Proof of Stake Crypto: How It Works and Why It’s Changing Blockchain

When you hear Proof of Stake crypto, a consensus mechanism where validators are chosen based on how much cryptocurrency they hold and are willing to "stake" as collateral. Also known as PoS, it’s the backbone of today’s most popular blockchains like Ethereum, Solana, and Cardano—replacing the old, power-hungry mining systems that wasted more electricity than entire countries. Unlike Proof of Work, where miners compete to solve math puzzles, Proof of Stake lets you earn rewards just by holding and locking up your coins. No fancy hardware. No roaring fans. Just your wallet and a little patience.

Staking isn’t just a way to earn passive income—it’s how these networks stay secure. The more coins someone stakes, the more likely they are to be picked to verify transactions. But if they try to cheat? They lose part of their stake. It’s a simple incentive system that aligns the interests of users with the health of the network. This is why staking crypto, the act of locking up digital assets to support a blockchain’s operations and earn rewards has exploded in popularity. Platforms like VoltSwap and AlphBanX let you stake tokens directly, while others like AdEx Network and Metahero once used staking to distribute airdrops. But not all staking is safe—some platforms, like LocalTrade and Decoin, pretend to offer rewards while hiding shady practices. Always check if a project is transparent, audited, and has real users.

Proof of Stake also enables new features like delegated proof of stake, a variation where token holders vote for representatives to validate transactions on their behalf, used by networks like EOS and Tron. It’s faster and more scalable, but it also centralizes power a bit—so you’re trusting others to act in your interest. Meanwhile, cryptocurrency consensus, the system that ensures all participants agree on the state of the blockchain is evolving fast. With regulations tightening and exchanges delisting privacy coins, PoS is becoming the default choice for new projects because it’s cheaper, greener, and easier to comply with laws. Even Bitcoin sidechains like Liquid are borrowing PoS ideas to improve speed without sacrificing security.

What you’ll find below isn’t just a list of articles—it’s a real-world guide to what works and what’s a trap. Some posts break down how staking actually pays out. Others expose fake airdrops tied to staking programs. You’ll see how tokens like VOLT, ABX, and SMH use PoS in different ways—and why some projects, like MARGA or CVTX, are dead ends with zero supply or no team. This isn’t theory. It’s what’s happening right now in crypto. And if you’re thinking about staking your coins, you need to know the difference between a legitimate reward and a scam waiting to happen.

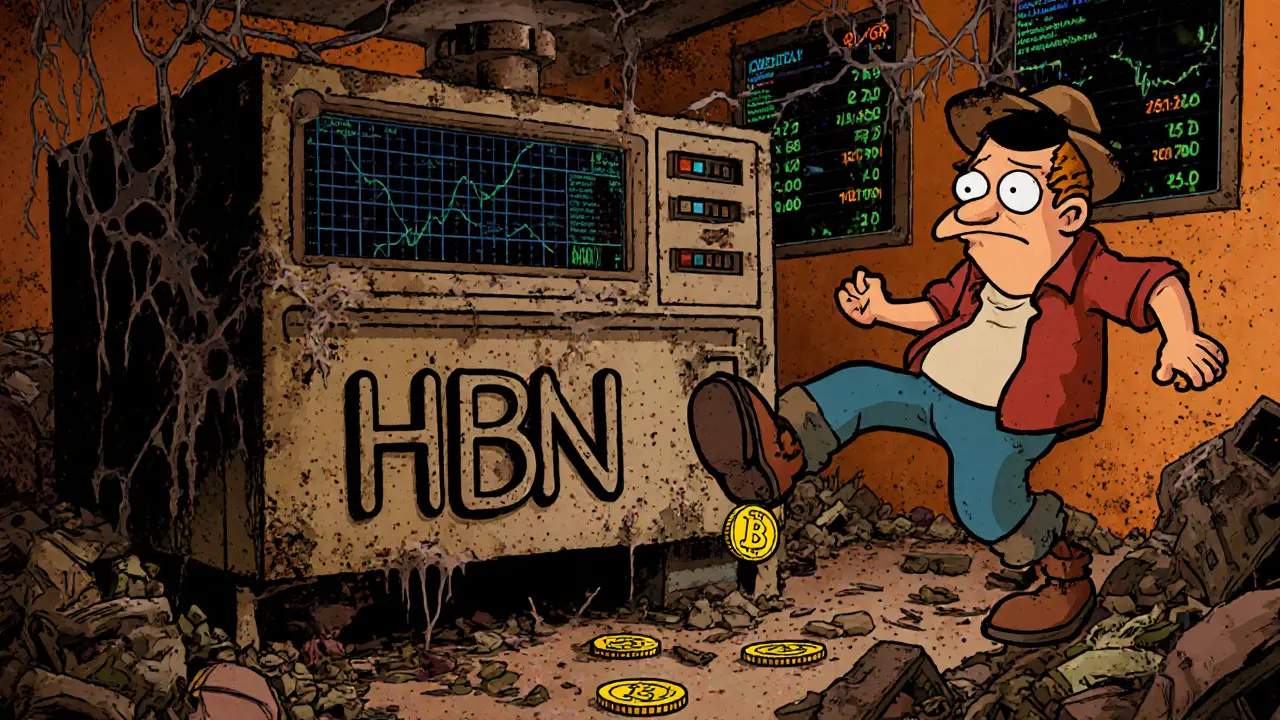

HoboNickels (HBN) is a nearly dead cryptocurrency with extreme volatility, no exchange listings, and zero real-world use. Learn why its price crashed 99% and why it's not worth investing in.

View More