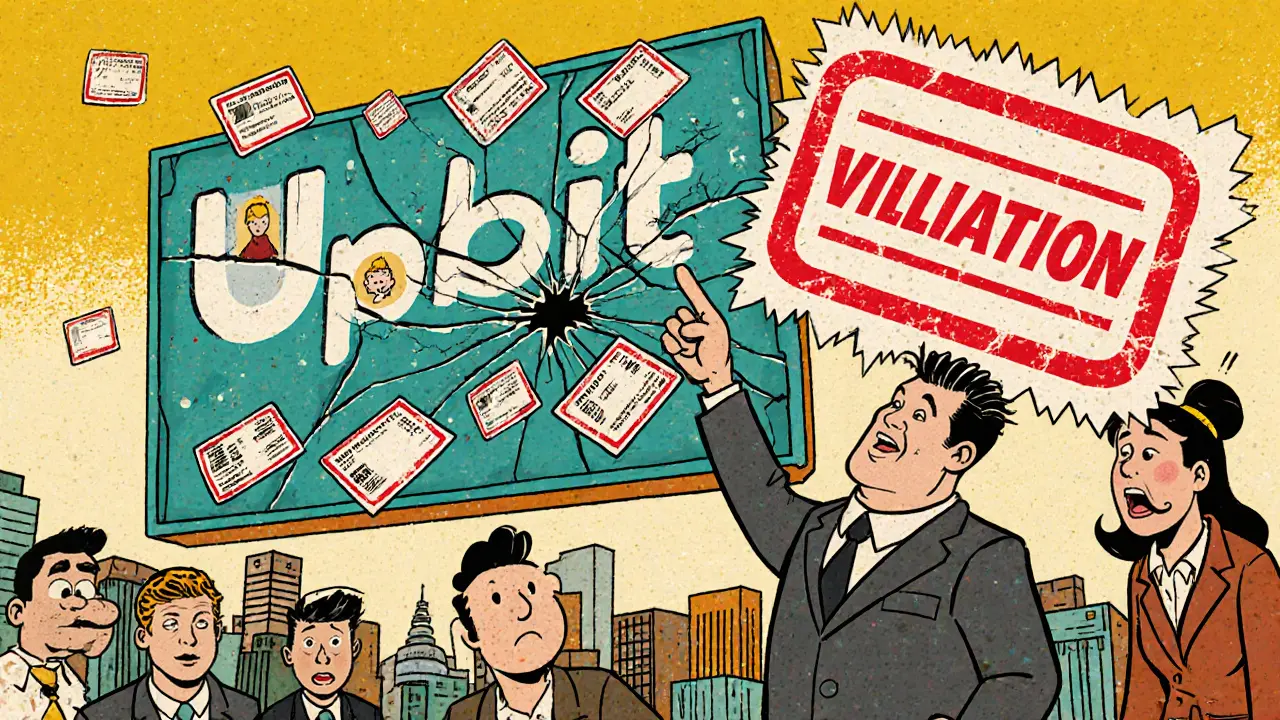

Upbit KYC Violations: What Happened and Why It Matters for Crypto Users

When Upbit KYC violations, a series of regulatory failures by the South Korean crypto exchange Upbit involving improper identity verification and failure to report suspicious activity. Also known as Upbit compliance breaches, these incidents triggered investigations from South Korea's Financial Services Commission and raised red flags across global exchanges. This wasn’t just a paperwork mistake—it was a breakdown in the system designed to stop money laundering, fraud, and terrorist financing in crypto.

Upbit’s failures didn’t happen in a vacuum. They connect directly to KYC crypto exchanges, platforms required by law to verify user identities to prevent financial crime. Most major exchanges now follow strict rules: collect government ID, verify address, monitor transaction patterns, and report anything unusual. But Upbit skipped steps—letting users with fake documents trade, ignoring repeated red flags, and failing to file Suspicious Activity Reports (SARs). This isn’t just about Upbit. It’s about what happens when any exchange cuts corners on AML crypto, anti-money laundering systems that track and block illicit crypto flows. When one exchange fails, regulators tighten rules for everyone. That means longer verification times, more documents, and stricter limits—even for honest users.

These violations also show why crypto KYC compliance, the ongoing process of verifying and updating user identities to meet legal standards isn’t optional. It’s the backbone of trust in crypto. Without it, exchanges become magnets for scammers. Look at the posts below: you’ll find stories about unregulated platforms like LocalTrade and Decoin that never did KYC—and how users lost everything. You’ll see how Vietnam’s new crypto rules demand $379 million in capital just to operate, because regulators learned from mistakes like Upbit’s. Even privacy coin delistings tie back to this: exchanges removed Monero and Zcash not because they’re bad tech, but because they made AML enforcement impossible.

What you’ll find here isn’t just news about Upbit. It’s a map of the real risks in crypto today. You’ll learn how KYC failures lead to exchange shutdowns, why some airdrops vanish overnight, and how regulatory crackdowns change what’s safe to trade. These aren’t abstract concepts—they’re the reasons your funds might disappear if you pick the wrong platform. The truth is simple: if an exchange doesn’t take KYC seriously, it doesn’t take your money seriously either. The posts below show you exactly where those lines are drawn—and where to stay clear.

Upbit faced over 500,000 KYC violations, exposing systemic failures in identity verification. South Korea’s regulators responded with a suspension of new sign-ups and a major compliance overhaul, setting a global precedent for crypto enforcement.

View More