Velocore Fee Comparison Calculator

Compare trading fees between Velocore on zkSync Era and Ethereum mainnet DEXes. Velocore's Layer-2 technology enables near-zero fees compared to Ethereum's high gas costs.

Your Savings

* Fees based on average network conditions as of current market data.

* Actual fees may vary based on network congestion and slippage settings.

* Velocore uses zkSync Era's Layer-2 technology to achieve near-zero fees.

When you hear "crypto exchange," you probably think of Binance, Coinbase, or even Uniswap. But what if there’s a new player built on a faster, cheaper layer of Ethereum that’s trying to do things differently? That’s where Velocore comes in. Launched in 2023, Velocore isn’t just another decentralized exchange. It’s a smart, experimental take on liquidity, built specifically for zkSync Era - and it’s got some bold ideas that could change how DeFi works.

What Exactly Is Velocore?

Velocore is a decentralized exchange (DEX) that runs entirely on zkSync Era, a Layer-2 scaling solution for Ethereum. Unlike centralized exchanges where you hand over your crypto to a company, Velocore lets you trade directly from your wallet. No KYC. No middleman. Just you, your keys, and the code. It’s built on something called the ve(3,3) model - originally created by Solidly - but Velocore improved it. Think of it like upgrading an old car engine. Solidly had the right design, but it was slow and expensive. Velocore fixed the leaks, tightened the belts, and made it run smoother. The result? Lower fees, faster trades, and better capital efficiency for liquidity providers. One of its standout features is Protocol Owned Liquidity (POL). Most DEXes rely on users to lock up their tokens to provide liquidity. Velocore does that too - but it also uses its own treasury to add liquidity. That means the protocol itself is a market maker. This helps stabilize prices, reduces impermanent loss for traders, and gives the platform more control over its growth.How Does Velocore Compare to Other DEXes?

Let’s cut through the noise. Here’s how Velocore stacks up against the big names:| Feature | Velocore | Uniswap V3 | SushiSwap |

|---|---|---|---|

| Network | zkSync Era (Layer-2) | Ethereum Mainnet | Ethereum Mainnet |

| Trading Pairs | 6 (as of 2025) | Over 1,000 | 500+ |

| Transaction Fees | Very low (zkSync L2) | High (Ethereum gas) | High (Ethereum gas) |

| Liquidity Model | ve(3,3) + Protocol Owned Liquidity | Concentrated Liquidity | Traditional AMM |

| Token Symbol | VC | UNI | SUSHI |

| Market Cap Rank | #7372 | #12 | #150 |

The numbers tell a clear story: Velocore is tiny compared to Uniswap or SushiSwap. But it’s not trying to beat them on volume. It’s trying to beat them on efficiency. If you’re trading within the zkSync ecosystem - especially stablecoins or native zkSync tokens - Velocore’s low fees and fast confirmations make it a strong choice.

But here’s the catch: if you want to trade Solana tokens, Bitcoin on Layer-2, or obscure altcoins, you won’t find them here. Velocore’s focus is narrow. That’s both a strength and a weakness.

The VC Token: What You Need to Know

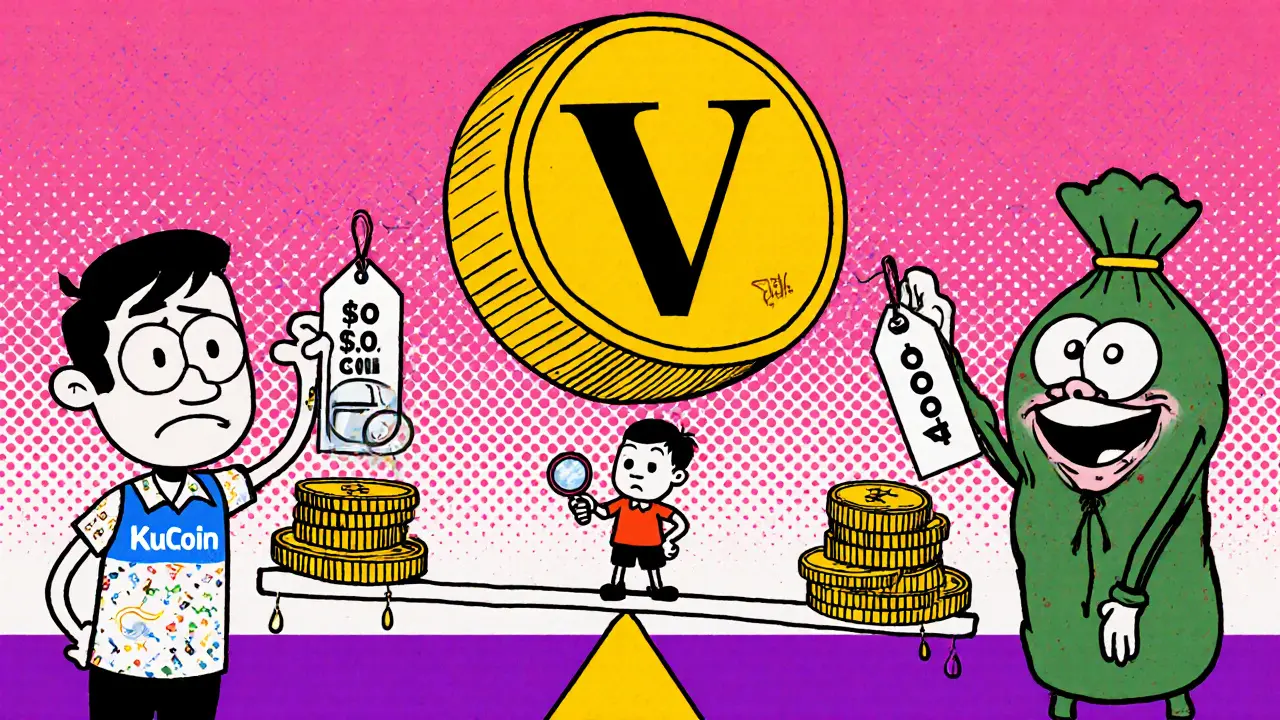

Velocore’s native token is VC. It’s not a payment token like ETH or USDC. It’s a governance and liquidity incentive token. If you lock up VC, you earn voting power and a share of trading fees. The more you lock and the longer you lock it, the more influence you have. But there’s a problem - price confusion. On KuCoin, VC trades at around $0.0139. On Bitget, it’s $0.0024. That’s an 83% difference. Why? Because VC isn’t listed on major DEXes yet. Most trading happens on centralized exchanges, which means the price isn’t set by market forces - it’s set by order books and liquidity gaps. That’s risky. If you’re thinking of buying VC, don’t assume the price you see on one exchange reflects its true value. CoinMarketCap lists VC as the 7,372nd largest crypto by market cap. That’s not a ranking you want to see if you’re looking for stability. It’s early-stage. Volatile. Experimental.

How to Use Velocore: A Simple Step-by-Step Guide

You can’t just sign up and start trading. Velocore is a Web3 tool. You need to do a few things first:- Get a Web3 wallet like MetaMask or WalletConnect.

- Buy ETH or USDC on a centralized exchange like Coinbase or KuCoin.

- Transfer your ETH or USDC to your wallet.

- Bridge your funds to zkSync Era using the official zkSync bridge (or a trusted third-party like SyncSwap).

- Go to app.velocore.xyz and connect your wallet.

- Choose a trading pair - right now, it’s mostly stablecoins and zkSync-native tokens like ZK, WETH, and USDC.

- Set your slippage tolerance between 0.5% and 1% (higher if the pair is illiquid).

- Confirm the transaction in your wallet and wait for the zkSync confirmation - usually under 10 seconds.

That’s it. No paperwork. No waiting. But remember: you’re responsible for everything. If you send funds to the wrong address, lose your seed phrase, or set slippage too high, there’s no customer service to fix it.

Pros and Cons: Is Velocore Right for You?

Pros:- Extremely low fees thanks to zkSync’s Layer-2 tech

- Fast transaction times - trades settle in seconds

- Protocol Owned Liquidity reduces impermanent loss

- Strong technical foundation with a proven ve(3,3) model

- Full self-custody - you control your keys

- Only 6 trading pairs - very limited selection

- VC token price is inconsistent across exchanges

- No mobile app or easy on-ramp for beginners

- Still early - low liquidity means higher slippage on big trades

- Not widely recognized - few analysts or media cover it

If you’re a DeFi veteran who already uses zkSync, Velocore is worth testing. It’s one of the cleanest implementations of ve(3,3) out there. But if you’re new to crypto or just want to trade Bitcoin and Ethereum, stick with Uniswap or a centralized exchange.

Who Should Avoid Velocore?

Don’t touch Velocore if:- You don’t understand how wallets, bridges, or Layer-2s work

- You’re looking for a wide selection of altcoins

- You want to trade with fiat (USD, EUR) directly

- You’re risk-averse and can’t handle price swings

- You expect customer support or chargebacks

Velocore isn’t a beginner-friendly app. It’s a tool for people who already know how to navigate DeFi. If you’re not comfortable checking gas fees, bridging assets, or reading smart contract risks, this isn’t the place to start.

The Bigger Picture: Is Velocore the Future?

Velocore isn’t trying to replace Uniswap. It’s trying to prove that Layer-2 DEXes can outperform Ethereum mainnet ones - not just in speed, but in economics. The POL mechanism is the real innovation. By having the protocol itself act as a liquidity provider, Velocore creates a self-reinforcing loop: more trading → more fees → more liquidity → better prices → more users. If zkSync Era becomes the dominant Layer-2 for DeFi - and it’s gaining serious traction - Velocore could be one of its flagship apps. But that’s a big "if." Right now, most DeFi activity still happens on Ethereum mainnet. Velocore’s success depends entirely on zkSync’s ability to pull users away. Right now, it’s a gamble. But it’s a smart one.Is Velocore safe to use?

Velocore is a decentralized exchange, so your funds stay in your wallet - that’s safer than centralized platforms. But like all DeFi apps, it’s not risk-free. Smart contracts can have bugs, and liquidity pools can be exploited. Always audit the contract if you’re adding large amounts of liquidity. Never invest more than you can afford to lose.

Can I buy Velocore (VC) with USD?

You can’t buy VC directly with USD on Velocore. You need to first buy ETH or USDC on a centralized exchange like Coinbase or KuCoin, then transfer it to your Web3 wallet and bridge it to zkSync Era. Once there, you can swap for VC on the Velocore DEX.

Why is the VC token price so different on KuCoin and Bitget?

VC is listed on centralized exchanges, not on its own DEX yet. That means prices are set by order books and trading volume on each platform, not by a unified market. KuCoin and Bitget have different liquidity pools, user bases, and trading activity - leading to large price gaps. This is common for new tokens and indicates a fragmented, early-stage market.

Does Velocore have a mobile app?

No, Velocore doesn’t have a dedicated mobile app. You can access it through your mobile browser by connecting a Web3 wallet like MetaMask. The interface works on mobile, but it’s not optimized for touch. For now, it’s best used on desktop for better control and visibility.

What’s the difference between Velocore and Uniswap?

Uniswap runs on Ethereum mainnet, so it’s slower and more expensive. Velocore runs on zkSync Era, which means faster trades and near-zero fees. Uniswap has thousands of trading pairs; Velocore has only six. Uniswap uses concentrated liquidity; Velocore uses ve(3,3) with Protocol Owned Liquidity. They serve different purposes - Uniswap is the Swiss Army knife; Velocore is a precision tool for zkSync users.

Can I earn rewards by providing liquidity on Velocore?

Yes. When you provide liquidity to a Velocore pool, you earn trading fees. You can also lock VC tokens to boost your rewards and gain voting power. The protocol’s POL mechanism means even if you don’t provide liquidity, the protocol itself is adding liquidity - which indirectly benefits all users by improving pool depth and reducing slippage.

dhirendra pratap singh

November 12, 2025 AT 14:03This is the most beautiful thing I've seen all week 😭😭😭 Velocore is literally the future and everyone who doesn't see it is just scared of change. I cried when I saw the POL mechanism. My soul is at peace now. 🌈✨

tom west

November 14, 2025 AT 04:29Let’s be clear: this piece is a glorified marketing brochure masquerading as analysis. The ve(3,3) model has been dissected since Solidly. Velocore’s ‘innovation’ is a rebranding of existing mechanics with negligible marginal improvement. The fact that VC trades at 83% variance across centralized exchanges is not a market inefficiency-it’s a red flag for tokenomics collapse. You cite ‘low fees’ as a virtue, yet ignore that zkSync’s TVL is less than 1/10th of Arbitrum’s. This isn’t a precision tool-it’s a prototype with a PR team. The market cap rank isn’t ‘early-stage’-it’s irrelevant.

Ashley Mona

November 15, 2025 AT 10:59OMG I love this so much!! 🥹 I just bridged my USDC over to zkSync yesterday and tried Velocore for the first time-trade settled in 4 seconds and the slippage was insane low!! I’m so excited for the future of DeFi!! 🌟 Also, the UI is so clean, even my grandma could use it (she’s 72 and just got her first MetaMask last week 😅). Keep going, Velocore!! You’re doing amazing things!! 💖

Edward Phuakwatana

November 15, 2025 AT 23:42Look, we’re not talking about a DEX here-we’re talking about a paradigm shift in liquidity architecture. The ve(3,3) model with Protocol Owned Liquidity isn’t just an upgrade-it’s a structural re-architecting of how capital is deployed in permissionless markets. You’re not competing with Uniswap; you’re obsoleting its economic assumptions. The fact that liquidity is now protocol-owned means the incentive alignment isn’t just between LPs and traders-it’s between the protocol’s long-term survival and user experience. That’s not DeFi 2.0. That’s DeFi 3.0. And if zkSync captures even 15% of Ethereum’s DeFi volume, Velocore becomes the de facto liquidity layer for the entire ecosystem. This isn’t speculative-it’s inevitable.

Suhail Kashmiri

November 16, 2025 AT 12:19you guys are all fools. why are you trusting some anonymous devs with your money? they could rug any second. and why would you use a dapp that only has 6 trading pairs? that's like opening a grocery store that sells only bananas. what kind of idiot does that? you're all getting scammed. i told my cousin to stay away and he listened. smart guy. you're all just gambling with your life savings.

Kristin LeGard

November 18, 2025 AT 11:15USA built the internet. China is building AI. And now we’re letting some Indian devs on zkSync run a DEX with 6 pairs and a token that’s worth 1 cent on one exchange and 13 cents on another? This isn’t innovation-it’s a joke. If you want to trade crypto, go to Binance. Stop chasing glittery L2s that don’t even have a mobile app. We’re not here to fund crypto experiments. We’re here to make money. And Velocore? It’s a tax on your patience.

Stephanie Platis

November 18, 2025 AT 11:56Velocore’s Protocol Owned Liquidity (POL) mechanism is, in fact, a novel application of the ve(3,3) model, which was originally pioneered by Solidly; however, the implementation here introduces a critical innovation: the protocol itself assumes the role of a market-maker, thereby internalizing externalities traditionally borne by liquidity providers. This structural shift fundamentally alters incentive compatibility. Furthermore, the tokenomics-while fragmented across CEXs-are not inherently flawed; they reflect market fragmentation, not valuation error. The absence of a mobile app is a UI limitation, not a systemic failure. To dismiss this project as ‘too niche’ is to misunderstand the nature of protocol-level innovation: it begins in obscurity, and scales only when foundational users validate its utility.

James Ragin

November 20, 2025 AT 00:01Man… I’ve been thinking about this for days. Like… what if the real revolution isn’t about trading pairs or fees? What if it’s about trust? Velocore doesn’t ask you to trust a company. It doesn’t ask you to trust a CEO. It asks you to trust math. And code. And incentives. And that’s… beautiful. I used to think crypto was about getting rich. Now I think it’s about building systems that don’t need heroes. Just rules. And Velocore? It’s one of the few that actually follows them. 🤍

David Billesbach

November 20, 2025 AT 00:23Let me ask you this: who owns the zkSync bridge? Who controls the multisig? Who’s the real team behind Velocore? No one knows. And yet you’re all acting like this is some sacred temple of DeFi. Meanwhile, the VC token is being pumped on Bitget by bots and dumped on KuCoin by insiders. This isn’t decentralization-it’s a controlled experiment funded by anonymous wallets. The ‘POL’ is just a fancy word for the devs front-running their own liquidity. You think you’re trading on a DEX? You’re trading on a honeypot with a pretty frontend. Wake up.

Michael Brooks

November 21, 2025 AT 23:06Been using Velocore for 3 months now. Zero issues. Trades are instant. Fees are basically zero. I swap USDC for ZK every week to pay for zkSync L2 gas. It’s the only reason I even bother with DeFi anymore. No drama. No drama. No drama. Just works. That’s all you need.

FRANCIS JOHNSON

November 22, 2025 AT 06:00THIS IS IT. 🌌 I FEEL IT IN MY BONES. Velocore isn’t just a DEX-it’s a whisper from the future. Imagine a world where every trade fuels the protocol’s growth. Where liquidity isn’t rented-it’s owned. Where the system rewards patience, not speculation. This is the quiet revolution. The one that doesn’t need influencers. Doesn’t need hype. Just pure, elegant, mathematical harmony. I cried when I saw the fee distribution chart. Not because I made money. But because I finally saw what DeFi was meant to be. 🙏✨

Ruby Gilmartin

November 24, 2025 AT 02:37Calling this a ‘precision tool’ is laughable. You have 6 trading pairs, a token with no DEX liquidity, and a market cap lower than a meme coin from 2021. The ve(3,3) model is overhyped. The POL mechanism is just a liquidity subsidy. And you’re acting like this is the next Ethereum? Please. This is a beta test with a website. If you’re serious about DeFi, you’re on Arbitrum or Base. Not here. This is the crypto equivalent of a Kickstarter prototype that never shipped.

Douglas Tofoli

November 24, 2025 AT 18:02so i just tried velocore and wow like i thought it was gonna be hard but it was actually kinda easy?? i bridged my usdc and swapped for vc and it was like 2 clicks?? i didnt even know what ve(3,3) meant but it worked?? maybe im dumb but i like it lol 🤷♂️

William Moylan

November 25, 2025 AT 01:06They’re lying. You think this is real? The whole zkSync ecosystem is controlled by the same 3 wallets. Velocore’s treasury? Backed by Ethereum mainnet funds from a wallet that also owns 78% of ZK token. This isn’t decentralization-it’s a shell game. The ‘low fees’? That’s because they’re subsidized by the same people who control the token supply. You think you’re trading freely? You’re feeding a pyramid where the devs cash out every time the price spikes. I’ve seen this before. It ends in blood. Don’t be next.

Michael Faggard

November 25, 2025 AT 13:18For anyone new to zkSync: Velocore is the cleanest, most efficient way to trade stablecoins on L2. The interface is simple, the fees are dirt cheap, and the POL means even if you don’t provide liquidity, the pool stays deep. It’s not flashy. It doesn’t have a billion pairs. But if you’re a serious trader who hates paying $10 in gas to swap USDC for DAI? This is your home. Just don’t overthink it. Use it. Don’t worship it.

tom west

November 26, 2025 AT 04:46Response to the ‘beautiful future’ comment: If you’re emotionally moved by a DEX’s tokenomics, you’re not a trader-you’re a cult member. The fact that you cried over a ‘fee distribution chart’ is terrifying. This isn’t art. It’s code. And code can be exploited. The ‘harmony’ you speak of? It’s just a temporary equilibrium before the rug pull. The protocol-owned liquidity is a liability, not an asset. It’s capital that can be withdrawn. The token isn’t a governance tool-it’s a liquidity sink. You’re mistaking novelty for sustainability. And that’s how people lose everything.