Virtual Assets Vietnam: Regulations, Risks, and Real Opportunities

When it comes to virtual assets Vietnam, digital financial instruments like cryptocurrencies and tokens regulated under national law. Also known as digital assets, they operate in a legal gray zone despite being officially recognized as property under Vietnam’s 2023 decree. But here’s the catch — while owning crypto isn’t illegal, using it to pay for goods or services? That’s banned. And exchanges? They need $379 million in capital just to apply for a license. This isn’t just strict — it’s one of the toughest frameworks in Asia.

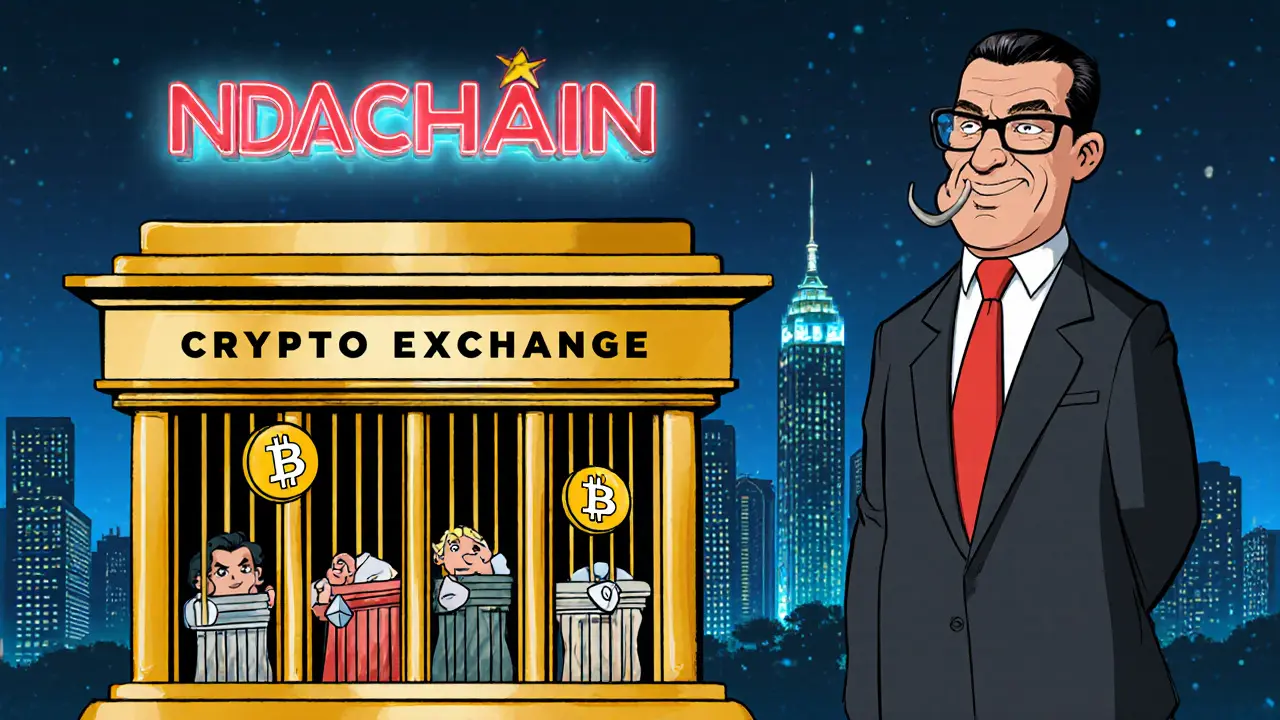

The backbone of this crackdown is Directive 05/CT-TTg, Vietnam’s official crypto regulatory framework requiring massive capital reserves and banning fiat-backed stablecoins. It doesn’t just target foreign platforms — it forces local players to either shut down or raise absurd amounts of cash. Meanwhile, crypto exchange Vietnam, platforms trying to operate legally under Vietnam’s rules. are vanishing. Many that once claimed to serve Vietnamese users now have zero local presence. And yet, trading continues — quietly — through peer-to-peer apps and offshore wallets. People aren’t giving up. They’re just getting smarter.

What you’ll find in this collection aren’t hype pieces or generic guides. These are real breakdowns of what’s happening on the ground. From platforms like LocalTrade that turned out to be scams with fake volume, to Metahero’s confusing 2025 token drop that left users wondering if it was real, this is the kind of intel you won’t get from news sites. You’ll see how KYC requirements are enforced (or ignored), how airdrops like HERO and HAPPY faded into nothing, and why projects like Carrieverse and Margaritis are dead before they ever launched. This isn’t about speculation — it’s about survival. If you’re trading, investing, or just trying to avoid getting scammed in Vietnam’s crypto space, these posts give you the facts before you click ‘send’.

Vietnam legalized cryptocurrencies in 2025 but with extreme restrictions: only five licensed exchanges, all trades in Vietnamese dong, no stablecoins, and $379 million capital requirements. Despite high public adoption, no firms have applied for licenses yet.

View More