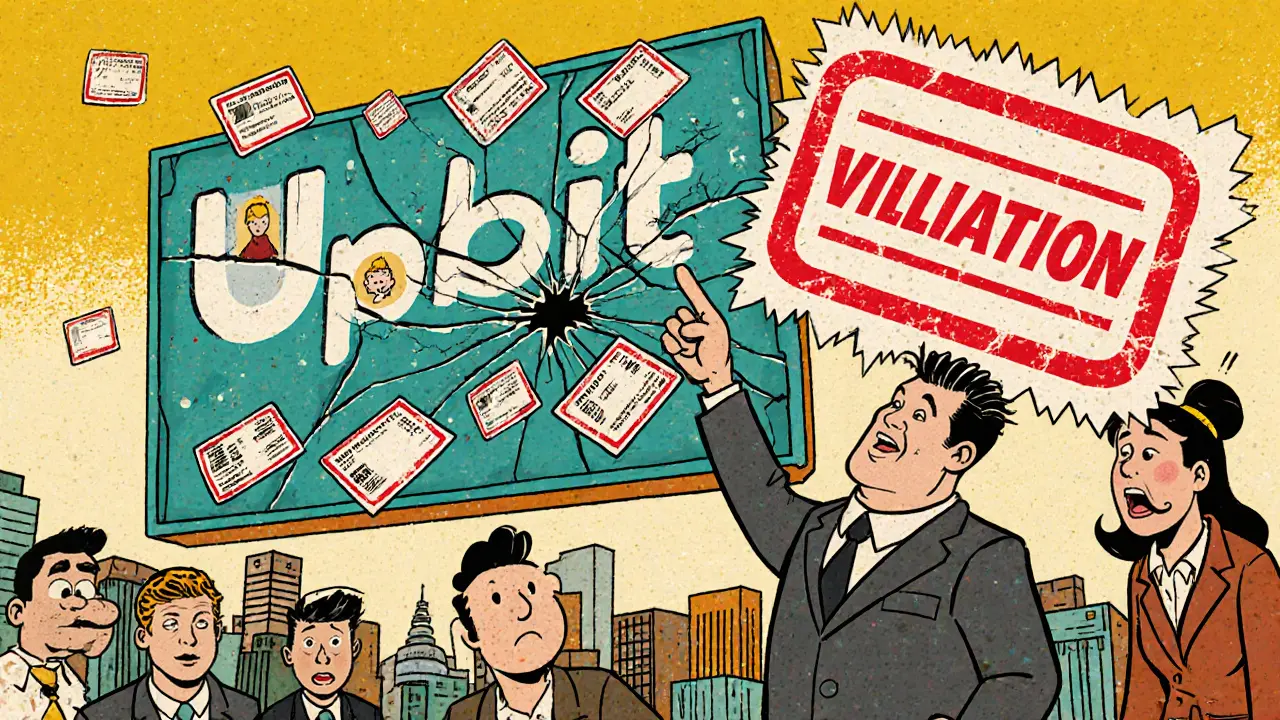

Upbit Suspension: What Happened and Why It Matters for Crypto Traders

When Upbit suspension, the abrupt halt of trading on South Korea’s largest crypto exchange. Also known as the Upbit trading freeze, it wasn’t just a technical glitch—it was a regulatory earthquake that sent shockwaves through global crypto markets. This wasn’t the first time a major exchange got pulled offline, but Upbit’s case stood out because of its scale: over 20 million users, billions in daily volume, and a reputation for being one of the most compliant platforms in Asia. So why did it happen? The answer lies in a mix of missing documentation, unreported asset flows, and regulators finally demanding real accountability.

Behind the scenes, South Korea’s Financial Services Commission (FSC) had been pushing exchanges for months to prove they were properly tracking user funds and reporting suspicious activity. Suspicious Activity Reporting, the formal process exchanges use to flag potential money laundering or fraud. Also known as crypto SAR, it’s a global standard enforced by bodies like FinCEN and FATF. Upbit failed to meet the threshold. Unlike other exchanges that quietly updated their systems, Upbit’s response was slow—and regulators didn’t wait. The suspension wasn’t a punishment for one mistake. It was the result of years of accumulated gaps in compliance, from KYC verification lapses to unclear internal controls. Meanwhile, crypto exchange compliance, the set of rules exchanges must follow to stay legal. Also known as crypto AML, it’s no longer optional—it’s the price of doing business. If you’re trading on any platform today, you’re indirectly affected by what happened at Upbit. Why? Because when one major exchange gets shut down, regulators globally take note. Other exchanges scramble to tighten their own systems. New rules get drafted. And users? They’re left wondering if their own platform could be next.

What you’ll find in these posts isn’t just a list of past incidents. It’s a map of how exchanges rise, fall, and sometimes vanish without warning. You’ll see how KYC requirements on crypto exchanges, the identity checks users must pass to trade. Also known as crypto identity verification, it’s the first line of defense against fraud. became mandatory overnight. You’ll learn how crypto policy Vietnam, a country that legalized crypto but made it nearly impossible to operate. Also known as Vietnam crypto law 2025, it’s a warning sign for what happens when regulation is too strict. forces platforms out of the market. And you’ll spot the same red flags that led to Upbit’s suspension—fake volume, no team info, unverified audits—in other platforms that look shiny but are built on sand. This isn’t about fear. It’s about awareness. If you’re trading crypto, you need to know who’s holding your money, what rules they follow, and what happens when those rules break. The posts below give you the real stories behind the headlines—not the hype, not the promises. Just what actually happened, and how to protect yourself before it’s too late.

Upbit faced over 500,000 KYC violations, exposing systemic failures in identity verification. South Korea’s regulators responded with a suspension of new sign-ups and a major compliance overhaul, setting a global precedent for crypto enforcement.

View More