Transaction Fee Estimation: How Crypto Fees Work and How to Avoid Overpaying

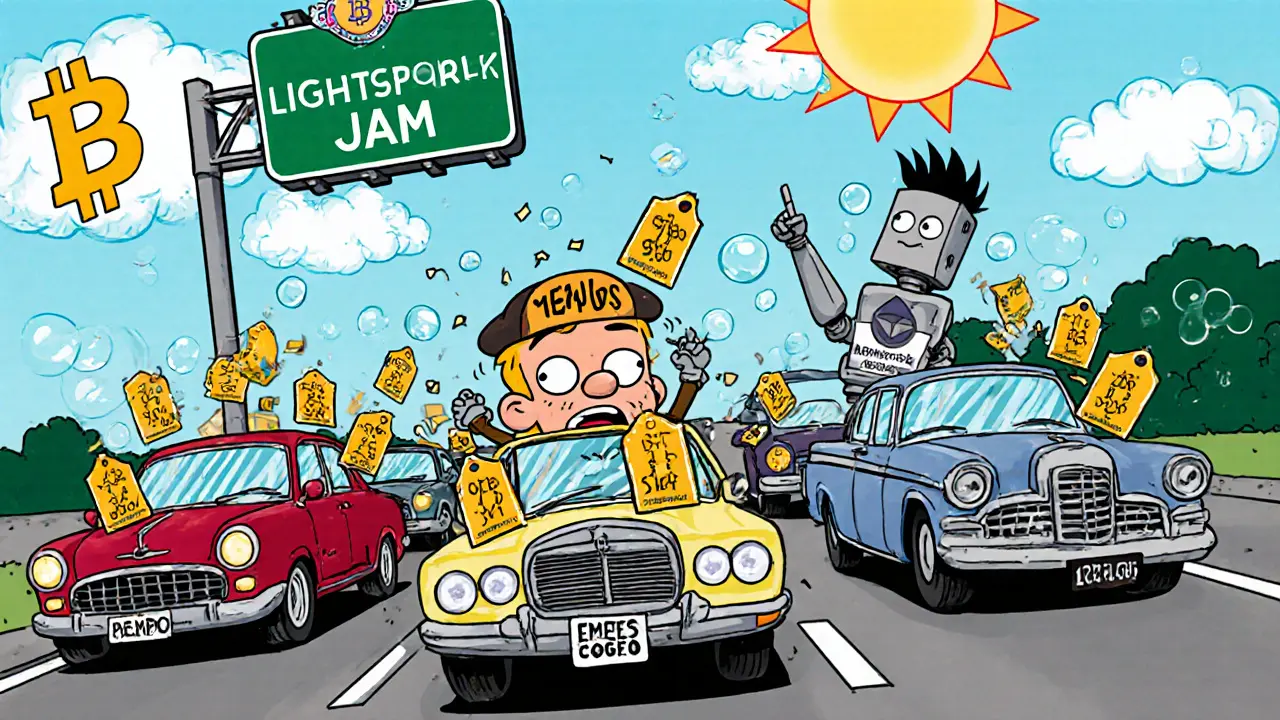

When you send crypto, you’re not just moving money—you’re paying for space on a blockchain. This payment is called a transaction fee estimation, the process of predicting how much you’ll need to pay to get your transaction confirmed on a blockchain network. Also known as gas fees, it’s the cost of using the network’s computing power, and getting it wrong can mean your transaction gets stuck or you waste money. Every blockchain handles this differently. Bitcoin uses a simple model based on data size. Ethereum and its Layer 2s like Base Chain use dynamic pricing where fees spike when the network is busy. Decentralized exchanges like VoltSwap and Alien Base rely on these same mechanics—so if you don’t understand fee estimation, you’re flying blind.

Most people think fees are fixed, but they’re not. On networks like Ethereum, fees change every few seconds based on demand. If you’re trading on a DEX like Alien Base or VoltSwap and set your fee too low, your trade might not go through for hours—or at all. Set it too high, and you’re giving away free money. Tools that auto-estimate fees often overcharge to be safe, leaving you paying 2x or 3x more than needed. Real users who track fee patterns—like those who trade on Meter blockchain or use the Liquid Network—know to check historical data, wait for off-peak hours, or use layer-2 solutions to cut costs. The same logic applies to token launches, airdrops, and even NFT mints. If you’re trying to claim Metahero (HERO) tokens or trade ABX on Alephium, your success depends on knowing when and how much to pay.

It’s not just about the number. It’s about timing, network congestion, and the type of transaction. Sending a simple ETH transfer costs less than swapping tokens on a DEX. Wrapping WBTC or using zk-STARKs for privacy adds layers of complexity that affect fees. Even regulatory shifts matter—when Turkey banned crypto payments or Vietnam enforced $379 million capital rules, it changed how exchanges priced fees to stay compliant. The best way to master transaction fee estimation is to watch what’s happening on the chain, not just what your wallet says. Look at real-time data from active networks, see how traders on Base Chain or Meter handle fees, and learn from the mistakes of those who lost money on dead projects like MARGA or CVTX because they didn’t account for cost.

Below, you’ll find real reviews and breakdowns from traders who’ve been burned by bad fee estimates—and those who learned to beat the system. Whether you’re dealing with a scammy exchange like LocalTrade, trying to claim a real airdrop like ADX, or just swapping tokens on a DEX, knowing how to estimate fees isn’t optional. It’s the difference between making a trade and watching it vanish into a blockchain void.

Learn how transaction fee estimation tools help you pay the right amount for Bitcoin and Ethereum transactions-no more overpaying or waiting hours for confirmations. Get the best tools and tips for 2025.

View More