Nepal Rastra Bank crypto: What you need to know about Nepal's crypto rules and how they affect traders

When it comes to Nepal Rastra Bank crypto, the central bank of Nepal and its official stance on digital assets. Also known as Nepal's financial regulator, it has been one of the most hostile institutions toward cryptocurrency in South Asia. Since 2019, the Nepal Rastra Bank has declared all cryptocurrency transactions illegal, calling them a threat to financial stability and national currency. No bank, payment processor, or exchange operating in Nepal is allowed to touch Bitcoin, Ethereum, or any other crypto asset. But here’s the twist—people are still trading anyway.

How? Through peer-to-peer (P2P) platforms, direct crypto trades between individuals without a central exchange. Also known as local crypto trading, these platforms let Nepalis buy and sell Bitcoin using Nepali rupees via mobile banking or cash deposits. The Nepal Rastra Bank hasn’t shut them down—not because they approve, but because they can’t. Thousands of users are already in the game, and the black market for crypto is thriving. Even if the law says it’s illegal, enforcement is patchy at best. You won’t find a single licensed crypto exchange in Nepal, but you’ll find dozens of Facebook groups, WhatsApp channels, and Telegram bots where trades happen daily. This gap between law and reality mirrors what’s happening in other countries with strict crypto rules, like Vietnam and Turkey, where regulators try to control the flow but end up just pushing activity underground.

What does this mean for you if you’re in Nepal? If you’re trying to trade crypto legally, you’re out of luck. There’s no official path. No KYC-compliant exchange, no regulated wallet, no legal recourse if you get scammed. That’s why so many Nepali traders end up using platforms like LocalTrade or Decoin—exchanges with no oversight, no customer support, and no accountability. The Nepal Rastra Bank doesn’t protect you. It just warns you. Meanwhile, crypto adoption, the growing use of digital assets by individuals and businesses. Also known as crypto usage in emerging markets, continues to rise here, driven by remittances, inflation fears, and young tech-savvy users who see crypto as their only financial escape. You can’t ignore it. You can’t stop it. You can only choose whether to play it safe—or take the risk.

Below, you’ll find real reviews and deep dives into platforms that Nepalis are actually using. Some are scams. Some are risky but functional. None are legal. But they’re all active. We don’t sugarcoat it. We show you what’s real, what’s fake, and what you need to watch out for before you send your money anywhere.

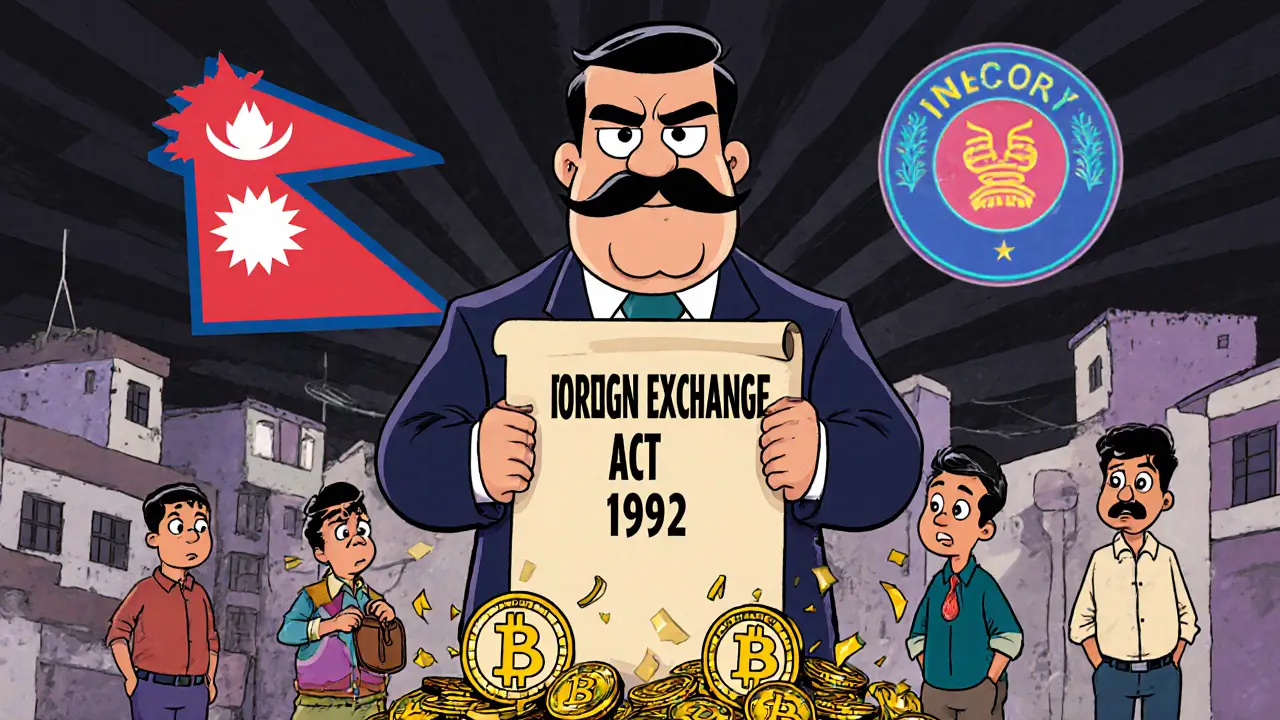

Nepal bans all cryptocurrency under the Foreign Exchange Act of 1962, with penalties including jail time and triple fines. Despite enforcement challenges, crypto trading continues underground. Experts warn the ban is outdated as global trends shift toward regulation.

View More