Foreign Exchange Act 1962: How Old Laws Still Shape Crypto Trading Today

When you trade crypto on a global exchange, you’re not just dealing with blockchain tech—you’re navigating rules written decades ago. The Foreign Exchange Act 1962, a UK law designed to control currency flows and prevent capital flight during economic instability. It’s not about Bitcoin or Ethereum, but it’s the legal skeleton behind why many exchanges refuse certain users, block fiat deposits, or require strict KYC. This law didn’t predict crypto, but it gave governments the power to regulate anything that moves value across borders—and that includes digital assets.

Related entities like financial compliance, the set of rules institutions must follow to avoid money laundering and illegal capital movement and foreign exchange control, government restrictions on buying, selling, or transferring currency are direct descendants of this act. Today, when a crypto exchange in Europe asks for proof of address or blocks a transfer from a high-risk country, it’s often because they’re following legacy frameworks like the Foreign Exchange Act 1962. Even though the law is over 60 years old, regulators still use it to justify cracking down on unlicensed platforms, especially those handling crypto-to-fiat conversions.

It’s why you can’t just send $10,000 in ETH to a Vietnamese exchange and expect it to clear—Vietnam’s 2025 crypto rules, like Directive 05/CT-TTg, mirror the same logic: control capital flow. The same logic applies to Turkey’s capital requirements, Switzerland’s wealth tax declarations, and even the U.S. Investment and Securities Act 2025. These aren’t random policies. They’re modern versions of the same old playbook: governments don’t trust untracked money moving across borders. The Foreign Exchange Act 1962 gave them the legal tools. Crypto gave them the reason to use them.

What you’ll find below isn’t a history lesson. It’s a collection of real cases showing how this outdated law still blocks traders, shuts down platforms, and forces compliance teams to make impossible choices. From unregulated exchanges like LocalTrade getting flagged under AML rules tied to this act, to privacy coins like Monero being delisted because they bypass foreign exchange controls, every post here connects back to one truth: if money crosses borders, someone’s watching—and they’re still using 1962’s rulebook.

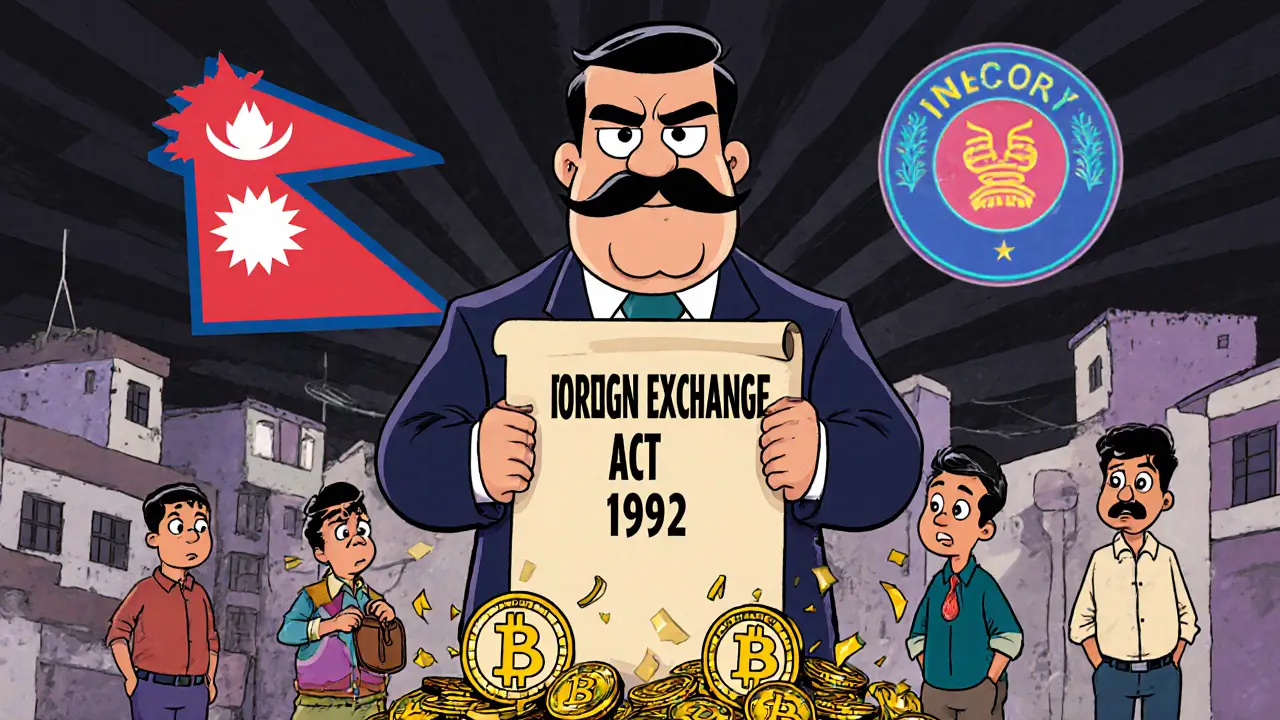

Nepal bans all cryptocurrency under the Foreign Exchange Act of 1962, with penalties including jail time and triple fines. Despite enforcement challenges, crypto trading continues underground. Experts warn the ban is outdated as global trends shift toward regulation.

View More