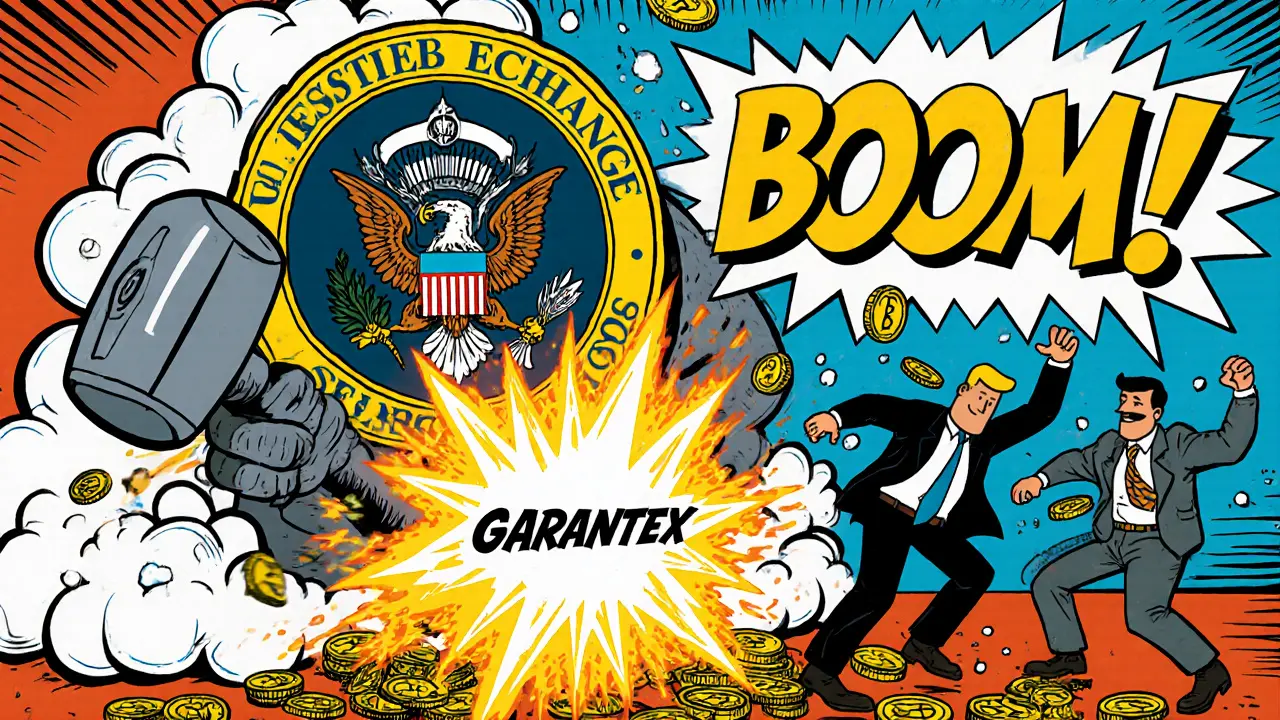

Garantex: What You Need to Know About This Crypto Exchange and Why It’s Controversial

When you hear Garantex, a cryptocurrency exchange based in Russia that offers fiat and crypto trading with low fees and a simple interface. Also known as Garantex.io, it’s one of the few platforms that still supports direct ruble deposits—but that’s also why it’s under heavy regulatory scrutiny. Unlike big names like Binance or Coinbase, Garantex doesn’t publish regular audits, doesn’t disclose its legal structure clearly, and has faced multiple reports of delayed withdrawals. If you’re looking for a fast, low-cost way to trade crypto, it might seem tempting. But if security and transparency matter to you, you need to ask: is this exchange worth the risk?

Garantex operates as a centralized exchange, a platform where users deposit funds and trade through the exchange’s own order book, not peer-to-peer. This means you don’t control your keys, and if the platform freezes or gets hacked, your funds could vanish. Compare that to decentralized exchanges like VoltSwap or Uniswap, where you hold your own wallet. Garantex’s model is older, riskier, and increasingly out of step with where crypto is headed. It also doesn’t enforce strong KYC for all users, which makes it attractive to some but a red flag for regulators. In 2023, the Russian financial watchdog flagged Garantex for possible violations of anti-money laundering rules, and multiple users reported being locked out of their accounts after large withdrawals. The platform has tried to rebuild trust by adding support for more tokens and improving its mobile app, but without third-party verification of its reserves or customer support response times, it’s hard to know if those changes are real.

What you’ll find in the posts below are real user experiences—some from people who made quick profits, others who lost months waiting for funds. You’ll see how Garantex compares to other unregulated platforms like Decoin or LocalTrade, and why even a platform with decent volume can still be dangerous. We’ll also break down what to look for in any exchange: withdrawal times, fee structures, and whether the team is even publicly identifiable. If you’re considering using Garantex, don’t just check the price chart. Look at the trust signals—and if they’re missing, walk away. The next post will show you exactly how to spot the warning signs before you deposit a single dollar.

U.S. sanctions have shut down major Russian crypto exchanges like Garantex and Grinex, targeting their leaders, infrastructure, and even new stablecoins like A7A5. Users face frozen funds and shrinking access to crypto services.

View More