When you send Bitcoin from one wallet to another, it looks private. But behind the scenes, a quiet system is watching. Every time a crypto exchange sees something odd - a sudden flood of cash, money vanishing into unknown wallets, or a user suddenly trading thousands in minutes - they’re legally required to file a report. This isn’t science fiction. It’s suspicious activity reporting in crypto, and it’s the backbone of how governments try to stop money laundering, scams, and terrorist funding in digital assets.

Why SARs Exist in Crypto

Cryptocurrency was built on the idea of anonymity. But that same feature made it a magnet for criminals. Hackers stole millions from exchanges. Scammers ran pump-and-dump schemes. Ransomware gangs demanded payments in Bitcoin. Law enforcement had no way to track it - until SARs came into play. The global standard comes from the Financial Action Task Force (FATF), a group of 180 countries that sets rules to fight financial crime. In 2019, FATF said crypto exchanges, wallet providers, and other virtual asset service providers (VASPs) must act like banks. That meant they had to monitor transactions and report anything suspicious. No more hiding behind blockchain’s pseudonymity. In the U.S., the Financial Crimes Enforcement Network (FinCEN) enforces this under the Bank Secrecy Act. If a crypto platform spots something fishy, they have 30 days to file a Suspicious Activity Report. And they can’t tell the customer they did it. That’s called "tipping off," and it’s a federal crime with fines up to $500,000.What Triggers a Suspicious Activity Report?

Not every weird transaction gets reported. But certain patterns raise red flags. Here’s what compliance teams watch for:- A user with a history of small trades suddenly sends $50,000 to a new wallet, then sends half of it to 15 different addresses within an hour.

- Multiple small deposits from different sources all go into one wallet, then get withdrawn in one large sum - classic layering for money laundering.

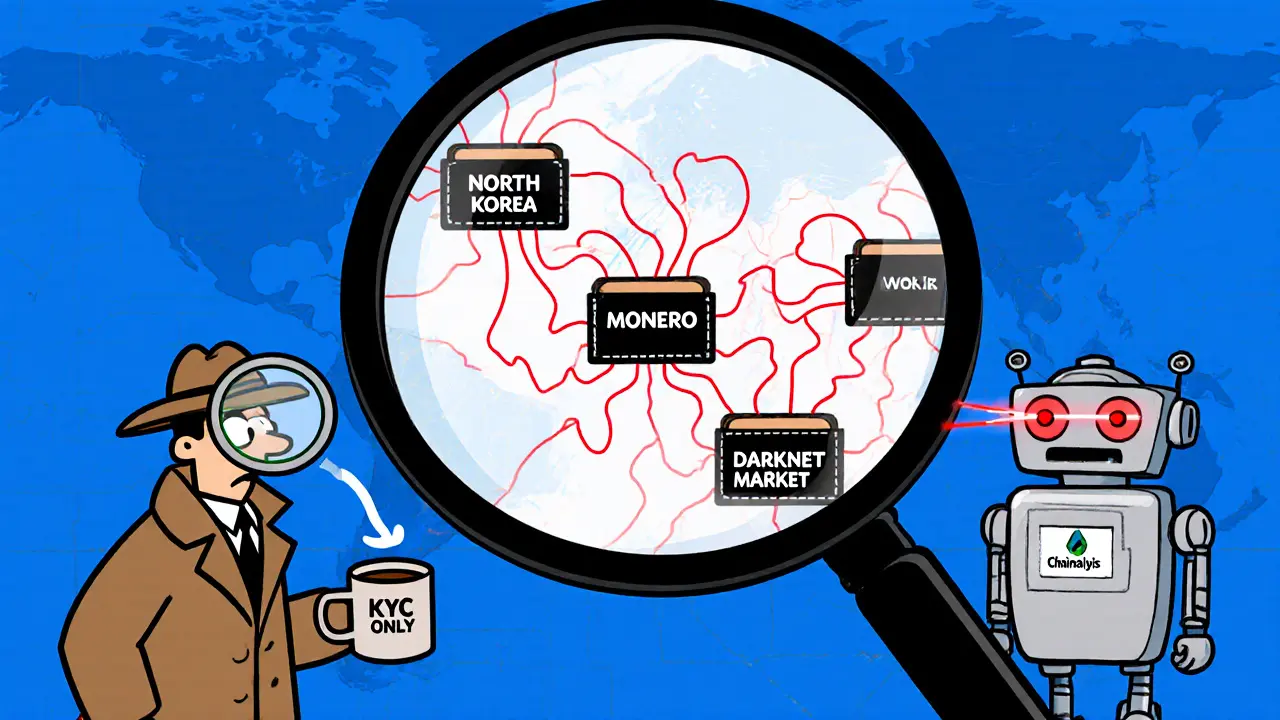

- Transactions involving wallets linked to darknet markets, ransomware groups, or sanctioned entities like those in North Korea or Iran.

- Large transfers to or from privacy coins like Monero or Zcash, which are designed to hide transaction details.

- A customer claims to be a professional trader but has no verifiable income, no history of trading, and no ID documentation.

How SARs Are Filed - The 5-Step Process

Filing a SAR isn’t just clicking a button. It’s a process that takes time, tools, and trained people.- Detection: AI-powered monitoring tools scan every transaction. Top exchanges flag about 0.8% of all transactions as suspicious. That’s still thousands of alerts per day on large platforms.

- Investigation: Compliance analysts dig deeper. They check wallet histories, link addresses to known criminal entities, and review user KYC data. This usually takes 3 to 5 business days.

- Documentation: The narrative section of the SAR is the most important part. It must clearly explain what happened, when, where, and why it’s suspicious. Just saying "unusual activity" isn’t enough. You need blockchain addresses, timestamps, transaction hashes, and risk reasoning.

- Submission: In the U.S., reports go through FinCEN’s BSA E-Filing System. In Europe, it’s through national FIUs under MiCA rules. The deadline is always 30 calendar days from detection.

- Recordkeeping: Platforms must keep records for at least five years. They also use automated tools to prevent accidental "tipping off" - like blocking internal emails or chat logs that mention the report.

Where the System Breaks Down

For all its power, SAR reporting in crypto is still messy. One big problem? Blockchain analytics. Not all platforms can trace funds across complex mixing services or privacy protocols. According to Elliptic’s 2023 survey, 78% of compliance teams struggle to track Monero transactions. Another issue? Cross-border confusion. A transaction might look legal in one country but illegal in another. A crypto exchange in Singapore might receive funds from a user in Russia - but which jurisdiction’s rules apply? Smaller exchanges are falling behind. While 98% of the top 50 exchanges have full SAR workflows, only 42% of smaller ones with under $10 million in daily volume do. Many don’t have the budget for blockchain forensics tools like Chainalysis or Scorechain. Some still rely on manual checks - which means bad actors slip through. And then there’s DeFi. Decentralized finance platforms don’t have a central company to file SARs. If someone uses a smart contract to launder crypto through a DEX, there’s no entity to report it. Regulators are scrambling to fix this - but right now, it’s a blind spot.What’s Changing in 2025 and Beyond

The rules are tightening fast. By January 2025, all MiCA-regulated platforms in Europe must monitor transactions in real time. By June 2024, every FATF member country must enforce the "Travel Rule" - meaning exchanges must share sender and receiver info for transactions over $3,000. That’s a game-changer. It means wallets can’t stay anonymous anymore when moving money between platforms. The tech is catching up too. Juniper Research predicts global crypto SAR filings will jump from 127,000 in 2022 to over 400,000 by 2027. That’s because more platforms are using AI to auto-generate SAR narratives, link addresses across blockchains, and flag anomalies before they happen. The market for compliance tools is booming. The global RegTech AML market hit $18.7 billion in 2022 and is growing over 20% a year. Companies like Chainalysis and Scorechain now serve 60 of the top 100 crypto exchanges. Their tools don’t just detect fraud - they help build cases for law enforcement.What This Means for You

If you’re a regular crypto user, SARs probably won’t affect you - unless you’re doing something shady. Legitimate traders, investors, and long-term holders rarely trigger alerts. But if you’re moving large amounts, using privacy coins, or frequently sending funds to unknown wallets, you might get flagged. Don’t panic. That doesn’t mean you’re under suspicion. It just means the system is doing its job. The goal isn’t to spy on users - it’s to stop criminals from turning crypto into a laundering machine. If you run a crypto business, you have no choice. You need a compliance team, monitoring software, and a clear SAR process. Ignoring it isn’t an option. Fines are steep. Reputations are destroyed. And regulators aren’t waiting.

What Happens After a SAR Is Filed?

Once a SAR lands in FinCEN’s system, it doesn’t vanish. It gets added to a database used by federal agents, the FBI, IRS, and international partners. Law enforcement uses it to connect dots across cases. One SAR might be part of a larger network - a ransomware gang using multiple exchanges, or a scam operation hiding behind fake identities. The best SARs don’t just say "suspicious." They tell a story. "On March 14, wallet 0xAbc... received 12.5 BTC from wallet 0xDef..., which is linked to the LockBit ransomware group. Within 12 minutes, the funds were split into 8 smaller transfers to 5 different wallets, including 0xGhi... which has been flagged by Chainalysis as a mixer used by North Korean hackers. User KYC shows no verifiable source of funds. No prior activity on this account." That’s the kind of detail that leads to arrests.How to Stay Compliant (If You’re a Business)

If you’re running a crypto exchange, wallet service, or even a crypto-focused startup, here’s what you need:- Install blockchain analytics software - even basic tools like TRM Labs or CipherTrace can help.

- Train your team on SAR triggers. Don’t rely on guesswork.

- Set up automated alerts for high-risk behaviors: rapid transfers, privacy coin usage, known blacklisted addresses.

- Keep clean, detailed records. If you’re audited, you need to prove you followed the rules.

- Never tell a customer you filed a SAR. Ever. Even as a joke.

Do I need to file a SAR if I’m just a crypto investor?

No. Only Virtual Asset Service Providers (VASPs) like exchanges, wallet providers, and crypto ATMs are legally required to file Suspicious Activity Reports. Individual users don’t have to report anything - even if they notice suspicious behavior. But if you’re using a regulated platform, they’re already monitoring your activity on your behalf.

Can I be tracked even if I use a non-custodial wallet?

Yes. If you send crypto to or from a regulated exchange, that exchange will see your wallet address and may flag unusual patterns. Blockchain analytics firms can trace transactions across wallets, even if they’re not hosted by a company. Your wallet isn’t invisible - it’s just not tied to your name unless you use a KYC platform.

What happens if I accidentally send money to a scammer?

If you use a regulated exchange, they may file a SAR if the destination wallet is linked to known fraud or ransomware. But you won’t get in trouble just for being scammed. Law enforcement uses SARs to track criminals, not punish victims. Still, always verify addresses before sending - once crypto is gone, it’s nearly impossible to recover.

Are privacy coins like Monero banned because of SARs?

No, privacy coins aren’t banned - but they’re heavily restricted. Many exchanges block Monero deposits entirely because they can’t trace them. FATF and FinCEN consider them high-risk. Some platforms allow them but require extra KYC checks. If you use privacy coins, expect more scrutiny, longer delays, and possibly being blocked from regulated services.

How long do SARs stay in the system?

SARs are kept by FinCEN and other FIUs for at least five years, and often longer if tied to an ongoing investigation. They’re shared internationally through networks like the Egmont Group. Even if a case is closed, the report stays in the database and can be referenced years later if new evidence emerges.

Arthur Crone

November 13, 2025 AT 11:33So let me get this straight - we’re spending billions on AI to track people who send crypto to mixers while billionaires dodge taxes through offshore trusts and no one bats an eye? This isn’t compliance - it’s performative policing. The system’s rigged and you know it.

Ainsley Ross

November 13, 2025 AT 22:32Thank you for this incredibly thorough breakdown. 🙏 As someone who works in international finance, I appreciate how clearly you’ve outlined the global regulatory landscape. The FATF guidelines are indeed the backbone - and the Travel Rule implementation in 2024 will be a watershed moment. Kudos to the compliance teams doing the hard work behind the scenes.

Brian Gillespie

November 14, 2025 AT 21:58They’re not watching you. They’re watching the money.

Wayne Dave Arceo

November 16, 2025 AT 19:26Correction: The Bank Secrecy Act doesn’t just apply to crypto - it applies to ALL financial institutions under Title 31 U.S.C. § 5311 et seq. And no, you don’t file a SAR because something ‘feels’ fishy - you file when there’s a reasonable basis to suspect illicit activity. The article got the legal standard right, but many commenters don’t. Also, ‘tipping off’ is a felony under 18 U.S.C. § 1905, not just a fine. Don’t misstate federal law.

Laura Hall

November 18, 2025 AT 12:59okay so i just sent 5k to my buddy’s wallet for a concert ticket and now i’m scared im gonna get flagged?? 😅 like… i know it’s not a crime but the way this reads makes it sound like i’m a money launderer just for using crypto. can we please not scare normal people? i just wanna buy my NFTs and chill.

Rebecca Saffle

November 20, 2025 AT 01:49Of course they’re watching. The government doesn’t care about your privacy - they care about control. You think your ‘anonymous’ wallet is safe? Think again. Every transaction is a fingerprint. And now they’re forcing exchanges to hand over your data. This isn’t about crime - it’s about power. And we’re letting them take it.

Michael Heitzer

November 22, 2025 AT 00:57There’s something deeply human here - we built crypto to be free, unchained, and sovereign. But freedom without responsibility becomes chaos. SARs aren’t the enemy. The enemy is the silence of good people who think ‘it won’t happen to me.’ The truth? It already did. And every SAR that gets filed is a brick in the wall keeping the next Silk Road from rising. We don’t need to fear the system - we need to help make it smarter. Let’s build better tools, not better excuses.

Elizabeth Stavitzke

November 23, 2025 AT 11:07Oh wow, look who’s suddenly concerned about ‘money laundering’ - the same people who cheered when crypto was the wild west. Now that it’s getting real, you want regulation? Funny how that works. The truth? This isn’t about stopping criminals - it’s about making sure the big banks get their cut. You think Chainalysis isn’t making bank off this? They’re the new Wall Street. Welcome to the new feudalism - with blockchain as the serfdom ledger.

Adrian Bailey

November 24, 2025 AT 17:10man i just read this whole thing and honestly i’m kinda impressed? like i thought crypto was just ‘send money to a wallet and boom’ but turns out there’s this whole behind-the-scenes detective work going on? i had no idea they use AI to flag stuff like splitting 50k into 15 wallets in an hour 😳 and the part about not being able to tell the user? that’s wild. also i just typo’d ‘monero’ as ‘moner0’ like 3 times but i’m still learning. anyway, props to the compliance nerds - you’re the unsung heroes keeping the internet from becoming a crime forum. also can someone explain why DeFi is still a loophole? 🤔

Rachel Everson

November 25, 2025 AT 11:20Hey if you’re just holding or trading normally - you’re fine. Seriously. I’ve been in crypto since 2017 and I’ve never been flagged. The system isn’t out to get you - it’s out to catch the bad actors. If you’re worried, keep your transactions clean, avoid mixing services, and don’t send to sketchy addresses. You got this. And if you ever get flagged? It’s not the end of the world - it just means the system worked. Breathe. You’re not a criminal. You’re just a regular person using tech. 🌱

Joanne Lee

November 27, 2025 AT 02:38Given the jurisdictional fragmentation in global crypto regulation - particularly between FATF-aligned nations and those with non-binding guidance - how do compliance teams reconcile conflicting legal obligations when a transaction originates in a non-FATF jurisdiction but passes through a regulated VASP? Is there a standardized framework for cross-border SAR escalation, or is this still largely ad hoc? I ask because the article mentions Singapore-Russia transactions as an example, yet no resolution path is provided. This gap appears to be the most significant operational vulnerability in the current system.