Airdrop Legitimacy Checker

Is This Airdrop Legitimate?

Enter details about a potential airdrop to see if it meets legitimacy criteria based on the CoinWind COW airdrop case study.

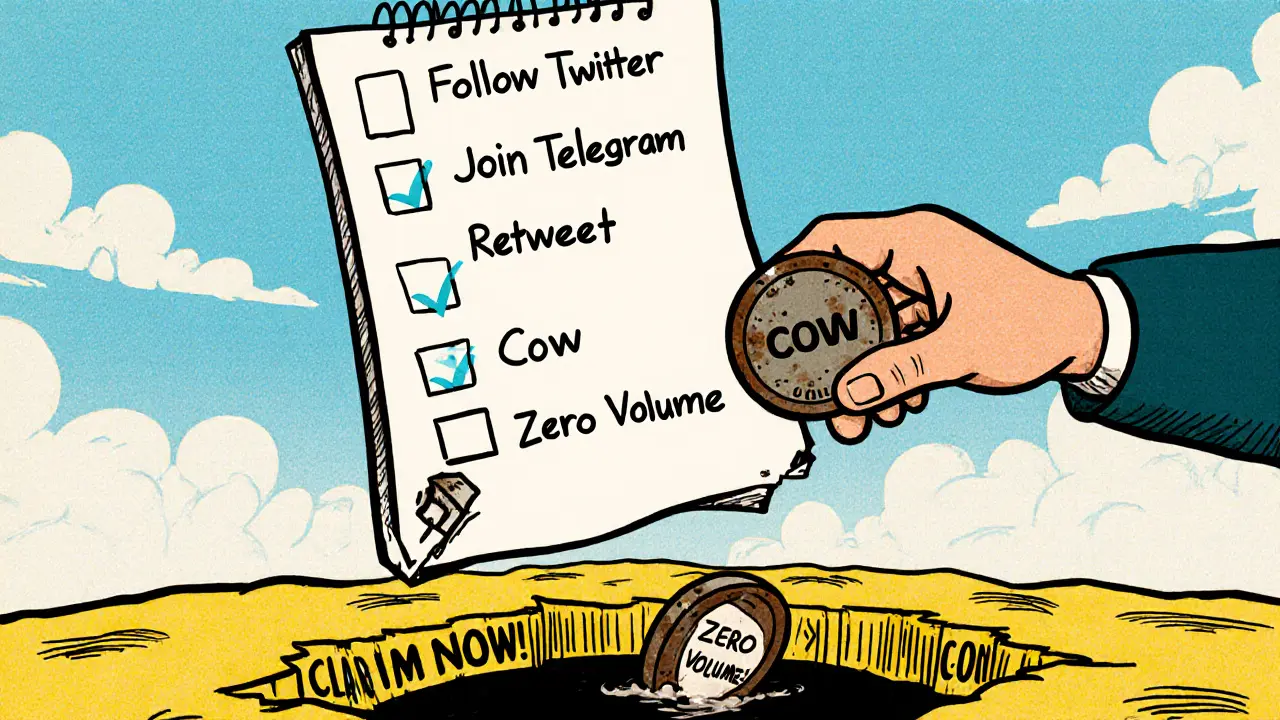

Key red flags to watch for: Zero trading volume, no team information, no whitepaper, confusing name with major projects, only social media tasks required.

Airdrop Evaluation Form

Enter details about the airdrop to check its legitimacy.

Airdrop Legitimacy Result

The CoinWind (COW) airdrop was a real campaign, but it didn’t lead to a breakout project. If you’re reading this now in late 2025, you’re probably wondering if it was worth it, or if there’s still a chance to get something from it. The short answer: the airdrop is long over, and the token has virtually no value or trading activity left. But understanding what happened - and why - can help you avoid similar traps in the future.

What Was the CoinWind COW Airdrop?

In mid-2024, CoinMarketCap ran a promotional airdrop for CoinWind (COW), distributing a total of 30,000 COW tokens to 1,000 winners. Each winner got up to 30 COW tokens. The campaign ran from July 20 to August 3, 2024. It wasn’t a big prize pool by crypto standards - you’d get more from a minor DeFi protocol airdrop these days - but it was enough to draw attention from people looking for free tokens.The setup was typical: sign up, follow social accounts, join Telegram groups, and retweet a pinned post. No deposit. No wallet connection. Just social media tasks. That’s how most small airdrops work - they’re marketing tools, not investment opportunities. CoinWind used the airdrop to build a following, not to launch a functional product.

How to Enter the CoinWind Airdrop (If It Were Still Active)

Even though the airdrop is closed, knowing the steps helps you spot patterns in future campaigns. Here’s what participants had to do:- Have an active CoinMarketCap account

- Add CoinWind (COW) to your watchlist on CoinMarketCap

- Follow the official CoinWind Twitter account: @coinwind_com

- Join the CoinWind Telegram group: t.me/CoinWind

- Follow the CoinWind News Telegram channel: t.me/CoinwindNews

- Retweet CoinWind’s pinned tweet on Twitter

That’s it. No KYC. No wallet address submission during sign-up. Winners were selected randomly from those who completed the tasks. The tokens were distributed directly to the winners’ CoinMarketCap accounts, and users had to claim them before the deadline.

What Happened to the COW Token After the Airdrop?

This is where things get messy. As of November 2025, CoinWind (COW) trades at $0.002837. Sounds cheap? It is. But here’s the kicker: the 24-hour trading volume is $0. That means no one is buying or selling it. The market cap? $0. The fully diluted valuation is just $283.65 - less than the cost of a decent smartphone case.On CoinMarketCap, COW is ranked #6631. That’s not just low - it’s buried. Out of over 25,000 cryptocurrencies tracked, it’s in the bottom 0.03%. Most tokens that hit this level either get delisted, get rebranded, or vanish entirely. COW hasn’t been updated since the airdrop. No new features. No team announcements. No roadmap.

Don’t Confuse CoinWind With CoW Protocol

This is a critical point. There’s a completely different project called CoW Protocol (also COW). It’s a decentralized exchange that uses batch auctions to protect traders from MEV (miner extractable value). It’s backed by 0x Labs and 1kx, has $23 million in funding, and a market cap of nearly $100 million.People mix them up constantly. You’ll see tweets, Reddit posts, and YouTube videos talking about “CoW Protocol airdrop” - but they’re linking to CoinWind’s site. That’s not a mistake. It’s a risk. If you’re looking to invest in a real DeFi protocol, CoW Protocol is the one. CoinWind? It’s a ghost.

Why Did CoinWind Fail?

Most crypto projects fail because they have no real use case. CoinWind had none. No whitepaper. No team names. No GitHub activity. No technical documentation. No partnerships. Just a Twitter account, a Telegram group, and an airdrop.Compare that to projects that actually grow. Take Uniswap - they launched with a token, but they had a working DEX, clear incentives for liquidity providers, and a governance model. CoinWind offered nothing but free tokens. Once people got their 30 COW, they moved on. No reason to stay. No reason to trade. No reason to care.

The airdrop was a one-time marketing stunt. It worked - it got 1,000 people to follow them. But after that, the project had no engine to keep going.

Is It Still Worth Claiming COW Tokens?

If you won the airdrop and never claimed your tokens, you can still try logging into your CoinMarketCap account. But don’t get your hopes up. Even if you claim them now, you won’t be able to sell them. No exchanges list COW. No wallets show meaningful balances. No DEXs have liquidity pools for it.Think of COW like a coupon for a restaurant that closed six months ago. You still have the paper. But there’s nothing to redeem.

What Should You Do Instead?

If you’re chasing airdrops, focus on projects with:- A working product (not just a website)

- A public team with LinkedIn profiles

- Active GitHub commits

- Real trading volume (not $0)

- Clear token utility (governance, staking, fee discounts)

Look at recent successful airdrops - like Arbitrum, zkSync, or LayerZero. They didn’t just give away tokens. They gave people a reason to use their network. CoinWind gave away tokens and disappeared.

Use airdrop trackers like AirdropAlert or CoinGecko’s airdrop calendar. But always dig deeper. Check if the project has been audited. Read their documentation. See if their Telegram group has more than 100 active members. If it’s quiet, walk away.

Red Flags to Watch For

CoinWind had several warning signs:- Zero trading volume - a dead token

- No team or founders named

- No whitepaper or technical docs

- Confusing name with a major project (CoW Protocol)

- Only social media engagement required - no real product involvement

If you see these in a new airdrop, assume it’s a pump-and-dump. The goal isn’t to build a product. It’s to get you to follow their socials, then disappear with your attention.

Final Thoughts

The CoinWind COW airdrop was a textbook example of a low-effort crypto marketing tactic. It didn’t fail because of bad luck. It failed because it had no substance. The tokens were free, but the real cost was your time - and the risk of confusing it with a legitimate project.There’s no shame in chasing free tokens. But always ask: what’s the real value here? If the answer is nothing, then the only thing you’re getting is a digital receipt for nothing.

Was the CoinWind COW airdrop legitimate?

Yes, the airdrop itself was legitimate - it was hosted by CoinMarketCap and followed standard rules. But legitimacy doesn’t mean value. The project behind it had no real product, team, or future roadmap. The tokens have no utility and zero trading activity.

Can I still claim my COW tokens from the airdrop?

If you won and didn’t claim, log into your CoinMarketCap account and check your airdrop history. But even if you claim them now, you won’t be able to sell or use them. No exchanges list COW, and there’s no liquidity. The tokens are essentially worthless.

Why is CoinWind’s market cap $0?

Market cap is calculated by multiplying the token price by the circulating supply. CoinWind has a price of $0.002837, but zero trading volume. That means no one is buying or selling it. Without trades, exchanges can’t confirm demand - so the market cap is reported as $0, even though the token still has a theoretical value.

Is CoinWind the same as CoW Protocol?

No. CoinWind (COW) is a low-activity project with no technical documentation. CoW Protocol (also COW) is a serious DeFi project backed by major investors, using batch auctions to protect traders from MEV. They’re completely different. Many people confuse them because of the similar names.

Should I participate in future airdrops like this?

Only if you’re okay with spending time for zero return. Most small airdrops like CoinWind are marketing stunts. Focus on airdrops from projects with working products, active teams, and real use cases. If the project only asks you to follow Twitter and join Telegram, it’s probably not worth your time.

Diana Dodu

November 12, 2025 AT 05:45Raymond Day

November 13, 2025 AT 00:49Michael Brooks

November 13, 2025 AT 09:34Kylie Stavinoha

November 15, 2025 AT 00:19What we call 'crypto culture' is just late-stage capitalism with better graphics.

FRANCIS JOHNSON

November 15, 2025 AT 13:03Ruby Gilmartin

November 16, 2025 AT 05:49Atheeth Akash

November 16, 2025 AT 23:35David Billesbach

November 17, 2025 AT 05:17Douglas Tofoli

November 18, 2025 AT 02:30Michael Faggard

November 19, 2025 AT 18:03Elizabeth Stavitzke

November 21, 2025 AT 02:51Ainsley Ross

November 23, 2025 AT 02:49Don’t chase tokens. Chase utility.

Andy Purvis

November 23, 2025 AT 03:57James Ragin

November 23, 2025 AT 22:02William Moylan

November 24, 2025 AT 06:07Brian Gillespie

November 26, 2025 AT 02:23Noriko Yashiro

November 27, 2025 AT 02:56