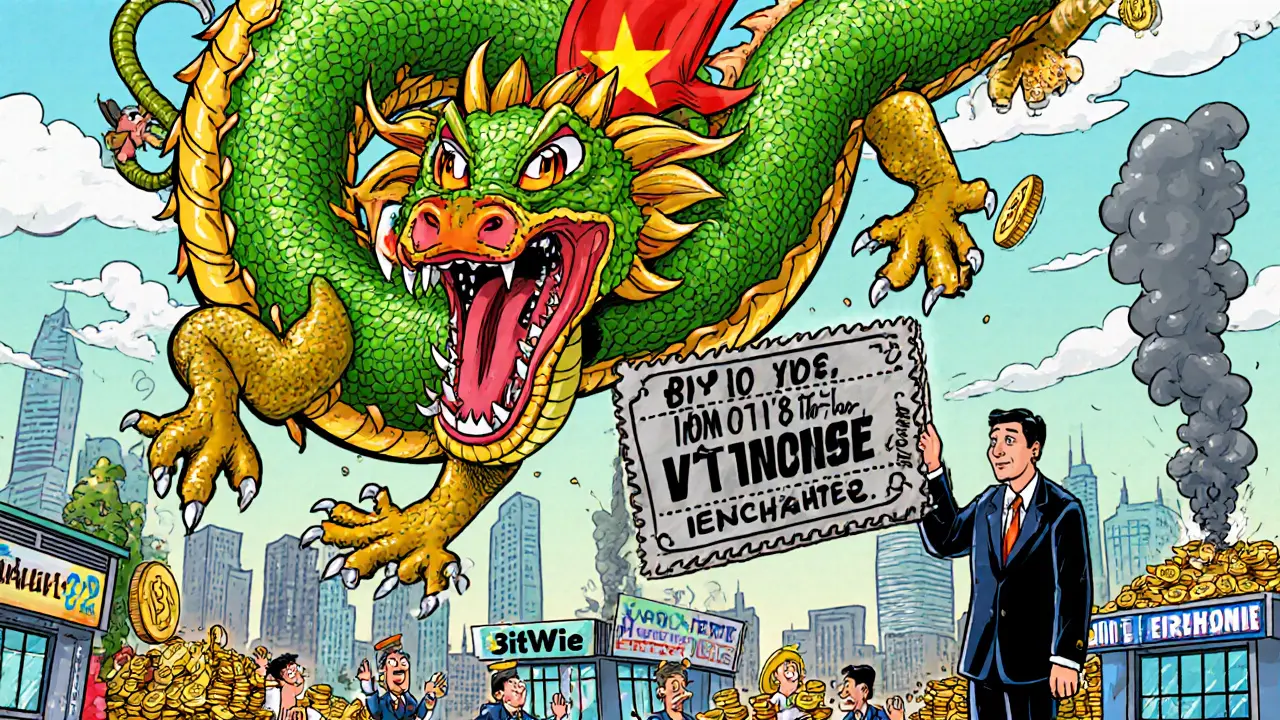

Vietnam Crypto Regulation: What’s Legal, What’s Not in 2025

When it comes to Vietnam crypto regulation, the official stance from the State Bank of Vietnam that defines how digital assets can be used, traded, and taxed within the country. Also known as cryptocurrency regulation in Vietnam, it’s one of the most restrictive frameworks in Southeast Asia—despite having one of the highest rates of crypto adoption among its population. You can’t buy Bitcoin with your bank account. You can’t trade USDT or any other stablecoin. And you can’t legally operate a crypto exchange unless you’ve raised nearly $400 million in capital—a number so high, no company has even tried to apply.

The State Bank of Vietnam, the central banking authority that controls all financial activity in the country, including foreign exchange and digital asset flows. Also known as SBV, it’s the only body with the power to approve or block any crypto-related business. In 2025, they finally gave legal status to cryptocurrencies as "virtual assets," but only for trading on licensed platforms. That’s it. No payments. No mining. No DeFi. No staking. Even foreign exchanges like Binance or Coinbase can’t legally serve Vietnamese users unless they get licensed—which no one has done. Meanwhile, millions of Vietnamese still trade crypto through peer-to-peer apps like LocalTrade, often without KYC, putting their money at risk.

Why such tight control? The government fears losing control over the national currency, the Vietnamese dong. They worry about capital flight, money laundering, and the rise of unregulated financial systems. But here’s the irony: while the rules are strict, enforcement is patchy. Underground trading thrives. P2P platforms are booming. People use crypto to send money abroad, hedge against inflation, or invest in global tokens like Bitcoin and Ethereum. The disconnect is glaring: the public is ahead of the law, and the law isn’t keeping up with reality.

That’s where the crypto policy Vietnam, the set of official guidelines and restrictions issued by the State Bank of Vietnam to govern digital asset usage, trading, and licensing. Also known as Vietnam crypto law 2025, it’s the only legal framework that matters if you’re operating inside the country comes in. It doesn’t ban crypto—it just makes it nearly impossible to use legally. You can hold it. You can trade it privately. But you can’t deposit it into a bank. You can’t cash out to your local account without triggering scrutiny. And if you run a platform that lets people trade crypto, you need to prove you’ve got more money than most banks.

What does this mean for you? If you’re in Vietnam, you’re stuck in a gray zone. The law says one thing. Reality says another. The result? A market full of risky platforms, fake exchanges, and scams that prey on people who don’t know the rules—or think they don’t apply to them. You’ll find posts here about platforms like LocalTrade, Decoin, and others that operate without licenses, with no oversight, and no protection for users. You’ll also see what’s happening on the legal side: the $379 million barrier, the ban on stablecoins, and why no exchange has stepped up to meet the requirement.

This collection isn’t about theory. It’s about survival. If you’re trading crypto in Vietnam, you need to know what’s legal, what’s dangerous, and who’s really in control. You’ll find reviews of shady exchanges, breakdowns of the official rules, and warnings about scams that look like real opportunities. There’s no sugarcoating here. The system is broken. But understanding how it works might just save your money.

Vietnam's new crypto framework, Directive 05/CT-TTg, requires exchanges to hold $379 million in capital and bans fiat-backed stablecoins. It's the strictest rule in Southeast Asia-and it's forcing a massive industry shakeup.

View More