Privacy Coin Delisting: Why Top Anonymous Coins Are Being Removed from Exchanges

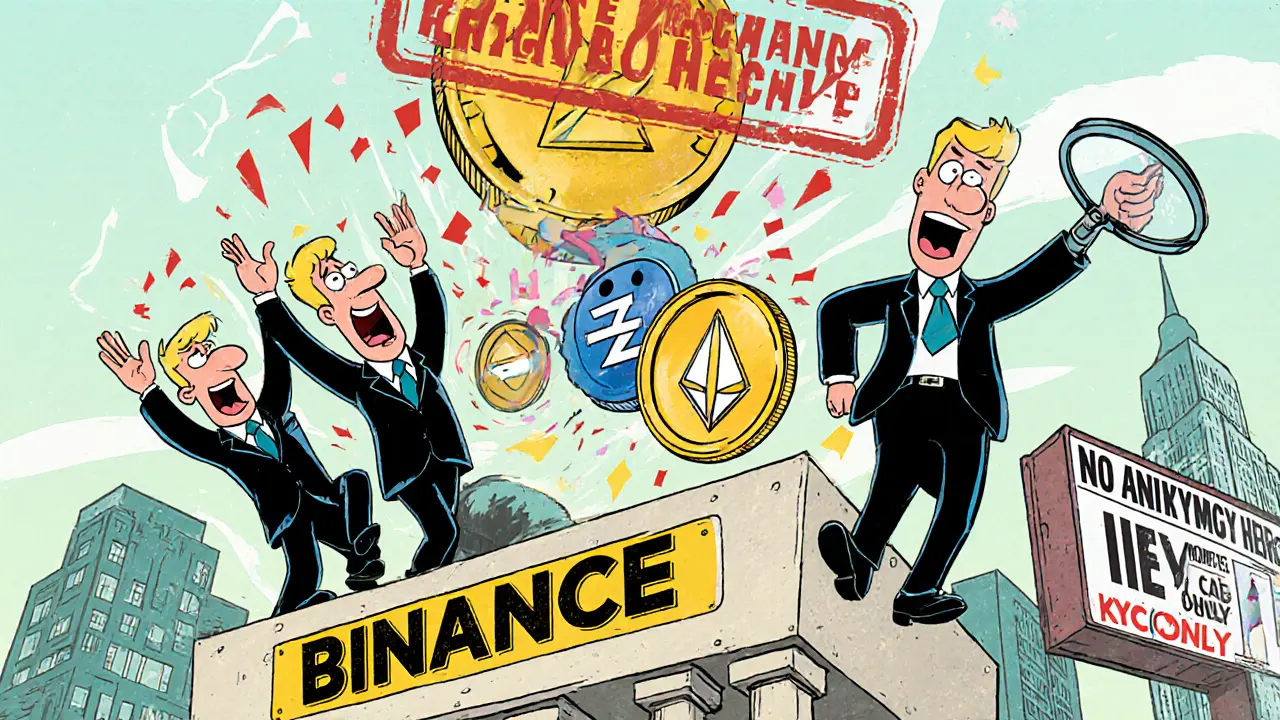

When you hear privacy coin delisting, the forced removal of anonymous cryptocurrencies from exchanges due to regulatory pressure. Also known as anonymity coin removal, it’s not just a technical change—it’s a legal earthquake for users who rely on financial privacy. This isn’t about banning tech. It’s about exchanges choosing survival over freedom. Major platforms like Binance, Kraken, and Coinbase have quietly pulled Monero, a cryptocurrency designed with built-in obfuscation to hide sender, receiver, and amount and Zcash, a coin using zero-knowledge proofs to verify transactions without revealing details from their trading pairs. Why? Because regulators in the U.S., EU, and Japan now demand full transaction transparency. Exchanges that don’t comply risk losing licenses, facing fines, or being blocked entirely.

It’s not just Monero and Zcash. Other privacy-focused coins like Pirate Chain, a Zcash fork with 100% shielded transactions and no KYC and Dash, a coin that once offered PrivateSend for mixing transactions have also been dropped. These coins aren’t scams—they’re engineered for privacy. But regulators don’t care about the engineering. They care about the fear: that these coins enable money laundering, ransomware payments, or darknet market activity. Even though most transactions on these networks are legal, the stigma sticks. And exchanges? They’re not risk-takers. They’re businesses. When the cost of keeping a coin outweighs the trading volume, they cut it.

What does this mean for you? If you own privacy coins, you’re now stuck with fewer places to trade. You might need to use non-KYC DEXs like VoltSwap, a decentralized exchange on Meter blockchain that resists front-running and supports privacy tokens or move funds to self-custody wallets. But even DEXs are feeling the heat—some now block wallet addresses linked to known privacy coin activity. The real shift isn’t just about delisting. It’s about the erosion of financial anonymity in crypto. The tools to stay private still exist, but they’re moving underground. You’ll find more of these stories in the posts below—real cases of coins being pulled, how users reacted, and the hidden exchanges still supporting them.

Privacy coins like Monero and Zcash are being removed from major crypto exchanges due to global regulatory pressure. Learn why this is happening, how it affects users, and what the future holds for financial privacy in crypto.

View More