UK Crypto Compliance Risk Checker

Assess Your Compliance Risk

Answer these questions to identify your compliance gaps under UK sanctions law for 2025.

Compliance Risk Assessment

It’s 2025, and if you run a crypto exchange, wallet service, or crypto ATM in the UK, you’re not just running a tech business-you’re running a financial compliance operation under a microscope. The UK sanctions regime no longer treats cryptocurrency as a gray area. It’s a high-risk asset class, and the Office for Financial Sanctions Implementation (OFSI) has made it crystal clear: failure to comply isn’t a mistake-it’s a crime.

Why Crypto Is Now a Sanctions Target

Cryptocurrency isn’t just about Bitcoin and NFTs anymore. It’s being used to move billions in hidden funds. In 2024, a Russia-linked crypto token called A7A5 moved $9.3 billion in just four months. It wasn’t a coin for speculation-it was built to bypass Western sanctions. The UK government responded by sanctioning the entire infrastructure behind it. That’s not an outlier. It’s the new normal. OFSI’s July 2025 threat assessment found that over 7% of all sanctions breach reports in the UK now involve crypto firms. That’s a massive jump from just two years ago. And here’s the scary part: OFSI says it’s almost certain that UK crypto companies have been under-reporting suspicious activity since August 2022. That means the real number of violations is likely much higher. The reason? Crypto moves fast, anonymously, and across borders. Traditional bank-style monitoring tools-designed for SWIFT transfers and branch transactions-can’t track a Bitcoin moving through five different wallets in five countries in under five minutes. If your compliance team is still using spreadsheets or basic watchlists, you’re already behind.Who Exactly Has to Comply?

It’s not just big exchanges. Under UK law, any firm that deals with crypto-assets must register with the Financial Conduct Authority (FCA). That includes:- Centralized crypto exchanges (like Binance UK or Kraken UK)

- Custodian wallet providers (companies holding crypto on behalf of customers)

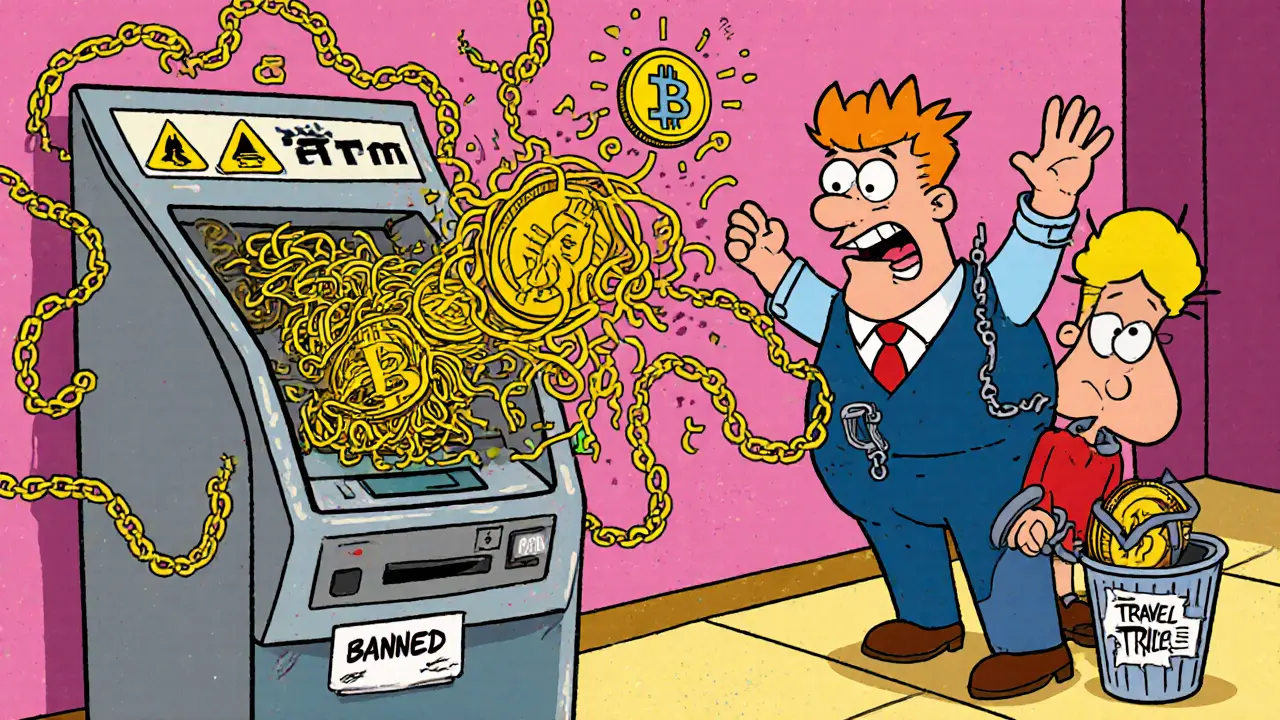

- Crypto ATMs

- Platforms running initial coin offerings (ICOs) or initial exchange offerings (IEOs)

- Peer-to-peer (P2P) trading platforms

The Compliance Minefield

Here’s what compliance actually looks like today:- You must screen every new customer against the UK sanctions list-now over 2,700 names, mostly tied to Russia.

- You must monitor every transaction in real time for links to sanctioned wallets or mixers.

- You must flag and report any suspicious activity to OFSI within 72 hours.

- You must keep records for at least five years.

- You must train staff regularly on crypto-specific sanctions risks.

What Happens If You Get Caught?

Fines aren’t just financial-they’re existential. In 2024, a UK-based crypto exchange was fined £2.4 million for failing to screen over 12,000 transactions linked to sanctioned Russian entities. The company had to shut down. Another firm lost its FCA registration after a 14-month investigation into missing Travel Rule data. No registration means no customers. No customers means no business. The UK government doesn’t just fine you. It names and shames. OFSI publishes enforcement notices publicly. Your name, your violation, your fine-all online for competitors, investors, and customers to see. That kind of reputational damage can kill a startup faster than any market downturn. And it’s not just OFSI. HM Revenue & Customs (HMRC) is now actively auditing crypto firms for tax evasion and money laundering. The FCA and HMRC are sharing data. The net is closing.What You Need to Do Right Now

If you’re running a crypto business in the UK, here’s your checklist for 2025:- Verify your FCA registration-if you’re not registered, stop operating immediately.

- Install blockchain analytics software-choose a platform that covers Bitcoin, Ethereum, and stablecoins. Don’t wait for a warning letter.

- Implement the Travel Rule-your platform must collect, store, and transmit customer info on all transfers over £1,000.

- Train your team-hire or upskill someone with crypto compliance experience. Don’t rely on general AML staff.

- Update your risk assessment-OFSI says passive compliance is dead. You need a dynamic, risk-based approach tailored to your business.

- Review your customer onboarding-are you asking for ID, proof of address, and source of funds? If not, you’re at risk.

The Bigger Picture

The UK isn’t acting alone. It’s coordinating closely with the U.S. Treasury and the EU on crypto sanctions enforcement. Recent joint actions against Kyrgyzstan-based Capital Bank and the Grinex exchange show this is a global crackdown. If you’re trying to hide funds using crypto, you’re not hiding from one country-you’re hiding from the entire Western financial system. New legislation in 2025 formally recognized crypto as personal property in England and Wales. That’s a big deal. It means courts can seize crypto assets just like they would cash or real estate. It also means your crypto holdings are now subject to inheritance laws, divorce settlements, and tax claims. The legal status of crypto is no longer fuzzy-it’s firmly anchored in UK law. The message from regulators is clear: crypto isn’t the wild west anymore. It’s part of the financial system. And if you’re in it, you’re bound by the same rules as banks, brokers, and payment processors.What’s Next?

Expect more enforcement. More fines. More public naming. More pressure on smaller firms to merge or shut down. The cost of compliance is rising fast. AI-powered transaction monitoring, real-time screening, and automated reporting are no longer futuristic ideas-they’re baseline requirements. If you’re a small crypto startup, the bar is higher than ever. If you’re a legacy financial firm entering crypto, you’re being held to the same standard as the biggest players. There’s no shortcut. No loophole. No excuse. The future of crypto in the UK belongs to those who treat compliance not as a cost center, but as their core product. Because in 2025, if you can’t prove you’re not helping sanctions evasion, you don’t get to play.Do UK sanctions apply to decentralized crypto exchanges?

Yes. If a decentralized exchange (DEX) operates in the UK or serves UK customers, it falls under FCA jurisdiction. Even if the platform is coded as decentralized, if it has a UK-based team, marketing presence, or accepts GBP deposits, regulators can hold it accountable. The FCA doesn’t care about the tech-it cares about who’s in control and who’s benefiting.

Can I use privacy coins like Monero or Zcash in the UK?

Technically, yes-but it’s extremely risky. The FCA has flagged privacy coins as high-risk for sanctions evasion. Most compliant crypto firms in the UK have either blocked these coins entirely or added extra layers of scrutiny. If you process Monero transactions, expect increased reporting requirements, audits, and potential red flags from OFSI. Many exchanges have stopped supporting them altogether to avoid liability.

What happens if I accidentally transact with a sanctioned wallet?

Accidental transactions happen-but ignorance isn’t a defense. If you didn’t have proper screening tools in place, you’re still liable. The key is showing you took reasonable steps: using blockchain analytics, training staff, and reporting the incident to OFSI immediately. Prompt reporting can reduce penalties. Silence or cover-up will make it worse.

Is the Travel Rule enforced on peer-to-peer (P2P) platforms?

Yes. If your P2P platform matches buyers and sellers and holds funds in escrow, you’re classified as a cryptoasset business under UK law. That means you must collect and transmit Travel Rule data. Platforms that only connect users and never touch funds (truly decentralized P2P) may be exempt-but those are rare. Most P2P operators in the UK are now required to comply.

Can I use a U.S.-based crypto compliance tool in the UK?

You can, but it’s not enough. U.S. sanctions lists (OFAC) are different from the UK’s (OFSI). You need a tool that updates both lists in real time and can screen for UK-specific designations, like the sanctioned Russian banks and crypto exchanges. A U.S.-only tool will miss critical UK targets and leave you exposed.

Are NFTs subject to UK sanctions?

Yes. NFTs are considered crypto-assets under UK law. If an NFT is used to transfer value to a sanctioned person or entity-like selling a digital artwork to a Russian oligarch-it can be a sanctions violation. The FCA has warned that NFT marketplaces must apply the same screening and reporting rules as crypto exchanges.

How often does OFSI update its sanctions list?

OFSI updates its list daily, often multiple times a day, especially during geopolitical crises. You cannot rely on weekly or monthly updates. Your compliance system must pull live data from OFSI’s official feed. Manual checks are no longer acceptable.

What if my crypto firm is based outside the UK but serves UK customers?

You’re still subject to UK law. The FCA has jurisdiction over any firm that targets UK customers-regardless of where it’s headquartered. If you market to UK users, accept GBP, or have a UK phone number or website domain, you’re in scope. Many overseas firms have been fined or blocked from operating in the UK for ignoring this rule.

Laura Hall

November 11, 2025 AT 20:10Okay but like… why are we still pretending crypto isn’t just a glorified money-laundering app at this point? I get the rules, I do. But if your compliance team is still using spreadsheets, you’re not a startup-you’re a time capsule. 🤦♀️

Arthur Crone

November 11, 2025 AT 21:43Most crypto firms are just scam factories with a compliance checkbox. They don’t care about OFSI. They care about exit liquidity. This whole post is just regulatory theater.

Michael Heitzer

November 13, 2025 AT 00:15Let’s reframe this. Compliance isn’t the enemy-it’s the bridge. The wild west is over. The real innovation now isn’t in DeFi yield farms or NFT art-it’s in building systems that can trace a transaction from a Russian oligarch’s wallet to a UK-based crypto ATM without a single human error. That’s the future. That’s the hard work. And honestly? It’s kind of beautiful.

Rebecca Saffle

November 14, 2025 AT 10:10They’re coming for the little guys first. You think Binance UK gives a damn? They’ve got lawyers on retainer. But your local crypto ATM operator? That guy’s gonna get fined £50K for letting some dude buy $1200 in BTC with a fake ID. And then he’s out of business. No one talks about that.

Adrian Bailey

November 16, 2025 AT 05:40So I’ve been using a U.S.-based blockchain tool for my small P2P platform and honestly? It’s been fine… until last week when OFSI flagged a wallet I didn’t even know was on their list. Turns out they added it 3 hours before the transaction. My software didn’t update in real time. So yeah… I’m switching to TRM Labs. Worth every penny. Also, I had to retrain my whole team because nobody knew what a ‘mixer’ was. My bad. 😅

Rachel Everson

November 17, 2025 AT 16:26If you’re a small operator reading this-don’t panic. Start small. Pick one tool. Train one person. Get your FCA registration done. You don’t need AI-powered everything on day one. Just be consistent. Show up. Do the work. Regulators notice effort, not perfection. You got this.

Johanna Lesmayoux lamare

November 18, 2025 AT 04:00Travel Rule on P2P? That’s a joke. How’s that even enforceable?

ty ty

November 18, 2025 AT 22:37Wow. So the government is now the blockchain police. Next they’ll be forcing us to wear compliance badges. How progressive.

BRYAN CHAGUA

November 19, 2025 AT 03:37It’s not about control. It’s about integrity. Crypto promised freedom. But freedom without accountability is just chaos. And chaos doesn’t scale. The firms that survive will be the ones who see compliance as a competitive advantage-not a burden.

Debraj Dutta

November 19, 2025 AT 08:11In India, we see this same pattern. Regulators want control. But innovation moves faster. The real challenge is not compliance-it’s adaptation. Tools exist. The will? That’s another story.

tom west

November 20, 2025 AT 21:17Let’s be real. The UK doesn’t care about crypto. They care about controlling capital flows. This is financial nationalism dressed up as regulation. The sanctions list is a political weapon. The crypto firms are just collateral damage. This isn’t about compliance-it’s about power.

dhirendra pratap singh

November 22, 2025 AT 18:23OMG I just got flagged by OFSI for a $200 USDT transfer. I thought it was just a normal trade. Now I’m being investigated. My whole business is in jeopardy. Who even made these rules?? 😭💸

Ashley Mona

November 24, 2025 AT 17:25Monero users are the real heroes here. They’re not trying to hide from the system-they’re defending privacy. The fact that the FCA treats it like a crime is terrifying. What’s next? Banning encrypted messaging? 😤

Edward Phuakwatana

November 24, 2025 AT 19:17Think of compliance as your business’s immune system. You don’t notice it until it’s fighting a virus. Chainalysis, Elliptic, TRM-they’re your antibodies. Skip them? You’re walking into a pandemic with no mask. And yes, the cost is high. But the cost of a shutdown? Zero. Your business. Gone. Poof. No second chances.

Phil Bradley

November 25, 2025 AT 21:43There’s a deeper question here: if crypto is personal property now, does that mean your crypto wallet is part of your estate? Can your ex-spouse claim your ETH in a divorce? Can the IRS seize your NFT if you owe back taxes? The legal implications are wild. We’re not just regulating transactions-we’re rewriting inheritance, marriage, and taxation. This is the quiet revolution.

Stephanie Platis

November 26, 2025 AT 04:49It’s not enough to ‘try’ to comply. You must prove, with documented, timestamped, auditable evidence, that every single transaction was screened against the most current OFSI list-updated in real-time, with no exceptions. Anything less is negligence. And negligence is a criminal offense under UK law. Period.

Ainsley Ross

November 27, 2025 AT 04:05As someone who works with cross-border fintech in the U.S., I can say this: the UK is ahead of the curve. We’re still arguing about whether crypto is a security or a commodity. Meanwhile, the UK has already defined it as property, enforced the Travel Rule, and is actively prosecuting violations. This isn’t overreach-it’s leadership. We should be watching, not criticizing.

Michelle Elizabeth

November 28, 2025 AT 10:25It’s funny. The same people who screamed ‘freedom from banks’ now want the government to tell them which blockchain tools to buy. The irony is delicious.

Wayne Dave Arceo

November 28, 2025 AT 22:27The UK is not being aggressive. It’s being precise. The U.S. is still in the ‘let’s regulate by press release’ phase. The UK? They’ve got lawyers drafting legislation while the crypto bros are still arguing about whether ‘decentralized’ means anything. This isn’t a crackdown-it’s a correction. And it’s long overdue.

Joanne Lee

November 29, 2025 AT 02:07Thank you for this detailed breakdown. I’m a compliance officer at a small wallet provider, and this clarified so much. The part about real-time OFSI feeds was a lightbulb moment. We were updating weekly. Now we’re integrating the API. Small step-but it might save our license.