Crypto Fee Calculator

Compare Your Trading Costs

See how much you'd pay in fees on CoinsBank versus industry standard exchanges like Binance and Kraken. With CoinsBank's double the fees, you're losing money with every trade.

If you're thinking about using CoinsBank to trade crypto, stop and read this first. This isn't another generic review that just lists features. This is the real story - what users actually experience, what goes wrong, and why so many people are losing money on this platform.

CoinsBank launched in 2016 as Bit-X, rebranded in 2018, and now markets itself as an "all-in-one" crypto financial platform. It offers trading, wallets, and payment tools for businesses. Sounds good on paper. But behind the clean interface and English-only dashboard, there’s a pattern of broken promises, locked funds, and silent customer support.

How CoinsBank Works - and Why It’s Risky

CoinsBank is a custodial exchange. That means when you deposit Bitcoin or Ethereum, you don’t control the private keys. CoinsBank holds your coins for you. That’s not inherently bad - Coinbase and Kraken do the same. But here’s the problem: when things go wrong, you have zero control. And they go wrong often.

Unlike non-custodial platforms like EMCD, where you keep your own keys, CoinsBank locks you into their system. You can’t move your funds out unless they approve it. And that’s where most users hit a wall.

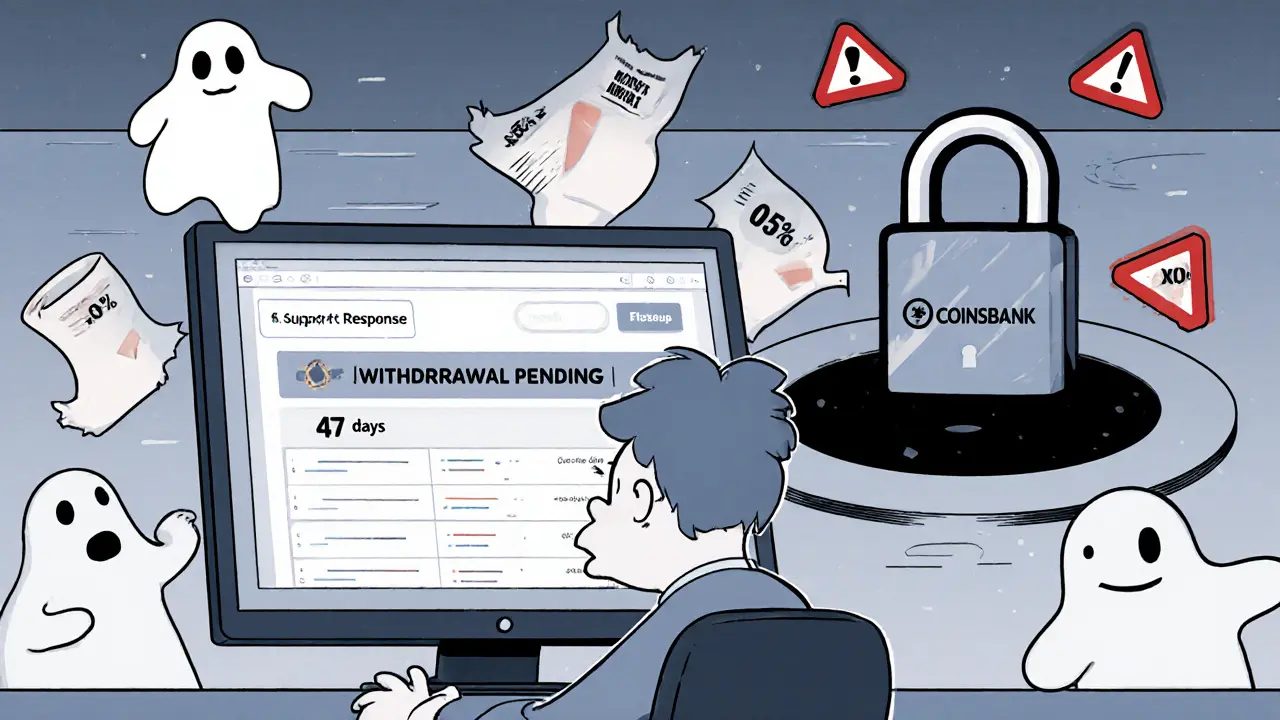

Users report waiting weeks - sometimes months - for withdrawals. One person, verified as Level 4 (the highest tier), said they tried to pull out 2 BTC. After sending multiple support tickets, getting no replies, and waiting over a week, their account was simply deleted. No warning. No refund. Just gone.

The Fees Are Double the Industry Standard

CoinsBank charges 0.5% for every trade - whether you’re buying or selling. That’s not just high. It’s double the industry average of 0.25%.

Let’s say you buy $1,000 worth of Bitcoin. CoinsBank takes $5 right off the top. On Binance or Kraken, you’d pay $2.50. That’s $2.50 you’re losing every time you trade. Over a year, if you trade $10,000, you’re paying $50 in fees instead of $25. That’s $25 you could’ve kept.

Deposits are free for Bitcoin and Litecoin, but withdrawals? Another 0.5% fee. So if you buy Bitcoin and then want to move it to a cold wallet, you pay 0.5% to deposit and another 0.5% to withdraw. That’s 1% just to move your own money. No other major exchange does this.

Customer Support Is Nonexistent

This is the worst part. You won’t find a live chat that works. You won’t get emails answered. You won’t get calls returned.

On Trustpilot, 84 users gave CoinsBank a 1.3 out of 5 rating as of September 2025. The most common complaint? "No response." One user, Rale, opened three support tickets in May 2021. Three months later, still no reply. Another user, Meh, waited 16 days for a withdrawal. No updates. No apology. Just silence.

BitTrust, a review aggregator, shows 37 user reports from 2021 to 2022. Over half mention account freezes, failed verifications, or funds disappearing after withdrawal requests. One user said they uploaded ID documents, passed verification, and then got locked out. Their account vanished. Their coins vanished. They were told it was "a system error."

When you’re dealing with crypto, time is money. Waiting 72 hours just to get a reply is unacceptable. Waiting months for your money? That’s not a delay - it’s theft by neglect.

User Ratings Tell the Real Story

CoinsBank claims to serve individuals and businesses. But the numbers don’t lie.

- Trustpilot: 1.3/5 from 84 reviews (September 2025)

- BitTrust: 1.89/5 from 37 reviews

- Cryptogeek: 1.7/5 from 6 verified reviews

Compare that to AAX Exchange, which has a 4.0/5 rating from just 4 reviews. Or Binance, which has hundreds of thousands of positive reviews. CoinsBank isn’t just behind - it’s in the bottom 1% of crypto exchanges.

And here’s the kicker: the reviews aren’t from a few angry users. They’re from people who’ve been with CoinsBank since 2016 - long-term users who trusted the platform. And they’re the ones losing the most.

Verification Is a Nightmare

CoinsBank requires a multi-step verification process to access full features. Sounds normal, right? Except it doesn’t work.

Users report submitting government ID, proof of address, and even selfies - and still getting rejected. Some get stuck in "pending" for weeks. Others get approved, then suddenly locked out later without explanation.

There’s no clear checklist. No email explaining what’s missing. No phone number to call. Just a dashboard that says "Verification Incomplete" and no way to fix it.

And since the platform only supports English, non-native speakers are at an even bigger disadvantage. No translations. No multilingual support. Just a wall of text you can’t understand if English isn’t your first language.

Why CoinsBank Still Exists (And Why You Should Avoid It)

How is CoinsBank still operating? Simple: people keep depositing money.

It’s a classic scam pattern. New users see a clean interface, low minimum deposits, and think, "This looks legit." They deposit $500, start trading, then try to withdraw. That’s when the silence starts. By then, it’s too late. The money is gone - locked in a system with no accountability.

There’s no evidence CoinsBank has improved since 2021. No updates. No new features. No public roadmap. No response to complaints. Just the same broken system, same high fees, same vanished funds.

The UK’s financial regulators haven’t shut them down - yet. But that doesn’t mean they’re safe. It just means they’re still collecting deposits while ignoring withdrawals.

What to Do Instead

If you want to trade crypto safely, use platforms with proven track records:

- Binance: Lowest fees, 200+ coins, 24/7 support

- Kraken: Strong security, good customer service, regulated in the US and EU

- Bitstamp: One of the oldest exchanges, transparent fees, reliable withdrawals

- EMCD: Non-custodial - you control your keys, no middleman

These platforms don’t delete your account. They don’t hide your money. They don’t charge you double to trade.

CoinsBank isn’t a bad exchange. It’s a dangerous one. And the data doesn’t lie: people are losing money here - not because the market crashed, but because the platform failed them.

If you’re already on CoinsBank, get your money out now. Don’t wait. Don’t trust promises. Don’t believe the "we’re working on it" replies. Your funds aren’t safe here.

And if you’re thinking of joining? Save yourself the stress, the sleepless nights, and the lost crypto. Walk away.

Is CoinsBank safe to use?

No. CoinsBank is a custodial exchange with a history of frozen accounts, unprocessed withdrawals, and deleted user profiles. Multiple users report losing funds with no recourse. With a 1.3/5 rating on Trustpilot and dozens of verified complaints about stolen crypto, it’s not safe for storing or trading funds.

Why are CoinsBank’s fees so high?

CoinsBank charges 0.5% per trade - double the industry average of 0.25%. They also charge 0.5% on withdrawals. This makes trading expensive and moving funds out costly. There’s no justification for these rates, especially when competitors like Binance and Kraken offer lower fees and better service.

Can I withdraw my crypto from CoinsBank?

Many users report being unable to withdraw. Some wait over 30 days. Others get locked out entirely, with accounts deleted after withdrawal requests. There’s no reliable timeline, and support rarely responds. If you need access to your crypto, avoid CoinsBank.

Does CoinsBank have a mobile app?

Yes, CoinsBank has apps for iOS and Android. But the app doesn’t fix the core problems. Withdrawals still fail, support still ignores messages, and fees remain the same. The app makes it easier to deposit - and harder to notice you’re trapped.

Is CoinsBank regulated?

CoinsBank is headquartered in Edinburgh, Scotland, so it falls under UK financial regulations. But there’s no public record of it holding a license from the FCA (Financial Conduct Authority) or any other regulatory body. Without clear compliance, users have no legal protection if funds are lost.

What should I do if I’m already on CoinsBank?

Withdraw your funds immediately. Don’t wait for a response. Don’t trust promises. Submit withdrawal requests, then move your crypto to a non-custodial wallet like Exodus or Ledger. If you’re blocked, stop depositing more money. Document everything - screenshots, ticket numbers, emails - in case you need to pursue legal action later.

Are there any positive reviews for CoinsBank?

A handful of reviews mention the interface is clean or the app is easy to use. But none of them address the core issues: withdrawal failures, frozen accounts, or lack of support. Positive comments are about appearance, not reliability. When your money is at stake, looks don’t matter.

Arthur Crone

November 12, 2025 AT 14:03Michael Heitzer

November 13, 2025 AT 18:27dhirendra pratap singh

November 15, 2025 AT 12:57Ashley Mona

November 17, 2025 AT 12:33Edward Phuakwatana

November 18, 2025 AT 07:07Suhail Kashmiri

November 19, 2025 AT 04:15Kristin LeGard

November 20, 2025 AT 16:21Arthur Coddington

November 22, 2025 AT 10:57Stephanie Platis

November 23, 2025 AT 10:01Michelle Elizabeth

November 24, 2025 AT 19:53Kylie Stavinoha

November 25, 2025 AT 16:02Diana Dodu

November 25, 2025 AT 23:39Raymond Day

November 26, 2025 AT 14:00Noriko Yashiro

November 28, 2025 AT 07:18Michael Faggard

November 29, 2025 AT 16:56Elizabeth Stavitzke

November 30, 2025 AT 12:48