Nepal Crypto Penalty Calculator

Calculate potential penalties for violating Nepal's crypto ban under Section 12 of the Foreign Exchange (Regulation) Act, 1962.

Penalties include up to 3 years imprisonment and fines equal to 3 times the transaction value.

Potential Consequences

Note: These penalties apply to transactions of any size. Enforcement is inconsistent but carries serious risks.

Comparison with Traditional Remittances

Current remittance costs: 6.5% of transaction value (average)

Potential crypto cost: Under 1% if legal

Nepal's ban makes legal crypto remittances impossible, forcing users into riskier channels.

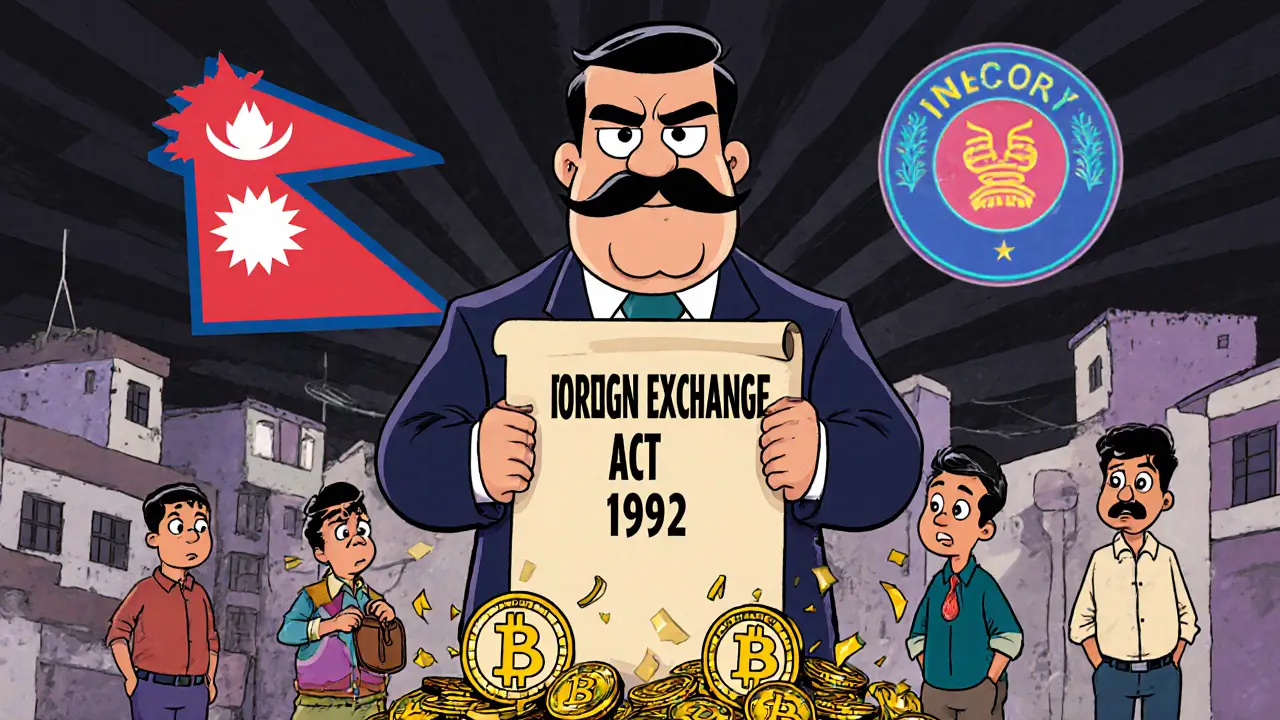

It’s 2025, and if you’re in Nepal and holding Bitcoin, Ethereum, or any other cryptocurrency, you’re technically breaking the law. Not because the government changed its mind recently - but because it never changed its mind at all. The ban isn’t new. It’s been in place since 2017, and it’s still rock solid today. The legal basis? Section 12 of the Foreign Exchange (Regulation) Act, 1962. That’s right - a law written before personal computers were common, now being used to jail people for trading digital coins.

How the Ban Actually Works

The Nepal Rastra Bank (NRB), the country’s central bank, didn’t just say "no" to crypto. They made it a criminal offense. On August 13, 2017, NRB issued a notice that labeled Bitcoin transactions as violations of foreign exchange rules. Why? Because crypto isn’t issued by any government or bank. It moves money across borders without oversight. And in Nepal’s eyes, that’s a threat to national finances.

By 2021, the ban got even tighter. The government expanded it to cover everything: buying, selling, mining, promoting, advertising, or even helping someone else trade crypto. Even using a VPN to access Binance or Coinbase is now considered illegal. The law doesn’t care how you do it - if you’re moving crypto in or out of Nepal, you’re breaking the law.

Penalties are serious. Under Section 61 of the Foreign Exchange Act, violators can face up to three years in prison and a fine equal to three times the value of the transaction. In 2022, four Nepalis were charged in Kathmandu District Court for illegally moving Rs376 million ($2.8 million) through crypto investments. That’s not a warning - it’s a message.

Who’s Enforcing It?

You might think the police are out hunting crypto traders. They’re not. Enforcement falls mostly on banks and financial institutions. NRB requires all banks to report any suspicious transactions over Rs500,000. That includes wire transfers that look like payments to foreign exchanges - even if the recipient name says "John Smith" or "CryptoPay Services."

But here’s the problem: most bank employees don’t know how to spot crypto transactions. Blockchain is invisible on a bank statement. A payment to a crypto exchange might look like a normal remittance to India or Dubai. In 2021-22, NRB flagged 237 cases totaling Rs1.82 billion as possible crypto-related - but only a fraction were confirmed.

To fix this, NRB partnered with Chainalysis in 2022 to train staff. Only 12 officials completed the certification. That’s not enough to monitor a country of 30 million people. So while the law is strict, enforcement is patchy. That’s why underground trading keeps going.

People Are Still Trading - Here’s How

Despite the ban, crypto isn’t dead in Nepal. It’s just hiding. According to a 2023 survey by Young Innovations Nepal, nearly 19% of tech-savvy Nepalis aged 18-35 have traded crypto since the ban. Most use foreign exchanges via VPN. Others use peer-to-peer (P2P) apps like LocalBitcoins or Paxful, paying in cash or bank transfers.

Some are even mining. Nepal has cheap hydropower - as low as Rs5.50 per kWh in districts like Kavrepalanchok and Nuwakot. In 2022, the Himalayan Times reported Nepal had quietly become a Bitcoin mining hub. Experts estimate 15-20% of mining activity continues despite the ban. Miners run rigs in basements, garages, and even small shops, using excess power from rural dams.

But it’s risky. There are no protections. If you send money to a P2P trader and they disappear? You lose everything. One Reddit user in 2022 reported losing $1,200 in a Bitcoin deal. No police report. No recourse. No law to protect you.

Why the Government Keeps the Ban

NRB says the ban protects Nepal’s economy. Between July and December 2021, foreign exchange reserves dropped 14.7% - from $11.75 billion to $10.03 billion. NRB blames crypto-related capital flight. Remittances, which make up 22.6% of Nepal’s GDP, fell 7.3% in early 2021-22. Some officials claim crypto users are sending money abroad instead of using official channels.

Former NRB Governor Dr. Shanker Sharma argues the ban keeps money from leaving the country. But critics say the opposite is true. Dr. Bhola Nath Ghimire, a former NRB deputy governor, points out that crypto could actually reduce remittance costs. Right now, sending $200 home from the Gulf or Malaysia costs Nepali workers an average of 6.5%. With crypto, that could drop to under 1%. But because of the ban, that option is illegal.

And while Nepal bans crypto, neighbors are moving forward. India taxes crypto gains at 30% but allows trading. Bangladesh has a ban too, but is testing a central bank digital currency. Pakistan requires exchanges to register under anti-money laundering rules. Even China - which banned crypto trading in 2017 - is now running its digital yuan with over 260 million users.

Nepal is one of only 11 countries in the world with a total crypto ban. That’s not leadership. It’s isolation.

What’s Changing? The Signs of a Shift

Don’t expect the ban to lift tomorrow. But it’s not frozen in time. In July 2023, NRB Governor Maha Prasad Adhikari said the bank is developing a central bank digital currency (CBDC). That’s a government-controlled digital rupee - not Bitcoin, not Ethereum. Just a digital version of the Nepali rupee.

In September 2022, the Ministry of Finance formed a 12-member committee to study global crypto rules. No recommendations have been made public yet. But the fact they’re looking? That’s a sign.

The International Monetary Fund (IMF) has been clear: Nepal’s ban is driving activity underground and doesn’t stop real risks like money laundering. The IMF says regulation - not prohibition - is the smarter path.

Most experts think Nepal will eventually move toward regulation, not full legalization. First, they’ll allow blockchain technology for things like land records or supply chains. Then, maybe, they’ll let crypto be used for cross-border remittances under strict controls. After all, Nepal gets over $8 billion in remittances every year. If crypto can make that cheaper and faster, the pressure to change will only grow.

What This Means for You

If you’re in Nepal and holding crypto: know the risk. You won’t be arrested overnight. But if you move large sums, get flagged by your bank, or get reported by a trader, you could face serious consequences.

If you’re thinking of starting a crypto business - don’t. Even if you think you’re clever, the law doesn’t care about your setup. NRB doesn’t need to prove you mined Bitcoin. They just need to prove you traded it. And they’ve got the power to shut you down.

If you’re sending money home - use official channels. The cost is high, but at least you’re protected. And if you’re tech-savvy and curious about blockchain? Learn it. Study it. Wait. The future of digital money in Nepal isn’t Bitcoin. It might be a digital rupee - and when it comes, you’ll be ready.

The ban isn’t going away soon. But the world around it is changing. Nepal’s economy is tied to global flows. And eventually, even the strictest bans can’t stop what people want - and need - to do.

Cody Leach

November 15, 2025 AT 05:50The fact that Nepal is still using a 1962 law to criminalize crypto is absurd. This isn't regulation, it's technological ignorance. Blockchain isn't going away just because a central bank says so. The real issue is that they're afraid of losing control over money flows, not that crypto is dangerous. The IMF is right - regulation beats prohibition every time.

sandeep honey

November 15, 2025 AT 22:31India taxes crypto but allows it. Pakistan registers exchanges. Even Bangladesh is building a CBDC. Nepal’s ban is a relic. People are mining with hydropower and trading P2P anyway. Why not tax it, regulate it, and collect revenue instead of chasing shadows? This isn’t protecting the economy - it’s starving it of innovation.

Mandy Hunt

November 16, 2025 AT 03:11They’re lying about the ban being about financial stability. This is a cover for the elite to control everything. The NRB doesn’t want people to have money they can’t track. The IMF? They’re just pushing for global financial control. CBDCs are the real threat - not Bitcoin. They want to know where every rupee goes. Every. Single. One. Watch what happens when the digital rupee rolls out. It’ll be worse than the ban.

anthony silva

November 17, 2025 AT 01:53So Nepal banned crypto because... they didn't get to make it first? Wow. What a brave move. Jailing people for using a technology that exists outside their borders. I'm sure the 1962 law was drafted with Bitcoin in mind. Totally foresaw it. Next they'll ban the internet because it doesn't have a Nepali flag on it.

Andrew Parker

November 18, 2025 AT 10:29There’s a deeper truth here - and I don’t say this lightly. Money is a story we all agree to believe in. Bitcoin is just a newer story. Nepal’s ban isn’t about law. It’s about fear. Fear that the old story is crumbling. That the priests of finance - the NRB, the banks, the politicians - are losing their sacred power. We’re witnessing the death rattle of centralized control. And people? They’re already whispering the new story in basements, behind VPNs, with cheap hydropower humming in the background. The future doesn’t ask permission.

Kevin Hayes

November 20, 2025 AT 00:34Legal frameworks evolve slowly - but not because they’re wise. Because power resists change. Nepal’s ban reflects a fundamental misunderstanding: that money must be tied to a state to be valid. But money has always been a social contract. The state just claimed ownership over it. Crypto doesn’t destroy that contract - it decentralizes it. The real question isn’t whether crypto should be banned - it’s whether the state has the moral authority to monopolize the medium of exchange. And if the answer is yes, then what justifies that monopoly? Tradition? Fear? Or just the inertia of institutions that don’t want to be obsolete?

Katherine Wagner

November 20, 2025 AT 03:20Wait - so they’re banning crypto… but allowing remittances? But remittances are literally money leaving the country? So why is sending $200 to your cousin in Qatar okay but sending it to a Binance wallet not? This makes zero sense. And the penalties? Three times the value? That’s not justice - that’s extortion. And the fact that they partnered with Chainalysis but only trained 12 people? That’s not enforcement. That’s theater. They don’t even care enough to do it right.

ratheesh chandran

November 20, 2025 AT 22:48you know what i think? its not about crypto at all. its about control. people in nepal are smart. they see how the world works. they know remittances are killing them with fees. they know mining is possible with hydropower. but the government? they dont want people to be independent. they want everyone to be dependent on banks and bureaucrats. and thats why they keep the ban. its not about money. its about power. and power doesnt like being questioned. and thats why the law is so old. because they dont want to change. they want to stay in charge. even if it hurts everyone else.

Hannah Kleyn

November 22, 2025 AT 06:17I’ve been following this for a while and honestly the most interesting part isn’t the ban - it’s the quiet resistance. People are mining in garages. Using P2P apps like it’s a secret club. Sending cash to strangers on the other side of the world because they trust the blockchain more than their own bank. And no one’s getting arrested. Not because the law isn’t there - but because enforcement is too lazy, too underfunded, too clueless. The ban is a ghost. It exists on paper but not in practice. And that’s the real story. The government thinks it’s winning. But the people? They’re already living in the future.

gary buena

November 23, 2025 AT 02:5819% of young Nepalis trading crypto? That’s not a niche. That’s a movement. And the fact that they’re using hydropower to mine? That’s genius. Imagine a country with one of the world’s cleanest energy sources quietly becoming a crypto hub because the government is too scared to adapt. This isn’t about law. It’s about innovation outpacing bureaucracy. And honestly? That’s beautiful. The ban is just a speed bump. The real revolution is happening in basements and village shops. And it’s not going to stop.