OFAC Sanctions and Crypto: What You Need to Know About Compliance and Risk

When you hear OFAC sanctions, U.S. government restrictions that block transactions with individuals, entities, or countries deemed a threat to national security. Also known as financial blacklists, these rules are enforced by the Office of Foreign Assets Control and apply to anyone doing business with U.S. dollars or interacting with U.S.-based platforms. In crypto, this isn’t theoretical—it’s daily reality. Exchanges like Coinbase and Kraken freeze wallets tied to sanctioned addresses. Tokens linked to blocked entities get delisted overnight. Even if you didn’t know a coin was flagged, your funds can disappear without warning.

Crypto compliance, the set of practices platforms and users follow to avoid violating financial laws like OFAC rules. Also known as crypto AML, it’s not optional anymore. If a platform doesn’t screen transactions, it risks losing its license, facing millions in fines, or being shut down entirely. That’s why KYC checks are now standard—even on decentralized exchanges that claim to be "anonymous." They still have to filter out addresses on the OFAC list. And it’s not just exchanges. Wallets, DeFi protocols, and even NFT marketplaces now scan for tainted addresses. If you’re trading tokens tied to North Korea, Russia, or Iran-linked wallets, you’re not just taking a risk—you’re breaking the law.

Sanctioned crypto, tokens or addresses officially blocked by OFAC, often linked to ransomware gangs, darknet markets, or state-sponsored hacking. Also known as tainted crypto, these aren’t always obvious. Some are outright scams like MARGA or HAPPY—zero supply, no team, but still traded by bots. Others are privacy coins like Monero, which got delisted from major exchanges not because they’re illegal, but because they make tracing transactions nearly impossible. OFAC doesn’t ban Monero itself, but exchanges ban it to avoid compliance headaches. Meanwhile, tokens tied to sanctioned entities—like those used by Lazarus Group or Iran’s IRGC—get flagged even if they’re on obscure DEXs. You don’t need to be a criminal to get caught. Just holding one of these tokens in your wallet could trigger a freeze.

What you’ll find in these posts isn’t theory—it’s real cases. LocalTrade? Unregulated and linked to scam recovery schemes that often involve laundering funds from OFAC-targeted actors. VoltSwap? A niche DEX on Meter blockchain, but still required to screen for blocked addresses. The Metahero airdrop? No official drop, but scammers are using fake claims to lure users into wallets that may already be flagged. Even Vietnam’s strict crypto rules, Turkey’s licensing crackdown, and the U.S. Investment and Securities Act of 2025 all tie back to one thing: OFAC sanctions are the invisible hand shaping global crypto regulation.

You can’t ignore this. Whether you’re trading on a centralized exchange, staking on a DEX, or chasing airdrops, you’re part of a system where compliance isn’t a checkbox—it’s a lifeline. The next time you see a token with no team, zero supply, or a name that sounds like a scam (looking at you, BABYDB), ask: Is this on an OFAC list? Because if it is, you’re not just risking your money—you’re risking your access to the entire crypto ecosystem.

OFAC has intensified sanctions against North Korean crypto networks that stole over $2.1 billion in 2025. These state-backed hackers use fake IT jobs to infiltrate U.S. companies and launder crypto into weapons funding.

View More

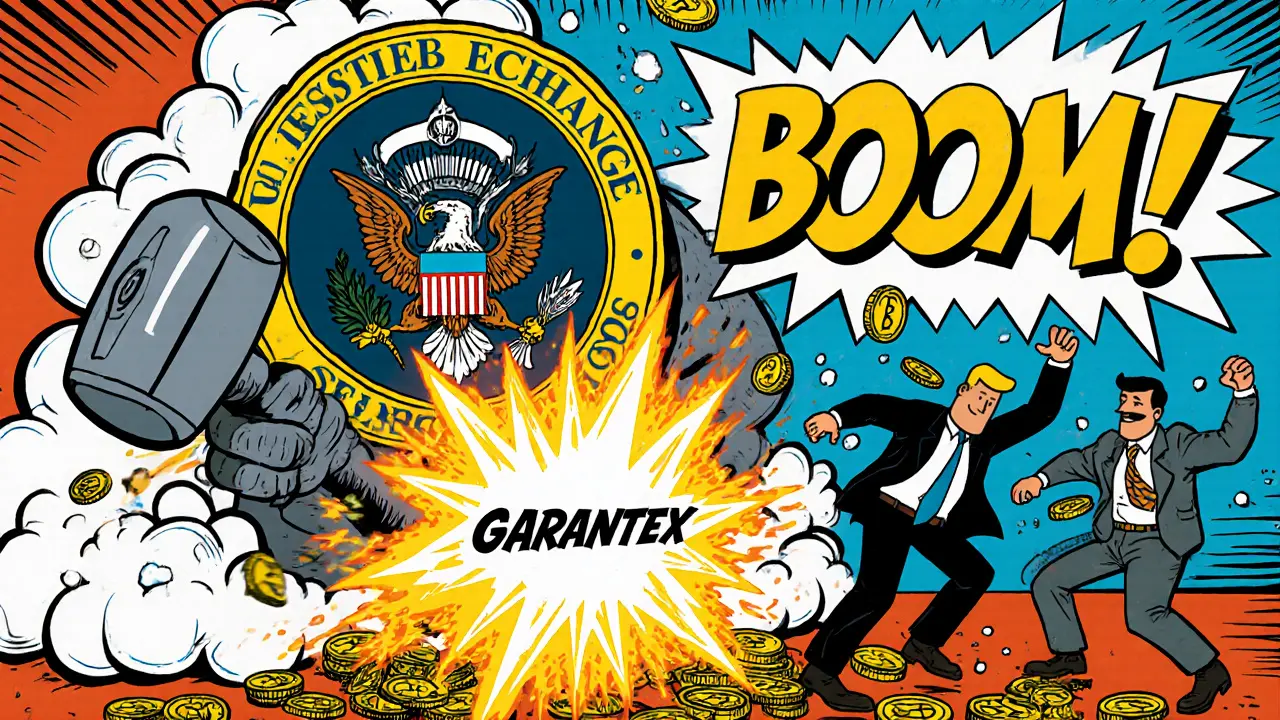

U.S. sanctions have shut down major Russian crypto exchanges like Garantex and Grinex, targeting their leaders, infrastructure, and even new stablecoins like A7A5. Users face frozen funds and shrinking access to crypto services.

View More