There’s no such thing as a safe crypto exchange you’ve never heard of. If you’re wondering whether Decoin is worth using, the answer isn’t hidden in marketing buzzwords-it’s buried under silence.

Decoin claims to be a "transparent and innovative Pro social Trading platform" with "maximum-security elements." Sounds great on paper. But when you dig deeper, there’s nothing to find. No website history. No team names. No registered address. No user reviews on Trustpilot, Reddit, or Twitter. Not even a single credible news article from 2023 to 2025 mentions it operating in the real world.

What Do We Actually Know About Decoin?

The only concrete detail available is that Decoin has a native token called DECOIN. According to a single whitepaper reference, 70 million DECOIN tokens were set aside to promise a 6.2% annual return to holders who stake them on the platform. That’s it. No other tokenomics details. No total supply. No distribution breakdown. No lock-up periods. No mechanism explaining how that return is "guaranteed."

Compare that to Binance, Coinbase, or Kraken-all of which publish full tokenomics documents, audit reports, and liquidity breakdowns. Decoin doesn’t even list its trading pairs. You won’t find out if you can trade BTC, ETH, or SOL. No fee schedule. No withdrawal limits. No KYC process described. No mobile app. No API access. No customer support contacts.

Why the Silence Is Dangerous

Legitimate exchanges don’t disappear from the internet. They post updates. They answer questions. They get reviewed by independent analysts. They get flagged by regulators when they do something wrong. Decoin does none of that.

Think about it: if a company claims to handle your money and your crypto, you’d expect to see:

- At least 500+ user reviews across multiple platforms

- A clear legal entity name and jurisdiction

- Published security audits from firms like CertiK or PeckShield

- Live trading volume data on CoinGecko or CoinMarketCap

- Active social media with real engagement

Decoin has none of these. Not one.

That’s not just incomplete-it’s a red flag. In crypto, silence isn’t neutrality. It’s risk. And in a space where scams cost users over $3 billion in 2024 alone, ignoring that silence is how people lose everything.

Staking 6.2%? That’s Not a Feature-It’s a Warning

The 6.2% staking return is the only number anyone can point to. But here’s the truth: if a platform can promise fixed returns without explaining how it makes money, it’s either lying or doomed.

Real staking platforms like Coinbase or Kraken offer yields based on network activity-ETH staking pays around 3-5%, SOL around 6-7%, and those rates change weekly. They don’t guarantee returns. They don’t promise them. They show you the math.

Decoin’s 6.2% sounds like a Ponzi scheme tactic: pay early users with money from new ones until the flow dries up. There’s zero public data showing where the funds come from. No revenue model. No liquidity pools disclosed. No treasury audits.

And if the platform shuts down tomorrow? Your staked DECOIN tokens could vanish overnight-with no recourse, no insurance, and no legal protection.

How Decoin Compares to Real Exchanges

Here’s what you get from a legitimate exchange versus what Decoin offers:

| Feature | Decoin | Established Exchanges (Binance, Coinbase, Kraken) |

|---|---|---|

| Trading Pairs | Unknown | 500+ including BTC, ETH, SOL, ADA, and fiat pairs |

| Staking Returns | 6.2% guaranteed (no proof) | Variable, based on network rates (transparently listed) |

| Security Audits | None reported | Regular audits by CertiK, Trail of Bits, or similar |

| User Reviews | Zero on all major platforms | Thousands of verified reviews |

| Regulatory Status | Unknown | Licensed in multiple jurisdictions (US, EU, UK, etc.) |

| Customer Support | No contact info available | 24/7 live chat, email, ticket system |

| Insurance Coverage | None mentioned | Up to $250M in cold storage insurance (e.g., Coinbase) |

There’s no middle ground here. Either Decoin is a ghost project-or it’s actively trying to lure people in with vague promises while hiding behind silence.

What Happens If You Deposit Funds?

Let’s say you ignore the red flags and deposit $1,000 into Decoin. What’s the real risk?

- You might not be able to withdraw for weeks-or ever.

- Your DECOIN tokens could become worthless if the platform shuts down.

- You have no legal recourse-no regulator to file a complaint with.

- Your funds could be frozen or stolen with no audit trail.

- You won’t find anyone to help you, because no one else has used it.

There are no success stories. No testimonials. No case studies. Just a vague website and a promise that sounds too good to be true.

And in crypto, when something sounds too good to be true-it almost always is.

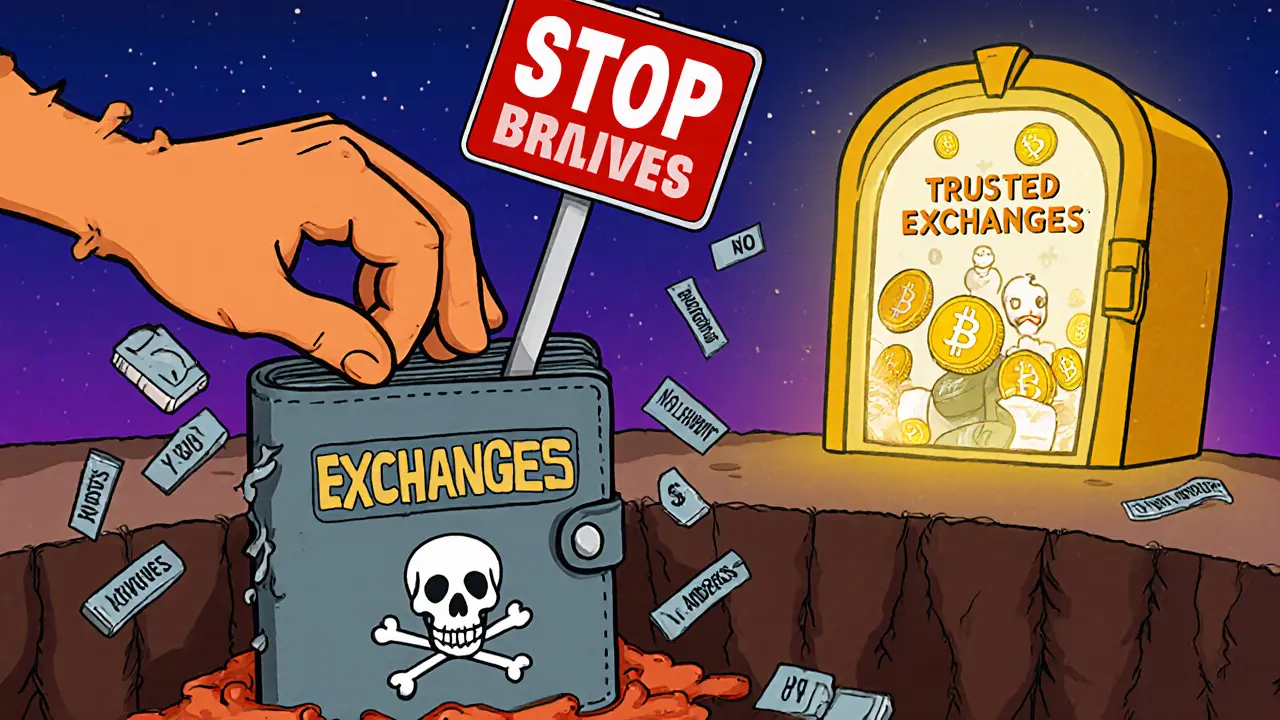

What Should You Do Instead?

You don’t need to gamble on unknown platforms to earn crypto returns. There are dozens of trusted exchanges with:

- Clear fee structures

- Verified security

- Regulatory compliance

- Active customer support

- Publicly audited staking programs

Start with Coinbase if you’re new. Use Kraken if you want lower fees. Try Binance if you need advanced trading tools. All of them have been around for years. All of them have millions of users. All of them let you see exactly how much you’re paying and how your money is protected.

There’s no reason to risk your savings on a platform that refuses to show you its face.

Final Verdict: Avoid Decoin

Decoin crypto exchange doesn’t have enough public information to be considered a legitimate platform. Not even close.

It’s not "underdeveloped." It’s not "new." It’s not "underrated." It’s invisible-and in crypto, invisibility equals danger.

If you’re looking for a place to trade, stake, or store crypto, choose a platform with a track record. Don’t bet on silence. Don’t trust promises without proof. And never, ever deposit money into a service that won’t tell you who’s running it.

Your crypto deserves better than a ghost exchange.

Is Decoin crypto exchange safe to use?

No, Decoin is not safe to use. There is zero verifiable information about its team, security practices, regulatory status, or user base. No audits, no reviews, no customer support contacts, and no transparency. These are not minor gaps-they’re warning signs of a high-risk or potentially fraudulent platform. Never deposit funds into an exchange you can’t verify.

Does Decoin have a mobile app?

There is no evidence that Decoin has a mobile app. No app listings exist on Google Play or the Apple App Store. No screenshots, no download links, no user reports of using a mobile version. If a crypto exchange doesn’t offer a mobile app, it’s a major red flag-most users trade on phones, and legitimate platforms prioritize mobile access.

Can I trust the 6.2% staking return on Decoin?

No, you cannot trust the 6.2% staking return. Real staking platforms don’t guarantee fixed returns-they show you how yields are calculated based on network activity. Decoin provides no proof of how this return is funded, how long it will last, or what happens if the platform fails. This is a classic tactic used by scams to lure users in with unrealistic promises.

Are there any user reviews for Decoin?

There are no verified user reviews for Decoin on Trustpilot, Reddit, Twitter, or any major crypto forum. Not one. No complaints. No success stories. No screenshots of trades. This absence of community feedback is extremely unusual for any exchange that claims to have users. Legitimate platforms have hundreds or thousands of reviews-even new ones.

What are better alternatives to Decoin?

Use Coinbase for beginners, Kraken for low fees, or Binance for advanced trading. All three are regulated, audited, insured, and have millions of active users. They publish full fee schedules, security details, and staking rates. You can verify their operations. You can contact support. You can trust their track record. There’s no reason to risk your money on an unknown platform when proven options exist.

alex piner

November 14, 2025 AT 19:51man i just checked decoin out of curiosity and holy crap, zero reviews, no team, nothing? this feels like one of those crypto ghost sites that vanish after collecting a few grand. stay away folks.

Gavin Jones

November 14, 2025 AT 20:56While I appreciate the thoroughness of this analysis, I must respectfully note that the absence of evidence is not necessarily evidence of absence. However, in the context of decentralized finance, transparency is not merely a virtue-it is a non-negotiable prerequisite for trust. The lack of any verifiable institutional footprint renders this platform, at present, an untenable risk.

Mauricio Picirillo

November 15, 2025 AT 15:12bro this is wild. i thought maybe it was just a new startup, but no website history? no team pics? no support email? that’s not ‘new’, that’s sketchy as hell. i’ve seen shady projects, but this one’s got no bones at all. don’t even think about staking.

Liz Watson

November 17, 2025 AT 10:46Oh wow. A crypto exchange that doesn’t even bother to fake having a legal department. How original. Did they outsource their ‘transparency’ to a ghostwriter who ghosted the whole project? 6.2% guaranteed? Sweet. I’ll just send my life savings to a .xyz domain with no DNS history. What could go wrong?

Rachel Anderson

November 18, 2025 AT 23:16I’m literally shaking. A 6.2% guaranteed return? With NO audit? NO team? NO NOTHING? This isn’t a crypto exchange-it’s a digital funeral home for your portfolio. I’ve seen scams, but this one feels like it’s been designed by someone who watched a Netflix documentary on Ponzi schemes and thought, ‘I can do better.’

Hamish Britton

November 20, 2025 AT 07:54the silence here is louder than any marketing page. i’ve used some sketchy platforms before, but this? it’s not even trying. if you can’t even name your founders, why should i trust you with my btc? just stick with coinbase or kraken. they’re boring, but at least they’re alive.

Robert Astel

November 21, 2025 AT 00:53you know what’s interesting about silence? it’s not just the absence of sound-it’s the presence of intention. decion’s silence isn’t accidental, it’s strategic. it’s the kind of silence that only exists when someone’s trying to hide something bigger than a bug in their code-it’s hiding the fact that they have no code, no team, no infrastructure, just a whitepaper written in google docs by someone who thinks ‘blockchain’ is a type of sandwich. and that 6.2%? that’s not a yield, that’s a siren song for the desperate. we live in a world where people still fall for ‘guaranteed returns’ because they don’t understand opportunity cost, or risk, or the fact that if something sounds too good to be true, it’s usually because it’s not true at all. and the worst part? the people who lose money on this won’t even realize it until it’s too late, because there’s no one to email, no helpdesk, no lawyer, no regulator, just a floating domain and a promise written in vapor.

Andrew Parker

November 22, 2025 AT 15:15why do people keep falling for this?? I mean… it’s like giving your house keys to a stranger who says ‘trust me, I’m a locksmith’… but you can’t even see their face. I cried last night thinking about all the grandmas sending their pensions to sites like this. 😭😭😭 the 6.2% is just the hook… then they vanish with your keys. i’ve been burned before. don’t be next.

Kevin Hayes

November 24, 2025 AT 11:25The philosophical underpinning of trust in decentralized systems is predicated on verifiability. Decoin, by virtue of its complete opacity, negates the very premise upon which blockchain-based trust is constructed. The absence of audit trails, team transparency, and regulatory alignment does not indicate immaturity-it indicates existential illegitimacy. One cannot build a house on air, no matter how beautifully the blueprint is rendered.

Katherine Wagner

November 25, 2025 AT 12:20ratheesh chandran

November 27, 2025 AT 01:26bro i live in india and i saw this site on telegram group… i thought its legit because it has ‘pro social trading’ written in big letters… now i realize… it’s just another pump and dump with fancy words. i almost sent 5000 rupees… thank god i checked reddit first. avoid at all cost.

Hannah Kleyn

November 28, 2025 AT 20:00it’s wild how much you can learn just by looking at what’s missing. no team? fine. no reviews? okay. no mobile app? whatever. but when you add it all up… it’s like a restaurant with no menu, no staff, no kitchen, and a sign that says ‘best food in town’. you don’t go in. you don’t even knock. you just walk away. and yet… people still do. i don’t get it.

gary buena

November 30, 2025 AT 08:02honestly i was gonna try it for the 6.2%… but then i saw the ‘no contact info’ part and i laughed out loud. like… how do you even support users if you don’t have an email? do they respond via tarot cards? i’m out. also, if you’re reading this and thinking ‘maybe it’s just new’… nah. new doesn’t mean invisible. new means ‘here’s our github, here’s our team, here’s our roadmap’. this is just a ghost.

Vanshika Bahiya

December 1, 2025 AT 05:44as someone who’s helped new traders for 5 years, i can’t stress this enough: if you can’t find a single real person talking about it on twitter or reddit, it’s not a platform-it’s a trap. i’ve seen dozens of these. they all look the same. fancy name, big promise, zero proof. please, use coinbase or kraken. they’re safe, they’re real, and they’ll help you grow. your future self will thank you.

Albert Melkonian

December 2, 2025 AT 13:49It is a fundamental principle of fiduciary responsibility that any entity handling assets must provide demonstrable accountability. Decoin fails to meet even the most minimal threshold of disclosure. The absence of audit reports, team identification, or regulatory compliance constitutes a material breach of the social contract between user and platform. One cannot ethically recommend participation in a system that offers neither transparency nor recourse. The choice is not between risk and safety-it is between informed risk and blind vulnerability.

Kelly McSwiggan

December 4, 2025 AT 05:23Oh wow. Another crypto ‘innovation’ that’s just a google doc with a fancy logo. 6.2%? Congrats, you’ve reinvented the pyramid. The only thing more impressive than the lack of transparency is how many people still fall for this. I’m surprised the SEC hasn’t shut this down yet. Or maybe they’re just too busy laughing.

Byron Kelleher

December 5, 2025 AT 01:38just wanna say thanks for this post. i was kinda tempted by the 6.2% but your breakdown made me pause. i’ve lost money before on sketchy stuff… not again. i’m going with kraken now. peace out, ghost exchange. you’re not welcome here.