Grinex: What It Is, Why It Matters, and What You Need to Know

When you hear Grinex, a crypto exchange platform focused on decentralized trading with low fees and minimal KYC. Also known as Grinex DEX, it’s one of the smaller platforms trying to compete with giants like Uniswap and PancakeSwap by offering faster trades and fewer restrictions. But here’s the catch: most people don’t know if it’s legit, safe, or even functional. Unlike big-name exchanges, Grinex doesn’t have a clear team, public audits, or verified liquidity pools. That’s why users are asking — is this just another quiet DEX with potential, or a hidden risk?

Grinex relates closely to other decentralized exchanges, platforms that let you trade crypto without a central authority. This category includes VoltSwap on Meter blockchain and other niche DEXs that avoid heavy regulation. But while VoltSwap at least has transparent tech and a small but active user base, Grinex’s opacity raises red flags. It also connects to crypto trading, the act of buying and selling digital assets directly from wallets. If you’re trading on Grinex, you’re not just using a tool — you’re trusting an unverified system with your funds. That’s why users who’ve tried it often compare it to LocalTrade or Decoin — platforms that vanished after collecting deposits.

What you’ll find in this collection isn’t hype. It’s real user experiences, technical breakdowns, and scam warnings. Some posts dig into how Grinex compares to exchanges with real depth, like Kraken or Coinbase. Others expose how fake volume and hidden teams make platforms like this dangerous. You’ll see how Grinex stacks up against DEXs that actually deliver — like VoltSwap, which at least has front-running resistance and clear tokenomics. You’ll also find warnings about similar platforms that promised low fees but disappeared overnight. This isn’t about ranking Grinex as #1 or #2. It’s about helping you avoid losing money on a platform that doesn’t answer basic questions.

There’s no official roadmap. No whitepaper update in the last year. No team photos. No Twitter replies from developers. That’s not normal in crypto — even the wildest meme coins have at least a Discord mod. So why does Grinex still show up on price trackers? Because someone’s still listing it. And someone’s still trading on it. But who? And why? The answers aren’t in marketing videos. They’re buried in user reports, wallet traces, and exchange reviews like the ones you’re about to read. If you’re thinking of using Grinex, you need to know what others have lost — and what, if anything, they gained.

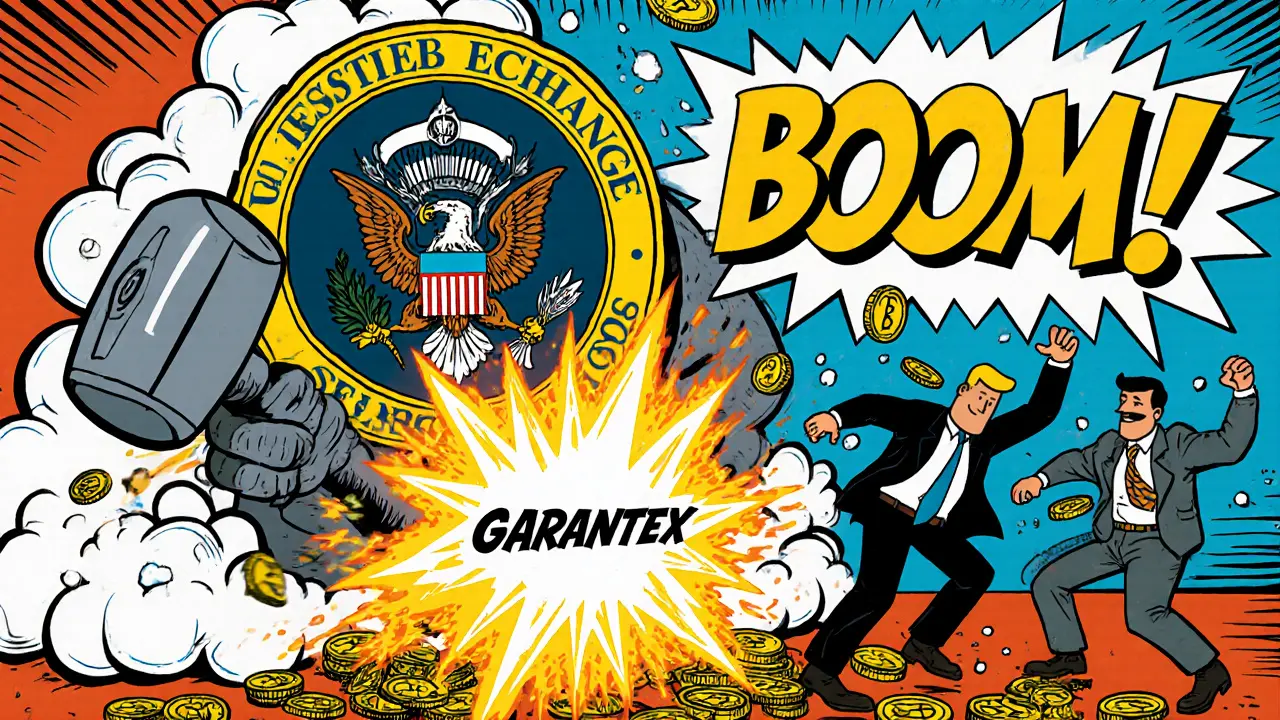

U.S. sanctions have shut down major Russian crypto exchanges like Garantex and Grinex, targeting their leaders, infrastructure, and even new stablecoins like A7A5. Users face frozen funds and shrinking access to crypto services.

View More