On June 30, 2025, Singapore’s crypto industry changed forever. The Monetary Authority of Singapore (MAS) stopped issuing new licenses to digital token service providers - and made it clear they won’t be reopening the door anytime soon. This wasn’t a gradual shift. It was a hard stop. If your crypto business was relying on Singapore as a friendly hub to operate globally, you had to either meet impossible standards or leave. And most didn’t make it.

Why Singapore Changed Its Mind

For years, Singapore was seen as one of the most open places in the world for crypto companies. Firms from Europe, the U.S., and Southeast Asia set up offices there to get the stamp of approval that came with being regulated by MAS. But behind the scenes, MAS was watching. And what they saw troubled them. Many of these companies weren’t serving Singaporean customers. They were using Singapore’s reputation as a cover to operate in places with no rules at all. Think of it like a company registering a luxury car in Switzerland just to drive it through countries with no speed limits. MAS didn’t want their name tied to that kind of behavior. So they pulled the plug. The Financial Services and Markets Act 2022 gave MAS the power to go after any company operating from Singapore - no matter where their users were. That’s called extraterritorial reach. It means if you’re based in Singapore, even if your servers are in Estonia and your customers are in Nigeria, MAS still controls you. And they’re not bluffing.The License That Almost Doesn’t Exist

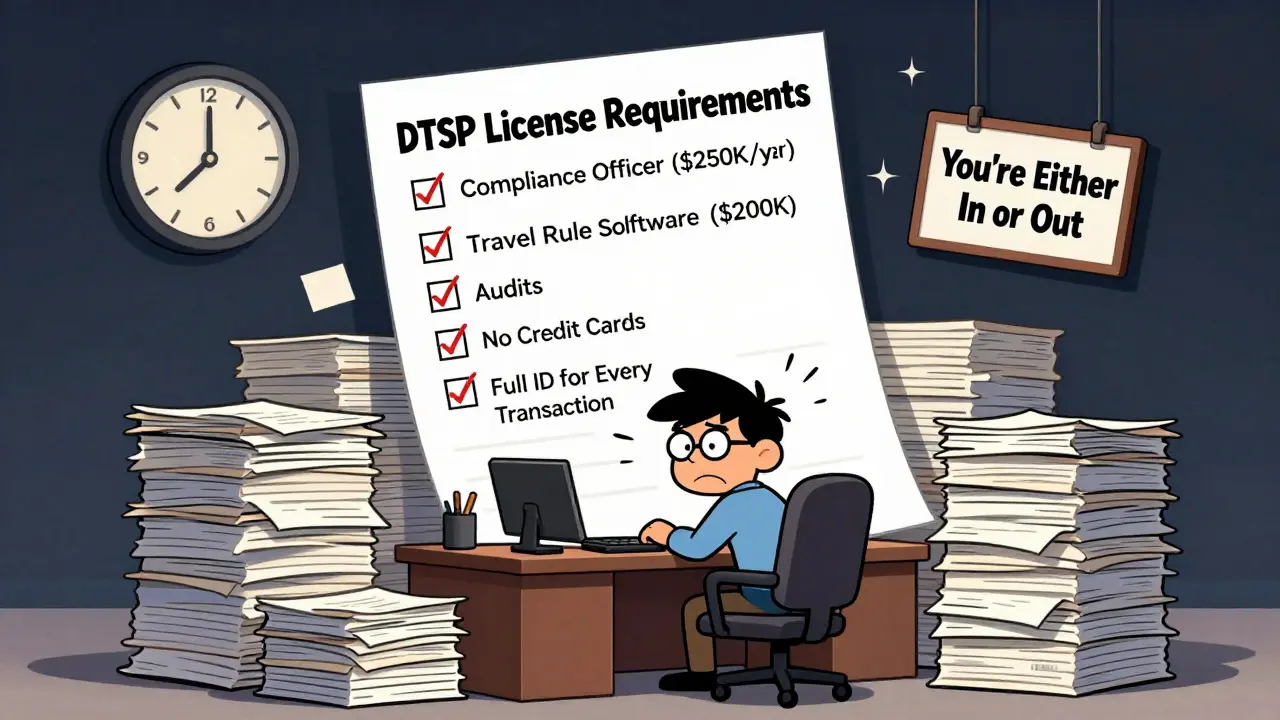

To legally operate any crypto service in Singapore - whether it’s exchanges, wallet providers, or token sales - you now need a Digital Token Service Provider (DTSP) license. Sounds simple, right? Except MAS says they’ll issue licenses only in “extremely limited circumstances.” That’s not a loophole. That’s a wall. To even get considered, you need:- A minimum capital reserve of SGD 5 million (about USD 3.7 million)

- A full-time, Singapore-based compliance officer - someone with proven AML/CFT experience

- Annual independent audits by a firm approved by MAS

- Full implementation of the Travel Rule for all transactions over SGD 1,500

- Robust cybersecurity systems that pass MAS’s technical review

What Happened to All the Crypto Companies?

Before June 2025, around 200 firms had applied for or held provisional licenses in Singapore. By the deadline, fewer than 20 had fully complied. That’s a 90% drop. Some closed their Singapore operations entirely. Others moved their headquarters to Dubai, Switzerland, or even Hong Kong - places that still offer active licensing. A few stayed, but only because they’re massive global players with deep pockets: firms like Coinbase and Binance had to build entire new compliance teams in Singapore just to keep their licenses. The job market reflected the shift. Crypto-related job postings in Singapore fell 37% in the first quarter of 2025 compared to the last quarter of 2024. Roles in compliance, legal, and risk management dropped hardest. Startups that relied on Singapore’s open environment either pivoted or shut down.The Travel Rule - A Real-World Nightmare

One of the biggest headaches for firms was the Travel Rule. Under Notice PSN02, any crypto transaction over SGD 1,500 must include the sender’s and receiver’s full name, ID number, and account details. It’s not optional. It’s not “recommended.” It’s mandatory. The problem? Most crypto platforms weren’t built to collect this kind of personal data. They were designed for privacy. Now, they have to integrate with third-party software that can securely exchange this info with other platforms - even if those platforms are in countries with different privacy laws. Notabene’s analysis found that small to mid-sized firms spent months just testing their systems. Some failed their first audit. Others had to delay launches because their software couldn’t handle cross-border data flows under MAS’s rules. And there’s no grace period. Miss the deadline? You’re done.

Penalties Are Brutal

MAS doesn’t give warnings. They don’t send gentle reminders. If you’re non-compliant, you face:- Fines up to SGD 200,000 (USD 147,000)

- Imprisonment for executives found knowingly violating rules

- Immediate shutdown of operations

Stablecoins and DeFi: What’s Next?

MAS has already laid out rules for stablecoins. They must be backed 1:1 by high-quality assets like U.S. Treasuries or cash equivalents. No algorithmic stablecoins. No unbacked tokens. That’s been in effect since late 2023. As for DeFi? MAS hasn’t issued formal rules yet. But in a May 2025 parliamentary reply, they hinted that DeFi protocols operating from Singapore will soon be required to register - even if they’re decentralized. That means if you’re running a DeFi protocol with a team based in Singapore, you’re not exempt. You’re still under MAS’s thumb. Experts believe this is just the beginning. MAS is watching how other jurisdictions handle DeFi and will likely impose strict KYC and transaction monitoring requirements soon.How Does This Compare to the Rest of the World?

Singapore used to be a leader in crypto regulation. Now, it’s one of the strictest. Compare it to Switzerland, where companies can get licenses with lower capital requirements and fewer staffing rules. Or the UAE, where Dubai’s Virtual Assets Regulatory Authority (VARA) actively recruits crypto firms with tax incentives and clear licensing paths. Singapore’s approach isn’t about growth. It’s about control. They’re not trying to become the next crypto capital. They’re trying to make sure no crypto company ruins their reputation as a global financial center. That’s a smart move - if you’re a bank or a sovereign wealth fund. But if you’re a startup trying to build something new? You’re out of luck.

Is There Any Way Around It?

No. Not really. Some firms tried to operate “offshore” from Singapore - meaning they kept their team in Singapore but moved their servers and user base overseas. MAS shut that down. Section 137 of the FSMA makes it clear: if you’re based in Singapore, you’re regulated - period. Others tried to hide behind “non-custodial” wallets or peer-to-peer platforms. MAS says that doesn’t matter. If you’re facilitating crypto transactions from Singapore, you’re a DTSP. No exceptions. The only real option left is to leave. Move your operations to a jurisdiction with clearer, more realistic rules. Or shut down.What This Means for Users

If you’re a retail investor in Singapore, you’ll notice fewer crypto platforms available. Fewer options. Higher fees. Slower customer service. But you’ll also see fewer scams. Fewer platforms that vanish overnight. Fewer cases of stolen funds because the company didn’t have proper security. MAS’s goal isn’t to make crypto easy. It’s to make it safe. And for many Singaporeans, that’s worth the trade-off. For international users, it means fewer Singapore-based platforms to choose from. If you’re outside Singapore, you might not even notice the change - unless you’re trying to use a platform that used to be based here.Final Reality Check

The Monetary Authority of Singapore didn’t ban crypto. They banned the kind of crypto business that operates without accountability. If you’re a serious, well-funded firm with deep compliance systems and a real presence in Singapore - you might still be in. But you’re now part of a tiny, elite group. For everyone else? The door is closed. And it’s not coming back open. This isn’t a temporary pause. It’s a permanent reset. Singapore isn’t trying to lead the crypto revolution anymore. They’re trying to protect their financial future - one strict rule at a time.Can I still trade crypto in Singapore?

Yes, you can still trade crypto in Singapore. The MAS rules target service providers - not individual users. You can still buy, sell, and hold crypto through platforms that are licensed under the DTSP framework. However, the number of available platforms has dropped sharply since June 2025, and new ones are unlikely to enter the market.

What happens if I use an unlicensed crypto platform from Singapore?

If you use an unlicensed platform, you’re not breaking any laws yourself. But you’re taking a big risk. These platforms aren’t regulated, so your funds aren’t protected. If the platform gets shut down by MAS or gets hacked, you have no legal recourse. MAS strongly advises against using unlicensed services.

Is the Travel Rule really that strict?

Yes. For any transaction over SGD 1,500, platforms must collect and share the full name, ID number, and account details of both sender and receiver. This applies to every single transaction - whether it’s between two individuals or two businesses. Platforms that fail to do this face immediate fines and license revocation.

Can a foreign company operate a crypto business from Singapore without a license?

No. Under Section 137 of the Financial Services and Markets Act 2022, any company operating from Singapore - even if it serves only overseas customers - must have a DTSP license. There are no exceptions. MAS has already taken enforcement action against firms that tried to bypass this rule.

Will MAS ever loosen these rules?

Unlikely in the near term. MAS has stated clearly that their priority is protecting Singapore’s financial reputation, not growing the crypto industry. Any future changes will focus on tightening rules further - especially around DeFi and stablecoins - not relaxing them.

Are there any licensed crypto platforms still operating in Singapore?

Yes, but only a handful. As of late 2025, fewer than 20 firms hold active DTSP licenses. Most are large, well-capitalized international players with full compliance teams based in Singapore. Small and mid-sized firms have largely exited the market.

Sammy Tam

December 16, 2025 AT 03:14Man, I remember when Singapore was the place to be for crypto startups. Now it’s like they turned into a bank with a side hustle. The Travel Rule alone sounds like a nightmare for any small team trying to build something real. I get why they did it, but wow - the cost to comply is insane. Half a mil just to stay in the game? That’s not regulation, that’s a tax on innovation.

Elvis Lam

December 17, 2025 AT 02:48Let’s be real - this was inevitable. Singapore’s not here to be the crypto Wild West. They’re a financial hub with global reputation to protect. If you’re running a sketchy exchange from a condo in Orchard Road while serving Nigerian rugpulls, yeah, you get kicked out. The license requirements are brutal, but they’re not arbitrary. They’re the bare minimum for any entity touching real money.

Sue Bumgarner

December 18, 2025 AT 14:56Why do Americans keep acting like Singapore is some crypto paradise? It was always a tax haven with a fancy name. Now they’re finally acting like adults. If you want freedom, go to El Salvador. Singapore never promised you freedom - they promised stability. And they delivered. The fact that you’re surprised means you never understood how finance actually works.

Jesse Messiah

December 18, 2025 AT 17:09It’s kind of sad, really. I know a few devs who moved to Singapore just for the vibe and the ecosystem. Now they’re scrambling to find jobs in Dubai or Lisbon. The people who really suffered weren’t the big players - it was the mid-sized teams who just wanted to build something honest. MAS didn’t mean to crush them, but the rules didn’t care about intent.

Kelsey Stephens

December 20, 2025 AT 11:19I think a lot of people miss the point. This isn’t about killing crypto. It’s about making sure when you trade, your money isn’t going to vanish because some guy in a garage didn’t bother with KYC. I’ve seen friends lose everything to unregulated platforms. I’d rather have fewer options and know my funds are safe. It’s not sexy, but it’s responsible.

Mark Cook

December 21, 2025 AT 02:23So… MAS is the new FBI of crypto? 😏

Kayla Murphy

December 22, 2025 AT 04:10It’s not that Singapore is being harsh - it’s that the rest of the world is still playing games. Imagine if your bank let anyone open an account without ID. You’d freak out. Crypto’s just money now. It’s time we treated it like it. The people who complain are the ones who wanted to use it as a loophole. And that’s on them.

Bradley Cassidy

December 22, 2025 AT 07:12the travel rule is wild honestly. like imagine trying to send 2k in usdt to your buddy in mexico and now you gotta send his passport number and address? who designed this? also why does every crypto rule sound like it was written by a lawyer who hates humans

Shruti Sinha

December 23, 2025 AT 15:42From an Indian perspective, this is actually admirable. Most countries pretend to regulate crypto while letting shady operators thrive. Singapore didn’t pretend. They drew a line and enforced it. That takes courage. The cost is high, but the integrity is preserved. This is how mature financial systems are built - not by chasing hype, but by protecting trust.

Dionne Wilkinson

December 24, 2025 AT 06:19I don’t know much about crypto, but I know what safety feels like. My uncle got scammed last year. He lost his life savings. If this means fewer people get hurt, then I’m okay with fewer platforms. It’s not about how cool the tech is - it’s about who it protects.

Greg Knapp

December 25, 2025 AT 19:07you think this is bad wait till they start tracking your wallet addresses and linking them to your bank account next year they’re already testing it i heard it from a guy at the bar who works for a fintech startup and he said mas is working with the irs on something big and if you think this is strict you havent seen anything yet

Heather Turnbow

December 26, 2025 AT 21:30It is worth noting that the Monetary Authority of Singapore operates under a sovereign mandate to safeguard the integrity of its financial system. The regulatory framework enacted is not merely administrative; it is a strategic imperative to prevent systemic risk, mitigate illicit finance, and uphold international financial standards. The compliance burden, while significant, is proportionate to the fiduciary responsibilities assumed by licensed entities.

Samantha West

December 28, 2025 AT 08:59isn’t it ironic that the same people who scream about decentralization now want governments to enforce rules on private code? crypto was supposed to be about freedom from control but now we’re begging for permission slips from bureaucrats? what happened to the dream? we traded anonymity for approval and called it progress

George Cheetham

December 28, 2025 AT 12:40There’s a quiet dignity in Singapore’s move. They didn’t chase the glitter of crypto hype. They looked at what their country stands for - stability, order, global trust - and chose to protect that, even if it meant losing the flashy startups. It’s not about being anti-innovation. It’s about being pro-civilization. Sometimes the hardest thing to do is say no - and they did.

Jonny Cena

December 28, 2025 AT 15:03For anyone feeling discouraged by this - don’t. This isn’t the end of crypto. It’s the beginning of a smarter one. The companies that survived? They’re the ones built to last. The ones who left? They were always going to burn out. This is a filter, not a wall. And honestly? The space is better for it.

Sally Valdez

December 30, 2025 AT 11:30USA could never do this. We’d be too busy arguing about whether crypto is a currency or a religion. Singapore just did what needed to be done. No drama. No press releases. No TikTok takes. Just a clean, cold, hard shutdown. And you know what? That’s why their economy doesn’t collapse every time a meme coin blows up. We need more of this. Not less.

Jack Daniels

December 30, 2025 AT 17:48i just hope nobody I know gets locked up over this. i saw a guy on reddit get arrested in 2023 for running a p2p node and he’s still in jail. i don’t want that to be me. i just bought btc on binance. i didn’t even know they had to report my id. now i’m scared to even check my balance.