Crypto Trading in Turkey: Rules, Risks, and Real Platforms

When you hear crypto trading Turkey, the practice of buying, selling, or holding digital assets by residents of Turkey. Also known as Turkish cryptocurrency trading, it’s one of the most active crypto markets in the region—even though the government hasn’t given it a clear green light. Over 40% of Turkish adults have tried crypto, according to local surveys, mostly because of inflation and a weak lira. People aren’t trading because it’s trendy—they’re trading because they have to.

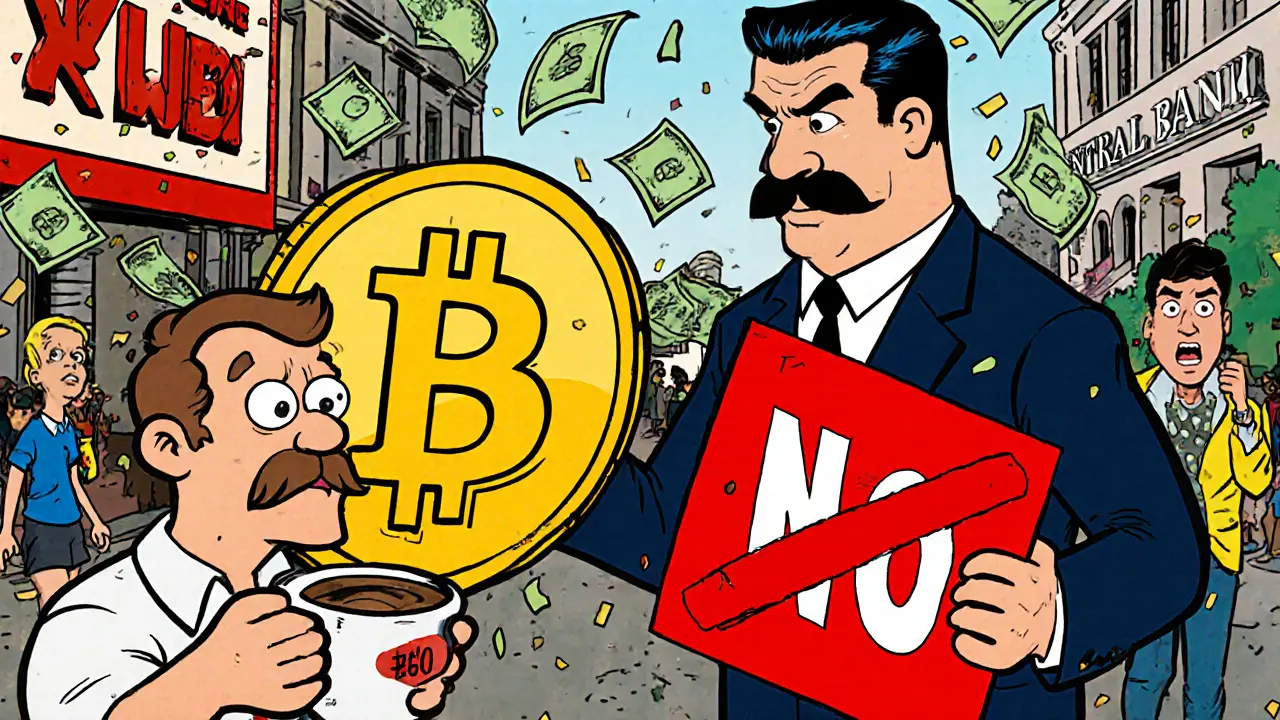

But here’s the catch: Turkey doesn’t ban crypto. It just makes it hard to use. The central bank banned credit and debit card payments for crypto purchases in 2021, and exchanges must now follow strict KYC crypto Turkey, the process of verifying user identity before allowing crypto trades in Turkey. Also known as Turkish crypto identity verification, it’s required by every licensed platform. That means if you’re using a foreign exchange, you’re likely skipping KYC—and that’s where the danger starts. Many platforms targeting Turkish users are unregulated, fake, or outright scams. You’ll see sites like LocalTrade or Decoin popping up with flashy ads, but they have no real team, no audits, and no way to get your money back if things go wrong.

What about taxes? Right now, Turkey doesn’t have a formal crypto tax Turkey, how digital asset gains are reported and taxed by Turkish authorities. Also known as Turkish crypto income rules, it’s a gray area where most traders operate without filing anything. But that could change fast. With new rules coming in from the Financial Crimes Investigation Board and pressure from global regulators, the government is watching. If you’re trading, you’re already in the system—your bank transactions, your exchange logins, your wallet addresses—they’re all traceable.

And then there’s the platforms. You won’t find Binance or Coinbase officially licensed in Turkey. Instead, locals use peer-to-peer markets, decentralized exchanges like VoltSwap, or local platforms that claim to be compliant. But even those come with risks. VoltSwap works on the Meter blockchain and offers low fees, but its volume is tiny. If you’re trading there, you’re trading with maybe a few hundred people. Meanwhile, projects like Metahero or HappyFans promise airdrops and big returns—but they vanished without a trace. No updates. No liquidity. Just silence.

If you’re serious about trading crypto in Turkey, you need to know the difference between what’s legal and what’s just quiet. You need to understand why KYC isn’t just bureaucracy—it’s your only protection. You need to avoid platforms with zero transparency, zero team info, and zero reviews. And you need to remember: if something sounds too easy, it’s probably a trap.

Below, you’ll find real reviews of exchanges, deep dives into scams hiding as opportunities, and clear breakdowns of what’s actually working for traders in Turkey right now—not what’s advertised, but what’s proven.

Turkey has implemented one of the world’s strictest crypto frameworks, banning payments while forcing exchanges to obtain multi-million-dollar licenses. Learn how this affects traders, businesses, and political freedom.

View More