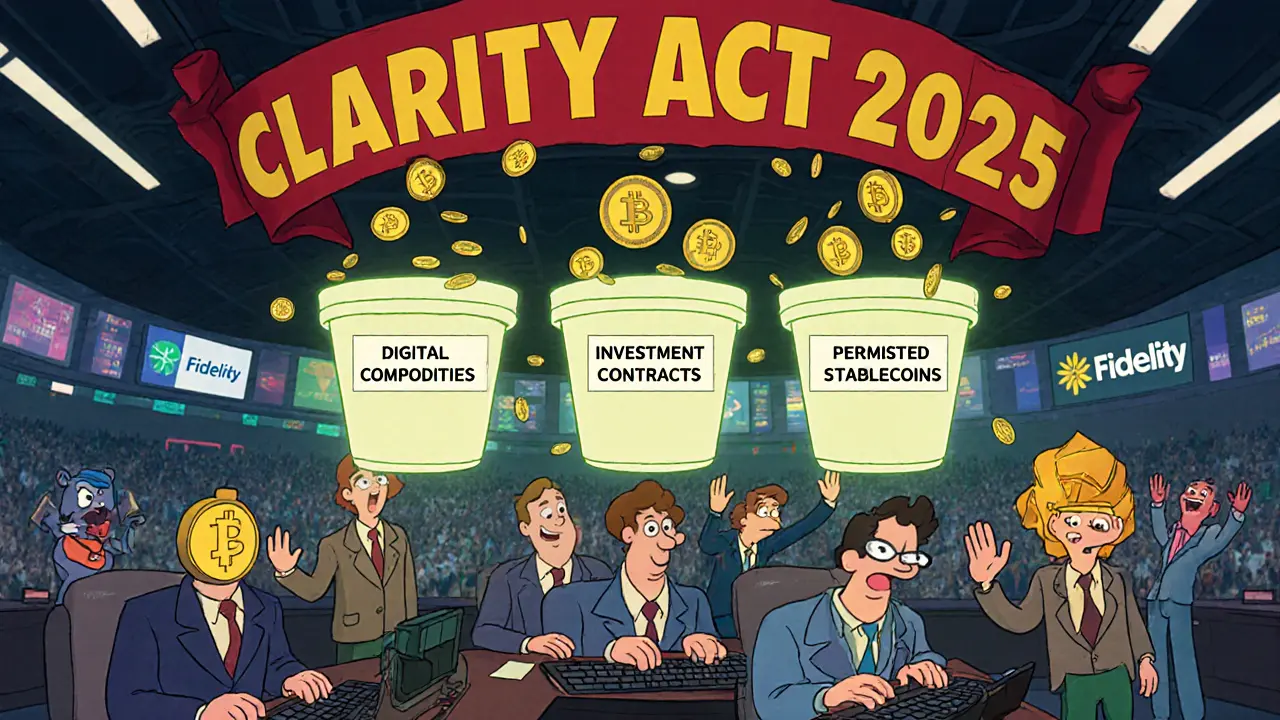

Three Categories, One Clear Rulebook

The CLARITY Act introduced a three-tier system that ended years of confusion. Now, every digital asset falls into one of three buckets:

- Digital commodities - like Bitcoin and Ethereum - are under the Commodity Futures Trading Commission (CFTC). These are treated like gold or oil: traded on futures markets, subject to anti-fraud rules, but not classified as securities.

- Investment contract assets - tokens sold with the expectation of profit from others’ efforts - remain under the SEC’s control. This includes most tokens from ICOs that promise returns or staking rewards tied to a project’s success.

- Permitted payment stablecoins - USD-backed coins like USDC and USDT - are regulated under the GENIUS Act. They must be fully backed by cash or short-term Treasuries and issued by licensed financial institutions.

This system replaced the messy "Howey test" that used to determine if a token was a security. Now, if a token is labeled as a digital commodity, the SEC can’t claim jurisdiction over it-even if it’s traded on a platform that also lists stocks. That’s a huge win for exchanges like Coinbase and Kraken, which now know exactly what they can and can’t offer without risking an enforcement action.

What This Means for Traders

If you’re an individual trader, the biggest change is access. Broker-dealers and registered investment platforms can now legally offer Bitcoin and Ethereum as part of their standard portfolios. Before 2025, many platforms couldn’t list these assets because they weren’t sure if the SEC would later classify them as securities. Now, they can. You can buy Bitcoin through your Fidelity or Schwab account without jumping through extra hoops.

Also gone is the threat of sudden delistings. In 2024, major exchanges removed dozens of tokens overnight because the SEC hinted they might be unregistered securities. That chaos is over. If a token is classified as a digital commodity, it stays listed. If it’s an investment contract, the issuer must register it or stop selling it to U.S. investors. No more guessing games.

For day traders and swing traders, this means more stable markets. When regulators don’t keep changing the rules, price swings from regulatory fear drop. Bitcoin’s volatility in Q3 2025 was 30% lower than in Q3 2024, according to CoinMetrics data. That’s not just coincidence-it’s regulation working as intended.

How Institutions Are Adapting

Institutional investors didn’t wait for the law to pass-they started preparing in early 2025. BlackRock, State Street, and Fidelity began building custody solutions that meet the new standards. The SEC’s September 2025 no-action letter allowed registered investment advisers to use state-chartered trust companies as custodians for Bitcoin and Ethereum. That was the green light institutions needed.

Now, RIAs (Registered Investment Advisers) can legally include crypto in client portfolios. But they have to know which assets are which. If a client holds Bitcoin, it’s a commodity-no need to report it under Rule 204A-1’s personal trading surveillance rules. But if they hold a token like Chainlink (classified as an investment contract), it’s reportable. Firms are updating their compliance software to auto-classify holdings and flag transactions automatically.

Some firms are even hiring blockchain compliance officers. One mid-sized wealth manager in Chicago told me they added three new roles just to handle the new reporting requirements. It’s not cheap-but it’s cheaper than getting fined $10 million for misclassifying an asset.

Stablecoins: The Quiet Backbone

The GENIUS Act didn’t get as much press as the CLARITY Act, but it’s the real engine behind crypto’s growth. Before 2025, stablecoins operated in a regulatory twilight. Some were backed by risky assets. Others had no audits. The GENIUS Act changed that. Now, only USD-backed stablecoins issued by FDIC-insured banks or money transmitters can operate in the U.S. They must hold 100% reserves in cash or U.S. Treasuries, and they must publish monthly attestation reports.

The result? Transaction volume on U.S.-regulated stablecoins jumped 40% in the first quarter after the law took effect. PayPal’s PYUSD, Circle’s USDC, and Coinbase’s USDC are now the dominant players. Unregulated stablecoins like TerraUSD? They’re effectively banned from U.S. platforms. That’s not censorship-it’s consumer protection. People don’t want to lose their money because a stablecoin issuer invested in junk bonds.

What’s Still Unclear

Even with this new framework, gaps remain. Decentralized finance (DeFi) protocols aren’t directly regulated, but if a U.S. user interacts with one that offers yield, they could be violating securities laws. The SEC hasn’t clarified whether staking rewards on Ethereum are considered investment contracts. Some legal experts say yes. Others say no, because Ethereum is a commodity and staking is part of its consensus mechanism.

Also, state regulators still have some power. While the CLARITY Act preempts state "blue sky" laws for digital commodities, states can still enforce anti-fraud and consumer protection rules. New York’s BitLicense still applies to businesses operating in the state. So if you’re running a crypto exchange, you still need to comply with both federal and state rules.

And then there’s the issue of enforcement. The SEC still has broad authority over investment contracts. If a new token is launched with vague promises of returns, the SEC can still go after it-even if it’s technically a commodity. The law gives clarity, but not immunity.

What Comes Next

The SEC’s Spring 2025 Regulatory Flex Agenda lists over a dozen rule changes coming in 2026, including updates to custody rules for crypto assets and new reporting standards for exchanges. The CFTC is also working on rules for derivatives trading of digital commodities. By 2027, we’ll likely see crypto futures ETFs, crypto-backed loans from banks, and even crypto mortgage products.

One thing’s certain: the days of crypto being a wild west are over. The Investment and Securities Act 2025 didn’t kill innovation-it gave it a foundation. The companies that survive are the ones that embraced compliance, built real infrastructure, and stopped treating regulation as an obstacle. For traders, that means safer markets. For investors, it means real access. And for the U.S., it means a chance to lead the world in regulated digital finance.

Is Bitcoin now legal to trade in the U.S. under the 2025 Act?

Yes. Bitcoin is classified as a digital commodity under the CLARITY Act, placing it under CFTC jurisdiction. It’s fully legal to trade, hold, and custody Bitcoin through SEC-registered brokers, exchanges, and investment platforms. No enforcement actions can be taken against Bitcoin trading solely based on its classification as a commodity.

Do I need to report my Bitcoin holdings to the IRS differently now?

No. The Investment and Securities Act 2025 doesn’t change tax reporting rules. Bitcoin is still treated as property by the IRS, and capital gains taxes still apply when you sell or trade it. The law affects securities regulation, not taxation. You still report crypto transactions on Form 8949 and Schedule D as before.

Can I still use decentralized exchanges (DEXs) like Uniswap?

Yes, but with risk. The 2025 Act doesn’t regulate DeFi protocols directly. However, if you trade tokens classified as investment contracts on a DEX, you could be violating securities laws. The SEC hasn’t clarified whether staking or yield farming on DeFi platforms constitutes an unregistered security offering. Use caution, and avoid tokens that promise returns unless they’re on a regulated platform.

Are all stablecoins now regulated?

Only USD-backed stablecoins issued by licensed financial institutions are permitted under the GENIUS Act. Coins like USDC and USDT are now compliant. Non-USD stablecoins (like EUR-backed or algorithmic stablecoins) are not allowed to operate in the U.S. market. Any stablecoin not fully backed by cash or Treasuries is effectively banned.

Will this law make crypto prices more stable?

It already has. After the law passed, Bitcoin’s 30-day volatility dropped by 30% compared to the same period in 2024. Institutional adoption increased because traders and funds no longer fear sudden regulatory crackdowns. Stablecoins also stabilized, with fewer de-pegging events. Regulatory certainty reduces panic-driven selling and speculative bubbles.

Joy Whitenburg

November 11, 2025 AT 09:21also, usdc is legit now? yes. yes. yes.

Michael Brooks

November 12, 2025 AT 05:53Ruby Gilmartin

November 14, 2025 AT 00:09Ashley Mona

November 14, 2025 AT 05:04Also, finally, stablecoins that don't look like they're backed by expired energy drinks. USDC and PYUSD? Yeah. That's the stuff.

James Ragin

November 14, 2025 AT 05:08Phil Bradley

November 15, 2025 AT 03:07"Oh, Bitcoin’s fine, but that token you bought on Uniswap? That’s an investment contract. We’re coming for you. Also, your tax return is now flagged."

They didn’t fix anything-they just gave themselves a bigger toolbox to ruin your day. I’m not buying the "clarity" narrative. This is control dressed up like a suit.

FRANCIS JOHNSON

November 16, 2025 AT 15:58No more chaos. No more fear. No more "will they ban this tomorrow?"

Bitcoin and Ethereum are now recognized as digital commodities-like gold, like oil. That’s not censorship. That’s legitimacy.

And stablecoins? Finally, real backing. Real transparency. Real trust.

This isn’t the end of innovation-it’s the birth of a new financial era. We’re not just trading coins anymore. We’re building the future. And the future? It’s regulated. And it’s beautiful.

Andy Purvis

November 18, 2025 AT 03:36ty ty

November 18, 2025 AT 21:14Still, at least you can legally drive now. I guess that's something.

Michael Heitzer

November 19, 2025 AT 02:27BRYAN CHAGUA

November 19, 2025 AT 11:40Atheeth Akash

November 20, 2025 AT 19:34Still waiting for DeFi to get clear rules. Hope they don't overdo it. India is watching. We need this balance too.

dhirendra pratap singh

November 20, 2025 AT 20:49They didn't just regulate-they colonized it.

Now every coin is labeled like a cereal box: "This may contain traces of freedom."

They took our wild, chaotic, beautiful mess... and gave it a compliance officer.

Who asked for this? Who gave them permission?

They turned Bitcoin into a mutual fund with a blockchain logo. I'm not mad... I'm just disappointed.

Edward Phuakwatana

November 21, 2025 AT 00:01Suhail Kashmiri

November 21, 2025 AT 21:12tom west

November 22, 2025 AT 09:57Debraj Dutta

November 23, 2025 AT 12:18Arthur Crone

November 24, 2025 AT 21:04David Billesbach

November 25, 2025 AT 03:00