Cryptocurrency Regulation in Vietnam: What You Need to Know in 2025

When it comes to cryptocurrency regulation Vietnam, the country’s approach is one of the most restrictive in Southeast Asia, banning financial institutions from processing crypto transactions and demanding massive capital reserves from exchanges. Also known as Vietnam crypto law, this framework isn’t about encouraging innovation—it’s about control. Unlike countries that are building crypto-friendly frameworks, Vietnam’s government sees digital assets as a threat to its financial sovereignty, not a tool for economic growth.

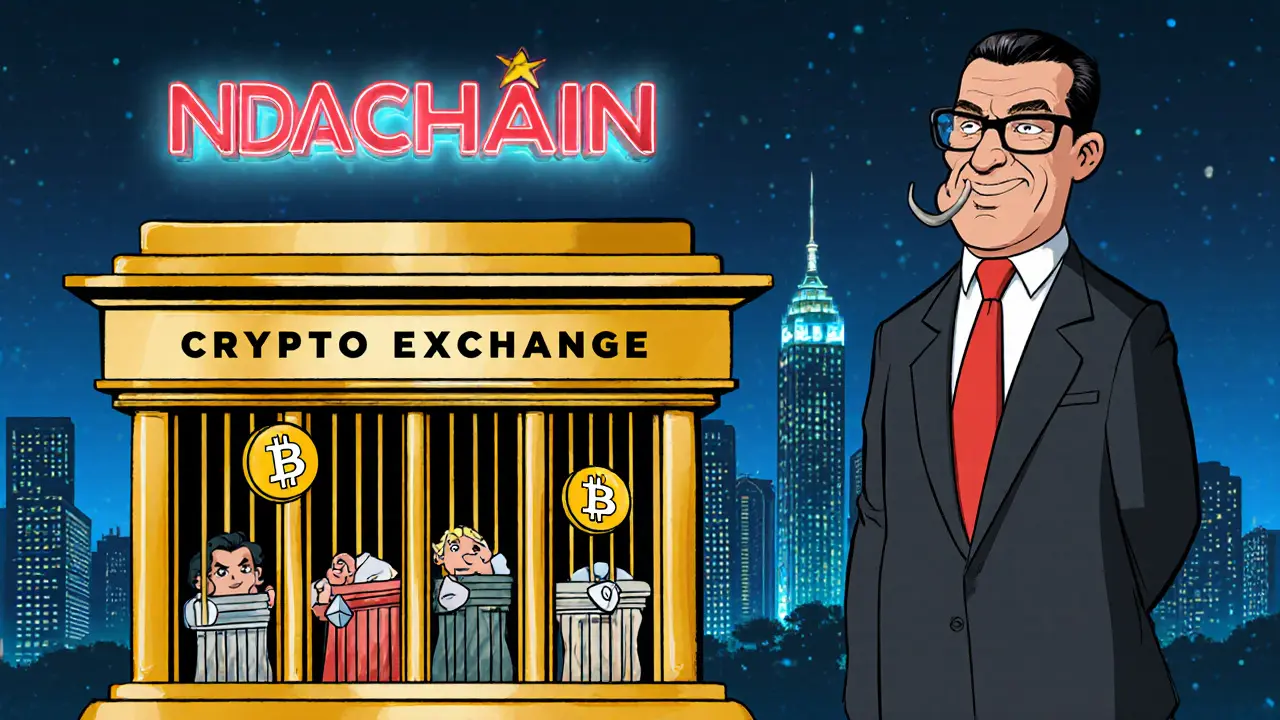

This isn’t just about banning banks from handling Bitcoin or Ethereum. The real turning point came with Directive 05/CT-TTg, a government mandate that requires all crypto exchanges operating in Vietnam to hold at least $379 million in capital and completely bans fiat-backed stablecoins. Also known as Vietnam crypto regulation, this rule forces platforms to either shut down or become financial giants overnight—something few can afford. The goal? To crush unregulated platforms and force users back into state-controlled systems. Meanwhile, crypto exchange license Vietnam is now a near-impossible barrier, with no public roadmap for how businesses can even apply. This isn’t regulation—it’s a wall.

What does this mean for you? If you’re trading crypto in Vietnam, you’re doing it in a legal gray zone. Peer-to-peer trading still happens, but it’s risky. Wallets aren’t monitored, but banks will freeze accounts linked to crypto activity. The government doesn’t want you to use crypto—it wants you to forget it exists. But people still do. That’s why you’ll find posts here about platforms like LocalTrade and Decoin—exchanges that try to operate in this space despite the risks. You’ll also see how scams thrive in this vacuum, preying on users who don’t understand the legal landscape. The truth? If you’re holding crypto in Vietnam, you’re on your own. There’s no consumer protection, no recourse if you get hacked, and no official guidance on taxes or reporting.

And yet, the world is moving forward. The U.S. just passed clear federal rules. Turkey and Switzerland have built structured systems. Even Nepal’s ban is being questioned. Vietnam’s approach feels like a time capsule from 2017. But here’s the thing: rules don’t stop demand. They just push it underground. That’s why you’ll find real stories here about people who traded through P2P platforms, got caught, and lost everything. Or how fake airdrops like LEOS and BABYDB exploded in popularity—not because they were real, but because people were desperate for any legal way to earn crypto.

What follows is a collection of posts that cut through the noise. You’ll find breakdowns of Vietnam’s exact rules, comparisons to other countries, and deep dives into the platforms that still operate here—some legit, most not. You’ll learn what happens when you ignore the law, how to spot a scam in this environment, and why even the most promising projects vanish overnight. This isn’t about hype. It’s about survival in one of the toughest crypto climates on Earth.

Vietnam legalized cryptocurrencies in 2025 but with extreme restrictions: only five licensed exchanges, all trades in Vietnamese dong, no stablecoins, and $379 million capital requirements. Despite high public adoption, no firms have applied for licenses yet.

View More