KYC Failures: Why Your Crypto Identity Verification Keeps Getting Rejected

When you hit a KYC failure, a rejected identity verification on a crypto exchange. Also known as identity verification decline, it’s not just a technical glitch—it’s often a red flag for fraud, mismatched documents, or outdated policies. If you’ve ever uploaded your ID only to get a "verification failed" email, you’re not alone. In 2025, over 30% of new users on regulated exchanges face at least one KYC failure before getting approved, according to real user reports from platforms like Kraken and Binance. This isn’t random. It’s systemic.

Most KYC failures happen because of three things: blurry or expired IDs, mismatched names (like using a nickname on your profile but your legal name on your passport), or inconsistent selfies. Exchanges use AI to match your face to your ID photo. If you’re wearing sunglasses, your hair covers your ears, or the lighting’s off, the system flags it. Some users even get rejected because their government ID was issued in a country the exchange doesn’t accept—even if it’s perfectly valid. And don’t forget: AML crypto, anti-money laundering rules that force exchanges to verify users means they can’t just let anyone through. The same rules that stop criminals also block honest people who don’t know the small print.

Then there’s the hidden layer: crypto compliance 2025, the tightening global rules forcing exchanges to be stricter than ever. Countries like the U.S., EU, and Singapore now require real-time document checks, facial liveness detection, and even proof of address. If you’re using a PO box, a temporary rental agreement, or a utility bill older than 90 days, you’re likely to fail. Even your internet connection can matter—some systems block uploads from VPNs or proxy servers because they look suspicious. And if you’ve ever used a crypto exchange that got shut down or flagged for scams (like LocalTrade or Decoin), your IP or device fingerprint might be blacklisted across other platforms, even if you never did anything wrong.

It’s frustrating, but fixable. Most KYC failures aren’t about being flagged as a criminal—they’re about not meeting the exact technical specs. You don’t need a lawyer. You need a well-lit room, a recent government-issued ID, and a clean selfie without filters. Some platforms let you retry once. Others lock you out for 30 days. The key is knowing what they’re looking for before you submit. Below, you’ll find real cases from users who got rejected, what went wrong, and how they finally got through. No fluff. Just what works in 2025.

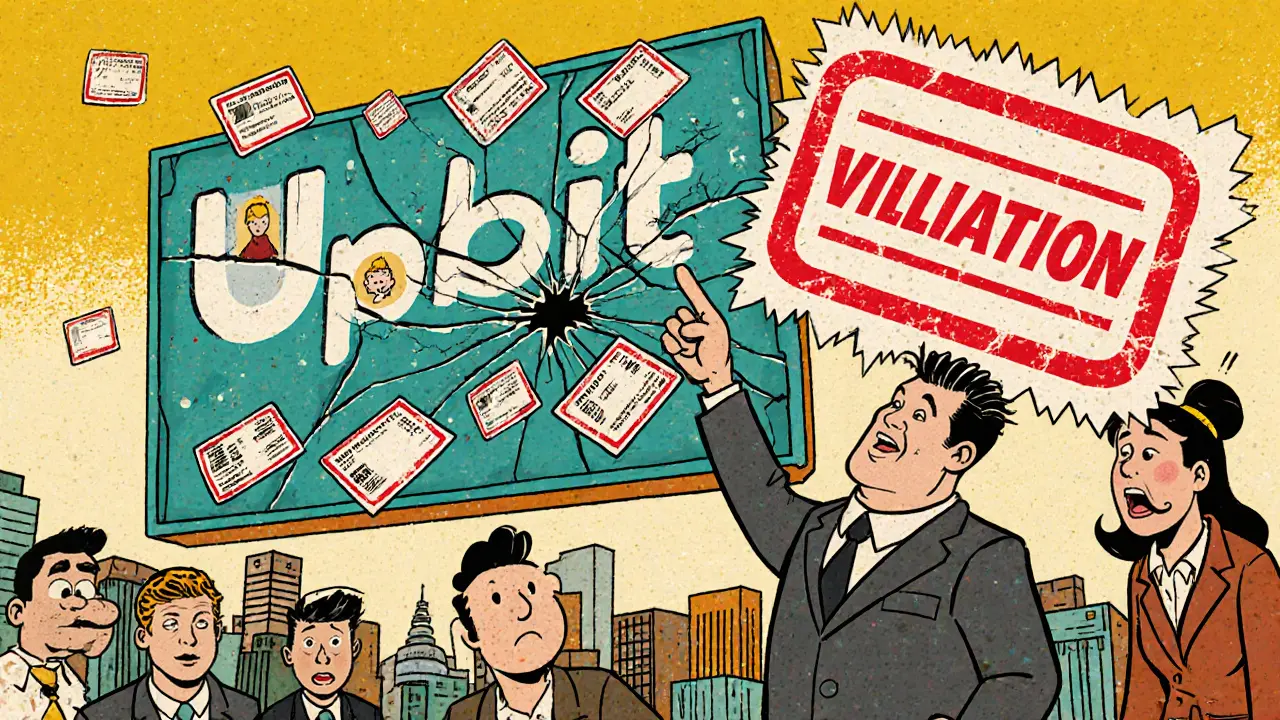

Upbit faced over 500,000 KYC violations, exposing systemic failures in identity verification. South Korea’s regulators responded with a suspension of new sign-ups and a major compliance overhaul, setting a global precedent for crypto enforcement.

View More