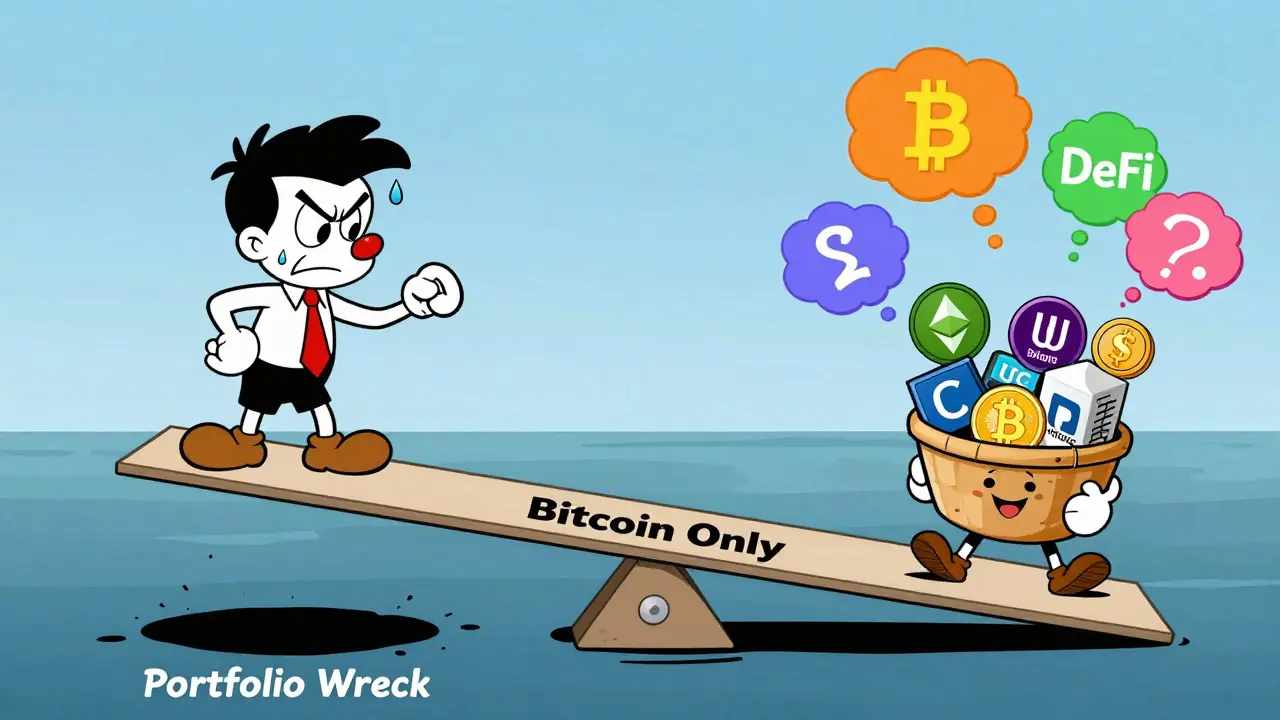

When you put all your money into one cryptocurrency, you’re not investing-you’re gambling. Bitcoin might go up 50% in a month, but what happens when it drops 30% the next? That’s not a market correction-it’s a portfolio wreck. The truth is, blockchain diversification isn’t optional anymore. It’s the only way to survive the wild swings of digital assets without losing everything.

Most people think diversifying means buying Bitcoin, Ethereum, and Solana. That’s not diversification. That’s just buying three coins that all move together. When the whole crypto market crashes-which it does, regularly-all three drop at the same time. You didn’t spread risk. You just multiplied your losses.

What Real Diversification Looks Like in Blockchain

True diversification means spreading your exposure across assets that don’t move in sync. In traditional investing, that means stocks, bonds, and real estate. In blockchain, it’s more complex-but just as possible.

Start with asset classes, not just coins. You’ve got:

- Layer 1 blockchains (Bitcoin, Ethereum, Solana, Avalanche)

- Layer 2 solutions (Polygon, Arbitrum, Optimism)

- DeFi protocols (Uniswap, Aave, Compound)

- Web3 infrastructure (Chainlink, The Graph, Filecoin)

- Tokenized real-world assets (real estate, gold, bonds on-chain)

- Stablecoins (USDC, DAI) for cash equivalents

Each of these behaves differently. When DeFi lending rates spike, Aave might surge while Bitcoin sits still. When regulatory pressure hits exchanges, stablecoins often rise as people flee risk. Layer 2 tokens like Polygon can climb during Ethereum congestion, even if ETH is flat.

Here’s the key: correlation. If two assets move up and down together 80% of the time, they’re not diversified. You need assets with low or negative correlation. Historical data shows Bitcoin and Ethereum have a correlation of 0.85 over the last five years. That’s high. But Bitcoin and Chainlink? 0.45. Bitcoin and USDC? -0.1. That’s real diversification.

Geographic and Regulatory Diversification Matters Too

Most crypto investors forget that risk isn’t just price volatility. It’s also jurisdictional. If you hold all your assets on a U.S.-based exchange and the SEC cracks down, you’re stuck. If you’re using a non-KYC wallet in Singapore, you’re not.

Real diversification means:

- Using wallets hosted in different legal jurisdictions

- Storing assets across multiple chains (Ethereum, Cosmos, Polkadot)

- Investing in projects regulated in the EU, Asia, or the Middle East-not just the U.S.

Projects like Cardano and Solana have strong regulatory presence in Switzerland and Japan. Polygon has partnerships with the Indian government. Holding tokens tied to these ecosystems reduces your exposure to any single country’s policy shift.

Don’t Ignore Non-Crypto Blockchain Exposure

Blockchain isn’t just crypto. It’s supply chains, identity systems, and digital ownership tools. If you’re only investing in tokens, you’re missing half the picture.

Consider companies building blockchain infrastructure:

- IBM (supply chain blockchain for food and pharma)

- Mastercard (blockchain-based cross-border payments)

- Visa (stablecoin settlement networks)

- Siemens (industrial IoT on blockchain)

These aren’t crypto coins. They’re public companies using blockchain as a tool. Their stock prices don’t move with Bitcoin. When crypto crashes, these can hold steady-or even rise. That’s the power of between-risk diversification: mixing crypto risk with traditional business risk.

Stablecoins Are Your Shock Absorber

Most investors treat stablecoins like cash. That’s wrong. They’re your risk buffer.

When the market turns sour-like in 2022 when Terra collapsed and Bitcoin fell 70%-the smart money moved into USDC and DAI. Those assets didn’t go up. They didn’t need to. They held value. That’s what you want: stability when everything else is falling.

Keep 15-25% of your portfolio in stablecoins. Not because you’re scared. Because you’re prepared. When others panic-sell, you have dry powder to buy the dip.

What Diversification Doesn’t Do

Diversification isn’t magic. It won’t stop losses. It won’t guarantee profits. It won’t protect you from a total market collapse.

But it will stop you from losing everything on one bad bet. In 2021, people put 90% of their portfolio into NFTs. When the floor dropped in 2022, they lost 90% of their net worth. Diversified investors? They lost maybe 30-40%. Still painful-but survivable.

Studies from the Canadian Institute of Actuaries show that portfolios with low-correlation assets reduce volatility by up to 40% without sacrificing long-term returns. That’s not a small win. That’s the difference between quitting crypto and sticking with it for the long haul.

How to Build Your Diversified Blockchain Portfolio

Here’s a simple, actionable plan:

- Start with 50% in major Layer 1s (Bitcoin, Ethereum, Solana)

- Allocate 20% to DeFi and infrastructure tokens (Chainlink, Uniswap, The Graph)

- Put 15% in stablecoins (USDC, DAI)

- Use 10% for emerging chains (Cosmos, Polygon, Aptos)

- Reserve 5% for tokenized real-world assets (like real estate tokens on Securitize)

Rebalance every 6 months. Sell what’s up too much. Buy what’s down. Don’t chase hype. Stick to the plan.

Use tools like Nansen or CoinGecko’s correlation dashboard to see how your assets move together. If two coins are moving in lockstep, you’re not diversified.

Why This Works Better Than Just Holding Bitcoin

Bitcoin is digital gold. But gold doesn’t pay interest. It doesn’t run smart contracts. It doesn’t power decentralized apps.

By holding only Bitcoin, you’re betting on one use case: store of value. But blockchain has dozens. DeFi yields 3-8% annually. Web3 infrastructure earns fees. Tokenized assets offer liquidity you can’t get with gold.

Diversification lets you capture all of it. You’re not just riding Bitcoin’s wave-you’re building a whole ecosystem of income streams.

One investor held only Bitcoin from 2020 to 2025. He made 1,200%. Another held a diversified portfolio. He made 1,800%-with 60% less volatility. That’s the edge.

Final Thought: It’s Not About Timing the Market

Most people think they need to time crypto. Buy low. Sell high. But no one consistently times the market-not even the pros.

What you can control? Your exposure. Your balance. Your risk.

Diversification doesn’t make you rich overnight. But it keeps you in the game long enough to get rich slowly. And in blockchain, where the rules change every year, staying in the game is the only way to win.

Is diversification still useful when all cryptocurrencies crash together?

Yes, but only if you’ve diversified beyond crypto. When Bitcoin, Ethereum, and Solana all drop, it’s usually because of macro events-like interest rate hikes or global recessions. In those moments, your stablecoins and tokenized real-world assets act as anchors. Even if crypto falls 50%, your portfolio might only drop 20% because your non-crypto holdings held steady. That’s the power of crossing asset classes.

How many different blockchain assets should I own?

You don’t need 50 coins. Aim for 8-12 well-chosen assets across 4-5 categories: Layer 1s, DeFi, infrastructure, stablecoins, and real-world tokenization. More than that becomes hard to track. Less than five means you’re still too concentrated. The goal isn’t quantity-it’s low correlation.

Can I diversify with just ETFs or crypto funds?

You can, but be careful. Many crypto ETFs only hold Bitcoin and Ethereum. That’s not diversification-it’s a single-asset bet with extra fees. Look for funds that include DeFi tokens, infrastructure, and stablecoins. Or better yet, build your own portfolio. You’ll save fees and have more control.

What’s the biggest mistake people make with diversification?

Thinking that owning 10 altcoins is diversification. If they’re all on Ethereum, tied to DeFi, and react the same way to market news, you’re not diversified-you’re just spread thin. True diversification means crossing categories, chains, and risk types. Don’t confuse quantity with strategy.

Should I include traditional stocks in my blockchain portfolio?

Absolutely. Companies like NVIDIA, Mastercard, and IBM are using blockchain behind the scenes. Their stock prices don’t move with crypto. Adding them reduces your overall portfolio risk. You’re not just betting on crypto’s future-you’re betting on the broader adoption of blockchain tech. That’s smarter.

Dustin Bright

December 23, 2025 AT 17:08chris yusunas

December 25, 2025 AT 13:19Rishav Ranjan

December 26, 2025 AT 12:25Sophia Wade

December 27, 2025 AT 23:32Ellen Sales

December 28, 2025 AT 08:08Alison Fenske

December 30, 2025 AT 05:07Aaron Heaps

December 30, 2025 AT 10:07Tristan Bertles

January 1, 2026 AT 04:51Earlene Dollie

January 2, 2026 AT 10:20Steve B

January 3, 2026 AT 23:44SHEFFIN ANTONY

January 5, 2026 AT 01:39Vyas Koduvayur

January 5, 2026 AT 08:41Jake Mepham

January 6, 2026 AT 19:28Craig Fraser

January 8, 2026 AT 07:27Grace Simmons

January 9, 2026 AT 10:53Jacob Lawrenson

January 9, 2026 AT 12:52