Russian sanctions and crypto: How global restrictions impact crypto trading and exchanges

When Russian sanctions, economic and financial restrictions imposed by Western nations on Russia since 2014, intensified after 2022, they didn’t just hit banks—they shook the crypto world. Suddenly, exchanges had to choose: cut off Russian users, risk fines, or find loopholes. This isn’t about politics—it’s about survival. crypto exchange compliance, the process of following global financial rules to avoid penalties became non-negotiable. Platforms like Binance, Kraken, and even smaller DEXs had to update their KYC systems, block VPNs, and flag transactions tied to sanctioned wallets. The AML crypto, anti-money laundering systems that track suspicious crypto flows rules tightened globally, and Russia became the biggest test case.

What happened next? A wave of delistings. Privacy coins like Monero and Zcash vanished from major exchanges because they made it too easy to hide money moving in and out of Russia. At the same time, Russian traders turned to peer-to-peer platforms and non-KYC DEXs—many of which turned out to be scams. That’s why you’ll find posts here about fake exchanges like LocalTrade and Decoin. They weren’t just shady—they were exploiting the chaos created by sanctions. Meanwhile, countries like Vietnam and Turkey started copying Russia’s playbook, building their own strict crypto rules. The crypto regulation, government laws that control how digital assets can be bought, sold, or held trend isn’t slowing down. If you’re trading crypto today, you’re not just betting on price—you’re navigating a minefield of legal risks.

What’s left for users? Not much. If you’re in Russia, your options are limited and risky. If you’re outside Russia, you’re still affected—through higher fees, longer verification times, and fewer coin choices. The Russian sanctions didn’t kill crypto. They exposed how fragile the system really is. Below, you’ll find real reviews of platforms that got caught in the crossfire, scams that popped up because of the chaos, and deep dives into how governments are rewriting the rules. No fluff. No theory. Just what you need to know to stay safe.

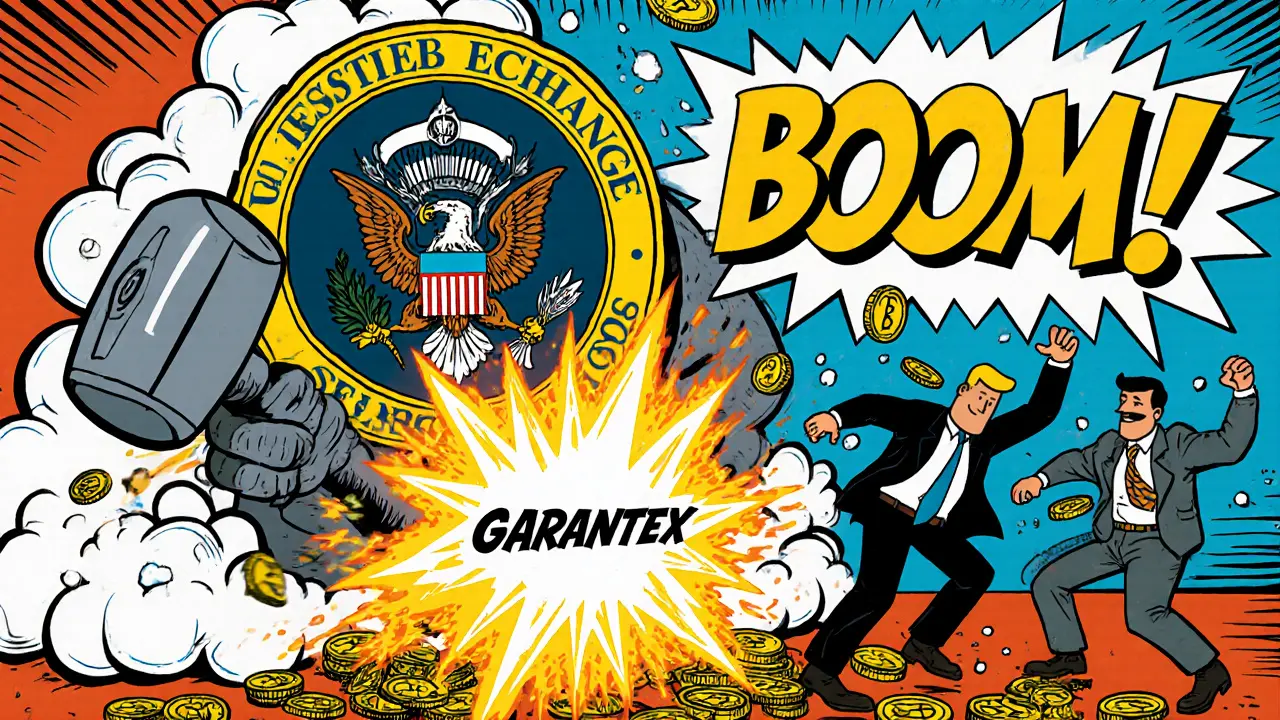

U.S. sanctions have shut down major Russian crypto exchanges like Garantex and Grinex, targeting their leaders, infrastructure, and even new stablecoins like A7A5. Users face frozen funds and shrinking access to crypto services.

View More