Turkey Crypto Compliance Cost Calculator

Calculate Your Compliance Costs

Based on Turkey's Law No. 7518 (2024) requiring:

- Minimum licensing fees: TRY 150M ($4.1M) for exchanges, TRY 500M ($13.7M) for custodians

- Ongoing compliance costs: 0.001% of transaction volume

Before 2021, you could buy coffee with Bitcoin in Istanbul. By 2025, that’s illegal. Turkey didn’t just tighten rules-it rebuilt the entire system. The country went from letting crypto thrive with minimal oversight to enforcing one of the strictest, most detailed regulatory frameworks in the world. And it’s not just about stopping money laundering. This is a full-scale reassertion of state control over money, technology, and even political dissent.

How Turkey Killed Crypto Payments-And Why It Matters

In April 2021, the Central Bank of Turkey banned using cryptocurrencies to pay for goods and services. Not trading. Not holding. Just spending. That single move set the tone for everything that followed. You could still buy Ethereum, sell Dogecoin, or hold Bitcoin in a wallet-but you couldn’t use it to buy a phone, pay rent, or send money to family abroad. The goal? Protect the Turkish lira from being replaced by something the government can’t control.

That ban still stands. And it’s not just a footnote. It’s the foundation of Turkey’s entire crypto strategy. While countries like the U.S. wrestle with whether crypto is a security, a commodity, or currency, Turkey made its choice: crypto is a speculative asset, not money. That distinction matters because it means the government can allow trading-while shutting down any real-world use.

The Law That Changed Everything: Law No. 7518

On June 26, 2024, Turkey passed Law No. 7518, the first formal, nationwide law governing crypto assets. This wasn’t a guideline. It wasn’t a suggestion. It was a legal overhaul. For the first time, terms like ‘cryptoasset,’ ‘wallet,’ and ‘cryptoasset service provider’ had official definitions in Turkish law.

The law forced every exchange, custodian, and trading platform operating in Turkey to apply for a license from the Capital Markets Board (CMB). The cost? At least TRY 150 million ($4.1 million) for exchanges. Custodians? TRY 500 million ($13.7 million). That’s not a startup fee. That’s a corporate barrier. Only deep-pocketed players-mostly Turkish firms with state ties or foreign investors willing to risk billions-can enter.

Before this law, anyone could set up a crypto platform. Now, you need audited financial statements, a physical office in Turkey, a dedicated compliance team, and a clean record. The result? Dozens of small exchanges shut down overnight. Only six major platforms remain licensed as of October 2025.

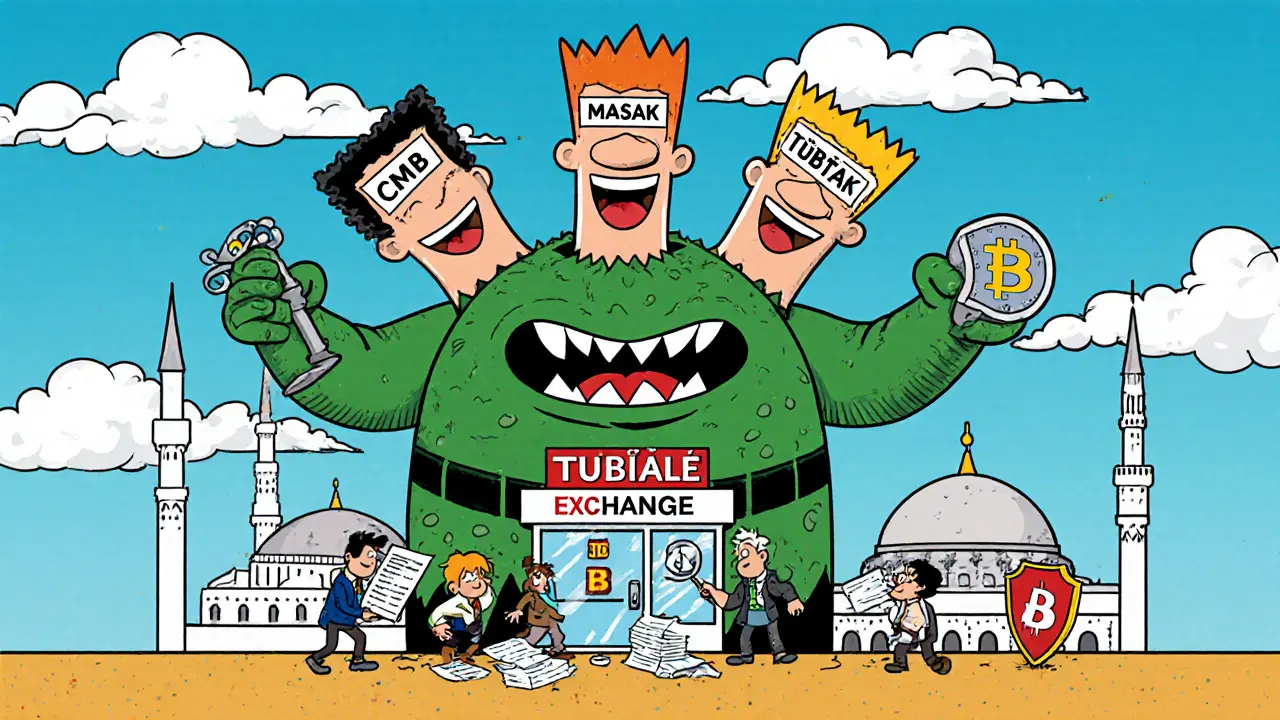

Who’s in Charge? The Three-Pillar Enforcement System

Turkey didn’t just create one regulator. It built a three-headed monster.

- The Capital Markets Board (CMB) is the boss. They issue licenses, set rules, and punish violators. If you’re running a crypto platform in Turkey, the CMB owns you.

- MASAK (Financial Crimes Investigation Board) has sweeping powers. They can freeze your crypto wallet, bank account, or even your business assets without a court order-if they suspect money laundering. And they’re using it. In July 2025, MASAK froze accounts linked to 17 individuals accused of funding opposition groups through crypto.

- TÜBİTAK (Scientific and Technological Research Council) handles the tech side. They check if your platform’s security protocols, encryption, and data storage meet national standards. No backdoors. No foreign servers. Everything must be hosted inside Turkey.

This isn’t just regulation. It’s surveillance wrapped in compliance.

What Happened When They Cracked Down

July 2025 was the turning point. On July 28, Turkish authorities blocked 46 unlicensed crypto exchanges-including global decentralized platforms like PancakeSwap and Uniswap. These weren’t shady local operations. These were the same platforms millions of Turkish users relied on for low-fee trading.

The fallout was immediate. Trading volumes on licensed platforms spiked-but so did frustration. Users reported delays of up to 14 days just to verify their identity. Some couldn’t withdraw funds because their transaction history didn’t meet MASAK’s new reporting rules. Others lost access to wallets they’d held for years because they weren’t registered with a licensed custodian.

And then came the arrest.

The founder of ICRYPEX, one of Turkey’s largest exchanges, was detained on charges of using crypto to fund political activists. The government didn’t charge him with fraud or tax evasion. They charged him with ‘supporting terrorist organizations.’ The case is still ongoing, but the message was clear: crypto isn’t just about finance anymore. It’s about power.

How This Compares to the Rest of the World

Turkey’s approach sits between two extremes. On one side, China banned crypto entirely. On the other, Switzerland lets anyone launch a crypto firm with minimal oversight.

Turkey’s model is closest to the EU’s MiCA regulation-but even stricter. Unlike MiCA, Turkey doesn’t allow crypto payments. Unlike the U.S., where the SEC, CFTC, and state regulators fight over jurisdiction, Turkey has one clear authority: the CMB. And unlike South Korea, which requires KYC but lets exchanges operate with lower capital, Turkey demands millions upfront.

It’s a hybrid: a crypto-friendly trading environment with a financial dictatorship underneath. You can trade-but you can’t spend. You can own-but you can’t move freely. You can profit-but only if the state says you’re clean.

Who’s Winning? Who’s Losing?

On paper, the system looks efficient. Licensed exchanges report fewer hacks. KYC checks have cut fraud by 62% since 2024, according to CMB internal reports. Customer support has improved. Disputes are resolved faster.

But the cost is steep.

For traders: You need a Turkish ID, a local phone number, and proof of income to trade over 15,000 lira (~$450). Every transaction above that requires a written explanation. Want to send crypto to a friend? You need to declare the purpose. No more anonymous transfers.

For businesses: Setting up a compliant exchange takes 8-12 months. You need lawyers, auditors, tech consultants, and a dedicated compliance officer. Many foreign firms gave up. Only one U.S.-based exchange made it through-after relocating its entire server infrastructure to Istanbul.

For ordinary people: Over 20% of Turkish adults own crypto. Many bought Bitcoin during the lira’s worst inflation years. Now, they’re trapped. They can’t use it to pay bills. They can’t cash out easily. And if they’re flagged by MASAK, their entire financial life can freeze overnight-no warning, no appeal.

What’s Next? The Next Wave of Controls

Turkey isn’t done. New legislation is being drafted to give MASAK even more power. The proposed rules include:

- Complete ban on stablecoin transfers unless tied to a government-approved bank account

- Real-time monitoring of all crypto transactions above 5,000 lira

- Automatic reporting of any crypto activity linked to foreign IP addresses

- Penalties of up to 10 years in prison for unlicensed crypto mining or trading

The goal? Eliminate any possibility of capital flight. Prevent Turks from using crypto to escape inflation. Stop opposition groups from raising funds. Control the narrative.

It’s working. Trading volume on licensed platforms is up 40% since July 2025. But the number of active crypto users has dropped 22%. Many have simply walked away.

Is This the Future for Other Countries?

Yes-and that’s the real story.

Turkey isn’t an outlier. It’s a blueprint. Emerging markets with unstable currencies-Nigeria, Argentina, Egypt-are watching closely. They see how Turkey stopped crypto from replacing the lira. They see how the state used regulation to crush dissent disguised as financial crime.

Other countries may not copy the exact rules. But they’ll copy the mindset: crypto is dangerous if it’s free. If it can’t be controlled, it must be banned-or absorbed.

Turkey didn’t ban crypto. It made crypto a state project. And that’s far more dangerous than any ban ever could be.

Raymond Day

November 11, 2025 AT 17:35Diana Dodu

November 13, 2025 AT 00:23Wayne Dave Arceo

November 14, 2025 AT 18:22Elizabeth Stavitzke

November 15, 2025 AT 22:35Michelle Elizabeth

November 17, 2025 AT 15:17Noriko Yashiro

November 18, 2025 AT 07:27Rachel Everson

November 19, 2025 AT 20:50Brian Gillespie

November 21, 2025 AT 12:37Douglas Tofoli

November 21, 2025 AT 19:36Adrian Bailey

November 22, 2025 AT 04:38Ainsley Ross

November 22, 2025 AT 12:19Kylie Stavinoha

November 23, 2025 AT 00:17Laura Hall

November 23, 2025 AT 10:32Rebecca Saffle

November 25, 2025 AT 06:14Kristin LeGard

November 25, 2025 AT 07:07Johanna Lesmayoux lamare

November 26, 2025 AT 10:14Michael Faggard

November 28, 2025 AT 08:22Joanne Lee

November 28, 2025 AT 19:43