CoinsBank Fees: What You Really Pay on Crypto Exchanges

When you hear CoinsBank fees, the charges applied by a crypto trading platform for buying, selling, or moving digital assets. Also known as trading fees, it’s the hidden cost that can eat into your profits faster than a bad trade. Most people think fees are simple—a flat 0.1% here, a withdrawal charge there. But the truth? Fees are a maze. Some exchanges slap on network fees, others charge for deposits, hidden slippage, or even inactive account fees. And if you’re using a decentralized exchange, you’re not just paying the platform—you’re paying the blockchain itself.

Think of transaction fees, the cost to get your crypto moved on a blockchain network, like Ethereum or Bitcoin as tolls on a highway. The busier the road, the higher the toll. During peak times, you might pay $10 to send $100 worth of ETH. That’s not a fee from CoinsBank—that’s the network charging you. Then there’s decentralized exchange costs, the combined price of platform fees and blockchain gas when trading directly from your wallet. These can add up fast, especially if you’re swapping small amounts often. And don’t forget crypto exchange fees, the charges platforms like CoinsBank apply on trades, withdrawals, or even converting one coin to another. Some hide them in the spread—the difference between buy and sell price—so you never see the number, but you pay it anyway.

Here’s what most users miss: low fees don’t always mean better value. A platform with 0% trading fees might charge $50 to withdraw your crypto. Or worse, it might have zero liquidity, so your trade gets filled at a terrible price. That’s not a discount—that’s a trap. The real goal isn’t to find the cheapest fee. It’s to find the clearest, most predictable costs. Look for platforms that list all fees upfront—deposit, withdrawal, trading, and network. And always check if they use maker-taker pricing. Maker fees (for adding liquidity) are often lower than taker fees (for removing it). That’s how smart traders save money over time.

You’ll find posts here that dig into real exchange fees—from VoltSwap’s tiny but transparent charges to Decoin’s complete lack of transparency. You’ll see how KYC rules force some platforms to raise fees to cover compliance costs. You’ll learn why some coins vanish because their fees made trading impossible. And you’ll see how tools like Ethereum gas calculators help you time your trades to avoid paying $50 to move $20. This isn’t about guessing. It’s about knowing exactly what you’re paying—and why.

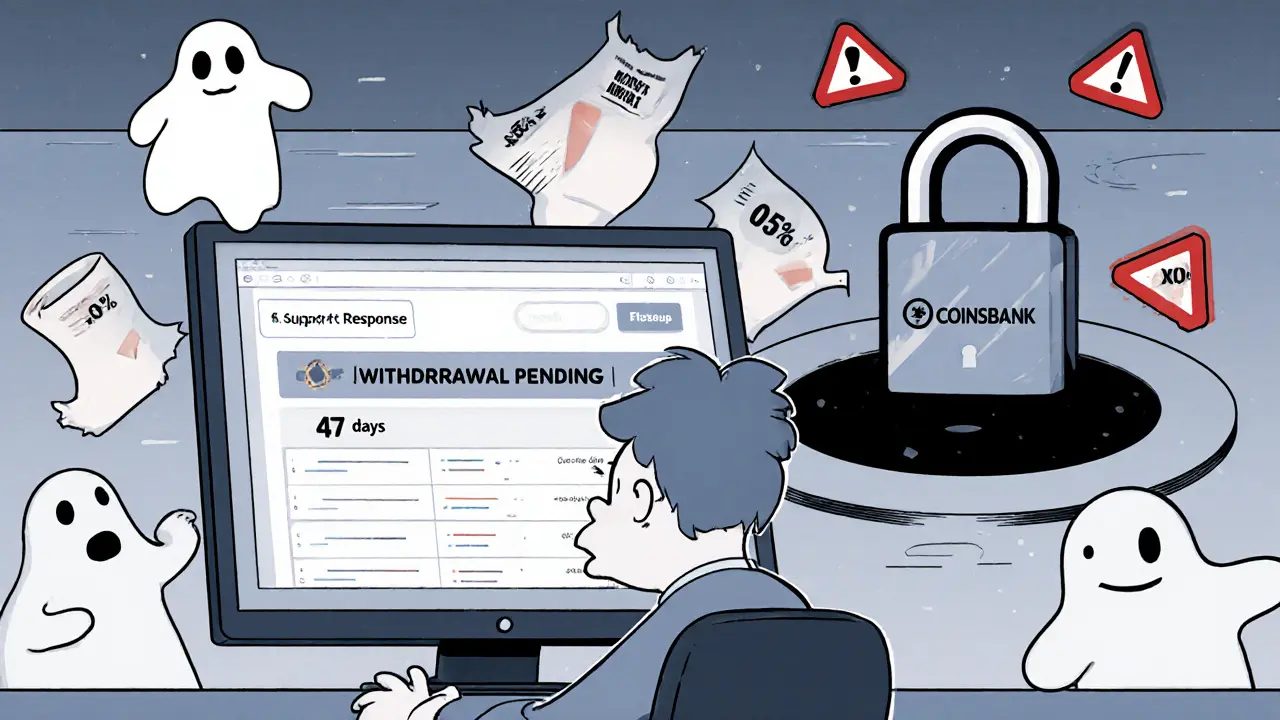

CoinsBank crypto exchange has high fees, poor support, and widespread withdrawal problems. Users report lost funds, deleted accounts, and no response from support. Avoid this platform and choose safer alternatives.

View More