South Korea Crypto Regulation: What You Need to Know in 2025

When it comes to South Korea crypto regulation, a tightly controlled framework that demands licensing, identity verification, and strict reporting from all crypto businesses. Also known as Korea's virtual asset rules, it's one of the most aggressive crypto regulatory systems in Asia—designed to stop money laundering, protect investors, and force exchanges to play by the government's rules. Unlike countries that took a wait-and-see approach, South Korea moved fast. By 2025, every crypto exchange operating in the country needs a license from the Financial Services Commission (FSC), must pass a $379 million capital requirement, and implement full KYC on every user. No exceptions. No gray areas.

This isn't just about exchanges. The KYC crypto Korea, mandatory identity checks that require government-issued ID, proof of address, and biometric verification. Also known as real-name trading system, it's been in place since 2018 and got even tighter after the FATF updated its travel rule guidelines. If you're trading crypto in Korea, you can't use an anonymous wallet. You can't deposit from an unverified account. Even peer-to-peer trades are monitored. The government tracks every transaction linked to your ID. This system was built to shut down scams and illegal flows—but it also makes it harder for privacy-focused users to operate freely.

Then there's the crypto taxation South Korea, a system where gains from crypto trades are treated as ordinary income, taxed up to 45%, and must be reported annually. Also known as digital asset income tax, it's one of the highest rates in the world. There's no capital gains exemption. No holding period discount. If you bought Bitcoin in 2020 and sold it for a profit in 2025, you owe taxes on the full gain. The tax office uses blockchain analytics to match wallet addresses with bank accounts. Fines for underreporting start at 30% of the unpaid tax—and can go up to 100% if they think you're hiding assets.

And it doesn't stop there. The FATF crypto rules, global standards that require crypto platforms to share user data across borders. Also known as travel rule compliance, South Korea enforces them more strictly than most countries. If you send $1,000 or more to a foreign exchange, your bank and your crypto platform must send your full name, ID number, and address to the recipient. No privacy. No loopholes. This is why many Korean users now trade on offshore platforms—but even those are under pressure. The FSC has cracked down on unlicensed platforms offering services to Koreans, shutting down dozens since 2023.

What you'll find below are real reviews and deep dives into platforms that either tried to operate under these rules—or got caught breaking them. Some are scams hiding behind fake compliance claims. Others are legitimate exchanges that survived the purge. You'll see how KYC processes actually work on the ground, why some tokens vanished overnight, and how traders are adapting to a system that doesn't allow for mistakes. This isn't theoretical. This is what’s happening right now in one of the world’s most regulated crypto markets.

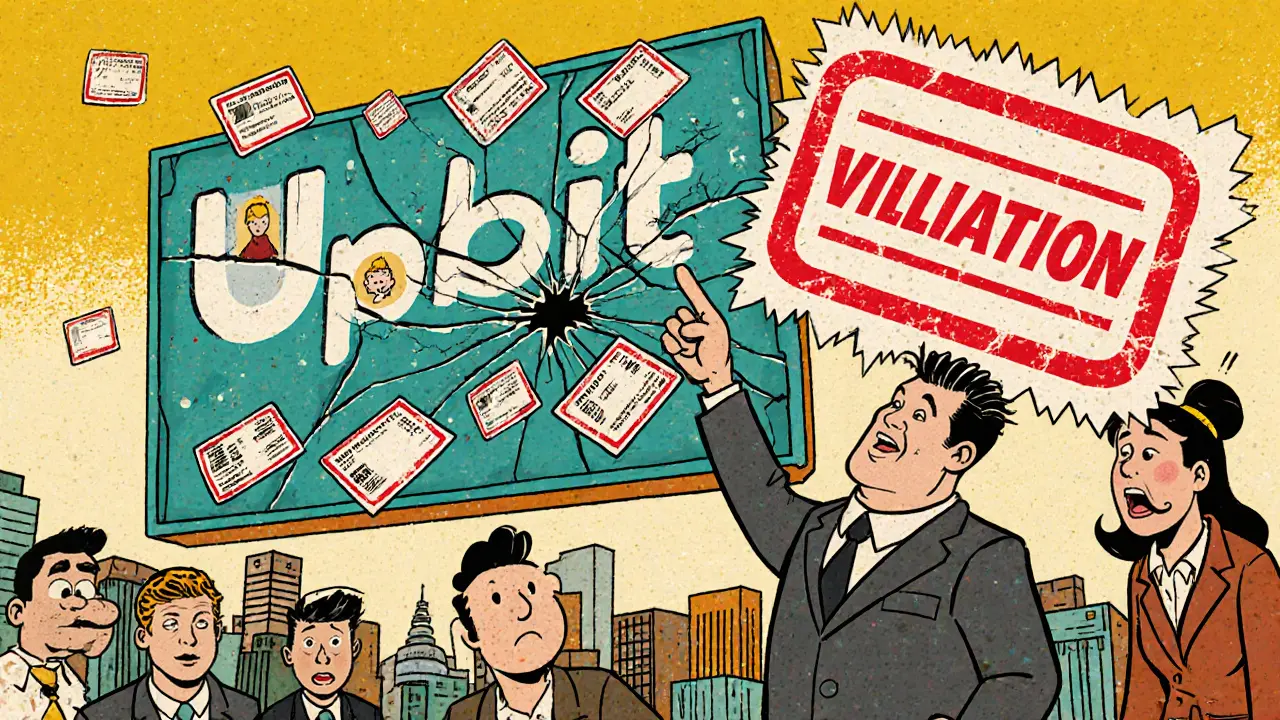

Upbit faced over 500,000 KYC violations, exposing systemic failures in identity verification. South Korea’s regulators responded with a suspension of new sign-ups and a major compliance overhaul, setting a global precedent for crypto enforcement.

View More