VARA Licensing: What You Need to Know About Crypto Regulation and Compliance

When a crypto company operates in Dubai, it doesn’t just need a website and a whitepaper—it needs VARA licensing, the Virtual Assets Regulatory Authority’s official permit to legally offer crypto services in the UAE. Also known as Dubai crypto license, this isn’t just paperwork. It’s a gatekeeper for trust, security, and legitimacy in a market flooded with fake exchanges and exit scams. If you’re trading, launching a token, or running a DeFi platform, ignoring VARA means risking your funds, your reputation, or worse—your freedom.

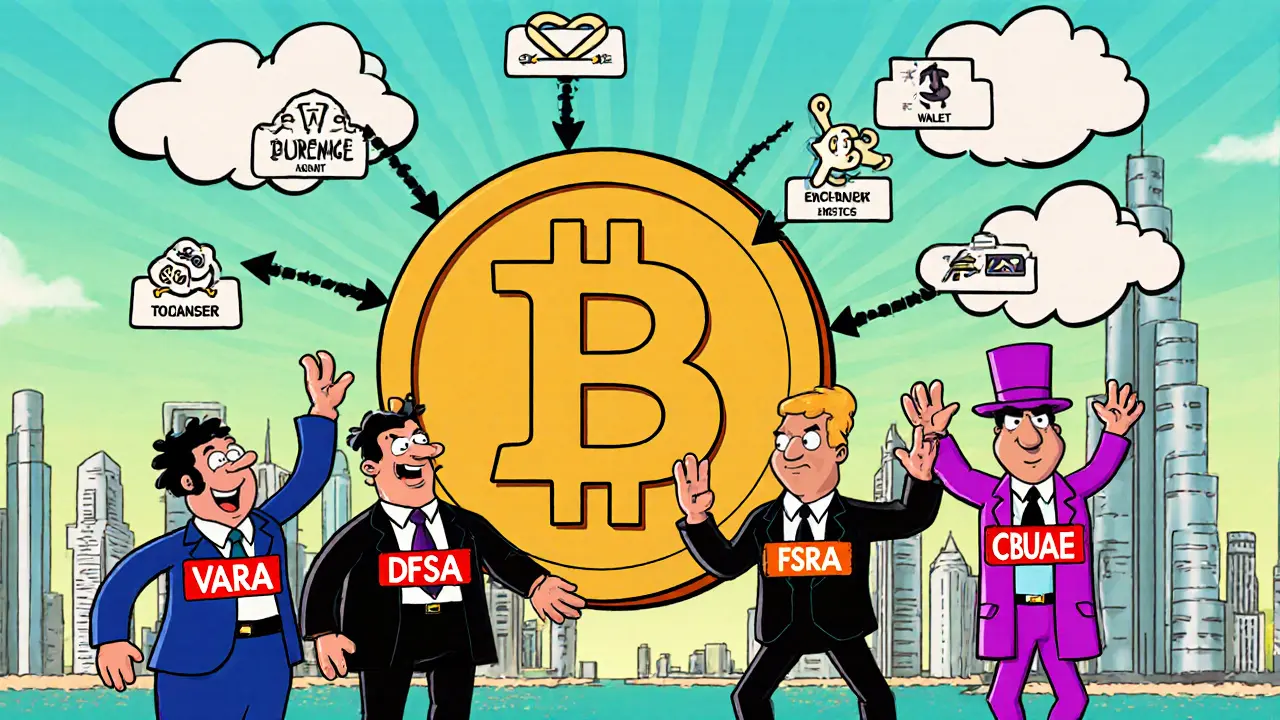

VARA licensing doesn’t exist in a vacuum. It’s tied directly to crypto regulation, the growing global push to bring digital assets under formal legal frameworks. Countries like Turkey and Vietnam are forcing exchanges to hold hundreds of millions in capital, while the U.S. is finally classifying assets under clear federal rules. VARA is part of that wave, but it’s one of the few that actually works. Unlike places where rules exist on paper but aren’t enforced, Dubai requires real audits, KYC systems, and anti-money laundering controls. That’s why you see real exchanges like Bybit and OKX operating under VARA, while shady platforms like LocalTrade vanish without a trace. It also connects to crypto compliance, the daily work of following rules around reporting, user verification, and transaction monitoring. Think KYC requirements, Suspicious Activity Reports, and capital controls—all things covered in posts about Metahero airdrops, AdEx Network, and Turkey’s CASP license. If a project claims to be "regulated" but doesn’t mention VARA or similar authority, it’s likely lying.

VARA licensing affects everyone. If you’re a trader, it means safer platforms and fewer rug pulls. If you’re a developer, it means clearer rules for launching tokens. If you’re an investor, it means knowing which projects have passed real scrutiny—not just marketing hype. The posts below don’t just list scams or explain tokens. They show you how regulation shapes what’s real and what’s not. You’ll see how projects like Metahero and AdEx Network evolved under pressure from compliance demands. You’ll find out why exchanges like Decoin and LocalTrade disappeared—not because they were unlucky, but because they never had the license to operate. And you’ll learn how rules like Directive 05/CT-TTg in Vietnam or the Investment and Securities Act 2025 in the U.S. mirror the same logic: if you handle money, you must be accountable.

This isn’t about bureaucracy. It’s about survival. In a world where zero-supply tokens like MARGA and abandoned metaverses like CVTX still show up on price trackers, VARA licensing is one of the few filters left that actually works. The posts here cut through the noise. They show you what matters—and what to avoid.

The UAE offers one of the world’s clearest crypto frameworks for Bitcoin and altcoins. Learn how licensing, tax rules, and regulations work in 2025-and why businesses are moving here in droves.

View More