Vietnam Crypto License Feasibility Calculator

Enter Your Company Capital

Vietnam Crypto License Requirements

For years, Vietnam’s central bank made it clear: no crypto payments, no bank involvement, no gray zones. But in 2025, everything changed. The State Bank of Vietnam didn’t just soften its stance-it rewrote the rules. Cryptocurrencies like Bitcoin and Ethereum are now legal, but not in the way most people expect. They’re not money. They’re not payments. They’re virtual assets-something you can own, trade, and inherit, but only under strict government control.

From Ban to Bureaucracy: How Vietnam’s Crypto Rules Changed

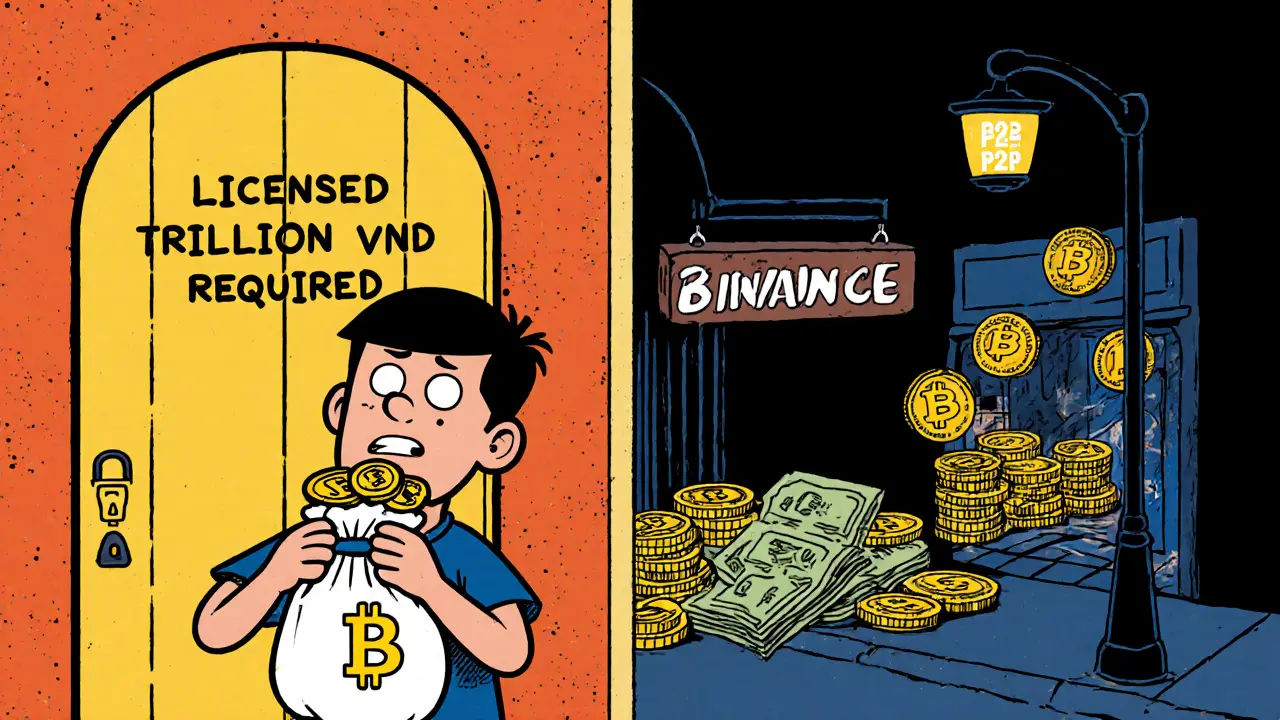

In 2024, using Bitcoin to buy coffee in Hanoi could get you fined. Financial institutions were banned from touching any crypto-related transaction. The State Bank of Vietnam treated digital assets like a dangerous experiment, not a financial tool. That changed in June 2025 with the passage of the Law on Digital Technology Industry. For the first time, Vietnam officially recognized cryptocurrencies as property. Not currency. Not payment. Property. That shift matters. It means if you hold Bitcoin, the law now protects your right to own it, pass it to your heirs, or sell it-within limits. But the State Bank didn’t open the floodgates. Instead, it built a cage with golden bars. The new framework, outlined in Resolution No. 05/2025/NQ-CP, doesn’t allow free trading. It doesn’t let foreign exchanges operate. It doesn’t even let you trade Bitcoin for US dollars. Everything must be done in Vietnamese dong. And only five companies in the entire country will ever be allowed to run crypto exchanges.The Five-Licence Rule: Who Can Trade Crypto in Vietnam?

If you want to run a crypto exchange in Vietnam today, you need to meet impossible-sounding requirements. First, you need at least 10 trillion Vietnamese dong in capital-that’s about $379 million. Not in assets. Not in revenue. Actual cash on hand. Second, you need at least two shareholders, and they can’t just be random investors. They must come from established financial institutions: commercial banks, securities firms, insurance companies, fund managers, or major tech enterprises. And those shareholders? They need to have been profitable for two years straight before even applying. The State Bank isn’t just filtering out small players. It’s filtering out the entire global crypto industry. Binance, Coinbase, Kraken-none of them qualify. Only Vietnamese-owned and Vietnamese-controlled companies can apply. Even then, they’ll be limited to five licenses total. As of October 2025, not a single company has submitted an application. Why? Because the bar is so high, and the risks so unclear, that even local banks are holding back.Trading Rules: Only Vietnamese Dong, Only Five Platforms

Here’s the catch: if you’re a Vietnamese citizen and you want to trade crypto, you can’t use Binance P2P anymore-not legally. The new law says all trades must happen on one of the five licensed exchanges, and all trades must be in Vietnamese dong. No USDT. No BTC/USD pairs. No stablecoins tied to foreign currencies. The only stablecoin allowed is one backed by real assets like gold or real estate, and even then, only if issued by a Vietnamese company. Foreign investors? They can’t trade directly. They have to go through Ministry of Finance-approved Crypto Asset Service Providers (CASPs). These aren’t exchanges. They’re intermediaries with heavy reporting requirements. Think of them as gatekeepers who monitor every dollar that flows in and out. This structure gives the State Bank full visibility into who’s buying crypto and how much.

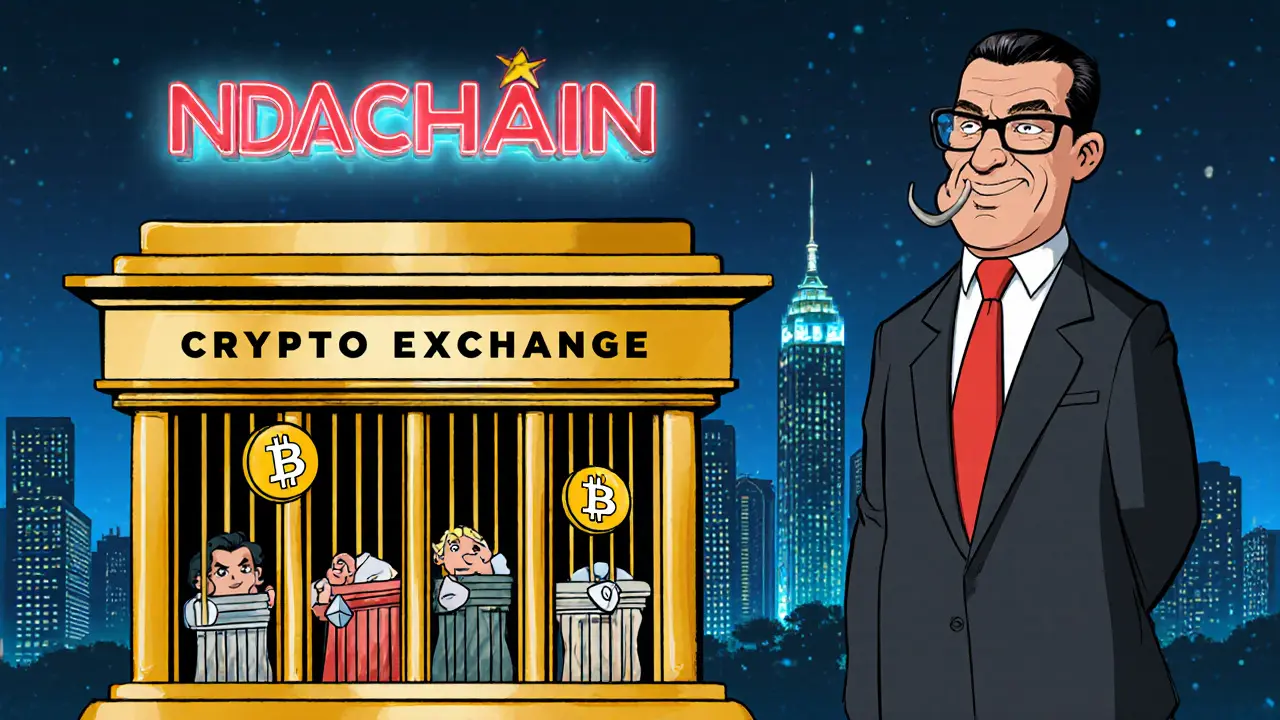

NDAChain: Vietnam’s Secret Crypto Infrastructure

While the public focus is on exchanges, the State Bank quietly launched something bigger: NDAChain. This isn’t a public blockchain like Ethereum. It’s a government-controlled, permissioned network. Think of it as Vietnam’s internal blockchain for official use. Banks can tokenize government bonds. Companies can track carbon credits. Insurance firms can issue digital policies. All transactions are recorded, visible to regulators, and impossible to alter. NDAChain is the real story behind Vietnam’s crypto policy. The State Bank isn’t trying to compete with Bitcoin. It’s trying to control the future of digital value. By building its own system, it ensures that even as citizens trade crypto on licensed exchanges, the backbone of the financial system remains under state control. It’s a hybrid model: public access to crypto, private control over infrastructure.Why Is Vietnam’s Approach So Strict?

Vietnam ranks fourth in the world for crypto adoption, according to Chainalysis. Over 20% of its tech-savvy population owns digital assets. Yet, most of that trading happens informally-through P2P apps, offshore exchanges, and cash deals. The State Bank knows this. It knows it can’t stop people from buying Bitcoin. So instead of fighting it, it’s trying to channel it. The goal? Three things: tax revenue, investor protection, and economic control. By forcing trades into licensed platforms, the government can track capital flows and collect taxes. By requiring high capital and strict ownership rules, it prevents foreign speculators from destabilizing the local market. And by banning stablecoins backed by foreign currencies, it protects the Vietnamese dong from being undermined. Deputy Governor Pham Thanh Ha has said the central bank expects crypto adoption to drive 20% credit growth in 2025. That’s not because people are spending Bitcoin-it’s because regulated crypto trading will unlock new forms of collateral, attract institutional investors, and push banks to innovate.

What’s Missing? The Real Problem With Vietnam’s Plan

The rules look smart on paper. But they’re not working yet. No companies have applied for licenses. Why? Because the cost is too high, the timeline is too long, and the rewards are too uncertain. A $379 million capital requirement isn’t just a barrier-it’s a wall. Even Vietnam’s biggest banks don’t have that kind of capital sitting idle. Meanwhile, the informal market keeps growing. People still use Binance P2P. They still buy USDT with cash. They still send crypto abroad. The State Bank can regulate exchanges, but it can’t regulate people. And as long as the legal system doesn’t offer a better, easier alternative, the underground market will thrive. There’s also a risk of isolation. Singapore and the Philippines are moving fast to attract global crypto firms. Vietnam is building a fortress. That might protect its economy-but it could also lock out innovation, talent, and investment.What’s Next? The Five-Year Pilot

The State Bank calls this a five-year pilot. That means everything could change. If no one applies for licenses, the rules might be relaxed. If trading volumes explode on the few platforms that do launch, the government might open more licenses. If NDAChain proves useful for bonds or insurance, the state might expand it. For now, Vietnam’s crypto policy is a balancing act. It’s not pro-crypto. It’s not anti-crypto. It’s control-crypto. The government wants to benefit from digital assets without losing power over them. Whether that’s sustainable depends on whether Vietnamese firms can meet the impossible standards-and whether people are willing to trade in a system that’s designed to be slow, expensive, and tightly watched.For now, if you’re in Vietnam and you want to trade crypto, you have two choices: play by the government’s rules on a platform that doesn’t exist yet, or trade outside the system-where the rules don’t apply, but the risks do.

Is Bitcoin legal in Vietnam in 2025?

Yes, Bitcoin and other cryptocurrencies are legal in Vietnam as of June 2025, but only as "virtual assets." You can own, trade, and inherit them, but you cannot use them to pay for goods or services. All trading must happen through government-licensed exchanges and must be conducted in Vietnamese dong.

Can I use Binance in Vietnam?

You can still access Binance, but only for peer-to-peer (P2P) trading using Vietnamese dong. Official trading pairs like BTC/USDT or ETH/USD are not allowed on licensed exchanges. Binance’s exchange platform is not licensed under Vietnam’s 2025 crypto law, so using it for direct trading violates the new regulations.

Why hasn’t any company applied for a crypto license in Vietnam?

The capital requirement is too high-10 trillion VND ($379 million)-and only Vietnamese firms with two profitable years can apply. Most banks and tech companies find the cost and complexity too risky, especially since the market is still unproven. Without any licensed exchanges yet, there’s no clear path to profitability.

Can foreigners trade crypto in Vietnam?

Foreigners cannot trade directly on Vietnamese crypto exchanges. They must go through Ministry of Finance-approved Crypto Asset Service Providers (CASPs), which act as intermediaries with strict reporting rules. This limits access and increases compliance burdens for international investors.

Are stablecoins like USDT allowed in Vietnam?

No, stablecoins tied to foreign currencies like USDT or USDC are banned. Only Vietnamese-issued stablecoins backed by real assets-like gold or property-are permitted, and even those are tightly controlled. This is to protect the Vietnamese dong from being replaced or undermined by foreign digital currencies.

What is NDAChain and why does it matter?

NDAChain is Vietnam’s government-run, permissioned blockchain system. It’s not public-it’s used internally by banks, insurers, and government agencies to tokenize bonds, track carbon credits, and secure digital records. It matters because it shows the State Bank of Vietnam isn’t just regulating crypto-it’s building its own digital financial infrastructure to stay in control.

Will Vietnam’s crypto policy change in the future?

Yes. The current rules are part of a five-year pilot program. If trading volumes grow and licensed exchanges succeed, the government may lower capital requirements, issue more licenses, or allow limited stablecoin use. If the system fails to attract participants, the rules could be scaled back or abandoned. Everything depends on real-world results, not theory.

Hannah Kleyn

November 14, 2025 AT 07:20so vietnam just turned crypto into a museum exhibit you can own but not touch

like a diamond in a glass case at the bank that says 'this is yours but dont even think about spending it'

imagine having a Ferrari but the only place you can drive it is a 100-meter track in your driveway

and the government gives you a ticket if you go over 5 km/h

its not regulation its performance art

ratheesh chandran

November 14, 2025 AT 20:11lol why do they even bother if no one applies for the licenses

its like building a 5 star hotel in the middle of the desert and then wondering why no one checks in

the state bank thinks people will trade on their platform but everyone just uses binance p2p with cash under the table

they dont get it

crypto is about freedom not paperwork

gary buena

November 15, 2025 AT 18:28the 379 million dollar requirement is a joke

even the biggest banks in vietnam are like 'nah fam we got better things to do'

its not a barrier its a tombstone

and the fact that they banned usdt but allow some gold-backed stablecoin that no one has ever heard of?

that’s not policy thats a fever dream

Vanshika Bahiya

November 16, 2025 AT 15:18actually this is kinda smart if you think about it

they know people are already using crypto so instead of fighting it they’re trying to bring it inside the system

yes the rules are crazy right now but its a pilot

if they start seeing volume they’ll adjust

think of it like vietnam’s version of the internet firewall

they want control but not total ban

and ndachain? that’s the real play

if they can tokenize bonds and insurance on their own chain they win regardless of whether people trade btc or not

Albert Melkonian

November 18, 2025 AT 14:50while the regulatory framework appears stringent on its surface, it is, in fact, a strategically calibrated approach to financial modernization

the state bank is not seeking to stifle innovation but to institutionalize it within a framework that preserves monetary sovereignty

the capital requirements, while substantial, serve to exclude speculative actors and ensure market integrity

the prohibition of foreign stablecoins is not protectionism but a necessary safeguard against currency dilution

in this light, the five-license model represents a controlled incubation environment rather than a barrier to entry

the absence of applications may reflect not resistance but prudence

institutions are likely conducting due diligence before committing capital

this is not a failure of policy but the natural latency of systemic transformation

history shows that financial revolutions are rarely swift

they are deliberate, cautious, and often misunderstood in their early phases

Kelly McSwiggan

November 20, 2025 AT 09:17so the government created a crypto system so rigid it’s practically dead on arrival

congrats you’ve invented the most expensive paperweight in southeast asia

379 million in cash? for what? to run a platform that no one will use because the only people who can afford it are the same banks that already have monopoly power

and ndachain? cool, another state-run ledger that tracks everything you do

you’re not regulating crypto you’re just building a digital panopticon with extra steps

and you wonder why people still use p2p

because freedom beats bureaucracy every time

Byron Kelleher

November 20, 2025 AT 13:39look i get the fear

crypto is wild and people lose money

but vietnam’s solution feels like putting a toddler in a straitjacket and calling it 'safety'

instead of trying to make the system perfect they should’ve started small

maybe 5 licenses is too much

what if they started with 1 and let it grow?

the market will tell you what works

not some spreadsheet in hanoi

and honestly? if people are already trading p2p anyway

why not just tax it and move on?

you can’t stop the tide

but you can build a better beach

Cherbey Gift

November 21, 2025 AT 03:29they think they’re playing chess but they’re just rearranging deck chairs on the titanic

crypto ain’t about licenses and dong

its about trustless systems and digital sovereignty

and now vietnam wants to put the blockchain in a cage with a golden lock and a guard who only speaks fluent bureaucracy

the people? they’re already dancing in the streets with usdt in their pockets

you can’t jail a ghost

ndachain? sounds like a government soap opera

the real story is that the youth of vietnam don’t care about your rules

they just want to build wealth

and if you make it too hard

they’ll just take it elsewhere

and you’ll be left holding a very expensive paperweight

Anthony Forsythe

November 22, 2025 AT 01:06the tragedy here is not the regulation

it’s the profound misunderstanding of what crypto truly is

it’s not a currency

it’s not a commodity

it’s a new form of social contract

the state bank wants to own the future

but they’re building it out of stone while the world is moving to quantum

they think they’re controlling chaos

but they’re just creating the perfect conditions for its most dangerous form: underground, untraceable, and utterly unregulated

ndachain is their attempt to be the god of digital value

but gods are only worshipped when they’re benevolent

and right now

the state bank looks less like a deity

and more like a nervous bureaucrat trying to hold back the ocean with a broom

Gavin Jones

November 22, 2025 AT 14:14imagine if the us tried to do this

imagine if they said you can only trade crypto through 5 banks that need 379 million each

they’d be laughed out of congress

but in vietnam they’re serious

and honestly? its kinda beautiful in a weird way

they’re not trying to be the next switzerland

they’re trying to be the next singapore

but with more paperwork and less crypto bros

the real question is

will the next generation just ignore it all and build their own system anyway?

Mauricio Picirillo

November 24, 2025 AT 03:15bro the fact that no one applied yet is the whole point

they didn’t expect anyone to

they just needed to say 'we did something'

now they can tell the world 'we’re regulating crypto'

and the people? they’ll keep trading on p2p

and the state bank will keep collecting taxes from the few who do use the platforms

its a win-win

they look like they’re in control

and everyone else gets to do what they want

its the most vietnamese thing ever

Liz Watson

November 25, 2025 AT 07:22oh wow

the state bank of vietnam just invented the world’s most expensive hobby

buy bitcoin

but only if you’re a billionaire with a law degree and a spare 379 million

and then pay 20% tax on it

and only trade it on a platform that doesn’t exist yet

congrats

you’ve created the first crypto ecosystem where the only winners are the accountants

and the losers? everyone who thought this was about finance

not feudalism

Rachel Anderson

November 25, 2025 AT 23:03the most ironic part? vietnam is the 4th most crypto-adopted country in the world

and now they’ve built a system so hostile to innovation that they’re basically saying

'we love your money

but we hate your freedom'

ndachain? cute

but no one’s going to trade bitcoin on a government blockchain

they’ll just keep using p2p and laughing at the bureaucracy

you can’t regulate what you can’t see

and the people of vietnam? they’ve already seen it

they just won’t let you control it

Hamish Britton

November 26, 2025 AT 18:51one sentence: this policy is a beautiful mess.

it’s not right, it’s not wrong

it’s just… vietnam.