Drift Protocol Leverage Risk Calculator

Calculate your potential liquidation price based on Drift Protocol's 95% liquidation threshold and Smart Margin system.

Your Position Details

Asset: BTC

Position Size: $0

Current Price: $0

Leverage: 1x

Risk Analysis

Required Margin: $0

Capital Efficiency: 100%

Liquidation Price: $0

Drift's Smart Margin system uses a unified account. At 50x leverage, your capital efficiency is 37% higher than isolated margin systems.

Caution: High leverage positions (above 20x) have high liquidation risk. Drift's liquidation engine processes 95% of positions within safety parameters during normal conditions.

Drift Protocol isn’t just another crypto exchange. It’s a high-speed, decentralized derivatives platform built for traders who want to move fast, use leverage, and avoid the delays of Ethereum. If you’ve ever waited 15 seconds for a trade to fill or watched your stop-loss get skipped during a flash crash, Drift might be the solution you didn’t know you needed. But it’s not perfect. This review cuts through the hype and shows you exactly how Drift performs in real trading conditions - from execution speed to risk exposure, liquidity gaps, and whether the DRIFT token is worth your attention.

What Drift Protocol Actually Does

Drift Protocol is a decentralized exchange (DEX) focused on perpetual futures trading. That means you can bet on whether Bitcoin, Ethereum, or Solana will go up or down - without owning the actual asset. You can go long or short with up to 50x leverage. Unlike centralized exchanges like Binance or Bybit, Drift runs entirely on-chain, meaning your funds never leave your wallet. It’s built on Solana, which gives it a massive speed advantage over Ethereum-based rivals like dYdX or GMX.

Its standout feature is Smart Margin. Instead of locking collateral separately for each trade (like most DEXs), Drift lets you use one unified margin account. You can hold BTC, SOL, USDC, and even staked tokens like stSOL as collateral in the same account. This lets you open multiple positions without wasting capital on redundant reserves. Traders report up to 37% better capital efficiency compared to isolated margin systems. That’s not theory - it’s money saved.

Speed That Actually Matters

Speed is Drift’s superpower. Trades execute in under 600 milliseconds - faster than most human reactions. During high volatility, 92% of stop-loss orders fill within one second, according to quant firm data from October 2025. Compare that to Ethereum-based DEXs, where slippage and delays often turn a planned exit into a loss.

This isn’t magic. It’s engineering. Drift uses a Just-In-Time (JIT) liquidity system that pulls liquidity from multiple sources the moment you place an order. No waiting for a matching order. No order book gaps. Even large orders (up to 100k USDC) execute with minimal slippage - something most DEXs can’t do.

There’s also gasless trading. You don’t pay SOL to place or cancel orders. Only when you actually close a position do you pay a tiny fee. That removes a major barrier for retail traders who get burned by Ethereum’s unpredictable gas fees.

Liquidity: The Hidden Weakness

Speed means nothing if you can’t enter or exit big positions. Here’s where Drift struggles. While it handles retail-sized trades well, institutional-sized orders run into walls.

As of August 2025, the average order book depth for BTC at 0.1% slippage was just 1.2 BTC. On Binance Futures, that number is 8.7 BTC. That’s a sevenfold difference. One trader on CryptoTwitter reported trying to buy 50 ETH during a CPI announcement - only 32 ETH filled before the price moved 2.3%. That’s a $15,000 slippage loss on a single trade.

Drift’s 24-hour volume sits at $218 million (as of September 2025), putting it at #7 among decentralized derivatives platforms. That’s solid for a DEX, but it’s less than half of dYdX’s $412 million. If you’re trading more than $50,000 per position, you’ll likely need to split your order across multiple platforms.

Risk Management: Insurance and Fail-Safes

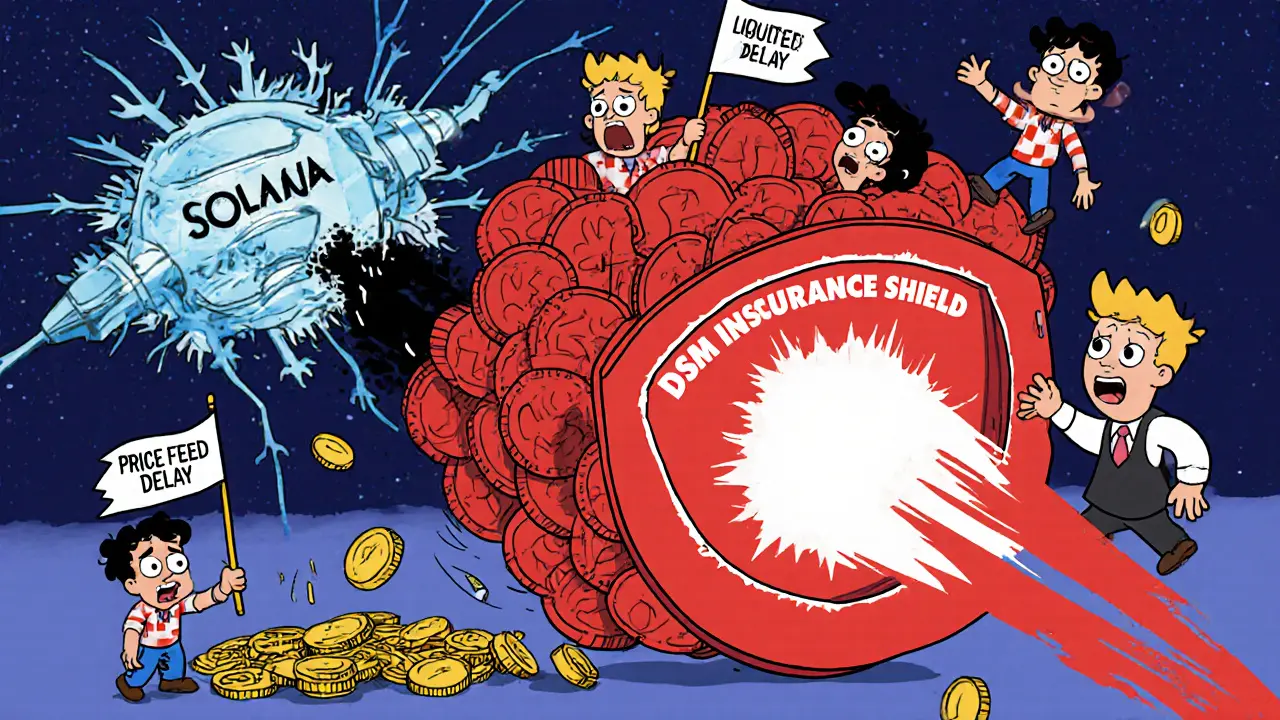

High leverage means high risk. Drift knows this. It has a Dynamic Safety Module (DSM) - an on-chain insurance fund funded by users who stake DRIFT tokens. As of September 2025, the DSM held $23.7 million and has covered $867,000 in bad debt across 12 events since launch.

The system monitors positions every 400 milliseconds. If a trader’s account hits 95% liquidation risk, the protocol automatically starts closing it. That’s faster than most centralized exchanges. But it’s not flawless. During the March 2025 BTC flash crash, Drift’s liquidation engine only processed 78% of positions within safety parameters. Hyperliquid handled 91%. That 13% gap cost some traders more than they expected.

Price feeds come from Pyth Network, updated every 15 seconds. That’s fast, but during Solana network congestion, price delays have caused mismatches. One user reported a 3% discrepancy between Drift’s price and CoinGecko during a spike. That’s rare - but it happens.

Security: Audits, Bugs, and Transparency

Drift’s code is open-source and has been audited 14 times by top firms: Trail of Bits, Neodyme, and OtterSec. No critical vulnerabilities remain unpatched. In fact, the August 2025 audit by Trail of Bits found zero critical issues.

The bug bounty program on Immunefi has paid out $1.7 million since launch. That’s more than most DeFi projects. Critical bugs are rewarded up to $250,000 - a signal that the team takes security seriously.

Still, the biggest risk isn’t hacking - it’s Solana. Drift has paused three times in Q2 2025 due to network outages. Each pause caused $1.4 million in unrealized PnL discrepancies. If Solana goes down, Drift goes down. There’s no backup chain.

DRIFT Token: Utility, Not Just Speculation

The DRIFT token isn’t just a speculative asset. It’s the backbone of the protocol’s risk system. Staking DRIFT earns you a share of trading fees, but more importantly, it backs the DSM. The more DRIFT staked, the safer the system becomes.

In October 2025, Drift upgraded its tokenomics. DRIFT now governs:

- Risk parameters for new markets

- Insurance coverage limits

- Liquidity incentives for market makers

That means token holders directly influence how the platform evolves. It’s not just a dividend token - it’s a governance tool. Price predictions are split: TradingBeast expects $1.02 by December 2025, while WalletInvestor forecasts a drop to $0.38. The token has been trading sideways at $0.75 for 220 days. If Solana’s ecosystem keeps growing, DRIFT could break out. If competition from Hyperliquid or dYdX intensifies, it could stagnate.

Who Is Drift For? (And Who Should Avoid It)

Drift is ideal for:

- Experienced traders who use leverage (10x-50x)

- High-frequency or algorithmic traders who need sub-second fills

- Users already in the Solana ecosystem with Phantom or Backpack wallets

- Traders who care about non-custodial control and transparency

Avoid Drift if:

- You trade large positions ($100k+ per trade) - liquidity won’t support it

- You’re new to crypto - the interface is complex and unforgiving

- You rely on 24/7 customer support - help is mostly Discord and docs

- You’re in a geo-blocked country - Drift restricts access in 32 jurisdictions

68% of Drift users have over two years of crypto experience. The platform doesn’t hold your hand. It expects you to know what you’re doing.

Getting Started: What You Need to Know

To use Drift, you need:

- A Solana wallet (Phantom, Backpack, or Slope)

- SOL for transaction fees (only when closing positions)

- USDC, SOL, or other supported assets as collateral

The interface is clean but dense. There are 37 tutorial videos and 12 interactive walkthroughs on GitHub. Most users report needing 8-12 hours to master advanced features like cross-margin optimization or JIT liquidity provision. The r/Drift101 Reddit community has 1,200+ daily posts - it’s the best place to learn from real traders.

Common issues: Wallet connection failures (23% of users) and price feed delays during Solana congestion (18%). Both are usually fixed by switching wallets or waiting for network recovery. Drift’s Discord support has a 92% satisfaction rating.

The Bigger Picture

Drift is part of a $18.3 billion decentralized derivatives market growing at 34% yearly. Solana now captures 29% of that market - up from 11% in 2023. Drift holds 19% of Solana’s DEX derivatives volume, making it the leader in its ecosystem.

New features are rolling out fast. In September 2025, Drift launched Social Trading, letting users copy the trades of the top 100 traders. Over $47 million has already been copied. It’s a smart move to attract less technical users.

But the future isn’t guaranteed. Hyperliquid V3 is gaining traction. dYdX is expanding to Layer 2. Drift’s reliance on Solana is both its strength and its Achilles’ heel. If Solana has another major outage, Drift’s reputation takes a hit.

For now, Drift is the fastest, most capital-efficient DEX for perpetual futures. It’s not the biggest. It’s not the safest. But if you’re a serious trader who values speed and control, it’s the best decentralized option available today.

Is Drift Protocol safe to use?

Yes, but with caveats. Drift has been audited 14 times by top security firms, and all critical bugs have been patched. Its on-chain Safety Module has covered over $867,000 in losses. However, it runs entirely on Solana, which has had network outages. If Solana goes down, Drift goes down. You’re not at risk of hacks like on centralized exchanges, but you are exposed to systemic blockchain risk.

Can I trade Bitcoin with 50x leverage on Drift?

Yes. Drift supports up to 50x leverage on BTC, ETH, SOL, and other major assets. But higher leverage increases liquidation risk. The platform’s risk engine will automatically close positions if your equity drops too low. Use leverage responsibly - it can amplify gains and losses equally.

Do I need to know how to use Solana wallets?

Yes. Drift only works with Solana wallets like Phantom, Backpack, or Slope. You need to understand how to send SOL for fees, connect your wallet, and manage your private keys. If you’re new to crypto, start with a centralized exchange first. Drift is not beginner-friendly.

What’s the difference between Drift and Binance Futures?

Drift is decentralized - you keep control of your funds. Binance is centralized - they hold your assets. Drift has faster execution on Solana but lower liquidity. Binance has deeper order books and supports larger trades. Drift is better for retail traders who want speed and control. Binance is better for big players who need liquidity.

Is the DRIFT token a good investment?

It depends on your outlook for Solana. DRIFT isn’t just a speculative token - it governs risk, insurance, and liquidity incentives. If Solana’s DeFi ecosystem grows, DRIFT could rise. If competition from Hyperliquid or dYdX wins, it could fall. Price predictions vary widely. Don’t invest more than you can afford to lose.

Can I earn passive income on Drift?

Yes. Drift’s Earn system lets you stake over 20 assets - including SOL, USDC, and even staked tokens - to earn yield. Returns vary based on market demand. Some users report 5-10% APY. But be aware: staking assets in volatile markets can lead to impermanent loss. It’s not risk-free.

Is Drift available in my country?

No. Drift blocks users in 32 high-risk jurisdictions, including the U.S., Canada, and parts of Europe, due to regulatory pressure. Check their website for the latest list before signing up. If you’re in a restricted region, you won’t be able to access the platform.

ty ty

November 11, 2025 AT 00:00Drift? More like Drift-Off-Your-Money-Protocol. You think 600ms is fast? My toaster has better latency. And don't get me started on 'gasless' trading - you still need SOL to close, which means you're just delaying the pain.

They call it 'Smart Margin'? More like 'Smart Way to Lose Everything Faster.'

50x leverage on Solana? That's not trading, that's Russian roulette with a loaded gun and a smiley face on the barrel.

BRYAN CHAGUA

November 12, 2025 AT 20:20While Drift offers impressive speed and capital efficiency, it's crucial to recognize that decentralized finance still carries systemic risks tied to underlying blockchain infrastructure. The reliance on Solana introduces a single point of failure that cannot be ignored, regardless of audit quality or insurance fund size.

For experienced traders seeking non-custodial control, Drift remains a compelling option - but only if they fully understand the trade-offs between decentralization and resilience.

Debraj Dutta

November 13, 2025 AT 01:45Interesting analysis. The liquidity gap for large positions is definitely a concern. I've tried trading 20 ETH on Drift during a volatility spike - only 12 filled before slippage hit 1.8%. Not ideal.

But for retail traders under $10k per trade, the speed and fee structure are unmatched. I've switched from dYdX to Drift entirely for my daily scalping - no regrets so far.

tom west

November 14, 2025 AT 02:09Let’s cut through the marketing fluff. Drift’s ‘Smart Margin’ is just a fancy way of saying ‘you’re putting all your eggs in one basket’ - and that basket is Solana, which has crashed three times this year alone.

They boast about a $23.7M insurance fund? That’s pocket change compared to the $1.4M in unrealized PnL losses per outage. And 78% liquidation success rate? That’s not safety - that’s gambling with your margin.

And don’t even get me started on the DRIFT token. It’s a governance token for a protocol that’s one network failure away from becoming a graveyard of leveraged positions. This isn’t innovation - it’s a time bomb wrapped in whitepaper jargon.

dhirendra pratap singh

November 14, 2025 AT 15:03OMG I CAN’T BELIEVE PEOPLE ARE STILL USING THIS 😭

My friend lost $80K during the March flash crash because Drift’s liquidation engine was too slow - he was literally screaming into his mic while watching his account vanish.

And now they have ‘Social Trading’?? Like, copy trades from people who just got liquidated?? 😭😭😭

Drift is the crypto version of a TikTok trend - flashy, fast, and ends in tears. Don’t say I didn’t warn you.

💔💔💔

Ashley Mona

November 15, 2025 AT 05:07For anyone new to DeFi derivatives: Drift is a beast, but it’s not a pet. You need to understand how margin works, how price feeds function, and how Solana’s network behavior affects your trades.

I started with $500 and spent 10 hours watching tutorials before touching a leveraged position. The interface is dense, but once you get past the learning curve, the execution speed is unreal.

And yes - the DRIFT token staking is legit. I’ve earned 7.2% APY over six months, and I know my stake is backing the insurance fund. It’s not passive income - it’s active participation in protocol security.

Just don’t go all-in. Start small, learn fast, and keep your risk under control.

Edward Phuakwatana

November 16, 2025 AT 22:30Drift isn’t just a DEX - it’s a philosophical statement about what decentralized finance should be: permissionless, fast, and capital-efficient. The JIT liquidity model redefines how we think about order matching - it’s not about waiting for a counterparty, it’s about algorithmically synthesizing liquidity on-demand.

Yes, Solana’s fragility is a risk - but isn’t that the price of innovation? Ethereum’s slow, expensive, and over-audited. Drift is raw, real, and relentless.

The DRIFT token isn’t a speculative asset - it’s a stake in the future of on-chain derivatives. You’re not just trading - you’re helping to architect the next layer of financial infrastructure.

And if you’re scared of 50x leverage? Then you’re not a trader. You’re a spectator. And spectators don’t build empires.

Suhail Kashmiri

November 18, 2025 AT 05:34Bro you’re all missing the point. This whole thing is just a casino with a blockchain sticker on it. You think staking DRIFT makes you a ‘governance participant’? Nah. You’re just giving them your tokens so they can pay themselves more in fees.

And ‘gasless trading’? LMAO. You still pay SOL to close - so you’re just getting fleeced later. Real traders use centralized exchanges and sleep at night.

Drift is for people who think ‘decentralized’ means ‘more money for me.’ It’s not. It means more risk. More stress. More tears.

Stop drinking the Kool-Aid.

Kristin LeGard

November 20, 2025 AT 05:02USA built the internet. USA built crypto. And now we’re letting some Indian devs run a critical DeFi protocol on a chain that crashes every other Tuesday?

Drift’s ‘speed’ is irrelevant if the whole thing goes down because Solana’s servers are hosted in a basement in Bangalore.

And don’t get me started on ‘social trading’ - copying trades from strangers? That’s how grandma loses her Social Security.

Drift is a threat to American financial sovereignty. And we’re letting it happen.

Arthur Coddington

November 20, 2025 AT 17:53Is Drift the future? Or just another flash in the pan? I mean, what even is ‘speed’ if you’re trading into a void? The liquidity is thin. The insurance fund is a Band-Aid on a bullet wound.

And the token? DRIFT? It’s like naming your startup ‘Zenith’ and expecting people to believe you’re the peak of innovation.

Maybe we’re all just chasing ghosts. Maybe the real revolution isn’t in DeFi - it’s in learning to sit still.

And yet… I still open the app every morning. Why? Because I’m addicted to the thrill of the fall.

Phil Bradley

November 22, 2025 AT 08:16Big shoutout to Ashley Mona - you nailed it. I started on Drift last year with $200 and now I’m teaching my cousins how to use cross-margin. The community on r/Drift101 is unreal - real people, real tips, no fluff.

And yeah, Solana had outages - but so did Coinbase in 2021. We adapt. We learn.

Drift’s not perfect, but it’s the closest thing we’ve got to a true decentralized futures exchange. If you’re tired of trusting Binance with your life savings, this is your shot.

Just don’t go 50x on your rent money. 😅

Stephanie Platis

November 22, 2025 AT 20:30Drift Protocol’s ‘Dynamic Safety Module’ (DSM) is not a ‘fund’-it is a risk-transfer mechanism, funded by token holders who voluntarily assume counterparty risk. This is not insurance in the traditional sense; it is a probabilistic, on-chain collateralization model subject to systemic volatility.

Furthermore, the claim that ‘92% of stop-loss orders fill within one second’ is statistically misleading without context: the sample size, market conditions, and slippage thresholds must be disclosed to validate the assertion.

Additionally, the DRIFT token’s governance scope-while nominally expansive-is functionally constrained by low voter turnout and concentrated ownership. Therefore, the assertion of ‘true decentralization’ is, at best, aspirational.

And finally: if you are using Phantom Wallet and not verifying transaction signatures manually, you are not a trader-you are a liability.